Protein Hydrolysate For Animal Feed Application Market Overview

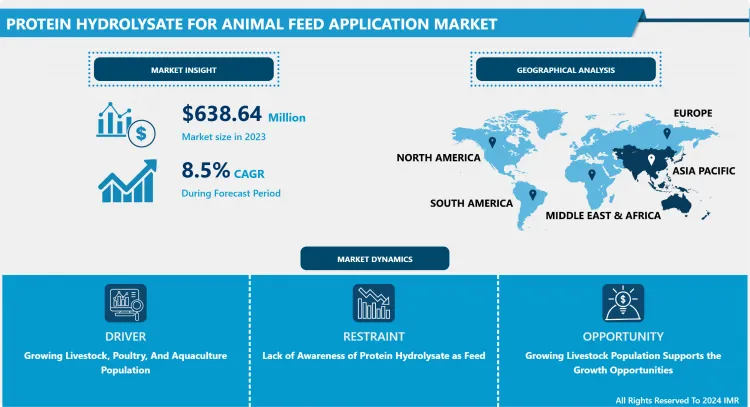

Protein Hydrolysate for Animal Feed Application Market was valued at USD 638.64 million in 2023 and is expected to reach USD 1,330.83 million by the year 2032, at a CAGR of 8.5 %.

Protein hydrolysate is the product that is obtained by the breakdown of protein. Protein hydrolysate is a collective term called for long peptides, short peptides, and amino acids. Moreover, protein hydrolysate has shown remarkable effects in boosting the immune system and aiding in the digestion process of various animals. Furthermore, peptides present in hydrolysate have demonstrated qualities like antioxidant, anticoagulation, anti-microbial, anticancer, and antihypertension. The antimicrobial quality of protein hydrolysate prevents the growth of harmful bacteria in the gut of animals thus promoting the growth of helpful bacteria and an increase in feed uptake. The large and small peptides generated by hydrolysis of protein hydrolysate have shown both nutritional and physiological or regulatory functions in livestock, fish, and poultry thus, supporting the expansion of the market during the forecast period. The high quality of protein content in protein hydrolysate is associated with the proper growth and development of animal cells and also helps in boosting immunity. In addition, protein hydrolysate is organic and is environmentally friendly. Furthermore, with the growing awareness towards animal health and nutrition as well as to cut down the use of expensive antibiotics, livestock holders are switching to the use of organic and animal-friendly protein hydrolysate. Solubility of protein hydrolysate in a wide range of pH is an ideal characteristic that helps in improvised water holding, foaming, oil binding, and emulsifying properties.

Market Dynamics and Factors in Protein Hydrolysate for Animal Feed Application Market

Drivers:

Growing Livestock, Poultry, And Aquaculture Population

Fish protein hydrolysate has found its uses in boosting the immune system of aquaculture. Furthermore, this has reduced the dependency of aquaculture on the use of expensive antibiotics promoting the use of fish protein hydrolysate as bioremediation, thus supporting the growth of the fish protein hydrolysate market flourish during the forecast period. Growing demand for nutrient enriched animal feed and globally increasing consciousness about livestock health is going to trigger the demand for protein hydrolysate for use as animal feed. Protein hydrolysate is enriched with peptides and collagen which will help in the growth of poultries, livestock, and other animals. Fish protein hydrolysates are a good source of fat, calcium, and protein hence, making them a major ingredient of animal feed. Moreover, when animals are provided with protein hydrolysate there is an increase in the production of animal-derived products such as milk, meat, and eggs which are high in nutrition content thus, driving the growth of the market in the forecast period.

Restraint:

Lack Of Awareness of Protein Hydrolysate as Feed

Lack of awareness of the beneficial uses of protein hydrolysate as animal feed among livestock holders is the major restraining factor that is hampering the market growth during the forecast period. According to scientists, there are determined values of hydrolysis within which hydrolysis of fish protein should be done because extensive hydrolysis can disintegrate protein. Consumption of fish protein hydrolysate is considered safe when it is hydrolyzed from proteins having a history of safe for consumption. Considering livestock health, livestock grower is attracted towards green-labeled and environmentally safe products which are organic. Preservation and storage of animal by-products are some of the factors that are hindering market growth.

Opportunities:

Growing Livestock Population

The processing of animal-derived foods leads to the generation of tremendous amounts of animal waste byproducts which include skin, frames, viscera, trimmings, and others which is not used as a food source for humans. Profitable utilization of these byproducts is the major area for research and development because such waste products are a possible outcome of protein hydrolysate thus, providing opportunities for market players to invest in research and development to optimize the yield of protein hydrolysate from animal byproducts. The growing livestock population has stressed convenient traditional methods of growing fodder resulting in the use of chemical fertilizers for fodder growth. The use of chemical fertilizers degrades the fodder quality thus animals don't get proper nutrition such situations have generated opportunities for market players to add protein hydrolysate in their products to recompensate the nutrition loss.

