Pharmaceutical Excipients Market Synopsis:

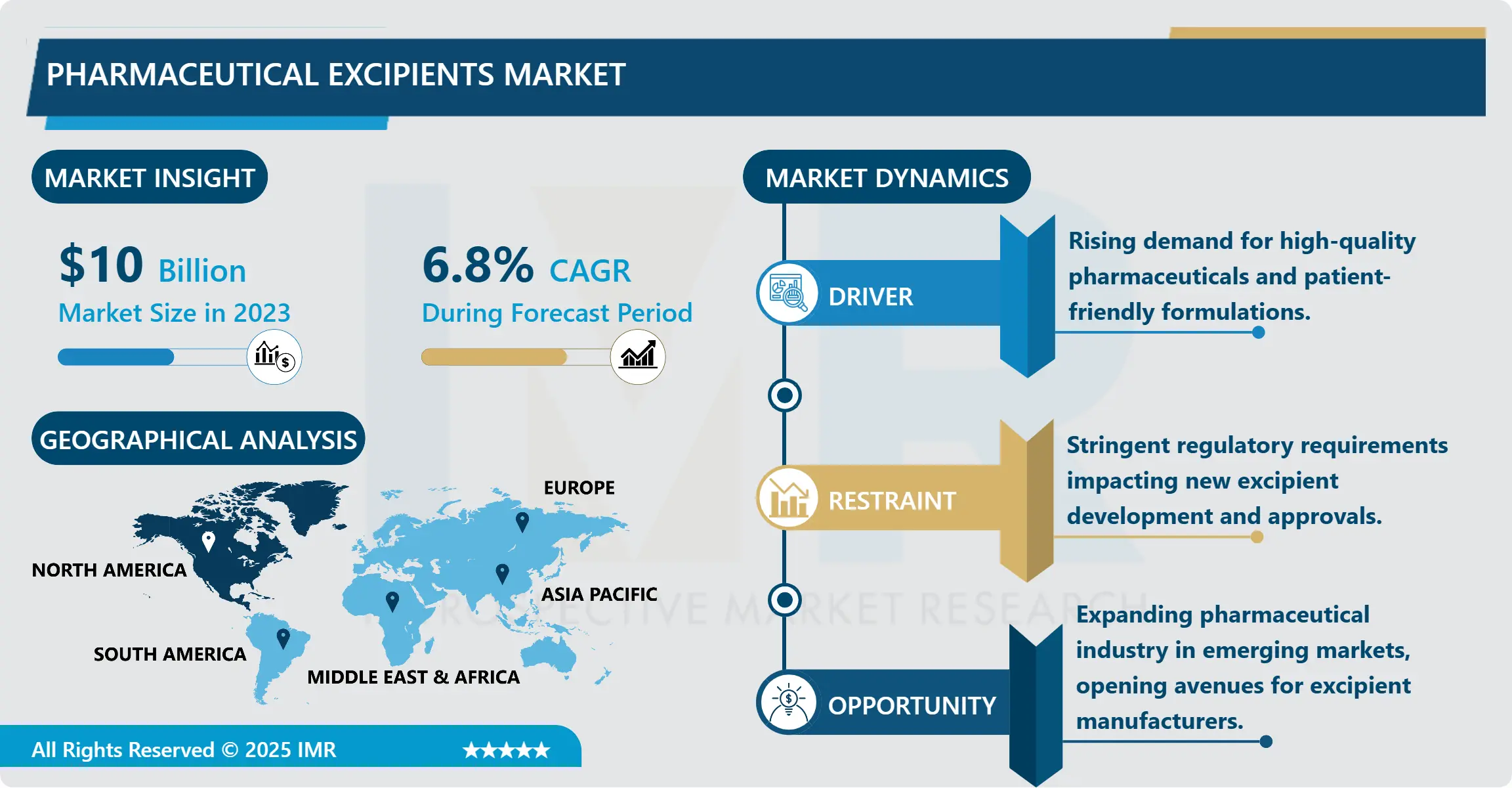

Pharmaceutical Excipients Market Size Was Valued at USD 10.0 Billion in 2023, and is Projected to Reach USD 18.07 Billion by 2032, Growing at a CAGR of 6.8% From 2024-2032.

