Key Market Highlights

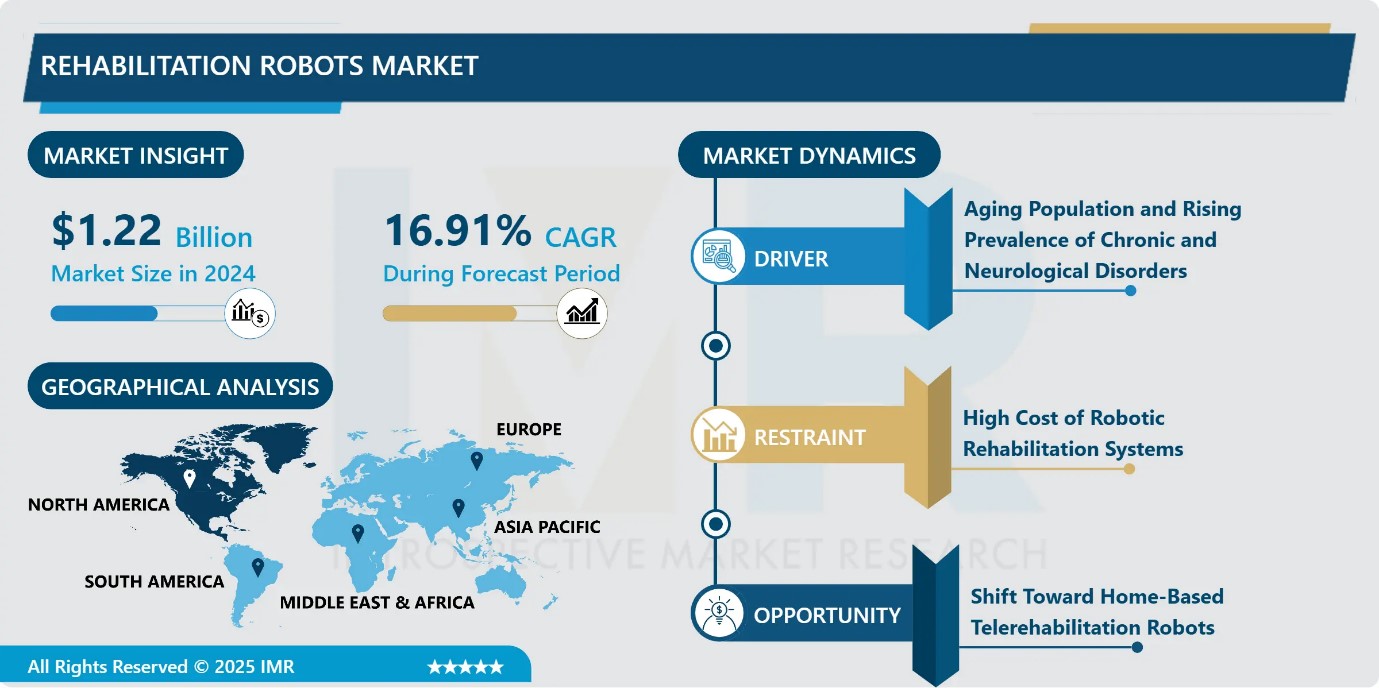

Rehabilitation Robots Market Size Was Valued at USD 1.22 Billion in 2024, and is Projected to Reach USD 6.80 Billion by 2035, Growing at a CAGR of 16.91% from 2025-2035.

- Market Size in 2024: USD 1.22 Billion

- Projected Market Size by 2035: USD 6.80 Billion

- CAGR (2025–2035): 16.91%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Body Region: The Upper Extremity segment is anticipated to lead the market by accounting for 61.43% of the market share throughout the forecast period.

- By End-User: The Lower Hospitals and Clinics segment is expected to capture 56.76% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 26.89% of the market share during the forecast period.

- Active Players: AlterG, Inc. (USA) BioXtreme Ltd. (Israel) Bionik Laboratories Corp. (USA/Canada) Cyberdyne, Inc. (Japan) DIH Holding US, Inc. / DIH Technologies Corporation (USA/Switzerland), and Other Active Players.

