Global Pro Audio Market Overview

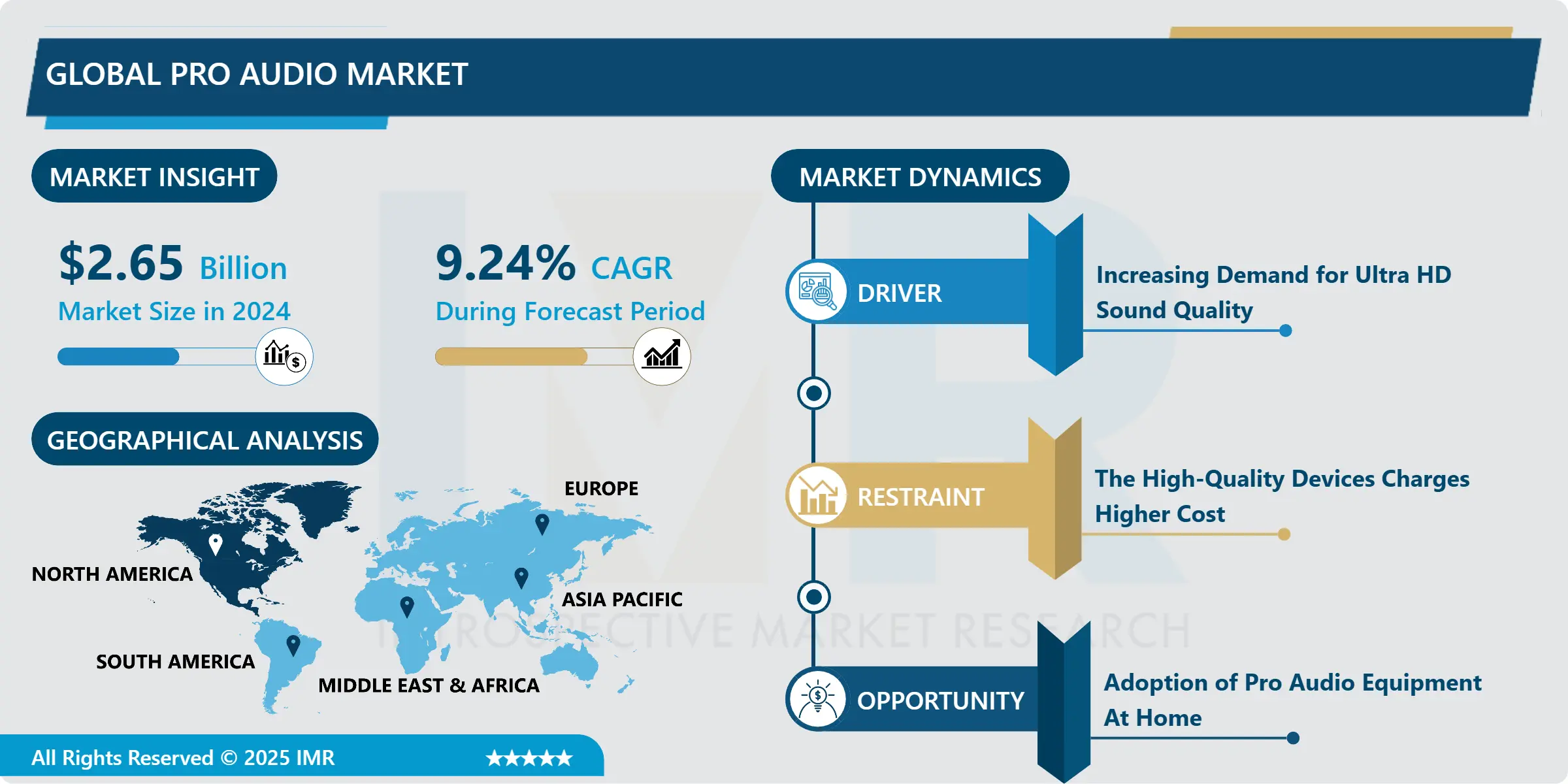

The pro audio market was valued at USD 2.65 Billion in 2024 and is expected to reach USD 5.37 Billion by the year 2032, at a CAGR of 9.24% over the forecast period 2025- 2032.

