Recombinant Vaccine Market Synopsis:

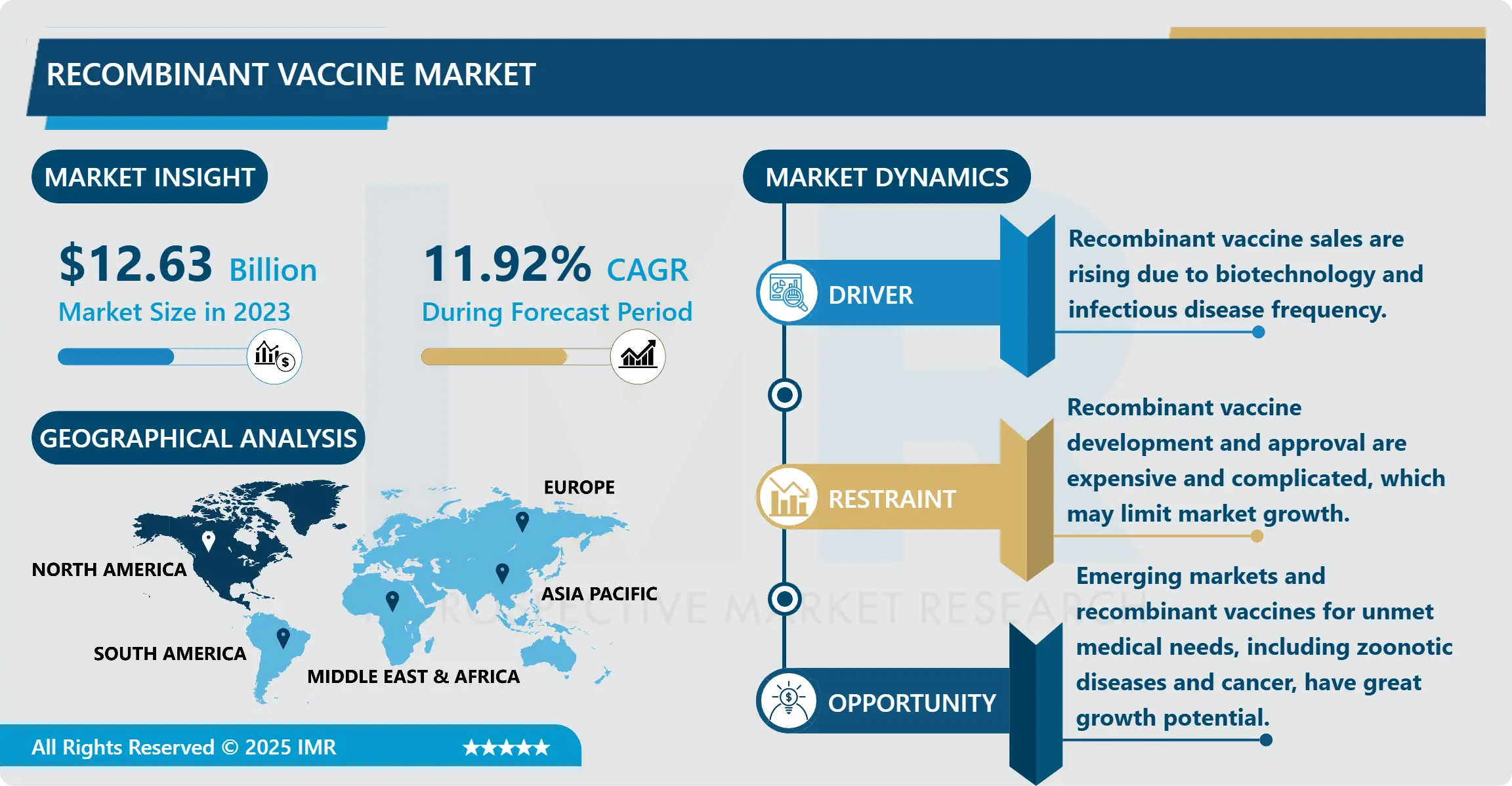

Recombinant Vaccine Market Size Was Valued at USD 12.63 Billion in 2023, and is Projected to Reach USD 34.80 Billion by 2032, Growing at a CAGR of 11.92% From 2024-2032.