Pharmaceutical excipients or pharmaceutical additives are other components mixed in the drug formulation in the active pharmaceutical ingredient to facilitate stability, bioavailability, and effectiveness. In themselves they are not therapeutic agents but rather valuable contributors guaranteeing efficacy, stability, and safety during production for the ultimate active pharmaceutical ingredient. Excipients include binders, fillers and disintegrants, preservatives and lubricants that are involved with the formulation of tablets, capsules, injectables, and topical dosage forms.

The pharmaceutical excipients market has been exhibiting a sustained growth worldwide owing to rising requirement for efficient, better-quality drugs. Pharmaceutical industry continues to grow especially the global Ingredients where more companies are focused on excipients that enable solubility, Stability, and absorption. This market is also influenced by the growing rates of chronic diseases that have consequently led to frequent prescription drugs prescriptions. Change in existing technologies like using multifunctional excipients where one compound performs several functions is therefore also increasing the market growth.

The market is set by an increasing trend in the use of personalized medicine and biologics in the excipients. Excipients are now designed to leverage new and complex product platforms such as coated and sustained release products and bioactive agents. This demand for precision in excipient functionality has therefore seen form cooperations between the manufacturers of excipients and the pharmaceutical industries. Moreover, the latest trends in development of formulations that are more convenient for patients and in new forms of medicines, including palatable tablets and fast-acting drugs, is giving a boost to further development of the excipients market, which also positively affects the general tendency of the market’s development.

Pharmaceutical Excipients Market Trend Analysis:

Focus on Multifunctional Excipients

-

Multifunctional excipients are the phenomenon which is likely to revolutionise the pharmaceutical excipients market. Pharmaceutical multicomponent preparations place added pressure on the pharma giants to cut down on their costs, plus miniaturize formulations – leading to the rising popularity of functional excipients. These excipients tend to have more than one function in a formulation; making the burden of drug production much easier, improving performance, and possibly causing the cost to come down. For instance, certain excipients can function as binders and disintegrating agents so as to enhance the development of the tablets without requiring use of other materials. This trend is expected to go on as organizations seek optimization, reduce environmental impacts, and ensure excellent methods of delivering drugs.

- Another is the increased focus on new formulations of drugs for instance sub skin patches and controlled release systems. Such systems demand sophisticated excipients aimed at modulating a rate of discharge of active substances, enhancing patient compliance thus offering the best therapeutic results. As the scope of using innovative forms of products increase there is consequently and increase in demand for high performance active substances that is specifically suited for the purpose of drug delivery.

Growing Demand in Emerging Markets

-

Top Db2 questions and answers: Developing economies offer great prospects for development in the segment of pharmaceutical excipients. Several Asian-Pacific, Latin American, and Middle Eastern countries have rapidly growing pharmaceutical industries because of higher and increasing health care expenditures, growing incidences of diseases, and the expanding middle-age populations. These regions are virgin markets for the excipient suppliers, where local manufacturers need to improve quality of their drugs to meet international requirements and standards. This produces a favorable environment for firms that are interested in these regions for the establishment of production centers or for searching for partners.

Pharmaceutical Excipients Market Segment Analysis:

Pharmaceutical Excipients Market is Segmented on the basis of Functionality, Application, End User, and Region.

By Functionality, Binders and Adhesives segment is expected to dominate the market during the forecast period

-

Among various segments to constitute the global pharmaceutical excipients market, the Binders and Adhesives segment is expected to lead the market during the given tenure owing to the critical use in tablet formulation and its stability. Binders and adhesives are important for improving flow interaction between the powder particles and keep the tablet structure and properties in a steady state. They facilitate high density and prevent the tendency to break down during handling besides assisting in the rate at which the active ingredients are released in the system which is important for the patient compliance and therapeutic outcomes.

- It is expected that the continual pushing of pharmaceutical manufacturers to ensure the production of high quality and patient central formulations would increase the usage of versatile and efficient binder and adhesive excipients and thereby solidify the position of their manufacturers in the market.

By Application, Oral segment expected to held the largest share

-

Among all the segments, the Oral segment is anticipated to dominate the market regarding application in the pharmaceutical excipients market because oral formulations are still the most common and preferred delivery systems. Tablets, capsules, syrups and other oral are preferred due to their administration route, patient’s compliance, and cost of manufacture.

