Plasma Protein Therapeutic Market Synopsis

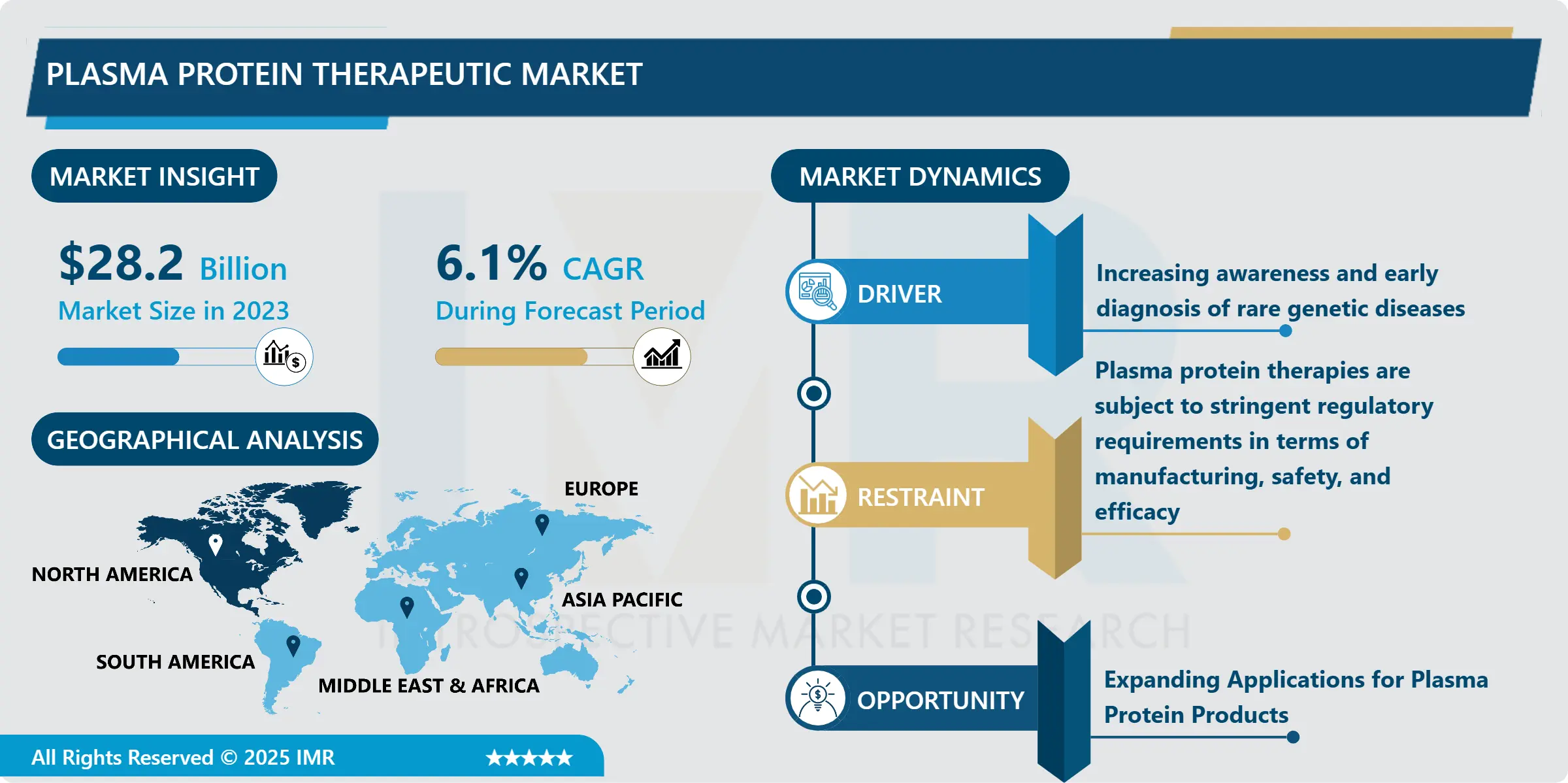

Plasma Protein Therapeutic Market Size Was Valued at USD 28.2 Billion in 2023, and is Projected to Reach USD 48.4 Billion by 2032, Growing at a CAGR of 6.1% From 2024-2032.

