Pharmacy Management System Market Synopsis:

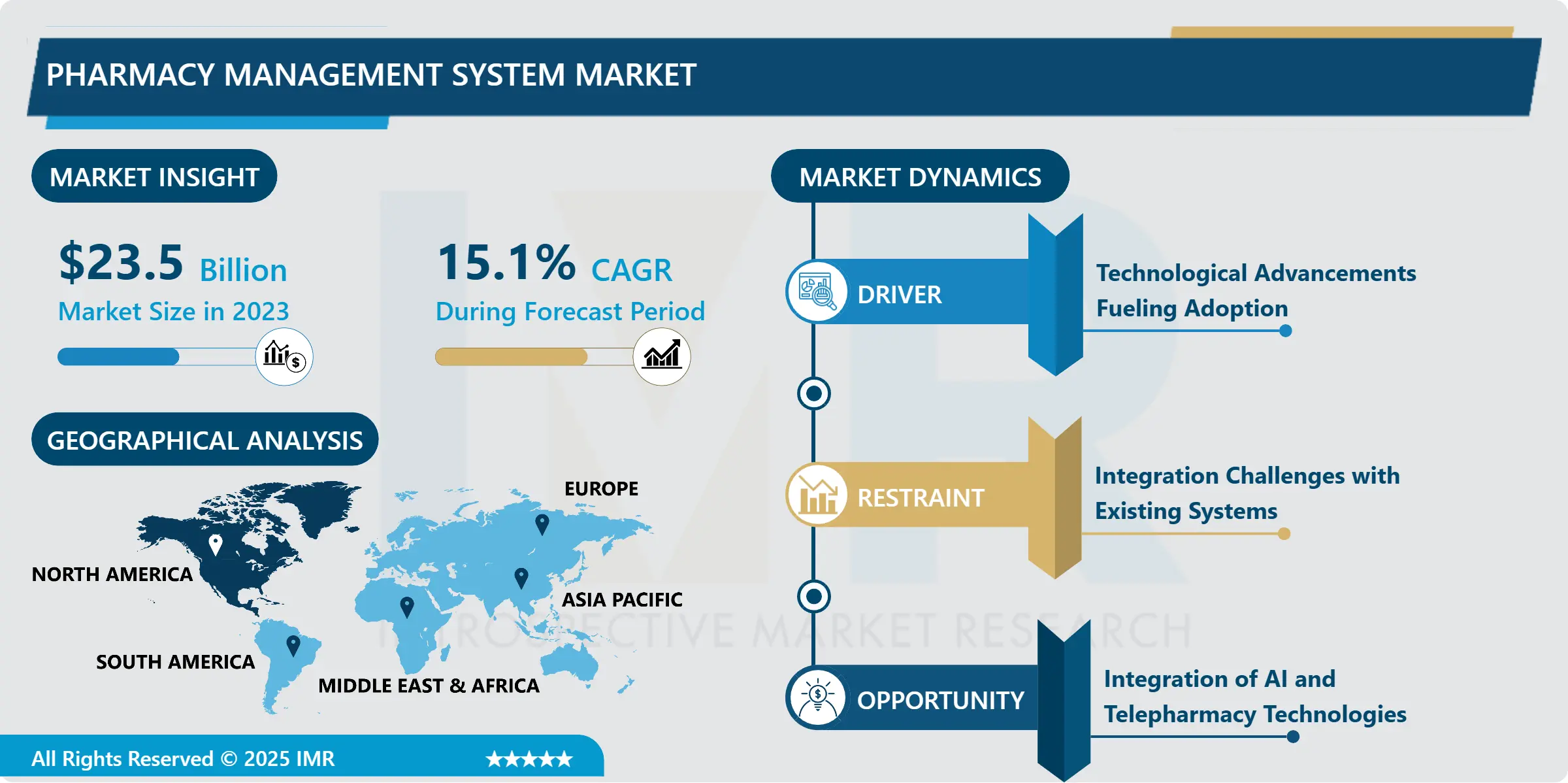

Pharmacy Management System Market Size Was Valued at USD 23.50 Billion in 2023, and is Projected to Reach USD 89.31 Billion by 2032, Growing at a CAGR of 15.10 % From 2024-2032.