- Corecipients are critical in oral solid dosage forms through promoting, protecting drug stability, improving drug bioavailability, and making the drug more acceptable to the patient provides the opportunity for controlled and /or site-specific delivery. Due to a growing prevalence of chronic diseases as well as the growing population, particularly in the emerging markets, the oral segment is expected to sustain growth as the primary market strategy for manufacturing continues to emphasize on newer formulations and better drug delivery systems in the solid oral dosages.

Pharmaceutical Excipients Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America constitutes the largest market for pharmaceutical excipients in 2023 backed by well-equipped pharmaceutical market, large scale investments in R&D and high regulatory enforcement. The focus that this region places on quality in its drugs and the management of patient needs will work to demand new excipients. The US represents a large proportion for the same reason; it is one of the many technologically advanced countries in the provision of healthcare services and is also a leader in pharmaceutical research and development. North America occupies a position of about 35% as the market share for large scale production of drug and multitude of pharmaceutical and biotechnology companies. This particular emphasis on the growth of custom-made high regulatory standards’ excipients prolongs the region’s dominance.

Active Key Players in the Pharmaceutical Excipients Market

- Archer Daniels Midland Company (U.S.)

- Ashland Global Holdings Inc. (U.S.)

- Associated British Foods plc (U.K.)

- BASF SE (Germany)

- Colorcon Inc. (U.S.)

- Croda International plc (U.K.)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- JRS Pharma LP (Germany)

- Kerry Group plc (Ireland)

- Lubrizol Corporation (U.S.)

- Meggle AG (Germany)

- Merck KGaA (Germany)

- Roquette Frères (France)

- The Dow Chemical Company (U.S.), and Other Active Players

|

Global Pharmaceutical Excipients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.0 Billion |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 18.07 Billion |

|

Segments Covered: |

By Functionality |

|

|

|

By Application |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Excipients Market by Functionality

4.1 Pharmaceutical Excipients Market Snapshot and Growth Engine

4.2 Pharmaceutical Excipients Market Overview

4.3 Binders and Adhesives

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Binders and Adhesives: Geographic Segmentation Analysis

4.4 Disintegrants

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Disintegrants: Geographic Segmentation Analysis

4.5 Coating Material

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Coating Material: Geographic Segmentation Analysis

4.6 Colouring Agents

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Colouring Agents: Geographic Segmentation Analysis

4.7 Solubilizers

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Solubilizers: Geographic Segmentation Analysis

4.8 Flavors

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Flavors: Geographic Segmentation Analysis

4.9 Sweetening Agents

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Sweetening Agents: Geographic Segmentation Analysis

4.10 Diluents

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Diluents: Geographic Segmentation Analysis

4.11 Lubricants

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Lubricants: Geographic Segmentation Analysis

4.12 Buffers

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.12.3 Key Market Trends, Growth Factors and Opportunities

4.12.4 Buffers: Geographic Segmentation Analysis

4.13 Emulsifying Agents

4.13.1 Introduction and Market Overview

4.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.13.3 Key Market Trends, Growth Factors and Opportunities

4.13.4 Emulsifying Agents: Geographic Segmentation Analysis

4.14 Preservatives

4.14.1 Introduction and Market Overview

4.14.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.14.3 Key Market Trends, Growth Factors and Opportunities

4.14.4 Preservatives: Geographic Segmentation Analysis

4.15 Antioxidants

4.15.1 Introduction and Market Overview

4.15.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.15.3 Key Market Trends, Growth Factors and Opportunities

4.15.4 Antioxidants: Geographic Segmentation Analysis

4.16 Sorbents

4.16.1 Introduction and Market Overview

4.16.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.16.3 Key Market Trends, Growth Factors and Opportunities

4.16.4 Sorbents: Geographic Segmentation Analysis

4.17 Solvents

4.17.1 Introduction and Market Overview

4.17.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.17.3 Key Market Trends, Growth Factors and Opportunities

4.17.4 Solvents: Geographic Segmentation Analysis

4.18 Emollients

4.18.1 Introduction and Market Overview

4.18.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.18.3 Key Market Trends, Growth Factors and Opportunities

4.18.4 Emollients: Geographic Segmentation Analysis

4.19 Glidants

4.19.1 Introduction and Market Overview

4.19.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.19.3 Key Market Trends, Growth Factors and Opportunities