The Plasma Protein Therapeutic Market is part of the plasma derivative industry, specialising in the development and application of therapeutic products derived from plasma collected from human beings whose been used to treat ailments such as immunodeficiency disorders, bleeding disorders, autoimmune diseases and chronic disorders like liver diseases. Plasma derived products are only Restricted to immunoglobulins (IVIG, SCIG), clotting factors (Factor VIII, Factor IX), albumin, alpha-1 antitrypsin, C1 esterase inhibitors, and fibrinogen which are important in the management of life threatening conditions including hemophilia, primary immune deficiencies, and many inflammatory diseases. The drivers for the market are; increase in incidence of chronic & rare diseases, increasing awareness of such diseases, increase in geriatric population, advancement in Plasma Fractionation techniques. Nevertheless the issues like high costs of production, scarcity of plasma, legal issues related to the procurement of blood products and the possibility of transmission of infectious diseases where remain a threat. However, market hurdles can certainly act as stimulants for growth as evidenced by increase in plasma collection networks predominantly in emerging markets and the ongoing developments in biologics and recombinant therapies that the market has to offer. There has been also the rise in government funding and better reimbursement policies for life saving therapies, which present big opportunities for new and experienced players in the market. With the increasing production of these therapies mainly driven by increased demand in the NA, Europe and Asia-Pacific regions, Plasma Protein Therapeutic Market is poised to grow, to address the unmet medical needs of a growing global population.

Currently, the Global Plasma Protein Therapeutic market is a rapidly rising subsector within the healthcare industry due to a rising prevalence of chronic and rare conditions requiring long-term management.. Immunoglobulins, clotting factors, albumin, alpha-1 antitrypsin and C1 esterase inhibitors are used in such diseases as haemophilia, immune deficiencies and autoimmune diseases. Such therapies are in constant demand because there is growing incidence of immunodeficiency, bleeding disorders and Chronic Non-communicable diseases that are more common in the elderly persons. Innovations in technologies which are used to fractionate plasma together with the expansion in networks of collection of plasma globally is enhancing the stock and quality of these eBook’s. At the moment, North America and Europe continue to demonstrate the highest need for the product; Asia-Pacific and Latin America are also expected to demonstrate high growth rates primarily due to the availability of diagnostics and access to healthcare.

Nevertheless the Plasma Protein Therapeutic Market has several challenges that exist as follow: Production costs being higher, and available human plasma being much less compared to the current need all over the world, poses a problem. The regulatory issues and risks of spreading infections viaelectricity, despite efforts to counteract such through screening are alsoan issue among manufacturers/healthcare providers as well as patients. Furthermore, competition from recombinant therapies and synthetic emulating products is stiffening hence providing other accommodating options to the use of plasma-derived products. However and simultaneously, the market offers significant opportunities for growth with the inventions of biotechnological advances, the personalized medicine concept that is fast being embraced in the medical field and the discovery of new indications for plasma derived therapeutic products. Thus, the Plasma Protein Therapeutic Market should remain a growing one, with rising investments in healthcare and developments within the field of biomanufacturing processes.

Plasma Protein Therapeutic Market Trend Analysis:

Shift Towards Recombinant and Biosimilar Therapies

-

Changing consumer preference towards recombinant and biosimilar therapies is one of the most revolutionary trends in the Plasma Protein Therapeutic Market. Recombinant therapy which is made by genetic engineering is one way of avoiding plasma derived stocks since it is manufactured by genetic engineering. They are; this becomes economical by reducing the usage of limited plasma and making treatments cheaper because of the low costs incurred. Also, recombinant therapies offer a safer approach because disease transmission from human plasma is removed. Likewise, biosimilars that are better versions of the originals at a cheaper price have taken root as an alternate to costly PD products. Governmental agencies like the FDA or the EMA are approving biosimilars as entities recognised as capable of bringing down the total costs of health care with the proper therapeutic results and safety.

- This shift is germinating some new opportunities in the market especially in the developing countries where access to plasma derived therapies is still very expensive due to the high costs associated with it. Optimal in cost and efficacy, recombinant joint with biosimilar therapies in delivering treatment for a rapidly increasing global health demands. However, the implementation of these alternatives is one which Call Centre faces certain problems. Despite these advantages of recombinant therapies, they have been meeting some resistance in the markets where people are habituated with plasma derived therapies. The biosimilars too are constrained by IP issues and entry barriers to the market and have faced specific challenges in their journey of development and commercialization. Nevertheless, from the present trends of stream technological advancement in the field of biotechnology and the favourable regulatory conditions that have already enveloped recombinant and biosimilar therapies, the later years will observe transformation in the plasma protein therapeutic processes.

