Remote Patient Monitoring Devices Market Synopsis:

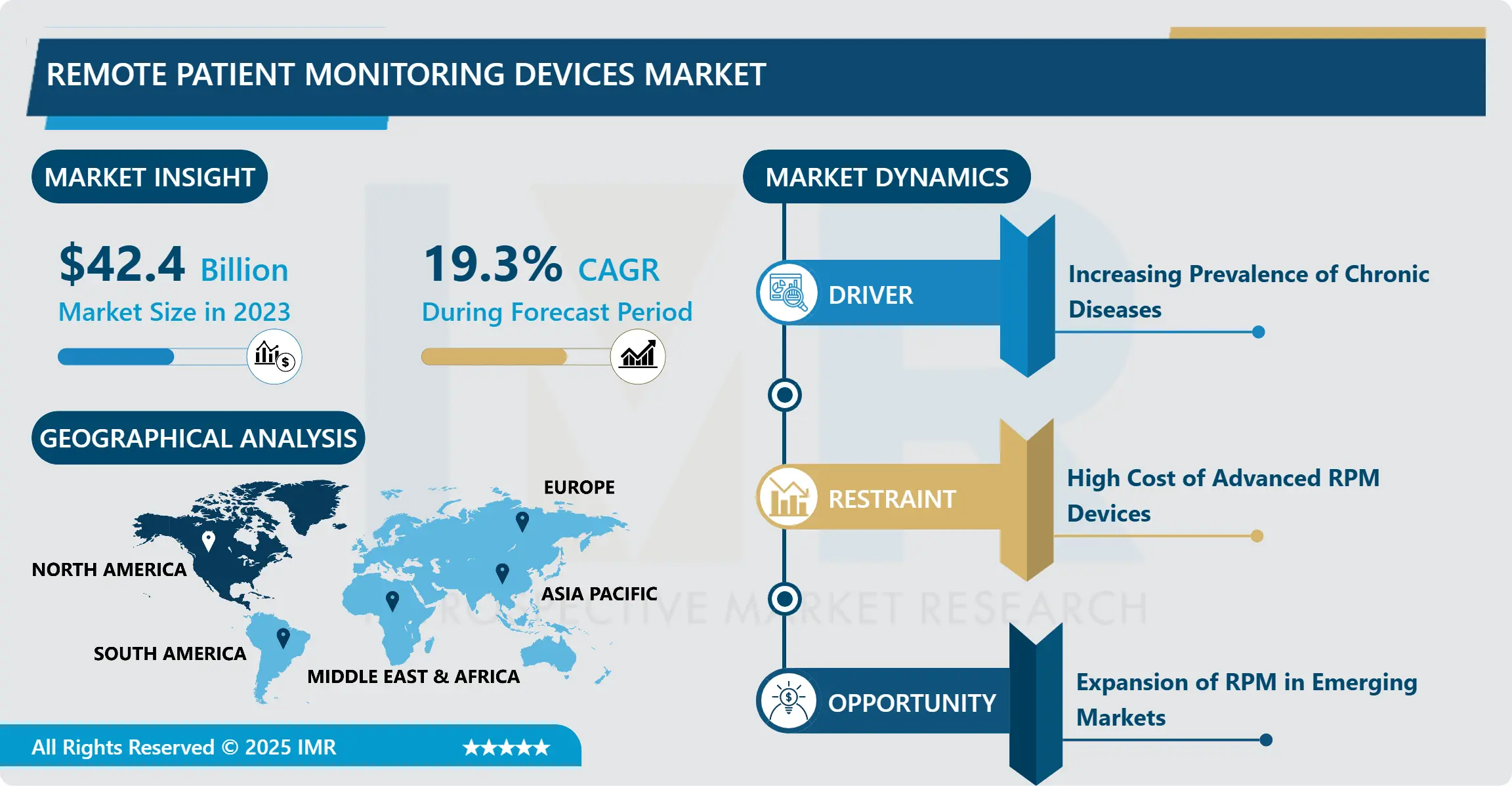

Remote Patient Monitoring Devices Market Size Was Valued at USD 42.40 Billion in 2023 and is Projected to Reach USD 207.55 Billion by 2032, Growing at a CAGR of 19.3 % From 2024-2032.