Pro audio or professional audio is devices that reproduce, record, and edit or process sound on a professional level. This pro audio is highly efficient and used to produce error-proof audio mixes. Pro audio is specified and advanced devices to create noise-proof and quality music or audio. It is mainly used in the entertainment industry for various reasons like creating music albums, advertisements, recordings, and other industry-related professional activities. Professional audio includes various products like amplifiers, headphones, DJ equipment, stage equipment, speakers, and others. This diversification of Products offers high specialty products to the market. Along with this, audio equipment such as DAW, audio interface, audio monitors, and others, are normally used in modern studios, dedicated home studios, complexes, pro studios, bedroom studios, and semi-pro studios for better sound quality which leads to growth to the Pro audio market over the forecast period.

Market Dynamics And Factors For Pro Audio Market

Drivers:

Increasing Demand for Ultra HD Sound Quality

The Pro Audio market is expanding due to its ability to provide high-quality sound. This is used by professionals in a music production house, and artists for live concerts and song recording. Due to market demands for good sound quality, demand for Ultra HD sound quality is anticipated. Initially, the audience was not very knowledgeable about musical instruments and sound quality. However, today, especially among Millennials, there is an increase in desire for HD & super HD sound quality, which is boosting demand for the pro audio market throughout the anticipated time. The major producers also provide a well-defined product with excellent sound quality. For instance, Sony's 360-reality audio provides a superior audio experience to the user in the creation of motion pictures, graphics & animations, and video games. As a result, the market for professional audio is growing thanks to the newest features and technological breakthroughs.

Restraints:

The High-Quality Audio Devices Charge Higher Initial Cost

There are many different types and price points for pro audio equipment. Investing in professional audio requires paying a greater initial price. The equipment is constructed with numerous intricate structures, which raises the cost of producing the finished good. The most expensive items are circuit designs and parts like transistors, capacitors, and telcos. Additionally, assembly is the process of building a single unique object out of batches of complementary components. For this part's assembly and testing, the company needs experts. The starting cost of pro audio is increased by all of these factors, which could slow the pro audio market's expansion during the forecasted period.

Opportunities:

Adoption of Pro Audio for Home Studios

Since so many people have a passion for music or want to spend their leisure time making art, they are adopting pro audio for personal use, which presents a chance for the market to grow the household sector of the economy. Additionally, because people spend more time at home during a pandemic, many of them renew their hobbies or creative spaces, which spurs the market's expansion. In order to encourage aspiring artists to stay at home safely and use this epidemic time to create and share music, for example, AIAIAI launched their web portal #stayhomemakemusic. In addition, As per the Statista, Microphone sales in the U.S. retail market for sound equipment totalled 650 million dollars in 2020. This is due to a growth in demand from consumers who record audio at home for YouTube, podcasts, and staying in touch during lockdowns as well as the need from professional users. This demonstrates the widespread use of pro audio by individuals and influencers, which supports the market's growth during the projected period.

Segmentation Analysis of Pro Audio Market

By Product, the speaker segment expected to dominates the market growth of the pro audio over the forecast period. The adoption of pro speakers by commercial as well as residential sectors propels the growth of the market. The speakers used at a professional level are called monitor speakers or studio monitors because they're used for monitoring critical listening during recording, mixing, and mastering. However, the pro speaker is not designed to enhance the sound or increase the volume of sound but it keeps all frequencies flat to provide purer, cleaner sound for more accurate mixing. Additionally, Monitor speakers are loudspeakers that we use specifically for audio and music production. Increasing music production on both commercial and residential levels helps to expand the market. Monitor speakers to ensure the sound quality of what the live audience is hearing is exactly there. The point of having good speakers is to hear your music played back properly and accurately, no matter what system it is played back on. These applications provide high growth to the pro audio market. Moreover, Pro speakers hold large shares in pro audio equipment. Revenue in the Speakers segment amounts to US$9.18bn in 2022.

By Distribution Channels, the offline segment anticipated to have highest growth in the pro audio market during the forecasted period. Pro audio is an electronic device and most people like to see, hear, and test the quality of products that they are buying. Offline distribution channels allow people to personally hear, see and experience the sound, and mixing quality which helps to enhance the offline business of pro audio equipment. Electronic devices have a high chance of being defected or damaged and require Installation, maintenance, and repair services, and offline distribution channels like specialty stores provide these services in a more effective way than online channels. It is easy for the customer to contact and coordinate with the offline distributor so this segment is getting high growth which also propels the growth of the Pro Audio market during the analysis period.

