Remifentanil Hydrochloride Market Synopsis

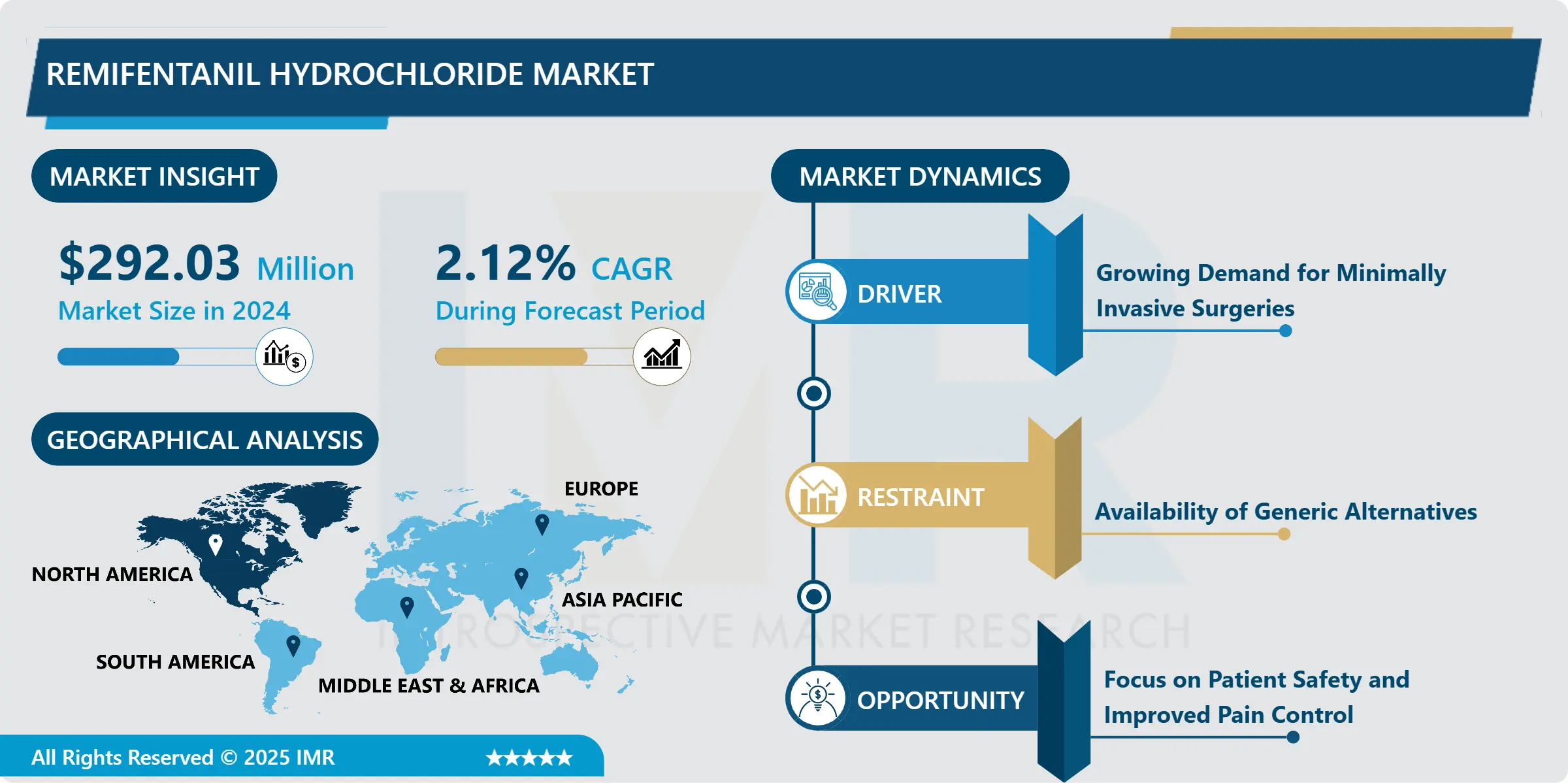

Remifentanil Hydrochloride Market Size Was Valued at USD 292.03 Million in 2024 and is Projected to Reach USD 367.83 Million by 2035, Growing at a CAGR of 2.12% From 2025-2035.