Rehabilitation Robots Market Synopsis:

The rehabilitation robots market refers to robotic systems designed to assist, support, or restore motor functions in patients affected by neurological, orthopedic, or traumatic conditions. These robots are used as adjuncts to physical therapy, enabling repetitive, precise, and measurable rehabilitation exercises. The market is witnessing steady growth driven by rising incidences of stroke, sports injuries, and age-related mobility disorders, along with a rapidly growing geriatric population. Advancements in robotics, sensors, and AI have improved clinical effectiveness and usability. Favorable reimbursement policies, increasing investments, and government and private funding initiatives are further enhancing adoption across hospitals, rehabilitation centers, and home-care settings worldwide.

Rehabilitation Robots Market Dynamics and Trend Analysis:

Rehabilitation Robots Market Growth Driver-Aging Population and Rising Prevalence of Chronic and Neurological Disorders

- The rehabilitation robots market is being driven by the growing aging population and increasing incidence of stroke, dementia, cerebral palsy, Parkinson’s disease, spinal cord injuries, and other chronic conditions. These disorders impair mobility and daily activities, creating a high demand for therapeutic, assistive, and exoskeleton robots. Advancements in neurorehabilitation, investments in innovative robotic solutions, and the ability of these devices to aid recovery and enhance quality of life are key growth factors. Rising awareness and adoption of rehabilitation robots in hospitals and rehabilitation centers further support market expansion globally.

Rehabilitation Robots Market Limiting Factor-High Cost of Robotic Rehabilitation Systems

- The high cost of robotic rehabilitation systems remains a significant market restraint. These advanced robots require substantial initial investment and ongoing maintenance, making them less affordable for individuals and smaller healthcare facilities. The expensive pricing limits adoption among low- and middle-income patients and restricts utilization in underdeveloped and developing countries. Many hospitals and rehabilitation centers face budgetary constraints that prevent the integration of these technologies into routine care. As a result, despite their clinical benefits, the affordability barrier continues to slow widespread adoption, particularly in regions with limited healthcare infrastructure and funding.

Rehabilitation Robots Market Expansion Opportunity-Shift Toward Home-Based Telerehabilitation Robots

- The growing development of home-based robotic rehabilitation solutions presents a significant market opportunity. Patients using home-based robots achieved higher mobility scores and reduced Medicare costs compared to skilled-nursing facilities. AI-driven virtual therapy delivered symptom relief in over 80% of cases, while pilot stroke studies showed measurable functional improvements. These advancements highlight the potential for rehabilitation robots to provide safe, effective, and convenient therapy at home, expanding market adoption and accessibility.

Rehabilitation Robots Market Challenge and Risk-Limited Knowledge, Regulatory Hurdles, and Technical Complexity

- The rehabilitation robots market faces several challenges that hinder widespread adoption. Limited awareness and understanding among patients and healthcare professionals reduce acceptance of robotic rehabilitation solutions, despite their proven efficacy. Regulatory and compliance requirements further slow market entry, as strict approval processes extend the time needed for new technologies to gain traction. Additionally, the technical complexity of these systems including potential hardware failures, software issues, and the need for specialized training poses operational difficulties for healthcare providers. These combined factors continue to challenge the seamless integration of robotic rehabilitation technologies into clinical practice worldwide.

Rehabilitation Robots Market Trend-Technological Advancements and Personalized Rehabilitation Driving Market Trends

- The rehabilitation robots market is witnessing rapid growth driven by technological innovations and personalized therapy solutions. Integration of artificial intelligence (AI), machine learning (ML), advanced sensors, and real-time data analytics enables adaptive and patient-specific rehabilitation, enhancing recovery outcomes. Wearable devices, neurorehabilitation robots, and AI-guided strength training provide interactive, evidence-based therapy that surpasses conventional physiotherapy in accuracy and effectiveness.

- Virtual reality (VR) exercises, real-time force feedback, and motion-adaptive programs further improve patient engagement and functional recovery. Collaborations between robot manufacturers, healthcare providers, and government organizations accelerate the accessibility of advanced solutions. With these innovations, the market is expected to expand significantly, reflecting the growing demand for smart, efficient, and personalized rehabilitation technologies worldwide.