Remote Patient Monitoring (RPM) Devices Market is defined as a large category of technologies and gadgets that are extendable through a tangible access point for transfer of patient health information for remote monitoring. RPM devices also check numerous health attributes such as blood pressure, blood sugar, cardiac rate, respiratory rate, and more; the readings can be relayed to the care givers through cloud technology. This market is still very new and has a lot of room to grow because as the patients and providers of healthcare increase, patients especially those with chronic conditions need regular check up.

The growth drivers which are in practice for the Remote Patient Monitoring Devices market include; rising incidence of chronic diseases, aging population, and enhanced potential to reduce the possibilities of hospital visits. RPM devices are now a norm within health care delivery because this keeps constant vigil over patients in the external environment which in turn saves patients’ time and enhances patients’ control in their everyday existence. Concerns towards the change in paradigm of continually shifting the focus to value-based, health care solutions, disease prevention and cost reduction have a lot to do with the advancement of RPM devices. In the current society with the COVID-19 virus around the globe, remote monitoring was even more important because hospitals do not allow the clients to come visit them in order to prevent spreading of the virus and at the same time serve quality services to the clients.

Advances in wearables with wireless signals and data analysis are shifting features of the RPM devices, into convenient, easy to use, and well-organized devices and systems. These devices are now offering a level of accuracy not seen in prior machines and are now linking into EHR systems which enable healthcare providers to make timely well-informed decisions. The market also receives the factor of government policies and reimbursements, which has made RPM an effective model of managing chronic diseases. Since RPM technology is still in its infancy, the potential use to improve patient assistance and reduce the pressure on healthcare structures will increase, dragging the market forward.

Remote Patient Monitoring Devices Market Trend Analysis:

Growing Adoption of Wearable and Portable RPM Devices

-

Portable and wearable RPM devices have continued to attract much market attention since they can be used conveniently to provide continuous health status assessment. That is why, smartwatches, wristbands, portable ECG monitors for RPM are not invasive, which makes the service quite popular among young people and other population. As new sensors have emerged, the devices no longer only monitor one kind of measure at a time, but heart rate, blood oxygen levels, amount of physical activity and sleeping cycle of the owner. Wearable RPM devices are currently in demand because consumers need a convenient management tool and as global awareness of health issues rise, there is likely to be higher demand for RPM devices. This is also in harmony with the revelations of a departure towards early signs of health risk intertwined with the fact that RPM wearable devices distinguish early anomalous health signs for the right action.

Expansion of RPM in Emerging Markets

-

Emerging markets offer the greatest potential for expanding the globalization of RPM Devices market and the global outreach that they have been steadily progressing in at a frankly dazzling pace. HC organizations in the developing world are yet to become more developed, a point which makes the need for better technologies for improved access and delivery of health care service greater. Many countries around the world especially in the Asia-Pacific region, Latin America and Africa have recorded an increase in occurrences of such ailments such as diabetes and cardiovascular diseases; ailments that require frequent checkups in hospitals. Again, RPM devices are helpful here because patients can manage and observe their own care without overwhelming the institutions full of people. Also, as for the people in these areas gaining more improved access to Smartphone and internet RPM devices are easily utilized since data can be transmitted and reviewed by clinical personnel remotely. RPM Devices market will hugely benefit from the many policies coming from governments of emerging markets that are spearheading health care infrastructure and e-Health.

Remote Patient Monitoring Devices Market Segment Analysis:

The Remote Patient Monitoring Devices Market is Segmented on the basis of Device Type, Application, End User, and Region.

By Device Type, Blood glucose segment is expected to dominate the market during the forecast period

-

Looking at the device type, Blood Glucose Monitoring is expected to take the major market share across the RPM Devices market analysis period. Diabetes is a condition that is on the rise globally and due to self-monitoring patients with diabetes can effectively control their blood glucose level. For example, the CGM systems and self-monitoring devices provide actual rates as a patient can adjust his /her diet, doses of medications and exercise regime. There is therefore escalated and consistent call for usage of BG monitoring devices because of the new culture, which is more inclined towards early prevention of complications associated with diabetes and risks, not forgetting the ever-changing behavior towards illnesses and diseases and because technology is easily demanded in today’s society. Further, new innovations in the touch of sensor engineering and non-intrusive techniques prevalent in glucose monitoring technology are improving the real usability of those gadgets nearing all the consumers in the market. Rising incidences of diabetes worldwide has made}' In sure that the blood glucose monitoring segment shall remain the dominant segment in the RPM Devices market.