Development of Biosimilars and Recombinant Therapies

-

The growth and availability of biosimilars and recombinant therapeutics is another secular growth driver in the Plasma Protein Therapeutic Market given the hunger for better quality less expensive Products compared with plasma-based ones. Biosimilar represents a biologic drug which is highly similar to an already approved reference biologic drug but comes at a fairly lower cost to the consumer. Recombinant therapies on the other hand are manufactured by genetic engineering to synthesize therapeutic proteins and factors from microbial or mammalian cell cultures other than human plasma such as clotting factors, immunoglobulins and albumin. The creation of these dissipatives is changing the market of plasma protein treatments, which offers several benefits compared to conventional therapies.

- The main motivation for this development is the desire for the affordability and increased availability of these therapies over plasma derivative sources. The process of collecting plasma is very lengthy and costly and there is limited amount of human plasma out ther which always poses constraints in production. These problems are solved by recombinant therapies since this approach allows for production of the desired therapeutic proteins at industrial scale and with consistent product supply. Importantly, recombinant and biosimilar therapies are less risky because of potential disease transmission, as they are synthesised in laboratory conditions. Thus, with more and more biosimilars obtaining regulatory approval across the world and mainly in the Europe and North America, the market of these therapies is only rising. Biosimilars’ transition is also facilitated by cost containment priorities of healthcare systems especially in the developing nations where affordable plasma derived therapies are unavailable. Nonetheless, despite these potentials, some barriers relating to recombinant and biosimilar therapies are still major issues that need to be addressed; these include issues to do with intellectual property rights and acceptance by the market.

Plasma Protein Therapeutic Market Segment Analysis:

Plasma Protein Therapeutic Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, IVIG (Intravenous Immunoglobulin) segment is expected to dominate the market during the forecast period

-

IVIG (Intravenous Immunoglobulin) segment is anticipated to be the largest in the Plasma Protein Therapeutic Market from 2016 to 2021 as the segment covers significant market size and has multiple vital uses in treatment. IVIG is an essential therapy for diverse diseases of immune deficiencies, but mainly for PIDs patients who have a compromised immune system and are prone to infections. IVIG gives passive immunity since it delivers a high-titered antibody, which is a part of the healthy human plasma and aids in prevention of soaring infections along with enhancing the immune response. Since, immune deficiencies and autoimmune diseases patients are on the rise throughout the world, the use IVIG –based therapies will remain high. In addition, IVIG is also indicated for several diseases including neurological diseases, autoimmune diseases and inflammatory diseases, and this makes the application of IVIG to be wider and this supports the market share of the dominating players.

- A growing understanding of immunological disorders and improvements in diagnostic methods, fast and accurate detection of diseases requiring IVIG, also contributes to the growth of the market for this product. Furthermore, that disease such as Guillain-Barré syndrome, Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) and other multisystem inflammatory disorders have been treated using IVIG makes its market position strong. As more patients require immunoglobulin therapy especially in the older persons and developing countries with adequate end or healthcare infrastructures, IVIG is projected to take the largest share of the plasma protein therapeutic market. The steadily rising availability of IVIG therapies worldwide through enlarged production capacities and better plasma procurement systems is also believed to bolster steady market growth through the forecasting period.

By Application, Immunodeficiency Disorders segment expected to held the largest share

-

Among the four segments in the Plasma Protein Therapeutic Market, the Immunodeficiency Disorders segment is expected to occupy the largest market share throughout the forecast period, primarily because of the rising awareness about PIDs and the immune system diseases. Deviations in immunocompetence, under which the immunity is low or missing, are given immunoglobulins (IVIG, SCIG) that would help normalize immunity. That is why more cases of primary immunodeficiencies are being diagnosed now due to the development of methods of genetic diagnostics and better understanding of the problem, which in turn increases the need for these therapies. Also, an increased rate of the secondary immunodeficiency due to HIV/AIDS, cancer, autoimmune diseases, etc., increases the need for immunoglobulin treatment. With people’s increased average age worldwide, the occurrence of these immune-related diseases will also increase, thereby further consolidating the position of this segment.

- Immunoglobulin therapies are widely available, and the prominence of the immune deficiency conditions in the segment is driving growth due to their effectiveness. IVIG is more important in the treatment of primary immunodeficiency diseases that affect children and adults with the capacity to lead near normal life styles as a result of virus prevention and immune enhancement. However, immunoglobulin therapies are also useful in neurological disorders as well as other immune disorders increasing the potential uses for immunoglobulins. Because healthcare organizations around the world are concentrating on expanding capacities in immunodeficiency diseases diagnostics and therapeutic approaches, the market of plasma products, including immunoglobulins, will post strong growth in the coming years to remain the largest segment.