The global market for recombinant vaccines is one of the most vibrant segments in the overall global vaccine market owing to the continuous progress of biotechnology along with the growing importance of immunization stake. Recombinant vaccines are developed with the use of recombinant DNA technology through which genes coding for particular antigens are incorporated into host cells in order to generate massive production of requisite immune reactions. This approach has ensured that a number of vaccines are developed and even improved in their efficiency, safety and stability than the normal vaccines formulation. Consequently, the recombinant vaccines are in rising use for a variety of infectious diseases like hepatitis B, human papillomavirus (HPV), and latterly COVID-19.

Expansion in the recombinant vaccine market is fortified even further by the increasing rate of infectious diseases worldwide and the increasing need for immunization. The governments and health organizations are contributing high amount towards vaccine development to prevent epidemic and pandemic and it is forging the funding and support for the research and experimentation. Furthermore, the emergence of COVID-19 has spurred the development and improvement of new vaccines and the manufacturing process for recombinant vaccines leading to availability of several recombinant vaccines in the market at a fairly short time. This has not only served to increase public understanding and recognition of the significance of vaccination but also to re-emphasise the significance of recombinant vaccinations in contemporary inter-connective world health affair.

The global recombinant vaccine market is primarily driven by North America and Europe: they possess well-developed research, highly developed health care systems and major pharmaceutical companies active in the field of vaccine production.icantly in vaccine development to combat epidemics and pandemics, thereby increasing funding and support for research and clinical trials. Moreover, the COVID-19 pandemic has catalyzed rapid advancements in vaccine technology and production capabilities, resulting in several recombinant vaccine candidates entering the market at an unprecedented pace. This has not only enhanced public awareness about the importance of vaccination but also reinforced the critical role of recombinant vaccines in global health initiatives.

North America and Europe are currently leading the recombinant vaccine market, owing to their strong research infrastructure, advanced healthcare systems, and the presence of key pharmaceutical companies engaged in vaccine development. However, Asia-Pacific and Latin America have been forecasted to grow at a steepest rate due to higher investment in Health care and immunization awareness. The recombinant vaccines market is currently in a period of growth, and new developments and strategic partnerships between biotech companies and academic institutions are likely to intensively contribute to the creation of new vaccines to meet present and emerging demand.

Recombinant Vaccine Market Trend Analysis:

Increasing Demand for Personalized Vaccines

-

The recombinant vaccine market is moving in the direction of more targeted medicines produced according to genetic and immune response profiles.. The shift in technology and subsequently the modification of vaccines made from genomic research and information diversification results in the two main principles: identification of specific pathogens and improving the immune response according to the given traits. Such an approach is very effective when treating multicentric diseases such as cancer and chronic infections for which conventional vaccines may not offer the best protection. As research advances with refined and individualized shots, this is anticipated to spur business growth of the recombinant vaccine market, guaranteeing enhanced efficiency and immunity for a variety of patients.

Rise in Vaccine Development for Emerging Infectious Diseases

-

Infectious diseases all over the world are a dynamic public health problem as new pathogens are emerging and some old pathogens are re-emerging.. Such a climate has called for elevated interest in designing the use of recombinant vaccinations for diseases like the zika virus, Ebola, as well as different strands of influenza. The feature of speedy generation and conversion depending on these pathogens is considered as a strength of recombinant technology especially when developing vaccines against these pathogens. As these diseases are highly contagious, governments and health organizations are focusing on the development of vaccines and public and private organizations have come together. This trend also emphasizes the relevance of new vaccine technologies, as well as the essential requirement for the prompt addressing of the global threats to populace health, consequently stimulating the recombinant vaccine market.

Recombinant Vaccine Market Segment Analysis:

Recombinant Vaccine Market is Segmented on the basis of Product, Disease, End-Users, and Region.