Challenges:

Cutting down the transportation and storage charges is one of the biggest challenges for the protein hydrolysate for animal feed application market players.

Market Segmentation

Segmentation Analysis of Protein Hydrolysate for Animal Feed Application Market

Based on the technology, the enzymatic hydrolysis segment is expected to hold maximum protein hydrolysate for animal feed application market share during the forecast period. The enzymatic hydrolysis is anticipated to reach share and is probably to observe faster growth as compared to its counterpart as during the acid & alkaline hydrolysis cysteine, serine, threonine, and arginine are destroyed, as a result, the producers are moving to slightly complicated; nevertheless, better enzymatic hydrolysis process.

Based on the form, paste form is expected to dominate the protein hydrolysate for the animal feed application market during the forecast period. Due to high solubility with water and convenient packaging in paper bags and high-density polyethylene drums. The product's high content of water-soluble proteins, trace elements, and vitamins make them ideal ingredients for pet food and aquaculture feed products. The paste form of these products improves digestibility particularly in aquaculture species with shorter gastrointestinal systems such as prawns, shellfish, and salmon fry.

Based on the livestock, the aquaculture segment is anticipated to register the largest protein hydrolysate for animal feed application market share over the forecast period. Growing maximum requirements for fish due to increasing population growth, urbanization, and rising incomes in developing countries such as India, Mexico, China, and Brazil should drive the aquaculture industry and accelerate the requirement of protein hydrolysates. Protein requirements for fish generally increase with growth and also vary according to water quality, water temperature, and rearing environment. Protein hydrolysates are used in the aquaculture feed to improve marine fish growth and survival.

Regional Analysis of Protein Hydrolysate for Animal Feed Application Market

Asia Pacific region is expected to dominate the protein hydrolysate for animal feed application market over the forecast period. Due to the rising aquaculture industry and significant demand for protein hydrolysate from the aquaculture industry. Increasing marine aquaculture production has led to growth in salmon, mollusks, and shrimp feed due to development in technology and various techniques which will turn the regional industry outlook. Furthermore, growing consumer disposable income and declining the manufacturing cost with the launch of new technologies. In addition, a wide consumer base coupled with adequate raw materials in the region is anticipated to turn protein hydrolysate into animal feed application market growth in the Asia Pacific throughout the forecast period.

North America is anticipated to register the significant protein hydrolysate for animal feed application market share due to the presence of major key players in the region, which provide opportunities to the protein hydrolysate producers with a wide consumer base. Apart from this, the high cost of production helps to the increased production cost of the final products, which is borne by the consumer. As the purchasing power of the consumers is high, there is raised acceptability of the product in developed economies.

Top Key Players Covered in Protein Hydrolysate For Animal Feed Application Market

- Copalis Sea Solutions (France)

- GELITA AG (Germany)

- Janatha Fish Meal & Oil Products (India)

- Shenzhen Taier (China)

- Hofseth BioCare ASA (Norway)

- Bio-marine Ingredients Ireland (Ireland)

- Scanbio Marine Group AS (Norway)

- SOPROPÊCHE (France)

- TripleNine (Denmark)

- Aller Aqua (Denmark)

- CRESCENT BIOTECH (India)

- Kemin Industries Inc (US)

- Azelis (Belgium) and other major players.

COVID-19 Impact on the Protein Hydrolysate for Animal Feed Application Market

COVID-19 has severely influenced the global economic outlook in the first quarter of 2020. The immediate animal nutrition sector bears from major supply chain disruption. The pandemic has influenced economies such as China, Italy, Spain, France, and other key countries and down chain supplier region and feed sector fighting to accomplish the demand. Since feed act as a key role in the manufacturing of different livestock animals, feed additives play a major ingredient in the manufacturing of nutrition improved feed. This nutritional-based feed supports livestock in their reproduction, health management, lactation, and brand equity. Owing to the pandemic and lockdown, the supply chain of the raw ingredient has influenced the utilization and manufacturing patterns globally. Animals cannot get enough nutrition from regular feed hence the feed additives are added in their regular meal containing vitamins, amino acids, fatty acids, and trace minerals. Though this pandemic situation has influenced their businesses as well, there is no significant influence on the global operations and supply chain of their phytogenic feed additives. Multiple manufacturing facilities of players are still in operation. For instance, in January 2020, Delacon Biotechnik GmbH introduced the latest product BioStrong Comfort in US and Canadian markets. This product contains plant-obtained antioxidants and is designed to lessen the impact of heat stress throughout high temperatures and humidity. Thereafter, as the restrictions of the government measures are probably to relax gradually, the market is probably to experience an increase in the coming years till 2025 as many feed additive producers have started seeking alternatives to antibiotics. There would be a strong consumer preference for meat products raised on natural feed additives and products, such as protein hydrolysate for animal feed application, that also support overcoming environmental impact.