Rehabilitation Robots Market Segment Analysis:

Rehabilitation Robots Market is segmented based on Robot, Application, Body Region, Mobility Level, End-User and Region.

By Body Region, Upper-Extremity segment is expected to dominate the market with around 61.43% share during the forecast period.

- The upper-extremity segment dominates the rehabilitation robots market due to the complex motor-control requirements and its relevance to daily activities. These devices assist in repetitive, labor-intensive therapy, reducing the time therapists spend on manual treatments. Innovations such as dielectric-elastomer robotic hands offering 27 degrees of freedom at sub-USD 1,000 price points indicate broader accessibility and potential democratization of upper-limb rehabilitation solutions.

- Lower-extremity robots focus on gait, balance, and mobility enhancement, particularly in Parkinson’s therapy, while cross-body systems integrating EEG-driven intent detection improve stroke rehabilitation with high brain-computer interface accuracy. Continued miniaturization of sensors, AI-powered control, and adaptive robotics are expected to sustain functional gains, driving the upper-extremity segment’s rapid market growth.

By End-User, Hospitals and Clinics is expected to dominate with close to 56.76% market share during the forecast period.

- By end-user, the hospitals and clinics segment led the global rehabilitation robots market in 2024, accounting for the largest revenue share of 47.1%. The dominance is driven by the availability of skilled professionals, specialized equipment, and capital investments required to operate advanced rehabilitation devices. Hospitals and clinics also benefit from favorable regulatory frameworks, ongoing clinical trials, and reimbursement policies that enhance accessibility.

- The rising prevalence of spinal cord injuries, musculoskeletal disorders, and other mobility-impairing conditions increases demand for hospital-based rehabilitation services. Additionally, rapid adoption of technologically advanced systems, higher FDA approvals for medical exoskeletons, and growing healthcare spending further reinforce the leadership of this segment in the rehabilitation robotics market.

Rehabilitation Robots Market Regional Insights:

North America region is estimated to lead the market with around 26.89% share during the forecast period.

- North America dominated the rehabilitation robots market in 2024, accounting for approximately 45% of global revenue. The region’s leadership is driven by advanced healthcare infrastructure, high per capita healthcare expenditure, and favorable reimbursement policies, including Medicare and Veterans Affairs programs that provide exoskeletons to spinal-cord-injured veterans. Regulatory support from the FDA has accelerated the approval of innovative robotic devices, while strategic partnerships between technology firms and healthcare providers foster continuous innovation.

- The United States and Canada lead the market, with major players such as Ekso Bionics and ReWalk Robotics headquartered in the region. Growing prevalence of spinal cord injuries, an aging population, and rising awareness of rehabilitation technologies further reinforce North America’s dominance, positioning it as an innovation and investment hub in the sector.

Rehabilitation Robots Market Active Players:

- AlterG, Inc. (USA)

- BioXtreme Ltd. (Israel)

- Bionik Laboratories Corp. (USA/Canada)

- Cyberdyne, Inc. (Japan)

- Ekso Bionics Holdings Inc. (USA)

- Fourier (China)

- Hocoma AG (Switzerland)

- Kinova Inc. (Canada)

- Life Science Robotics ApS (Denmark)

- ReWalk Robotics Ltd. / Lifeward Ltd. (Israel)

- Rehab-Robotics Company Limited (Hong Kong, China)

- Rex Bionics Ltd. (New Zealand/Australia)

- Tyromotion GmbH (Austria)

- DIH Holding US, Inc. / DIH Technologies Corporation (USA/Switzerland)

- Instead Technologies Ltd. (UK)

- Other Active Players

Key Industry Developments in the Rehabilitation Robots Market:

- In February 2025: Lifeward finalized a reimbursement agreement with Germany’s BARMER. The pact extends coverage to approximately 8.5 million people.

This milestone strengthens Lifeward’s presence in the European rehabilitation market. - In May 2024: DIH Holding US, Inc. announced a strategic partnership with B-Temia, Inc. .The collaboration focuses on integrating AI-based rehabilitation robotics with DIH’s smart integral solutions.B-Temia brings expertise in advanced AI-driven rehab robotdevelopment.

