Global Poultry Probiotics Market Overview

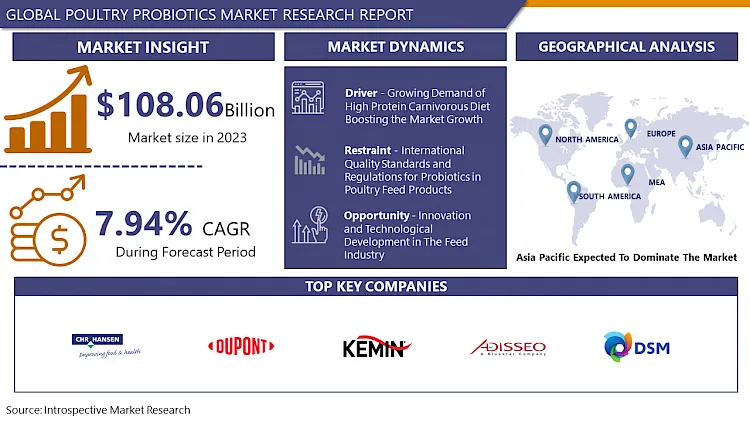

Global Poultry Probiotics Market size was valued at USD 108.06 billion in 2023 and is projected to reach 214.93 billion in 2032, growing at a CAGR of 7.94% from 2024 to 2032

Probiotics referred to live bacteria, fungi, or yeasts that additive the gastrointestinal flora and support the maintenance of a healthy digestive system, thereby encouraging the growth performance and overall health of poultry. Probiotics are highly being included in poultry feed as substitutes to antibiotics. This systematic review helps a summary of the application of probiotics in poultry production and the potential role of probiotics in the nutrient application, growth and laying performance and gut health of poultry. Furthermore, the poultry industry has become an important economic activity in various economies. In large-scale raising facilities, wherein stressful circumstances poultry is exposed, problems concerning to diseases and rotting of environmental conditions usually occur and results ending up adverse economic losses. For a healthy gut, a well-balanced feed poultry probiotic in nutrition and energy coupled with all-sufficient essentials for health.

The growing demand for poultry probiotics over the globe benefits the gut flora of the host animal resulting in the proper raising of poultry. Additionally, rising government regulations for poultry probiotics have created profitable opportunities for the global poultry probiotics market. For example, according to WHO (World Health Organization), poultry probiotics utilization associated products that can offer the poultry industry with a secondary control mechanism, that can develop better intestinal health by conserving the structure of the microbial population in the GI stretch, to guard poultry herds against diseases with pathogenic bacteria and to check monetary losses which are created by pathogens.

Market Dynamics and Factor for Poultry Probiotics Market:

Drivers:

Extensive population growth, increasing consumer consciousness associated with health and nutritional foods along rising economic standards has led to increased demand for poultry products from foodservice sectors. Rapid globalization along with a change in food habits existing to meat and processed meat utilization should turn industry growth.Inducing malnutrition conditions in children and growing protein intake among health-awareness consumers has led to the utilization of more meat-based products in their diets. Consumers are shifting towards ready-to-eat processed meat products consumption owing to busy lifestyles and growing innovations in meat processing technology.Changing producers' inclination towards animal health has covered the way for the livestock industry where the quality of meat holds utmost significance. Industry players are investing in R&D to increase reliable, sustainable production of high-quality probiotic ingredients which should stimulate product demand. Growing animal health awareness as well as raising awareness related to feeding additive products among various farmers is anticipated to have a positive impact on poultry probiotic ingredients market demand.Poultry probiotic ingredients include Lactobacilli, Streptococcus, Bifidobacterium, and Bacillus which are natural, live, direct-fed microbial species safe for human utilization and do not leave any residue in meat products thereby causing no harm to human health. Growth in demand for high-quality meat products owing to persuading poultry-borne infections and diseases such as avian flu, E. coli infections, and salmonellosis has led to a rise in usage of efficient animal feed additives thereby accelerating industry outlook.

Opportunities:

Innovation and technological development in the feed industry

Development has been a main target area in the feed industry, especially for additives, where regulatory bodies, such as the European Food Safety Authority (EFSA) and Food and Drug Administration (FDA), are continuously engaged in research and identification of sustainable feed additives. To accomplish the rising demand, feed manufacturers are offering the best ingredients and technologies to develop innovative additive combinations.

Poultry Probiotics Market Segment Analysis:

Poultry Probiotics Market Segmented on the basis of type, and Application

By Application, On-premises segment is expected to dominate the market during the forecast period

Based on the Application, the broilers segment registers the maximum market share over the forecast period due to Broilers, or meat chickens, represent a significant portion of the overall poultry industry and are raised on a large scale to meet the escalating global demand for poultry meat. The intensive farming practices associated with broiler production often lead to stress, disease susceptibility, and the extensive use of antibiotics to maintain productivity. Poultry probiotics offer a sustainable alternative to antibiotics by promoting gut health, improving nutrient absorption, and enhancing the overall immune system of broilers. As consumer awareness about the potential risks of antibiotic use in livestock grows, there is a rising demand for natural and effective alternatives, such as probiotics, in the poultry industry. The broiler segment's adoption of poultry probiotics is further fueled by the increasing emphasis on sustainable and organic farming practices. Probiotics contribute to improved feed conversion ratios and enhanced growth rates in broilers, leading to higher efficiency in meat production. As the poultry industry continues to evolve towards more responsible and eco-friendly practices, the broilers segment becomes a key driver in propelling the Poultry Probiotics Market forward.

Players Covered in Poultry Probiotics market are :

- Chr. Hansen

- DuPont

- Kemin

- DSM

- Adisseo

- ASAHI GROUP HOLDING Ltd.