Remifentanil Hydrochloride is a potent, short-acting opioid analgesic used primarily for anesthesia and pain management during surgical procedures. It acts by binding to opioid receptors in the central nervous system, producing rapid onset and offset of effects. Due to its unique pharmacokinetic profile, Remifentanil offers precise control over anesthesia depth and allows for rapid recovery after surgery. Its short duration of action makes it suitable for use in procedures of varying lengths. It has potent nature requires careful dosing and monitoring to prevent respiratory depression and other adverse effects.

Healthcare facilities are increasingly adopting Remifentanil Hydrochloride due to its effectiveness in managing pain during surgeries and other medical procedures. Its quick onset and short duration of action make it a preferred choice among anesthetists and physicians. The rising prevalence of chronic diseases and the subsequent increase in surgical procedures worldwide are significant factors driving the demand for Remifentanil Hydrochloride. The advancements in drug delivery systems and formulations are further driving market expansion.

In terms of regional dynamics, developed regions such as North America and Europe hold a substantial share in the Remifentanil Hydrochloride market due to the presence of well-established healthcare infrastructure and higher healthcare expenditure. However, emerging economies in Asia Pacific, Latin America, and the Middle East are witnessing rapid market growth attributed to improving healthcare facilities and increasing awareness regarding pain management.

Furthermore, collaborations and partnerships among pharmaceutical companies and research institutions for product development and clinical trials are contributing to market growth. Continuous efforts to enhance the safety profile and efficacy of Remifentanil Hydrochloride formulations are anticipated to fuel market growth in the coming years. With the growing demand for effective pain management solutions and advancements in healthcare technology, the Remifentanil Hydrochloride market is expected to continue to offer significant opportunities for stakeholders in the pharmaceutical and healthcare sectors.

Remifentanil Hydrochloride Market Trend Analysis

Growing Demand for Minimally Invasive Surgeries

- The growing demand for minimally invasive surgeries indeed plays a significant role in driving the market for drugs like Remifentanil Hydrochloride. Remifentanil is a potent opioid analgesic often used during anesthesia for various surgical procedures, including minimally invasive surgeries.

- Minimally invasive surgeries offer several advantages over traditional open surgeries, including shorter recovery times, reduced pain, lower risk of infection, and smaller incisions, among others. These procedures require specialized anesthesia techniques to ensure patient comfort and safety, making drugs like Remifentanil Hydrochloride crucial in such settings.

- The increasing adoption of minimally invasive techniques across various surgical specialties, including cardiac, orthopedic, gynecological, and general surgery, is contributing to the rising demand for drugs like Remifentanil Hydrochloride. Additionally, advancements in surgical technology and techniques are further fueling this demand.

- Furthermore, the growing prevalence of chronic diseases and the aging population are driving the need for surgical interventions, further boosting the demand for drugs used in anesthesia, including Remifentanil Hydrochloride. The advantages offered by minimally invasive surgeries and the increasing volume of such procedures is a major driving force behind the growth of the Remifentanil Hydrochloride market.

Focus On Patient Safety and Improved Pain Control

- Remifentanil hydrochloride, a potent opioid analgesic, offers major opportunity for the healthcare industry with its dual emphasis on patient safety and enhanced pain management. One major factor driving its market growth is its unique pharmacokinetic profile, characterized by rapid onset and offset of action, allows for precise titration and quicker recovery from anesthesia. This property minimizes the risk of over-sedation and respiratory depression, crucial aspects in ensuring patient safety during surgical procedures.

- The demand for improved pain control solutions continues to escalate, particularly in critical care settings and surgical interventions. Remifentanil hydrochloride offers clinicians the flexibility to tailor anesthesia regimens according to individual patient needs, contributing to more effective pain management strategies. This adaptability is particularly valuable in scenarios where rapid changes in analgesic requirements are anticipated, such as during complex surgeries or in patients with comorbidities.

- The growing adoption of remifentanil hydrochloride is strengthened by advancements in technology and anesthesia delivery systems, which enable precise dosing and monitoring, further enhancing patient safety and optimizing pain control outcomes. As healthcare providers increasingly prioritize patient-centered care and strive to minimize the risks associated with opioid use, remifentanil hydrochloride emerges as a promising solution, poised to drive advancements in perioperative medicine and improve overall patient outcomes.