By Application, Diabetes segment expected to held the largest share

-

When applied, it is expected that the Diabetes segment would most dominate the RPM Devices market. This type of treatment requires the evaluation of glucose concentrations chronically, a process that RPM devices are capable of performing with extreme accuracy and in a very short time. Patients’ escorts have a chance to benefit from RPM as they are frequently encouraged to give feedback on glucose level and then changes made on insulin dosage or diet are made in small portions. This is because through aspects such as inadequate diet, lack of physical activities and aging populations, more people are developing type 2 diabetes in this part of the world and globally and therefore the need for the monitoring systems. They allow diabetic patients to take more responsibilities for their condition, and have less interactions with others, and even less hospitalizations. The other contributory factor being the rising number of patients employing RPM Devices within the diabetes segment owing to aracialities of cheap and relatively simple glucometers.

Remote Patient Monitoring Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Presently, RPM Devices market is expected to observe the highest growth in North America throughout the forecast period owing to factors like colour ate healthcare facility, high prevalence of chronic diseases along with growing acceptance for digital health solutions and services among others. The United States is the world’s largest customer for RPM due to the indispensability of RPM in the delivery of care for ailments such as diabetes, hypertension, cardiovascular diseases, among others due to the increasing prevalence of chronic diseases. The healthcare sector in the region has been well developed and RPM devices are encouraged by the regulators through adoption of telemedicine and remote monitoring as best practices.

- Canada is the other critical actor in the North American RPM Devices market, which has been gradually emerging more dynamically in the digital health and telecare, particularly in the rural context. RPM has therefore been embraced by the Canada healthcare system in delivery and improvement of patient care to patients with such diseases; which require constant monitoring. It looks like RPM technology has favorable potential for further evolution, and North America is seen to have the possibility to provide the global market health care solutions which may potentially be useful in the additional improvement of the patient satisfaction and the potential constant reduction of the cost. This shift towards preventive remedy, chronic diseases, and personalised medicine is estimated to retain the regions standing in RPM Devices market through the forecast years.

Active Key Players in the Remote Patient Monitoring Devices Market:

- Abbott Laboratories (USA)

- AliveCor, Inc. (USA)

- AMD Global Telemedicine, Inc. (USA)

- Baxter International Inc. (USA)

- Biotronik SE & Co. KG (Germany)

- Boston Scientific Corporation (USA)

- Dexcom, Inc. (USA)

- GE Healthcare (USA)

- Koninklijke Philips N.V. (Netherlands)

- Masimo Corporation (USA)

- Medtronic PLC (Ireland)

- Nihon Kohden Corporation (Japan)

- Omron Healthcare, Inc. (Japan)

- Roche Diagnostics (Switzerland)

- Welch Allyn (USA), and Other Active Players

|

Remote Patient Monitoring Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 42.40 Billion |

|

Forecast Period 2024-32 CAGR: |

19.3 % |

Market Size in 2032: |

USD 207.55 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Remote Patient Monitoring Devices Market by Device Type

4.1 Remote Patient Monitoring Devices Market Snapshot and Growth Engine

4.2 Remote Patient Monitoring Devices Market Overview

4.3 Cardiac

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cardiac: Geographic Segmentation Analysis

4.4 Respiratory

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Respiratory: Geographic Segmentation Analysis

4.5 Blood glucose

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Blood glucose: Geographic Segmentation Analysis

4.6 Blood pressure

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Blood pressure: Geographic Segmentation Analysis

4.7 Neuro monitoring

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Neuro monitoring: Geographic Segmentation Analysis

4.8 Multiparameter

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Multiparameter: Geographic Segmentation Analysis

4.9 others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 others: Geographic Segmentation Analysis

Chapter 5: Remote Patient Monitoring Devices Market by Application

5.1 Remote Patient Monitoring Devices Market Snapshot and Growth Engine

5.2 Remote Patient Monitoring Devices Market Overview

5.3 Oncology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oncology: Geographic Segmentation Analysis

5.4 Cardiology

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cardiology: Geographic Segmentation Analysis

5.5 Hypertension

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Hypertension: Geographic Segmentation Analysis

5.6 Chronic Respiorty Disease

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Chronic Respiorty Disease: Geographic Segmentation Analysis

5.7 Neurology

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Neurology: Geographic Segmentation Analysis

5.8 Diabetes and others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Diabetes and others: Geographic Segmentation Analysis

Chapter 6: Remote Patient Monitoring Devices Market by End User

6.1 Remote Patient Monitoring Devices Market Snapshot and Growth Engine

6.2 Remote Patient Monitoring Devices Market Overview

6.3 Home health care settings

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Home health care settings: Geographic Segmentation Analysis

6.4 Hospitals and Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Hospitals and Clinics: Geographic Segmentation Analysis

6.5 Ambulatory Care Centres and others)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Ambulatory Care Centres and others): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Remote Patient Monitoring Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALIVECOR INC.