- Evonik Industries

- Land O'Lakes Inc.

- Kerry Inc.

- Novus International

- Novozymes

- Vit-E-Men Company

- Lesaffre

- Lallemand Inc.

- Alltech

- Unique Biotech

- Suguna Foods Private Limited.

- Provita Eurotech

- Protexin,and other major players.

Regional Analysis of Poultry Probiotics Market:

Asia-Pacific dominates the probiotics in the poultry market owing to rising demand for poultry products in the region and rapid urbanization in the region. China poultry meat utilization was accounted for over 15.96 million tons in 2019. Shifting consumer preference towards poultry meat owing to easy accessibility at low cost and growing hotels and restaurants is probably to drive industry size. Growth in financial support from government subsidies along with high industrialization may hasten meat production. Rising animal health awareness along with increasing consciousness related to the feed additive products among different farmers should accelerate poultry probiotic ingredients demand.

Recent Developments for the Poultry Probiotics Market:

- In August 2021, Chr. Hansen introduces science-based probiotics for the pet segment. Launching a new portfolio of?stable?live probiotics?for?use in?pet foods and supplements, entitling every pet's life stage with good?bacteria. The company Chr. Hansen is preferably positioned to support pet food and supplement producers develop premium products, based on its long history of mobilizing the power of good bacteria to help extensive segments of industry sectors, including animal and human health.

- In August 2023, Kemin Industries, a global ingredient manufacturer that strives to sustainably transform the quality of life every day for 80 percent of the world with its products and services, has opened a new manufacturing facility in Verona, Missouri, to produce its Proteus® line of clean-label functional proteins that are used to increase yield and enhance the quality of meat and poultry products within the food industry.

- In March 2023, International Flavour and Fragrances Inc. successfully scaled up the production of a new, strictly anaerobic probiotic strain to an industrial level.

|

Global Poultry Probiotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 108.06 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.94% |

Market Size in 2032: |

USD 214.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Poultry Probiotics Market by Type (2018-2032)

4.1 Poultry Probiotics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lactobacillus Bulgaricus

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Streptococcus Thermophilus

4.5 Enterococcus Faecium

4.6 Lactobacillus Acidophilus

4.7 Lactobacillus Casei

4.8 Other

Chapter 5: Poultry Probiotics Market by Application (2018-2032)

5.1 Poultry Probiotics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Broilers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Layers

5.5 Turkeys

5.6 Breeders

5.7 Chicks & Poults

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Poultry Probiotics Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 VIVINT INCDATALOGIC S.P.AMEYER ELECTRICAL SERVICES INCRED RIVER ELECTRIC INCHELLOTECH INCCALIX INCFINITE SOLUTIONS LLC

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 HANDY INCMIAMI ELECTRIC MASTERS INCINSTEON INC

Chapter 7: Global Poultry Probiotics Market By Region

7.1 Overview

7.2. North America Poultry Probiotics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Lactobacillus Bulgaricus

7.2.4.2 Streptococcus Thermophilus

7.2.4.3 Enterococcus Faecium

7.2.4.4 Lactobacillus Acidophilus

7.2.4.5 Lactobacillus Casei

7.2.4.6 Other

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Broilers

7.2.5.2 Layers

7.2.5.3 Turkeys

7.2.5.4 Breeders

7.2.5.5 Chicks & Poults

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Poultry Probiotics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Lactobacillus Bulgaricus

7.3.4.2 Streptococcus Thermophilus

7.3.4.3 Enterococcus Faecium

7.3.4.4 Lactobacillus Acidophilus

7.3.4.5 Lactobacillus Casei

7.3.4.6 Other

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Broilers

7.3.5.2 Layers

7.3.5.3 Turkeys

7.3.5.4 Breeders

7.3.5.5 Chicks & Poults

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Poultry Probiotics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Lactobacillus Bulgaricus

7.4.4.2 Streptococcus Thermophilus

7.4.4.3 Enterococcus Faecium

7.4.4.4 Lactobacillus Acidophilus

7.4.4.5 Lactobacillus Casei

7.4.4.6 Other

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Broilers

7.4.5.2 Layers

7.4.5.3 Turkeys

7.4.5.4 Breeders

7.4.5.5 Chicks & Poults

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Poultry Probiotics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Lactobacillus Bulgaricus

7.5.4.2 Streptococcus Thermophilus

7.5.4.3 Enterococcus Faecium

7.5.4.4 Lactobacillus Acidophilus

7.5.4.5 Lactobacillus Casei

7.5.4.6 Other

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Broilers

7.5.5.2 Layers

7.5.5.3 Turkeys

7.5.5.4 Breeders

7.5.5.5 Chicks & Poults

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Poultry Probiotics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Lactobacillus Bulgaricus

7.6.4.2 Streptococcus Thermophilus

7.6.4.3 Enterococcus Faecium

7.6.4.4 Lactobacillus Acidophilus

7.6.4.5 Lactobacillus Casei

7.6.4.6 Other

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Broilers

7.6.5.2 Layers

7.6.5.3 Turkeys

7.6.5.4 Breeders

7.6.5.5 Chicks & Poults

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Poultry Probiotics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Lactobacillus Bulgaricus

7.7.4.2 Streptococcus Thermophilus

7.7.4.3 Enterococcus Faecium

7.7.4.4 Lactobacillus Acidophilus

7.7.4.5 Lactobacillus Casei

7.7.4.6 Other

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Broilers

7.7.5.2 Layers

7.7.5.3 Turkeys

7.7.5.4 Breeders

7.7.5.5 Chicks & Poults

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Poultry Probiotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 108.06 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.94% |

Market Size in 2032: |

USD 214.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||