Pharmaceutical Analytical Testing Market Synopsis:

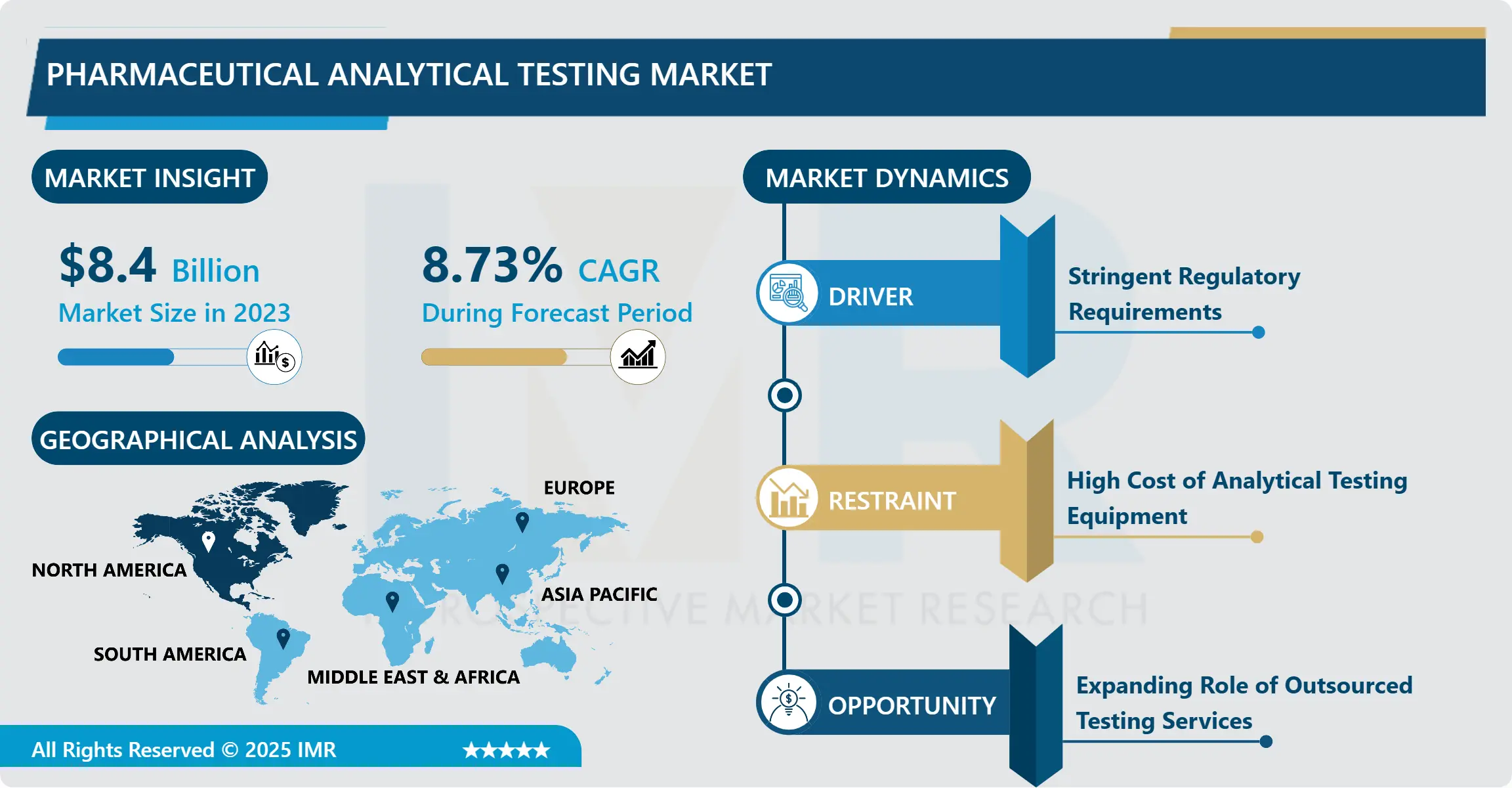

Pharmaceutical Analytical Testing Market Size Was Valued at USD 8.40 Billion in 2023, and is Projected to Reach USD 17.84 Billion by 2032, Growing at a CAGR of 8.73% From 2024-2032.

The Pharmaceutical Analytical Testing Market deals with segment of the market that deals with testing pharmaceutical products for qualities such as quality, safety and efficacy. This market includes activities such as testing for compliance of raw materials, in-process samples and finished products. Analytical testing assists the creation, formulation and “pre approval process” of a pharmaceutical product and may include chemical, physical, microbiological and molecular testing.