Regional Analysis Of Pro Audio Market

North America is dominating region for the pro audio market during the projected period. The adoption of pro audio is increasing and expected highest growth rate in North America, as compared to the other regions. The main factor that impacted the increasing adoption rate is the presence of various prominent market players. This region includes developed countries such as Canada and the US which consist of major key manufacturers such as SONOS, HEOS, Control, and Bose, which are providing technically advanced and economically affordable solutions. In the United States, 76% of professional users use Sonos and it is one of their three preferred wireless audio brands. Additionally, Bose is a global leader in audio manufacturing. They offer multiple products like personal audio equipment, home audio systems, automobile infotainment, and professional audio generating annual sales revenue of 3.2 billion U.S. dollars in the fiscal year 2021. This shows the high adoption of pro audio equipment, which helps in the expansion of Pro Audio in the North American region.

The Europe region is the fast-growing region for the pro audio market during the forecasted period. The use of pro audio is increasing to create music by small-scale businesses and the high adoption rate of pro audio solutions to build home studios is the key factor affecting the market growth in this region. Individuals are purchasing pro audio to create music as a hobby. Additionally, people who are just started their journey and wish to have a career in music are the main consumer of this market. Manufacturers are providing cost-effective equipment for beginner to create their studio at home. These home studios require comparatively low establishment cost, using just main and minimum equipment individuals are creating their music studio which is boosting the growth of the pro audio market during the analysis time in the Europe region.

Asia Pacific region is experiencing significant growth in the pro audio market during the forecasted period. This region contains the most populated countries like India, China, and Japan. The population contains potential candidates which are contributing to the entertainment industry. The new emerging talent and increasing popularity of singers, and live concerts among the population is providing high growth to the market. Hence the expansion of the music industry propels the growth of the pro audio market. Additionally, pro audio is also used to enhance the customer or user experience in various locations such as pubs, malls, sports complexes, and stadiums. For instance, restaurant owners are using professional audio to enhance dining experiences across various countries also boosting the growth of the pro audio market during the projected period.

Top Key Players Covered In Pro Audio Market

- Sennheiser(Germany)

- Yamaha (Japan)

- Audio-Tehcnica (Japan)

- Shure (US)

- AKG (Austria)

- Blue (Japan)

- Lewitt Audio (Austria)

- Sony(Japan)

- Takstar (China)

- MIPRO (US)

- Allen&heath (UK)

- TOA (Japan)

- Wisycom (Italy)

- Beyerdynamic (Germany)

- Lectrosonic (US)

Key Industry Development In The Pro Audio Market

- In March 2024, Meyer Sound acquired Audio Rhapsody, a nascent startup founded by sound designer Jonathan Deans. This acquisition enhanced Meyer Sound's position in theater sound solutions. By incorporating Deans' expertise, the company aimed to develop advanced software solutions, thereby expanding its portfolio of integrated digital systems. The strategic move allowed Meyer Sound to leverage cutting-edge technology and innovation from Audio Rhapsody, positioning itself more robustly in the competitive market of audio engineering and sound design.

- In February 2024, Audio Pro initiated a collaboration in the United States with United Radio, a long-established leader in the global electronics repair and recycling industry. United Radio supported Audio Pro with warehousing, distribution, and product repairs. Managing logistics for North, South, and Central America, United Radio's services included both online and offline store support. This encompassed aiding Audio Pro’s website and Amazon sales.

|

Global Pro Audio Market |

|

|||

|

Base Year: |

2023 |

Forecast Period: |

2025-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.65billion. |

|

|

Forecast Period 2024-32 CAGR: |

9.24% |

Market Size in 2028: |

USD 5.37 billion. |

|

|

Segments Covered: |

By Product Type |

|

||

|

By Distribution Channel |

|

|||

|

By Region |

|

|||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the report: |

|

|||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pro Audio Market by Product Type (2018-2032)

4.1 Pro Audio Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Speakers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Mixers