Technical Insights and Innovations in Rehabilitation Robotics: Advanced Systems, AI-Driven Therapy, Sensor Integration, and Patient-Specific Adaptive Solutions

- Rehabilitation robots are advanced electromechanical systems designed to assist patients in regaining mobility, strength, and motor functions. They include therapeutic robots, exoskeletons, assistive robots, and wearable devices, integrating technologies such as artificial intelligence (AI), machine learning (ML), sensor-based feedback, and real-time data analytics. Upper-extremity robots focus on fine motor control, daily-living tasks, and repetitive therapy, while lower-extremity exoskeletons enhance gait, balance, and lower-limb rehabilitation. Many devices incorporate brain-computer interface (BCI) systems and virtual reality (VR) to enable patient-specific, adaptive therapy.

- Real-time force feedback, motion-adaptive control, and biofeedback mechanisms improve therapy precision and engagement. Advanced software enables tracking, performance analytics, and personalized rehabilitation plans. These technical features allow robotic systems to provide consistent, high-intensity therapy, overcoming limitations of traditional physiotherapy, and improving functional recovery for patients with neurological, musculoskeletal, or mobility disorders.

|

Rehabilitation Robots Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.22 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.91 % |

Market Size in 2035: |

USD 6.80 Bn. |

|

Segments Covered: |

By Robot |

|

|

|

By Application

|

|

||

|

By Body Region |

|

||

|

By Mobility Level |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Rehabilitation Robots Market by Robot (2018-2035)

4.1 Rehabilitation Robots Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Therapeutic Robots

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Assistive Robots

4.5 Exoskeleton Robots

4.6 Others

Chapter 5: Rehabilitation Robots Market by Application (2018-2035)

5.1 Rehabilitation Robots Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Physical Rehabilitation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Neurological Rehabilitation

5.5 Orthopedic Rehabilitation

Chapter 6: Rehabilitation Robots Market by Body Region (2018-2035)

6.1 Rehabilitation Robots Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Upper Extremity

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Lower Extremity

Chapter 7: Rehabilitation Robots Market by Mobility Level (2018-2035)

7.1 Rehabilitation Robots Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Stationary Platforms

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Mobile Systems

Chapter 8: Rehabilitation Robots Market by End User (2018-2035)

8.1 Rehabilitation Robots Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Rehabilitation Centers

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Hospitals

8.5 Clinics

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Rehabilitation Robots Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ALTERG

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 INC. (USA)

9.4 BIOXTREME LTD. (ISRAEL)

9.5 BIONIK LABORATORIES CORP. (USA/CANADA)

9.6 CYBERDYNE

9.7 INC. (JAPAN)

9.8 DIH HOLDING US

9.9 INC. / DIH TECHNOLOGIES CORPORATION (USA/SWITZERLAND)

9.10 EKSO BIONICS HOLDINGS INC. (USA)

9.11 FOURIER (CHINA)

9.12 HOCOMA AG (SWITZERLAND)

9.13 INSTEAD TECHNOLOGIES LTD. (UK)

9.14 KINOVA INC. (CANADA)

9.15 LIFE SCIENCE ROBOTICS APS (DENMARK)

9.16 REWALK ROBOTICS LTD. / LIFEWARD LTD. (ISRAEL)

9.17 REHAB-ROBOTICS COMPANY LIMITED (HONG KONG

9.18 CHINA)

9.19 REX BIONICS LTD. (NEW ZEALAND/AUSTRALIA)

9.20 TYROMOTION GMBH (AUSTRIA) AND OTHER ACTIVE PLAYERS

Chapter 10: Global Rehabilitation Robots Market By Region

10.1 Overview

10.2. North America Rehabilitation Robots Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Rehabilitation Robots Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Rehabilitation Robots Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Rehabilitation Robots Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Rehabilitation Robots Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Rehabilitation Robots Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Rehabilitation Robots Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.22 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.91 % |

Market Size in 2035: |

USD 6.80 Bn. |

|

Segments Covered: |

By Robot |

|

|

|

By Application

|

|

||

|

By Body Region |

|

||

|

By Mobility Level |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||