Remifentanil Hydrochloride Market Segment Analysis:

Remifentanil Hydrochloride Market Segmented based on Product Type, Application, Distribution Channel and Region

By Product Type, Injections segment is expected to dominate the market during the forecast period

- Remifentanil Hydrochloride injections are extensively utilized in hospitals, surgical centers, and other healthcare facilities for anesthesia and pain management during various surgical procedures. The injections offer rapid onset of action, allowing for precise control over anesthesia depth, is crucial for ensuring patient comfort and safety during surgery. Moreover, the injections' short duration of action enables quick recovery post-surgery, facilitating efficient patient turnover in operating rooms and enhancing overall procedural efficiency.

- With advancements in drug delivery systems and formulations, the injections segment within the Remifentanil Hydrochloride market continues to witness innovation. Manufacturers are focusing on developing novel formulations that improve drug stability, enhance patient convenience, and minimize the risk of medication errors.

- The increasing prevalence of surgical procedures worldwide, with the rising demand for effective pain management solutions, further drives the growth of the injections segment in the Remifentanil Hydrochloride market. As healthcare facilities prioritize patient safety and procedural efficiency, Remifentanil Hydrochloride injections remain a preferred choice for anesthesia and pain management in diverse surgical settings.

By Applications, Neurosurgery segment held the largest share in 2024

- The neurosurgery segment often involves intricate procedures on the brain and spinal cord, necessitating precise control of anesthesia and pain management. Remifentanil Hydrochloride's rapid onset and offset of action make it particularly advantageous in neurosurgical settings, allowing for swift adjustment of anesthesia levels to accommodate the delicate nature of the procedures. Its potency ensures effective pain relief during surgery while minimizing the risk of prolonged sedation post-operation.

- The short duration of Remifentanil Hydrochloride's effects facilitates rapid emergence from anesthesia, enabling neurosurgeons to assess patients' neurological status promptly after surgery. This feature is crucial for early detection of any postoperative complications, ensuring timely interventions when necessary. As neurosurgical techniques advance and demand for precise anesthesia grows, Remifentanil Hydrochloride continues to play a vital role in enhancing patient safety and surgical outcomes in neurosurgery.

Remifentanil Hydrochloride Market Regional Insights:

North America is expected to dominate the Market over the Forecast period

- North America stands tall as a dominant force in the Remifentanil Hydrochloride market. With its robust healthcare infrastructure, technological advancements, and strong research and development capabilities, the region asserts its supremacy in producing and distributing this potent opioid analgesic.

- The North America boasts a thriving pharmaceutical industry, supported by a network of cutting-edge manufacturing facilities and regulatory frameworks ensure quality and safety standards. This enables the efficient production and supply of Remifentanil Hydrochloride to meet the demands of both medical institutions and patients across the continent.

- Moreover, the region's advanced healthcare system fosters a high demand for Remifentanil Hydrochloride, particularly in surgical settings where its rapid onset and short duration of action make it an invaluable tool for anesthesiologists. This widespread adoption is further fueled by the region's large population and high incidence of surgical procedures, creating a substantial market for the drug.

- Additionally, North America's commitment to research and development fuels continuous innovation in the field of pain management, driving the discovery of new formulations and applications for Remifentanil Hydrochloride. This relentless pursuit of advancement solidifies the region's position as a leader in the global pharmaceutical landscape.

Remifentanil Hydrochloride Market Top Key Players:

- Mylan (United States)

- AMRI (United States)

- Abbott Laboratories (USA)

- Merck & Co., Inc. (USA)

- Pfizer Inc. (USA)

- Fresenius SE & Co. KGaA (Germany)

- Arevipharma (Germany)

- GSK (United Kingdom)

- Novartis International AG (Switzerland)

- Mallinckrodt Pharmaceuticals (United Kingdom)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Cipla Limited (India)

- Lupin Limited (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Other Active Players.