4.19.4 Glidants: Geographic Segmentation Analysis

4.20 Chelating Agents

4.20.1 Introduction and Market Overview

4.20.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.20.3 Key Market Trends, Growth Factors and Opportunities

4.20.4 Chelating Agents: Geographic Segmentation Analysis

4.21 Antifoaming Agents

4.21.1 Introduction and Market Overview

4.21.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.21.3 Key Market Trends, Growth Factors and Opportunities

4.21.4 Antifoaming Agents: Geographic Segmentation Analysis

4.22 and Others

4.22.1 Introduction and Market Overview

4.22.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.22.3 Key Market Trends, Growth Factors and Opportunities

4.22.4 and Others: Geographic Segmentation Analysis

Chapter 5: Pharmaceutical Excipients Market by Application

5.1 Pharmaceutical Excipients Market Snapshot and Growth Engine

5.2 Pharmaceutical Excipients Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oral: Geographic Segmentation Analysis

5.4 Topical

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Topical: Geographic Segmentation Analysis

Chapter 6: Pharmaceutical Excipients Market by End User

6.1 Pharmaceutical Excipients Market Snapshot and Growth Engine

6.2 Pharmaceutical Excipients Market Overview

6.3 Pharmaceutical and Biopharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pharmaceutical and Biopharmaceutical Companies: Geographic Segmentation Analysis

6.4 Contract Formulators

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Contract Formulators: Geographic Segmentation Analysis

6.5 Research Organizations and Academics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research Organizations and Academics: Geographic Segmentation Analysis

6.6 and Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Excipients Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARCHER DANIELS MIDLAND COMPANY (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASHLAND GLOBAL HOLDINGS INC. (U.S.)

7.4 ASSOCIATED BRITISH FOODS PLC (U.K.)

7.5 BASF SE (GERMANY)

7.6 COLORCON INC. (U.S.)

7.7 CRODA INTERNATIONAL PLC (U.K.)

7.8 DUPONT (U.S.)

7.9 EVONIK INDUSTRIES AG (GERMANY)

7.10 JRS PHARMA LP (GERMANY)

7.11 KERRY GROUP PLC (IRELAND)

7.12 LUBRIZOL CORPORATION (U.S.)

7.13 MEGGLE AG (GERMANY)

7.14 MERCK KGAA (GERMANY)

7.15 ROQUETTE FRÈRES (FRANCE)

7.16 THE DOW CHEMICAL COMPANY (U.S.)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Excipients Market By Region

8.1 Overview

8.2. North America Pharmaceutical Excipients Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Functionality

8.2.4.1 Binders and Adhesives

8.2.4.2 Disintegrants

8.2.4.3 Coating Material

8.2.4.4 Colouring Agents

8.2.4.5 Solubilizers

8.2.4.6 Flavors

8.2.4.7 Sweetening Agents

8.2.4.8 Diluents

8.2.4.9 Lubricants

8.2.4.10 Buffers

8.2.4.11 Emulsifying Agents

8.2.4.12 Preservatives

8.2.4.13 Antioxidants

8.2.4.14 Sorbents

8.2.4.15 Solvents

8.2.4.16 Emollients

8.2.4.17 Glidants

8.2.4.18 Chelating Agents

8.2.4.19 Antifoaming Agents

8.2.4.20 and Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Oral

8.2.5.2 Topical

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Pharmaceutical and Biopharmaceutical Companies

8.2.6.2 Contract Formulators

8.2.6.3 Research Organizations and Academics

8.2.6.4 and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmaceutical Excipients Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Functionality

8.3.4.1 Binders and Adhesives

8.3.4.2 Disintegrants

8.3.4.3 Coating Material

8.3.4.4 Colouring Agents

8.3.4.5 Solubilizers

8.3.4.6 Flavors

8.3.4.7 Sweetening Agents

8.3.4.8 Diluents

8.3.4.9 Lubricants

8.3.4.10 Buffers

8.3.4.11 Emulsifying Agents

8.3.4.12 Preservatives

8.3.4.13 Antioxidants

8.3.4.14 Sorbents

8.3.4.15 Solvents

8.3.4.16 Emollients

8.3.4.17 Glidants

8.3.4.18 Chelating Agents

8.3.4.19 Antifoaming Agents

8.3.4.20 and Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Oral

8.3.5.2 Topical

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Pharmaceutical and Biopharmaceutical Companies

