Petri Dish Market Synopsis:

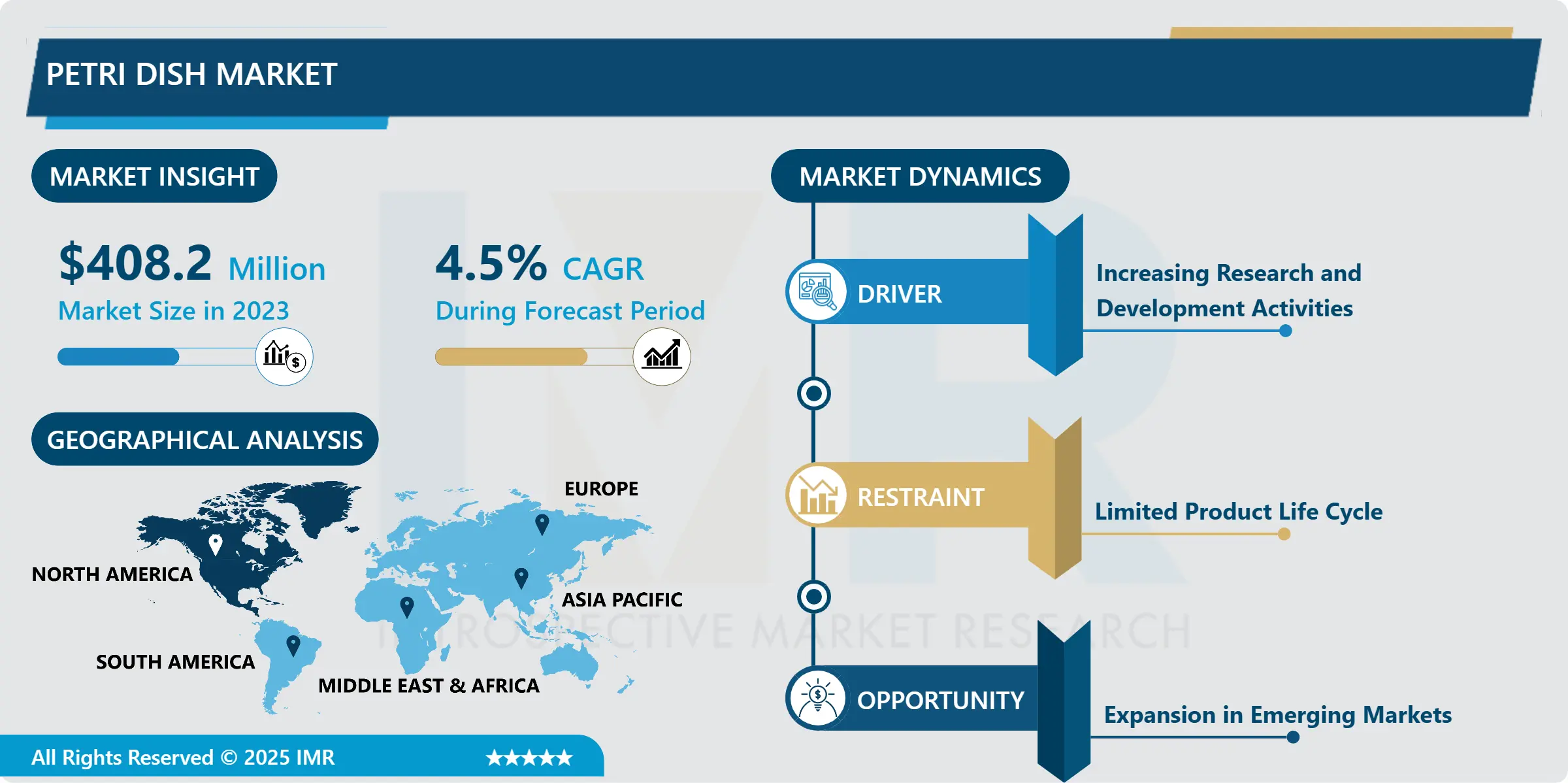

Petri Dish Market Size Was Valued at USD 408.2 Million in 2023, and is Projected to Reach USD 606.62 Million by 2032, Growing at a CAGR of 4.5% From 2024-2032.

The market for petri dishes involves the manufacturing and distribution of shallow, flat dishes made of glass or plastic. Mainly, these are used inside laboratories for culturing microorganisms, cell cultures, and varying biological experiments. Using the petri dishes, scientists can analyze the growth and behavior of different biological specimens in a controlled environment, making them inevitable tools in microbiology, environmental testing, and pharmaceutical research.

As active research and development in biotechnology, pharmaceuticals, and environmental sciences have sparked the growth of the Petri dish market for several decades, the fact that infectious diseases have been growing increasingly, followed by an increased demand for diagnostic tools and equipment of superior quality, has created a thrust for high-quality Petri dishes in clinical laboratories. Moreover, increased food safety and quality demand has led the field of testing in the food and beverage sectors to look further into the market demand for Petri dishes. As hospitals transform and research methodology changes, the market also evolves with the tides and offers innovation, such as biodegradable dishes that comply with the sustainability movement of laboratory practices.