The Pharmaceutical Analytical Testing Market is specifically involved in the testing and Analysis of Pharma products along with providing necessary support to the pharma and biopharma industries for their drugs and compliance. Analytical testing services are required irrespective of clinical trial phases or new drug application, in preclinical, clinical, and post-marketing phases. Due to regulatory hurdles set down by a number of agencies such as the FDA and the EMA, it is common to find large pharmaceutical firms outsourcing testing with specialized labs possessing sophisticated skills and equipment. This outsourcing trend is further propelled by the desire to shortening development time for these drugs, analytical testing services supports the duodecimo formulated drug to meet these global quality requirements.

The rising demand for pharmaceutical analytical testing across the world is also attributable to increasing drug differentiation as well as a new focus on delivering biologics and biosimilars, which requires testing that conventional drug types do not necessitate. Asian-Pacific area continues to grow especially the ‘emerging markets’ resulting from expansion of CROs and investment on manufacturing of pharmaceutical products. Further, improvements in high-performance liquid chromatography (HPLC), mass spectrometry and other analytical instruments are driving the sophistication and effectiveness of testing leading to market growth.

Pharmaceutical Analytical Testing Market Trend Analysis:

Rising Adoption of Advanced Analytical Techniques

- With the desire of drug companies to decrease time to market and enhance precision, there has been growing incorporation of high-resolution mass spectrometry, nuclear magnetic resonance spectroscopy and next generation sequencing. These methods allow increased understanding of the molecular nature and makeup of the drugs, making it amicable to both small molecule and large molecule analysis. The increase of sophisticated testing methods is largely due to the fact that the analysis of more complex analytes, especially relating to biologic products such as monoclonal antibodies or gene therapies requires pinpoint accuracy.

- This trend is also caused by various regulatory bodies calling for quality testing to check on the safety and efficacy of a drug being developed as well as the compressed time of discovery. It precisely for these reasons that many analytical labs are now sourcing for high powered instruments to aid in these measures, especially for impurity profiling, stability testing and release testing. Those supplying specialized services of extra analytical testing are likely to benefit from this trend since they will meet the changing requirements of the pharma industry.

Expanding Role of Outsourced Testing Services

- The outsourcing trends of pharmaceutical analytical testing services have created a vital opportunity for the contract research organizations and testing laboratories. Hence more, the treasury costs and time involved in the setup of in house testing facilities form a major reason why most of the pharma and bio pharma firms do not undertake testing on their own but source the services from other contractors. Outsourcing helps them to obtain sophisticated testing services without capital expenditures, as well as to concentrate on corpulent activities, including research and production.

- Today’s drugs – especially the newly developing biologics – are more complex than those of the past, they require specific applications that are well within the capabilities of CROs and independent laboratories. Such service providers may be our informed of the latest analytical technologies and have a team of workforce proficient in tackling complex testing needful which might cover compliance with some regulatory standards. The practise of outsourcing is likely to increase, especially considering that now many small and mid-sized pharmaceutical companies arrive at the market.

Pharmaceutical Analytical Testing Market Segment Analysis:

Pharmaceutical Analytical Testing Market is Segmented on the basis of Service Type, Product Type, and End User.

By Product Type, Small Molecule segment is expected to dominate the market during the forecast period

- Small molecule testing continues to be an important subsector of the Pharmaceutical Analytical Testing Market since a majority of the approved pharmaceutical drugs are in this category. Determination of small molecules involves numerous tests for purity, potency, dissolution, and stab injury to make sure inorganic Drugs reach a particular standard. Compared to biologics, small molecules generally require fewer steps to be tested, which makes it easier and more entities can perform such testing services.

- The growth of biologics has made large molecule testing an important part of this market in the recent past. Biologics like monoclonal antibodies, peptides and polypeptides and various other multi-dimensional molecules need sophisticated analysis for factors like molecular conformation, protein degradation, and aggregation. It is projected that this segment will increase considerably as more biologic drugs and biosimilars require testing services due to their sensitivity to the process and complexity of the products.

By End User, Pharmaceutical & Biopharmaceutical Companies segment expected to held the largest share

- It is worth to note that the major industry which uses analytical testing services are companies in the pharmaceutical and biopharmaceutical sectors. Many of these firms use testing services at several stages of drug development and production in order to conform with the various regulatory requirements. With the demand for more drugs on the market rising, these companies have started outsourcing analytical testing to the CROs so as to make it efficient and cost effective.