Key Industry Development in Protein Hydrolysate for Animal Feed Application Market

- In August 2023, Bio-Marine Ingredients Ireland, Ltd. (BMII), an Irish firm, specializes in extracting protein, calcium, and oil from fish for applications in food, pharmaceutical, and cosmetic industries. Utilizing a patented process, the company extracts these nutrients from fish to produce a range of products, including fish protein hydrolysate, fish oil, and fish collagen.

- In April 2021, Kemin Nutrisurance in collaboration with Fibervita, a food ingredient provider company in Brazil, developed TEGRAVIA as a functional fiber for pet food. TEGRAVIA is having a rich fiber source with prebiotic and intestinal health support qualities for animal feed and can also benefit pet food product formulations by improvising texture and starch gelatinization.

- In September 2021, Azelis, a leading company in food and feed nutrition, declared that it has completed the Quimdis. Quimdis is one of the top suppliers of ingredients in France for animal nutrition, personal care, and pet food.

|

Protein Hydrolysate for Animal Feed Application Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 638.64 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 1330.83 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Livestock |

|

||

|

By Form |

|

||

|

By Sources |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Protein Hydrolysate For Animal Feed Application Market by Technology (2018-2032)

4.1 Protein Hydrolysate For Animal Feed Application Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Enzymatic Hydrolysis

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Autolysis

4.5 Microbial Hydrolysis

4.6 Chemical Hydrolysis

Chapter 5: Protein Hydrolysate For Animal Feed Application Market by Livestock (2018-2032)

5.1 Protein Hydrolysate For Animal Feed Application Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Poultry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cattle

5.5 Aquatic

5.6 Swine

5.7 Other

Chapter 6: Protein Hydrolysate For Animal Feed Application Market by Form (2018-2032)

6.1 Protein Hydrolysate For Animal Feed Application Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Powder

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Granules

6.5 Paste

6.6 Liquid

Chapter 7: Protein Hydrolysate For Animal Feed Application Market by Sources (2018-2032)

7.1 Protein Hydrolysate For Animal Feed Application Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Fish Source

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Plant Source

7.5 Milk Source

7.6 Animal Source

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Protein Hydrolysate For Animal Feed Application Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ARKEMA S.A

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BASF SE

8.4 DOW

8.5 COVESTRO AG

8.6 HUNTSMAN CORPORATION

8.7 TEKNOR APEX COMPANY

8.8 LUBRIZOL CORPORATION

8.9 TOSH CORPORATION

8.10 KRATON CORPORATION

8.11 CHINA PETROLEUM AND CHEMICAL CORPORATION

8.12 MITSUBISHI CHEMICAL COMPANY

8.13 DUPONT

8.14 SIBUR

8.15 EVONIK INDUSTRIES AG

8.16 DYNASOL ELASTOMERS.

Chapter 9: Global Protein Hydrolysate For Animal Feed Application Market By Region

9.1 Overview

9.2. North America Protein Hydrolysate For Animal Feed Application Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Technology

9.2.4.1 Enzymatic Hydrolysis

9.2.4.2 Autolysis

9.2.4.3 Microbial Hydrolysis

9.2.4.4 Chemical Hydrolysis

9.2.5 Historic and Forecasted Market Size by Livestock

9.2.5.1 Poultry

9.2.5.2 Cattle

9.2.5.3 Aquatic

9.2.5.4 Swine

9.2.5.5 Other

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Powder

9.2.6.2 Granules

9.2.6.3 Paste

9.2.6.4 Liquid

9.2.7 Historic and Forecasted Market Size by Sources

9.2.7.1 Fish Source

9.2.7.2 Plant Source

9.2.7.3 Milk Source

9.2.7.4 Animal Source

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Protein Hydrolysate For Animal Feed Application Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Technology

9.3.4.1 Enzymatic Hydrolysis

9.3.4.2 Autolysis

9.3.4.3 Microbial Hydrolysis

9.3.4.4 Chemical Hydrolysis

9.3.5 Historic and Forecasted Market Size by Livestock

9.3.5.1 Poultry

9.3.5.2 Cattle

9.3.5.3 Aquatic

9.3.5.4 Swine

9.3.5.5 Other

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Powder

9.3.6.2 Granules

9.3.6.3 Paste

9.3.6.4 Liquid

9.3.7 Historic and Forecasted Market Size by Sources

9.3.7.1 Fish Source

9.3.7.2 Plant Source

9.3.7.3 Milk Source

9.3.7.4 Animal Source

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Protein Hydrolysate For Animal Feed Application Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Technology