Key Industry Developments in the Remifentanil Hydrochloride Market:

- In February 2024, GSK plc finalized its acquisition of Aiolos Bio, a clinical-stage biopharmaceutical company specializing in respiratory and inflammatory conditions. The acquisition includes AIO-001, a promising long-acting anti-TSLP monoclonal antibody, set to enter phase II clinical trials for adult asthma patients. With AIO-001, GSK aims to broaden its respiratory biologics portfolio, potentially offering treatment to a significant portion of asthma patients with low T2 inflammation.

- In September 2023, Abbott finalized its acquisition of Bigfoot Biomedical, a pioneer in smart insulin management systems for individuals with diabetes. This move bolsters Abbott's presence in diabetes care, leveraging its renowned FreeStyle Libre® continuous glucose monitoring technology. Bigfoot now operates as a wholly-owned subsidiary of Abbott, marking a significant step in Abbott's mission to enhance personalized and precise diabetes management solutions.

|

Global Remifentanil Hydrochloride Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2025 : |

USD 292.03 Mn. |

|

Forecast Period 2025-35 CAGR: |

2.12% |

Market Size in 2035 : |

USD 367.83 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Remifentanil Hydrochloride Market by Product Type (2018-2032)

4.1 Remifentanil Hydrochloride Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Injections

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pre-mixed Solutions

Chapter 5: Remifentanil Hydrochloride Market by Application (2018-2032)

5.1 Remifentanil Hydrochloride Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cardiac Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Neurosurgery

5.5 General Surgery

5.6 Urology

5.7 Obstetrics and Gynecology

Chapter 6: Remifentanil Hydrochloride Market by Distribution Channel (2018-2032)

6.1 Remifentanil Hydrochloride Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.5 Clinics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Remifentanil Hydrochloride Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GTW (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 EUROTRACK (EUROPE)

7.4 BRIDGESTONE INDUSTRIAL (JAPAN)

7.5 CAMSO (CANADA)

7.6 SOUCY (CANADA)

7.7 MATTRACKS (USA)

7.8 GRIPTRAC (USA)

7.9 ZUIDBERG (NETHERLANDS)

7.10 ATI (USA)

7.11 OTHER MAJOR PLAYERS

7.12

Chapter 8: Global Remifentanil Hydrochloride Market By Region

8.1 Overview

8.2. North America Remifentanil Hydrochloride Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Injections

8.2.4.2 Pre-mixed Solutions

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Cardiac Surgery

8.2.5.2 Neurosurgery

8.2.5.3 General Surgery

8.2.5.4 Urology

8.2.5.5 Obstetrics and Gynecology

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Clinics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Remifentanil Hydrochloride Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Injections

8.3.4.2 Pre-mixed Solutions

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Cardiac Surgery

8.3.5.2 Neurosurgery

8.3.5.3 General Surgery

8.3.5.4 Urology

8.3.5.5 Obstetrics and Gynecology

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Clinics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Remifentanil Hydrochloride Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Injections

8.4.4.2 Pre-mixed Solutions

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Cardiac Surgery

8.4.5.2 Neurosurgery

8.4.5.3 General Surgery

8.4.5.4 Urology

8.4.5.5 Obstetrics and Gynecology

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Clinics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Remifentanil Hydrochloride Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Injections

8.5.4.2 Pre-mixed Solutions

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Cardiac Surgery

8.5.5.2 Neurosurgery

8.5.5.3 General Surgery

8.5.5.4 Urology

8.5.5.5 Obstetrics and Gynecology

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Clinics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Remifentanil Hydrochloride Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Injections

8.6.4.2 Pre-mixed Solutions

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Cardiac Surgery

8.6.5.2 Neurosurgery

8.6.5.3 General Surgery

8.6.5.4 Urology

8.6.5.5 Obstetrics and Gynecology

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Clinics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Remifentanil Hydrochloride Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Injections

8.7.4.2 Pre-mixed Solutions

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Cardiac Surgery

8.7.5.2 Neurosurgery

8.7.5.3 General Surgery

8.7.5.4 Urology

8.7.5.5 Obstetrics and Gynecology

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Clinics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Remifentanil Hydrochloride Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2025 : |

USD 292.03 Mn. |

|

Forecast Period 2025-35 CAGR: |

2.12% |

Market Size in 2035 : |

USD 367.83 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||