- Contract Research Organizations are important service providers to the Pharmaceutical Analytical Testing Market through outsourcing services to pharma firms. CRO segment is in growth phase as main players of pharma/biopharma industries are in demand to outsource analytic testing demands for both small molecule as well as biologic drugs. While many CROs rely on complex analytical tools and professional personnel, they are very suitable for partnering with pharmaceuticals companies still struggling to establish such resources.

Pharmaceutical Analytical Testing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the largest region of the Pharmaceutical Analytical Testing Market due to enhanced drug manufacturing and effective regulatory norms. Again, CRO service providers based in the United States have a large market share due to strong investments in developing new drugs, and a large density of pharmaceutical companies along with CRO’s. Further, the growth of series market players like FDA which have rigorous test regulatory policies also adds to the emergence of high quality analytical testing services market.

- In Canada, government measures that encourage research into pharmaceuticals also help drive the market forward, and the use of high-performance analytical tools increases testing opportunities. The increasing number of neoteric and innovative analytical testing services in North America serves a great avenue for market development across the globe.

Active Key Players in the Pharmaceutical Analytical Testing Market:

- Eurofins Scientific (Luxembourg)

- SGS SA (Switzerland)

- Intertek Group plc (United Kingdom)

- Charles River Laboratories (United States)

- WuXi AppTec (China)

- Laboratory Corporation of America Holdings (United States)

- PPD, Inc. (United States)

- Pace Analytical Services LLC (United States)

- Toxikon Corporation (United States)

- Exova Group plc (United Kingdom)

- Almac Group (United Kingdom)

- Syneos Health (United States), and Other Active Players

Key Industry Developments in the Pharmaceutical Analytical Testing Market:

- In March 2024, LGM Pharma invested over USD 2 million to expand its analytical testing services and include drug delivery suppository manufacturing capabilities by 50% in its facility in Rosenburg, Texas.?

- In January 2024, Kindeva Drug Delivery increased its analytical service capabilities by launching a new global business unit, which provides integrated and stand-alone analytical support to pharmaceutical, biopharmaceutical, and medical device companies.

|

Global Pharmaceutical Analytical Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.40 Billion |

|

Forecast Period 2024-32 CAGR: |

8.73% |

Market Size in 2032: |

USD 17.84 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Product Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Analytical Testing Market by Service Type

4.1 Pharmaceutical Analytical Testing Market Snapshot and Growth Engine

4.2 Pharmaceutical Analytical Testing Market Overview

4.3 Raw Material Testing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Raw Material Testing: Geographic Segmentation Analysis

4.4 Finished Product Testing

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Finished Product Testing: Geographic Segmentation Analysis

4.5 Microbial Testing

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Microbial Testing: Geographic Segmentation Analysis

4.6 Bioanalytical Testing

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Bioanalytical Testing: Geographic Segmentation Analysis

4.7 Stability Testing

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Stability Testing: Geographic Segmentation Analysis

4.8 Environmental Monitoring

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Environmental Monitoring: Geographic Segmentation Analysis

Chapter 5: Pharmaceutical Analytical Testing Market by Product Type

5.1 Pharmaceutical Analytical Testing Market Snapshot and Growth Engine

5.2 Pharmaceutical Analytical Testing Market Overview

5.3 Small Molecule

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Small Molecule: Geographic Segmentation Analysis

5.4 Large Molecule

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Large Molecule: Geographic Segmentation Analysis

Chapter 6: Pharmaceutical Analytical Testing Market by End User

6.1 Pharmaceutical Analytical Testing Market Snapshot and Growth Engine

6.2 Pharmaceutical Analytical Testing Market Overview

6.3 Pharmaceutical & Biopharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pharmaceutical & Biopharmaceutical Companies: Geographic Segmentation Analysis

6.4 Contract Research Organizations (CROs)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Contract Research Organizations (CROs): Geographic Segmentation Analysis

6.5 Government and Academic Research Institutions

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Government and Academic Research Institutions: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Analytical Testing Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EUROFINS SCIENTIFIC (LUXEMBOURG)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SGS SA (SWITZERLAND)