Plasma Protein Therapeutic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America expected to be the largest Plasma Protein Therapeutic Market during the prescribed time due to high disposable income, better health care facilities, and advanced technology saturation towards plasma derived products therapy. The largest market for plasma protein therapies is the United States because of the high concentration of industrial players, numerous plasma centers, and free and accessible healthcare systems. The U.S. remains a leading market for IVIG (Intravenous Immunoglobulin) on global levels because immunodeficiency disorders and other autoimmune diseases or neurological disorders constantly require plasma therapies. Also, the U.S. market has a better reimbursement package that has made the plasma protein therapies easily accessible to patients with different status. Also, there are hopes in biotechnology, good regulation, and the growing awareness of rare diseases in the region create demand for plasma protein therapies.

- Besides the U.S., Canada plays a role in the development of the North American plasma protein therapeutic market due to its efficient health care structure and growing concern regarding chronic and rare diseases. Canada has been experiencing a growing demand for plasma derived products through diseases such as hemophilia, immune deficiencies and liver diseases. North America also boasts of a robust expenditure in pharmaceutical research and development as the market players continue to seek ways of making plasma derived products safer, more effective and readily available. Due to a high level of consciousness about the plasma protein therapies and their importance for the treatment of life threatening diseases, North America will continue to dominate the global market till the forecast period.

Active Key Players in the Plasma Protein Therapeutic Market:

-

AbbVie Inc. (United States)

- Amgen Inc. (United States)

- Baxter International Inc. (United States)

- Bayer AG (Germany)

- Biocryst Pharmaceuticals (United States)

- Biotest AG (Germany)

- China Biologic Products Inc. (China)

- CSL Behring (Australia)

- Emergent BioSolutions Inc. (United States)

- Grifols, S.A. (Spain)

- Hualan Biological Engineering (China)

- Kedrion Biopharma Inc. (Italy)

- LFB Group (France)

- Octapharma AG (Switzerland)

- Pfizer Inc. (United States)

- Samsung Biologics (South Korea)

- Shire Pharmaceuticals (United Kingdom)

- Sobi AB (Sweden), and Other Active Players

|

Global Plasma Protein Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.2 Billion |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 48.4 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Plasma Protein Therapeutic Market by Type

4.1 Plasma Protein Therapeutic Market Snapshot and Growth Engine

4.2 Plasma Protein Therapeutic Market Overview

4.3 Immunoglobulins (IVIG

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Immunoglobulins (IVIG: Geographic Segmentation Analysis

4.4 SCIG)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 SCIG): Geographic Segmentation Analysis

4.5 Clotting Factors (Factor VIII

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Clotting Factors (Factor VIII: Geographic Segmentation Analysis

4.6 Factor IX.)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Factor IX.): Geographic Segmentation Analysis

4.7 Albumin

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Albumin: Geographic Segmentation Analysis

4.8 Alpha-1 Antitrypsin

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Alpha-1 Antitrypsin: Geographic Segmentation Analysis

4.9 C1 Esterase Inhibitors

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 C1 Esterase Inhibitors: Geographic Segmentation Analysis

4.10 Fibrinogen

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Fibrinogen: Geographic Segmentation Analysis

Chapter 5: Plasma Protein Therapeutic Market by Application

5.1 Plasma Protein Therapeutic Market Snapshot and Growth Engine

5.2 Plasma Protein Therapeutic Market Overview

5.3 Immunodeficiency Disorders

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Immunodeficiency Disorders: Geographic Segmentation Analysis

5.4 Hemophilia

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Hemophilia: Geographic Segmentation Analysis

5.5 Autoimmune Diseases

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Autoimmune Diseases: Geographic Segmentation Analysis

5.6 Chronic Inflammatory Diseases

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Chronic Inflammatory Diseases: Geographic Segmentation Analysis

5.7 Liver Diseases

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Liver Diseases: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Plasma Protein Therapeutic Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBVIE INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMGEN INC. (UNITED STATES)