4.5 Amplifiers

4.6 Wired & Wireless Microphones

4.7 Headphones

4.8 Others

Chapter 5: Pro Audio Market by Distribution Channel (2018-2032)

5.1 Pro Audio Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offline

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Pro Audio Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 HOLMES (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TRACXN TECHNOLOGIES LIMITED (UNITED STATES)

6.4 AMBIENT THERAPEUTICS (CANADA)

6.5 HANDY COOLER (UNITED STATES)

6.6 HONEYWELL (UNITED STATES)

6.7 O2COOL (UNITED STATES)

6.8 EMERSON ELECTRIC CO. (UNITED STATES)

6.9 BLUONICS (UNITED STATES)

6.10 ERGODYNE (UNITED STATES)

6.11 NEWAIR (UNITED STATES)

6.12 MISSION COOLING (UNITED STATES)

6.13 DESIGN GO LTD. (UNITED KINGDOM)

6.14 LAKELAND LIMITED (UNITED KINGDOM)

6.15 GEIZEER (ITALY)

6.16 DYSON LTD (UNITED KINGDOM)

6.17 EVAPOLAR (EUROPE)

6.18 COOLINGSTYLE (CHINA)

6.19 EIJING HUIMAO COOLING EQUIPMENT CO. LTD. (CHINA)

6.20 SHENZHEN KRG ELECTRONICS (CHINA)

6.21 FREDA (CHINA)

6.22 TORRAS (CHINA)

6.23 XIAOMI (CHINA)

6.24 SYMPHONY (INDIA)

6.25 HAVELLS INDIA LTD. (INDIA) OTHER MAJOR KEY PLAYERS

Chapter 7: Global Pro Audio Market By Region

7.1 Overview

7.2. North America Pro Audio Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Speakers

7.2.4.2 Mixers

7.2.4.3 Amplifiers

7.2.4.4 Wired & Wireless Microphones

7.2.4.5 Headphones

7.2.4.6 Others

7.2.5 Historic and Forecasted Market Size by Distribution Channel

7.2.5.1 Online

7.2.5.2 Offline

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Pro Audio Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Speakers

7.3.4.2 Mixers

7.3.4.3 Amplifiers

7.3.4.4 Wired & Wireless Microphones

7.3.4.5 Headphones

7.3.4.6 Others

7.3.5 Historic and Forecasted Market Size by Distribution Channel

7.3.5.1 Online

7.3.5.2 Offline

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Pro Audio Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Speakers

7.4.4.2 Mixers

7.4.4.3 Amplifiers

7.4.4.4 Wired & Wireless Microphones

7.4.4.5 Headphones

7.4.4.6 Others

7.4.5 Historic and Forecasted Market Size by Distribution Channel

7.4.5.1 Online

7.4.5.2 Offline

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Pro Audio Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Speakers

7.5.4.2 Mixers

7.5.4.3 Amplifiers

7.5.4.4 Wired & Wireless Microphones

7.5.4.5 Headphones

7.5.4.6 Others

7.5.5 Historic and Forecasted Market Size by Distribution Channel

7.5.5.1 Online

7.5.5.2 Offline

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Pro Audio Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Speakers

7.6.4.2 Mixers

7.6.4.3 Amplifiers

7.6.4.4 Wired & Wireless Microphones

7.6.4.5 Headphones

7.6.4.6 Others

7.6.5 Historic and Forecasted Market Size by Distribution Channel

7.6.5.1 Online

7.6.5.2 Offline

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Pro Audio Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Speakers

7.7.4.2 Mixers

7.7.4.3 Amplifiers

7.7.4.4 Wired & Wireless Microphones

7.7.4.5 Headphones

7.7.4.6 Others

7.7.5 Historic and Forecasted Market Size by Distribution Channel

7.7.5.1 Online

7.7.5.2 Offline

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Pro Audio Market |

|

|||

|

Base Year: |

2023 |

Forecast Period: |

2025-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.65billion. |

|

|

Forecast Period 2024-32 CAGR: |

9.24% |

Market Size in 2028: |

USD 5.37 billion. |

|

|

Segments Covered: |

By Product Type |

|

||

|

By Distribution Channel |

|

|||

|

By Region |

|

|||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the report: |

|

|||