By Product, Subunit Recombinant segment is expected to dominate the market during the forecast period

-

The recombinant vaccine market is categorized primarily by product type into two main segments: There are recombination subunit vaccines and live attenuated recombinant vaccines. Recombinant vaccines refer to the parts of the pathogen that have a capacity to cause an immune response, and include proteins and sugars, but not the live pathogen. This type of vaccine has little risk associated with it and is often used in vaccines in diseases such as hepatitis B, and HPV. The other type of viral vaccines are the attenuated recombinant vaccines that consist of live infective but less virile strain of the pathogen; it offers more privative reactions against the pathogen since it contains the natural pathogen which include measles and mumps vaccines. These two angles are proving popular due to their efficacy and safety and are playing a big role in boosting the recombinant vaccines market as well as advancements seen in the light of increasing emerging diseases and continued vaccinations worldwide.

End-Users, Pediatrics segment expected to held the largest share

-

The recombinant vaccine market serves a diverse range of end-users, primarily categorized into three segments: for pediatric use, adults and even veterinary uses. Within pediatrics, recombinant products are vital for creating immunity against different diseases, including hepatitis B and rotavirus, in children at certain ages. In adults, these vaccines are critical in managing some diseases such as HPV and influenza, tasks that relate to health issues people face as they age and/or make other life style adjustments. The veterinary segment also registers shifting demand to recombinant products used to vaccinate pets and livestock needed to control and prevent diseases likes rabies and avian influenza to boost animal health and productivity. With increased knowledge about recombinant technology driving its application, the market remains capable of providing differentiated immunization as per various end-user segments, thus supporting growth in each segment.

Recombinant Vaccine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America will remain the largest market for recombinant vaccines in 2020-25 benefiting from a well-developed economy, strong research fundamentals, and high investments in biopharmaceutical industries. Naturally, key participants contributing to technology growth, such as large pharmaceutical firms and biotech companies, are essential in the process of the development of innovative approaches to vaccine creation. Positive government policies and funding schemes directed at improving vaccine development and innovation, especially where a public health crisis is concerned, are responsible for the regional leadership in the market. enhanced public education on the effectiveness and safety of the vaccine, coupled with enhanced campaigns of vaccination put North America in a strategic place of the recombinant vaccine market and improved development of vaccines.

Active Key Players in the Recombinant Vaccine Market:

- Abiomed (US)

- Emergent Bio Solutions, Inc. (US)

- GlaxoSmithKline (United Kingdom)

- Johnson & Johnson (US)

- Sanofi Pasteur SA (France)

- Serum Institute of India Pvt. Ltd ( India)

- Mitsubishi Tanabe Pharma Corporation (Japan)

- Daiichi Sankyo (Japan)

- Pfizer, Inc. (US), and Other Active Players

|

Recombinant Vaccine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.63 Billion |

|

Forecast Period 2024-32 CAGR: |

11.92% |

Market Size in 2032: |

USD 34.80 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Disease |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Recombinant Vaccine Market by Product

4.1 Recombinant Vaccine Market Snapshot and Growth Engine

4.2 Recombinant Vaccine Market Overview

4.3 Subunit Recombinant and Attenuated Recombinant Vaccines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Subunit Recombinant and Attenuated Recombinant Vaccines: Geographic Segmentation Analysis

Chapter 5: Recombinant Vaccine Market by Disease

5.1 Recombinant Vaccine Market Snapshot and Growth Engine

5.2 Recombinant Vaccine Market Overview

5.3 Cancer

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cancer: Geographic Segmentation Analysis

5.4 Pneumococcal Disease

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pneumococcal Disease: Geographic Segmentation Analysis

5.5 Hepatitis B

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Hepatitis B: Geographic Segmentation Analysis

5.6 and DPT

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 and DPT: Geographic Segmentation Analysis

Chapter 6: Recombinant Vaccine Market by , End-Users

6.1 Recombinant Vaccine Market Snapshot and Growth Engine

6.2 Recombinant Vaccine Market Overview

6.3 Pediatrics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pediatrics: Geographic Segmentation Analysis

6.4 Adults

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Adults: Geographic Segmentation Analysis