6.4 BAXTER INTERNATIONAL INC. (UNITED STATES)

6.5 BAYER AG (GERMANY)

6.6 BIOCRYST PHARMACEUTICALS (UNITED STATES)

6.7 BIOTEST AG (GERMANY)

6.8 CHINA BIOLOGIC PRODUCTS INC. (CHINA)

6.9 CSL BEHRING (AUSTRALIA)

6.10 EMERGENT BIOSOLUTIONS INC. (UNITED STATES)

6.11 GRIFOLS

6.12 S.A. (SPAIN)

6.13 HUALAN BIOLOGICAL ENGINEERING (CHINA)

6.14 KEDRION BIOPHARMA INC. (ITALY)

6.15 LFB GROUP (FRANCE)

6.16 OCTAPHARMA AG (SWITZERLAND)

6.17 PFIZER INC. (UNITED STATES)

6.18 SAMSUNG BIOLOGICS (SOUTH KOREA)

6.19 SHIRE PHARMACEUTICALS (UNITED KINGDOM)

6.20 SOBI AB (SWEDEN)

6.21 OTHER ACTIVE PLAYERS

Chapter 7: Global Plasma Protein Therapeutic Market By Region

7.1 Overview

7.2. North America Plasma Protein Therapeutic Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Immunoglobulins (IVIG

7.2.4.2 SCIG)

7.2.4.3 Clotting Factors (Factor VIII

7.2.4.4 Factor IX.)

7.2.4.5 Albumin

7.2.4.6 Alpha-1 Antitrypsin

7.2.4.7 C1 Esterase Inhibitors

7.2.4.8 Fibrinogen

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Immunodeficiency Disorders

7.2.5.2 Hemophilia

7.2.5.3 Autoimmune Diseases

7.2.5.4 Chronic Inflammatory Diseases

7.2.5.5 Liver Diseases

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Plasma Protein Therapeutic Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Immunoglobulins (IVIG

7.3.4.2 SCIG)

7.3.4.3 Clotting Factors (Factor VIII

7.3.4.4 Factor IX.)

7.3.4.5 Albumin

7.3.4.6 Alpha-1 Antitrypsin

7.3.4.7 C1 Esterase Inhibitors

7.3.4.8 Fibrinogen

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Immunodeficiency Disorders

7.3.5.2 Hemophilia

7.3.5.3 Autoimmune Diseases

7.3.5.4 Chronic Inflammatory Diseases

7.3.5.5 Liver Diseases

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Plasma Protein Therapeutic Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Immunoglobulins (IVIG

7.4.4.2 SCIG)

7.4.4.3 Clotting Factors (Factor VIII

7.4.4.4 Factor IX.)

7.4.4.5 Albumin

7.4.4.6 Alpha-1 Antitrypsin

7.4.4.7 C1 Esterase Inhibitors

7.4.4.8 Fibrinogen

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Immunodeficiency Disorders

7.4.5.2 Hemophilia

7.4.5.3 Autoimmune Diseases

7.4.5.4 Chronic Inflammatory Diseases

7.4.5.5 Liver Diseases

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Plasma Protein Therapeutic Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Immunoglobulins (IVIG

7.5.4.2 SCIG)

7.5.4.3 Clotting Factors (Factor VIII

7.5.4.4 Factor IX.)

7.5.4.5 Albumin

7.5.4.6 Alpha-1 Antitrypsin

7.5.4.7 C1 Esterase Inhibitors

7.5.4.8 Fibrinogen

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Immunodeficiency Disorders

7.5.5.2 Hemophilia

7.5.5.3 Autoimmune Diseases

7.5.5.4 Chronic Inflammatory Diseases

7.5.5.5 Liver Diseases

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Plasma Protein Therapeutic Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Immunoglobulins (IVIG

7.6.4.2 SCIG)

7.6.4.3 Clotting Factors (Factor VIII

7.6.4.4 Factor IX.)

7.6.4.5 Albumin

7.6.4.6 Alpha-1 Antitrypsin

7.6.4.7 C1 Esterase Inhibitors

7.6.4.8 Fibrinogen

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Immunodeficiency Disorders

7.6.5.2 Hemophilia

7.6.5.3 Autoimmune Diseases

7.6.5.4 Chronic Inflammatory Diseases

7.6.5.5 Liver Diseases

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Plasma Protein Therapeutic Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Immunoglobulins (IVIG

7.7.4.2 SCIG)

7.7.4.3 Clotting Factors (Factor VIII

7.7.4.4 Factor IX.)

7.7.4.5 Albumin

7.7.4.6 Alpha-1 Antitrypsin

7.7.4.7 C1 Esterase Inhibitors

7.7.4.8 Fibrinogen

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 Immunodeficiency Disorders

7.7.5.2 Hemophilia

7.7.5.3 Autoimmune Diseases

7.7.5.4 Chronic Inflammatory Diseases

7.7.5.5 Liver Diseases

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Plasma Protein Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.2 Billion |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 48.4 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||