Pharmacy management system is an application on software that help to manage the various aspects in pharmacy operation including dispensing drugs, stocking and issuing, billing and compliance with regulatory procedures. It empowers the pharmacist to handle prescription, enhance the quality of their service and enhance effective working. They are used more commonly to improve the effectiveness of delivering clinical services as well as minimizing mistakes in the distribution of medicines.

The primary factor fueling the pharmacy management system market is the factor of digitalization of the healthcare sector. National governments across the globe have been urging the implementation of digital health solutions to enhance the health services’ effectiveness in their operation and the reduction of incensement within the health facilities’ operations are placing pressure on the pharmacies to implement compounded management systems. Further, the growth of chronic diseases and an aging population increases the require for better medication dispensing and reduction of medication error through automation at the pharmacy, enhancing the adoption of these systems.

The other important factor is the innovation evoking elevated technologies like AI, ML, and cloud. These technologies facilitate real-time monitoring, improving the general analytical capacity of a pharmacy as well as raising inventory control effectiveness and flexibility. In addition, other reasons include; higher patient expectation standards for quick and accurate service forces the adoption of these advanced measures.

Pharmacy Management System Market Trend Analysis:

Cloud-based solutions have gained popularity

- Pharmacy management systems are widely implemented across the global markets and especially cloud-based solutions have gained popularity among the customers. Cloud solutions are more convenient and elastic, require less expenses in comparison with on-premise systems. Most supermarkets are especially in developed countries are are choosing to adopt cloud-based solutions to help them ensure continuity with other pharmacists.

- Another one is about the combination of tele pharmacy functionality into pharmacy management systems. Tele pharmacy includes consultation, prescription processing, and home delivery since clients from distant and deprived areas can benefit immensely. As the application of telemedicine evolves, this benefit or added feature is quickly becoming part of every reliable pharmacy management software.

E-pharmacy service is still in the development stage

- They forecasted that the intensive use of pharmacy management systems in the emerging countries would bring great development opportunities to pharmacies. Some of the emerging economies in Asia-Pacific, Latin America, and Africa are developing their health care systems, which are opening up appealing business opportunities in terms of affordable innovation. Governments in these regions are also spending significantly on digitization of healthcare, which will also increase demand, he said.

- The e-pharmacy service is still in the development stage can also be valued as a major opportunity. With customers preferring to obtain medication online through online pharmacy, the pharmacies are using management system to deal with online prescriptions/ orders, packaging and delivery of the products as well as compliance with the set legal requirements. Such change is expected to enhance the use of other sophisticated pharmacy management solutions.

Pharmacy Management System Market Segment Analysis:

Pharmacy Management System Market is Segmented on the basis of Component, Deployment Type, End-User, and Region.

By Component, Software segment is expected to dominate the market during the forecast period

- The Software segment is expected to dominate the Pharmacy Management System (PMS) market during the forecast period due to the increasing demand for automation and the need for efficient management in pharmacies. Software solutions enable pharmacies to streamline operations, including inventory management, order processing, billing, and compliance with regulatory requirements. These systems also enhance customer service by enabling faster processing of prescriptions and providing better insights into stock levels, medication usage, and customer preferences.

- The growing adoption of cloud-based PMS software allows for remote access, scalability, and reduced IT maintenance costs, making it a preferred choice among pharmacies of various sizes. Integration with other healthcare management systems further drives the adoption of software solutions, ensuring better coordination of care and improved patient outcomes. As technology continues to evolve, the software segment's growth is expected to outpace other components, such as hardware and services, in the coming years.

By Deployment Type, On-Premise segment expected to held the largest share

- The Pharmacy Management System (PMS) market is increasingly influenced by deployment types, with the on-premise segment expected to hold the largest market share in the near future. This trend is driven by the higher level of control and security offered by on-premise deployments.

- For pharmacies, having a system installed and managed within their own infrastructure allows them to protect sensitive patient data more effectively, ensuring compliance with strict regulatory requirements. On-premise solutions offer better customization capabilities, enabling businesses to tailor the system according to their specific needs. While cloud-based systems have also gained popularity due to lower initial costs and scalability, the on-premise solution remains the dominant choice for many large pharmacies and healthcare providers looking for more control over their operations and data security.