6.5 and Veterinary

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Veterinary: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Recombinant Vaccine Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABIOMED (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 EMERGENT BIO SOLUTIONS INC. (US)

7.4 GLAXOSMITHKLINE (UNITED KINGDOM)

7.5 JOHNSON & JOHNSON (US)

7.6 SANOFI PASTEUR SA (FRANCE)

7.7 SERUM INSTITUTE OF INDIA PVT. LTD (INDIA)

7.8 MITSUBISHI TANABE PHARMA CORPORATION (JAPAN)

7.9 DAIICHI SANKYO (JAPAN)

7.10 PFIZER INC. (US)

7.11 OTHER ACTIVE PLAYERS

Chapter 8: Global Recombinant Vaccine Market By Region

8.1 Overview

8.2. North America Recombinant Vaccine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product

8.2.4.1 Subunit Recombinant and Attenuated Recombinant Vaccines

8.2.5 Historic and Forecasted Market Size By Disease

8.2.5.1 Cancer

8.2.5.2 Pneumococcal Disease

8.2.5.3 Hepatitis B

8.2.5.4 and DPT

8.2.6 Historic and Forecasted Market Size By , End-Users

8.2.6.1 Pediatrics

8.2.6.2 Adults

8.2.6.3 and Veterinary

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Recombinant Vaccine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product

8.3.4.1 Subunit Recombinant and Attenuated Recombinant Vaccines

8.3.5 Historic and Forecasted Market Size By Disease

8.3.5.1 Cancer

8.3.5.2 Pneumococcal Disease

8.3.5.3 Hepatitis B

8.3.5.4 and DPT

8.3.6 Historic and Forecasted Market Size By , End-Users

8.3.6.1 Pediatrics

8.3.6.2 Adults

8.3.6.3 and Veterinary

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Recombinant Vaccine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product

8.4.4.1 Subunit Recombinant and Attenuated Recombinant Vaccines

8.4.5 Historic and Forecasted Market Size By Disease

8.4.5.1 Cancer

8.4.5.2 Pneumococcal Disease

8.4.5.3 Hepatitis B

8.4.5.4 and DPT

8.4.6 Historic and Forecasted Market Size By , End-Users

8.4.6.1 Pediatrics

8.4.6.2 Adults

8.4.6.3 and Veterinary

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Recombinant Vaccine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product

8.5.4.1 Subunit Recombinant and Attenuated Recombinant Vaccines

8.5.5 Historic and Forecasted Market Size By Disease

8.5.5.1 Cancer

8.5.5.2 Pneumococcal Disease

8.5.5.3 Hepatitis B

8.5.5.4 and DPT

8.5.6 Historic and Forecasted Market Size By , End-Users

8.5.6.1 Pediatrics

8.5.6.2 Adults

8.5.6.3 and Veterinary

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Recombinant Vaccine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product

8.6.4.1 Subunit Recombinant and Attenuated Recombinant Vaccines

8.6.5 Historic and Forecasted Market Size By Disease

8.6.5.1 Cancer

8.6.5.2 Pneumococcal Disease

8.6.5.3 Hepatitis B

8.6.5.4 and DPT

8.6.6 Historic and Forecasted Market Size By , End-Users

8.6.6.1 Pediatrics

8.6.6.2 Adults

8.6.6.3 and Veterinary

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Recombinant Vaccine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product

8.7.4.1 Subunit Recombinant and Attenuated Recombinant Vaccines

8.7.5 Historic and Forecasted Market Size By Disease

8.7.5.1 Cancer

8.7.5.2 Pneumococcal Disease

8.7.5.3 Hepatitis B

8.7.5.4 and DPT

8.7.6 Historic and Forecasted Market Size By , End-Users

8.7.6.1 Pediatrics

8.7.6.2 Adults

8.7.6.3 and Veterinary

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Recombinant Vaccine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.63 Billion |

|

Forecast Period 2024-32 CAGR: |

11.92% |

Market Size in 2032: |

USD 34.80 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Disease |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||