8.3.6.2 Contract Formulators

8.3.6.3 Research Organizations and Academics

8.3.6.4 and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Excipients Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Functionality

8.4.4.1 Binders and Adhesives

8.4.4.2 Disintegrants

8.4.4.3 Coating Material

8.4.4.4 Colouring Agents

8.4.4.5 Solubilizers

8.4.4.6 Flavors

8.4.4.7 Sweetening Agents

8.4.4.8 Diluents

8.4.4.9 Lubricants

8.4.4.10 Buffers

8.4.4.11 Emulsifying Agents

8.4.4.12 Preservatives

8.4.4.13 Antioxidants

8.4.4.14 Sorbents

8.4.4.15 Solvents

8.4.4.16 Emollients

8.4.4.17 Glidants

8.4.4.18 Chelating Agents

8.4.4.19 Antifoaming Agents

8.4.4.20 and Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Oral

8.4.5.2 Topical

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Pharmaceutical and Biopharmaceutical Companies

8.4.6.2 Contract Formulators

8.4.6.3 Research Organizations and Academics

8.4.6.4 and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Excipients Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Functionality

8.5.4.1 Binders and Adhesives

8.5.4.2 Disintegrants

8.5.4.3 Coating Material

8.5.4.4 Colouring Agents

8.5.4.5 Solubilizers

8.5.4.6 Flavors

8.5.4.7 Sweetening Agents

8.5.4.8 Diluents

8.5.4.9 Lubricants

8.5.4.10 Buffers

8.5.4.11 Emulsifying Agents

8.5.4.12 Preservatives

8.5.4.13 Antioxidants

8.5.4.14 Sorbents

8.5.4.15 Solvents

8.5.4.16 Emollients

8.5.4.17 Glidants

8.5.4.18 Chelating Agents

8.5.4.19 Antifoaming Agents

8.5.4.20 and Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Oral

8.5.5.2 Topical

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Pharmaceutical and Biopharmaceutical Companies

8.5.6.2 Contract Formulators

8.5.6.3 Research Organizations and Academics

8.5.6.4 and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Excipients Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Functionality

8.6.4.1 Binders and Adhesives

8.6.4.2 Disintegrants

8.6.4.3 Coating Material

8.6.4.4 Colouring Agents

8.6.4.5 Solubilizers

8.6.4.6 Flavors

8.6.4.7 Sweetening Agents

8.6.4.8 Diluents

8.6.4.9 Lubricants

8.6.4.10 Buffers

8.6.4.11 Emulsifying Agents

8.6.4.12 Preservatives

8.6.4.13 Antioxidants

8.6.4.14 Sorbents

8.6.4.15 Solvents

8.6.4.16 Emollients

8.6.4.17 Glidants

8.6.4.18 Chelating Agents

8.6.4.19 Antifoaming Agents

8.6.4.20 and Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Oral

8.6.5.2 Topical

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Pharmaceutical and Biopharmaceutical Companies

8.6.6.2 Contract Formulators

8.6.6.3 Research Organizations and Academics

8.6.6.4 and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmaceutical Excipients Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Functionality

8.7.4.1 Binders and Adhesives

8.7.4.2 Disintegrants

8.7.4.3 Coating Material

8.7.4.4 Colouring Agents

8.7.4.5 Solubilizers

8.7.4.6 Flavors

8.7.4.7 Sweetening Agents

8.7.4.8 Diluents

8.7.4.9 Lubricants

8.7.4.10 Buffers

8.7.4.11 Emulsifying Agents

8.7.4.12 Preservatives

8.7.4.13 Antioxidants

8.7.4.14 Sorbents

8.7.4.15 Solvents

8.7.4.16 Emollients

8.7.4.17 Glidants

8.7.4.18 Chelating Agents

8.7.4.19 Antifoaming Agents

8.7.4.20 and Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Oral

8.7.5.2 Topical

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Pharmaceutical and Biopharmaceutical Companies

8.7.6.2 Contract Formulators

8.7.6.3 Research Organizations and Academics

8.7.6.4 and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pharmaceutical Excipients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.0 Billion |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 18.07 Billion |

|

Segments Covered: |

By Functionality |

|

|

|

By Application |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||