Pharmacy Management System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Pharmacy Management System (PMS) market in North America is expected to experience significant growth and dominate the global market during the forecast period. This dominance is attributed to several key factors, including the increasing adoption of advanced healthcare technologies, government initiatives promoting digital healthcare solutions, and the rising demand for streamlined pharmacy operations.

- North America, particularly the United States, has been a leader in integrating electronic health records and pharmacy management systems into healthcare practices, enhancing operational efficiency and patient care. The growing focus on reducing medication errors, improving patient safety, and enhancing regulatory compliance is driving the need for advanced PMS solutions in the region. As healthcare providers continue to adopt automation, cloud-based solutions, and data analytics, the market in North America is poised for substantial growth.

Active Key Players in the Pharmacy Management System Market:

- Allscripts Healthcare Solutions (United States)

- BD (Becton, Dickinson, and Company) (United States)

- Cerner Corporation (United States)

- Epic Systems Corporation (United States)

- GE HealthCare Technologies Inc. (United States)

- McKesson Corporation (United States)

- Omnicell Inc. (United States)

- Parata Systems LLC (United States)

- ScriptPro LLC (United States)

- Swisslog Healthcare (Switzerland), and Other Active Players

|

Global Pharmacy Management System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.50 Billion |

|

Forecast Period 2024-32 CAGR: |

15.10 % |

Market Size in 2032: |

USD 89.31 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmacy Management System Market by Type

4.1 Pharmacy Management System Market Snapshot and Growth Engine

4.2 Pharmacy Management System Market Overview

4.3 Oral Tablets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Oral Tablets: Geographic Segmentation Analysis

4.4 Injectable Solutions

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Injectable Solutions: Geographic Segmentation Analysis

Chapter 5: Pharmacy Management System Market by Application

5.1 Pharmacy Management System Market Snapshot and Growth Engine

5.2 Pharmacy Management System Market Overview

5.3 Epilepsy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Epilepsy: Geographic Segmentation Analysis

5.4 Sedation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Sedation: Geographic Segmentation Analysis

5.5 Anxiety

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Anxiety: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Pharmacy Management System Market by End User

6.1 Pharmacy Management System Market Snapshot and Growth Engine

6.2 Pharmacy Management System Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinics: Geographic Segmentation Analysis

6.5 Homecare Settings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Homecare Settings: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmacy Management System Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CERNER CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MCKESSON CORPORATION (UNITED STATES)

7.4 EPIC SYSTEMS CORPORATION (UNITED STATES)

7.5 ALLSCRIPTS HEALTHCARE SOLUTIONS (UNITED STATES)

7.6 SCRIPTPRO LLC (UNITED STATES)

7.7 BD (UNITED STATES)

7.8 PARATA SYSTEMS LLC (UNITED STATES)

7.9 OMNICELL INC. (UNITED STATES)

7.10 SWISSLOG HEALTHCARE (SWITZERLAND)

7.11 GE HEALTHCARE TECHNOLOGIES INC. (UNITED STATES)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmacy Management System Market By Region

8.1 Overview

8.2. North America Pharmacy Management System Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Oral Tablets

8.2.4.2 Injectable Solutions

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Epilepsy

8.2.5.2 Sedation

8.2.5.3 Anxiety

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Homecare Settings

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmacy Management System Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Oral Tablets

8.3.4.2 Injectable Solutions

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Epilepsy

8.3.5.2 Sedation

8.3.5.3 Anxiety

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Homecare Settings

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmacy Management System Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Oral Tablets

8.4.4.2 Injectable Solutions

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Epilepsy

8.4.5.2 Sedation

8.4.5.3 Anxiety

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Homecare Settings

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmacy Management System Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Oral Tablets

8.5.4.2 Injectable Solutions

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Epilepsy

8.5.5.2 Sedation

8.5.5.3 Anxiety

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Homecare Settings

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmacy Management System Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Oral Tablets

8.6.4.2 Injectable Solutions

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Epilepsy

8.6.5.2 Sedation

8.6.5.3 Anxiety

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Homecare Settings

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmacy Management System Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Oral Tablets

8.7.4.2 Injectable Solutions

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Epilepsy

8.7.5.2 Sedation

8.7.5.3 Anxiety

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Homecare Settings

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pharmacy Management System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.50 Billion |

|

Forecast Period 2024-32 CAGR: |

15.10 % |

Market Size in 2032: |

USD 89.31 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||