7.4 BIOTRONIK SE & CO. KG

7.5 BOSTON SCIENTIFIC CORPORATION

7.6 DEXCOM INC

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Remote Patient Monitoring Devices Market By Region

8.1 Overview

8.2. North America Remote Patient Monitoring Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Device Type

8.2.4.1 Cardiac

8.2.4.2 Respiratory

8.2.4.3 Blood glucose

8.2.4.4 Blood pressure

8.2.4.5 Neuro monitoring

8.2.4.6 Multiparameter

8.2.4.7 others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Oncology

8.2.5.2 Cardiology

8.2.5.3 Hypertension

8.2.5.4 Chronic Respiorty Disease

8.2.5.5 Neurology

8.2.5.6 Diabetes and others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Home health care settings

8.2.6.2 Hospitals and Clinics

8.2.6.3 Ambulatory Care Centres and others)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Remote Patient Monitoring Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Device Type

8.3.4.1 Cardiac

8.3.4.2 Respiratory

8.3.4.3 Blood glucose

8.3.4.4 Blood pressure

8.3.4.5 Neuro monitoring

8.3.4.6 Multiparameter

8.3.4.7 others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Oncology

8.3.5.2 Cardiology

8.3.5.3 Hypertension

8.3.5.4 Chronic Respiorty Disease

8.3.5.5 Neurology

8.3.5.6 Diabetes and others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Home health care settings

8.3.6.2 Hospitals and Clinics

8.3.6.3 Ambulatory Care Centres and others)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Remote Patient Monitoring Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Device Type

8.4.4.1 Cardiac

8.4.4.2 Respiratory

8.4.4.3 Blood glucose

8.4.4.4 Blood pressure

8.4.4.5 Neuro monitoring

8.4.4.6 Multiparameter

8.4.4.7 others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Oncology

8.4.5.2 Cardiology

8.4.5.3 Hypertension

8.4.5.4 Chronic Respiorty Disease

8.4.5.5 Neurology

8.4.5.6 Diabetes and others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Home health care settings

8.4.6.2 Hospitals and Clinics

8.4.6.3 Ambulatory Care Centres and others)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Remote Patient Monitoring Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Device Type

8.5.4.1 Cardiac

8.5.4.2 Respiratory

8.5.4.3 Blood glucose

8.5.4.4 Blood pressure

8.5.4.5 Neuro monitoring

8.5.4.6 Multiparameter

8.5.4.7 others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Oncology

8.5.5.2 Cardiology

8.5.5.3 Hypertension

8.5.5.4 Chronic Respiorty Disease

8.5.5.5 Neurology

8.5.5.6 Diabetes and others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Home health care settings

8.5.6.2 Hospitals and Clinics

8.5.6.3 Ambulatory Care Centres and others)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Remote Patient Monitoring Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Device Type

8.6.4.1 Cardiac

8.6.4.2 Respiratory

8.6.4.3 Blood glucose

8.6.4.4 Blood pressure

8.6.4.5 Neuro monitoring

8.6.4.6 Multiparameter

8.6.4.7 others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Oncology

8.6.5.2 Cardiology

8.6.5.3 Hypertension

8.6.5.4 Chronic Respiorty Disease

8.6.5.5 Neurology

8.6.5.6 Diabetes and others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Home health care settings

8.6.6.2 Hospitals and Clinics

8.6.6.3 Ambulatory Care Centres and others)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Remote Patient Monitoring Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Device Type

8.7.4.1 Cardiac

8.7.4.2 Respiratory

8.7.4.3 Blood glucose

8.7.4.4 Blood pressure

8.7.4.5 Neuro monitoring

8.7.4.6 Multiparameter

8.7.4.7 others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Oncology

8.7.5.2 Cardiology

8.7.5.3 Hypertension

8.7.5.4 Chronic Respiorty Disease

8.7.5.5 Neurology

8.7.5.6 Diabetes and others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Home health care settings

8.7.6.2 Hospitals and Clinics

8.7.6.3 Ambulatory Care Centres and others)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Remote Patient Monitoring Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 42.40 Billion |

|

Forecast Period 2024-32 CAGR: |

19.3 % |

Market Size in 2032: |

USD 207.55 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||