9.4.4.1 Enzymatic Hydrolysis

9.4.4.2 Autolysis

9.4.4.3 Microbial Hydrolysis

9.4.4.4 Chemical Hydrolysis

9.4.5 Historic and Forecasted Market Size by Livestock

9.4.5.1 Poultry

9.4.5.2 Cattle

9.4.5.3 Aquatic

9.4.5.4 Swine

9.4.5.5 Other

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Powder

9.4.6.2 Granules

9.4.6.3 Paste

9.4.6.4 Liquid

9.4.7 Historic and Forecasted Market Size by Sources

9.4.7.1 Fish Source

9.4.7.2 Plant Source

9.4.7.3 Milk Source

9.4.7.4 Animal Source

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Protein Hydrolysate For Animal Feed Application Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Technology

9.5.4.1 Enzymatic Hydrolysis

9.5.4.2 Autolysis

9.5.4.3 Microbial Hydrolysis

9.5.4.4 Chemical Hydrolysis

9.5.5 Historic and Forecasted Market Size by Livestock

9.5.5.1 Poultry

9.5.5.2 Cattle

9.5.5.3 Aquatic

9.5.5.4 Swine

9.5.5.5 Other

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Powder

9.5.6.2 Granules

9.5.6.3 Paste

9.5.6.4 Liquid

9.5.7 Historic and Forecasted Market Size by Sources

9.5.7.1 Fish Source

9.5.7.2 Plant Source

9.5.7.3 Milk Source

9.5.7.4 Animal Source

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Protein Hydrolysate For Animal Feed Application Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Technology

9.6.4.1 Enzymatic Hydrolysis

9.6.4.2 Autolysis

9.6.4.3 Microbial Hydrolysis

9.6.4.4 Chemical Hydrolysis

9.6.5 Historic and Forecasted Market Size by Livestock

9.6.5.1 Poultry

9.6.5.2 Cattle

9.6.5.3 Aquatic

9.6.5.4 Swine

9.6.5.5 Other

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Powder

9.6.6.2 Granules

9.6.6.3 Paste

9.6.6.4 Liquid

9.6.7 Historic and Forecasted Market Size by Sources

9.6.7.1 Fish Source

9.6.7.2 Plant Source

9.6.7.3 Milk Source

9.6.7.4 Animal Source

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Protein Hydrolysate For Animal Feed Application Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Technology

9.7.4.1 Enzymatic Hydrolysis

9.7.4.2 Autolysis

9.7.4.3 Microbial Hydrolysis

9.7.4.4 Chemical Hydrolysis

9.7.5 Historic and Forecasted Market Size by Livestock

9.7.5.1 Poultry

9.7.5.2 Cattle

9.7.5.3 Aquatic

9.7.5.4 Swine

9.7.5.5 Other

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Powder

9.7.6.2 Granules

9.7.6.3 Paste

9.7.6.4 Liquid

9.7.7 Historic and Forecasted Market Size by Sources

9.7.7.1 Fish Source

9.7.7.2 Plant Source

9.7.7.3 Milk Source

9.7.7.4 Animal Source

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Protein Hydrolysate for Animal Feed Application Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 638.64 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 1330.83 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Livestock |

|

||

|

By Form |

|

||

|

By Sources |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Protein Hydrolysate for Animal Feed Application Market research report is 2024-2032.

Copalis Sea Solutions, GELITA AG, Janatha Fish Meal & Oil Products, Shenzhen Taier, Hofseth BioCare ASA, Bio-marine Ingredients Ireland, Scanbio Marine Group AS, SOPROPÊCHE, TripleNine, Aller Aqua, CRESCENT BIOTECH, Kemin Industries Inc, Azelis and Others major players.

The Protein Hydrolysate for Animal Feed Application Market is segmented into Technology, Livestock, Form, Sources and Region. By Technology, the market is categorized into Enzymatic Hydrolysis, Autolysis, Microbial Hydrolysis, And Chemical Hydrolysis. By Livestock, the market is categorized into Coconut, Poultry, Cattle, Aquatic, Swine, Other. By Form, the market is categorized into Powder, Granules, Paste, Liquid. By Sources, the market is categorized into Fish Source, Plant Source, Milk Source, Animal Source. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Protein hydrolysate is the product that is obtained by the breakdown of protein. Protein hydrolysate is a collective term called for long peptides, short peptides, and amino acids. Moreover, protein hydrolysate has shown remarkable effects in boosting the immune system and aiding in the digestion process of various animals.

Protein Hydrolysate for Animal Feed Application Market was valued at USD 638.64 million in 2023 and is expected to reach USD 1,330.83 million by the year 2032, at a CAGR of 8.5 %.