7.4 INTERTEK GROUP PLC (UNITED KINGDOM)

7.5 CHARLES RIVER LABORATORIES (UNITED STATES)

7.6 WUXI APPTEC (CHINA)

7.7 LABORATORY CORPORATION OF AMERICA HOLDINGS (UNITED STATES)

7.8 PPD INC. (UNITED STATES)

7.9 PACE ANALYTICAL SERVICES LLC (UNITED STATES)

7.10 TOXIKON CORPORATION (UNITED STATES)

7.11 EXOVA GROUP PLC (UNITED KINGDOM)

7.12 ALMAC GROUP (UNITED KINGDOM)

7.13 SYNEOS HEALTH (UNITED STATES)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Analytical Testing Market By Region

8.1 Overview

8.2. North America Pharmaceutical Analytical Testing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Service Type

8.2.4.1 Raw Material Testing

8.2.4.2 Finished Product Testing

8.2.4.3 Microbial Testing

8.2.4.4 Bioanalytical Testing

8.2.4.5 Stability Testing

8.2.4.6 Environmental Monitoring

8.2.5 Historic and Forecasted Market Size By Product Type

8.2.5.1 Small Molecule

8.2.5.2 Large Molecule

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Pharmaceutical & Biopharmaceutical Companies

8.2.6.2 Contract Research Organizations (CROs)

8.2.6.3 Government and Academic Research Institutions

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmaceutical Analytical Testing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Service Type

8.3.4.1 Raw Material Testing

8.3.4.2 Finished Product Testing

8.3.4.3 Microbial Testing

8.3.4.4 Bioanalytical Testing

8.3.4.5 Stability Testing

8.3.4.6 Environmental Monitoring

8.3.5 Historic and Forecasted Market Size By Product Type

8.3.5.1 Small Molecule

8.3.5.2 Large Molecule

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Pharmaceutical & Biopharmaceutical Companies

8.3.6.2 Contract Research Organizations (CROs)

8.3.6.3 Government and Academic Research Institutions

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Analytical Testing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Service Type

8.4.4.1 Raw Material Testing

8.4.4.2 Finished Product Testing

8.4.4.3 Microbial Testing

8.4.4.4 Bioanalytical Testing

8.4.4.5 Stability Testing

8.4.4.6 Environmental Monitoring

8.4.5 Historic and Forecasted Market Size By Product Type

8.4.5.1 Small Molecule

8.4.5.2 Large Molecule

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Pharmaceutical & Biopharmaceutical Companies

8.4.6.2 Contract Research Organizations (CROs)

8.4.6.3 Government and Academic Research Institutions

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Analytical Testing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Service Type

8.5.4.1 Raw Material Testing

8.5.4.2 Finished Product Testing

8.5.4.3 Microbial Testing

8.5.4.4 Bioanalytical Testing

8.5.4.5 Stability Testing

8.5.4.6 Environmental Monitoring

8.5.5 Historic and Forecasted Market Size By Product Type

8.5.5.1 Small Molecule

8.5.5.2 Large Molecule

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Pharmaceutical & Biopharmaceutical Companies

8.5.6.2 Contract Research Organizations (CROs)

8.5.6.3 Government and Academic Research Institutions

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Analytical Testing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Service Type

8.6.4.1 Raw Material Testing

8.6.4.2 Finished Product Testing

8.6.4.3 Microbial Testing

8.6.4.4 Bioanalytical Testing

8.6.4.5 Stability Testing

8.6.4.6 Environmental Monitoring

8.6.5 Historic and Forecasted Market Size By Product Type

8.6.5.1 Small Molecule

8.6.5.2 Large Molecule

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Pharmaceutical & Biopharmaceutical Companies

8.6.6.2 Contract Research Organizations (CROs)

8.6.6.3 Government and Academic Research Institutions

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmaceutical Analytical Testing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Service Type

8.7.4.1 Raw Material Testing

8.7.4.2 Finished Product Testing

8.7.4.3 Microbial Testing

8.7.4.4 Bioanalytical Testing

8.7.4.5 Stability Testing

8.7.4.6 Environmental Monitoring

8.7.5 Historic and Forecasted Market Size By Product Type

8.7.5.1 Small Molecule

8.7.5.2 Large Molecule

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Pharmaceutical & Biopharmaceutical Companies

8.7.6.2 Contract Research Organizations (CROs)

8.7.6.3 Government and Academic Research Institutions

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pharmaceutical Analytical Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.40 Billion |

|

Forecast Period 2024-32 CAGR: |

8.73% |

Market Size in 2032: |

USD 17.84 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Product Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||