The high demand for Asia-Pacific and Latin America is pushing the market for Petri dishes. The increasing numbers of educational institutions and research organizations in the aforementioned countries have increased the demands of laboratories for their laboratory equipment, supplies, and also for Petri dishes. Further, manufacturing technologies have advanced to improve the performance of produced Petri dishes for more applications, including cell culture, environmental monitoring, and microbiological studies. The market for personalized medicine and regenerative therapies also throws light on the increasing importance of in vitro conditions associated with the use of Petri dishes that can be afforded to support the complexities of experimental designs that could support growth.

Petri Dish Market Trend Analysis:

Shift Towards Biodegradable Petri Dishes

-

Among the trends developed by the growing awareness of environmental sustainability in the Petri dish market is the uptake of biodegradable Petri dishes. Such dishes are made from naturally decomposable material, free from environmental impact generated by traditional plastic options. With the regulatory bodies and research institutions now on the road to emphasizing sustainable practices in laboratories, a commendable demand for biodegradable Petri dishes has emerged. Besides that, more pressure from the scientific community has been increasing, given the need for a reduction in plastic waste. As a result, manufacturers have been compelled to be innovative and come up with environment-friendly alternatives.

- Many companies respond to these changes by making considerable investments in research and development to develop biodegradable materials under high standards of requirements in laboratory application. Such biodegradable material should exhibit sterility, strength, and compatibility with different testing procedures in addition to having evident environmental benefits. Implementation of these biodegradable Petri dishes is not just aligned to the approach of corporate social responsibility but also meets the needs of socially and environmentally aware consumers and researchers. Finally, they will mold the future of the market for the Petri dishes.

Expansion in Emerging Markets

-

The growth opportunity in the Petri dish market is significant in the emerging markets. Industrialization and rapid urbanization in the Asia-Pacific and Latin American markets are key drivers of investment in healthcare infrastructure and laboratory capabilities. As these markets continue to grow, demand for laboratory supplies, such as Petri dishes, will significantly increase. Increasing research and development activity in association with growing interest of people in biotechnology and pharmaceutical products may lead to regions becoming all the more important leaders in the global Petri dish market.

- Local producers may partner with overseas corporations to introduce high-tech laboratory equipment in the respective regions. A business may be able to make entry into a new developing market easier using existing distribution networks as well as the knowledge of markets already acquired. This opportunity serves not only in building up the market presence but also in the growth of the Petri dish industry, where key focus will be made on serving varied applications in diverse scientific disciplines.

Petri Dish Market Segment Analysis:

Petri Dish Market is Segmented on the basis of Material, Size, Type, Application, End User, and Region.

By Type, Standard Petri Dishes segment is expected to dominate the market during the forecast period

-

The market for Petri dish is segmented into various types such as standard Petri dishes, dual-chamber Petri dishes, biodegradable ones, and other types. Standard Petri dishes are extremely in use in the laboratories for the culture of microorganisms and for carrying out various experiments. These standard ones are versatile and also inexpensive enough to be widely used in many research setups. Dual chamber Petri dishes offer a better capability to study the interaction between different microbial species or cell types, which makes possible some very complex experimental designs.

- The second pressure from sustainability has set up biodegradable Petri dishes popular among environmentally responsible researchers and institutions. Biodegradable Petri dishes based on the materials that naturally decompose have aligned with global efforts at reducing plastic waste in laboratory environments. Increasing environmental consciousness should lead to investment on the part of manufacturers with a focus toward developing biodegradable alternatives that align with significant scientific research's stringent standards while at the same time having a minimum ecological footprint.

By Application, Microbiology segment expected to held the largest share

-

In the application varieties of petri dish markets include mainly: microbiology, cell culture, environmental testing, food and beverage testing, pharmaceutical applications, among others. In the field of microbiology, there is a need to have petri dishes in the process of isolating and identifying microorganisms, which are further analyzed regarding their characteristics and behavior. For this reason, in the use of petri dishes, cell culture applications make use of controlled environments for growing and maintaining cells since this can lead to breaking research in medical fields and biotechnology.

- Environmental testing and food and beverage testing are other significant applications of Petri dishes. In environmental research, they are utilized to assess samples of soil and water for microbial contamination, and within the food industry, they play a very significant role in safety and regulation with health inputs. The design and testing of drugs could not be carried out without Petri dishes. These applications remain to this day part of a broad area of science, and in such a scenario, the Petri dish market will continue growing due to research innovations and regulatory needs.

Petri Dish Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America currently accounts for the largest share in the market for Petri dishes, mainly because of the maturity of its healthcare infrastructure and strong focus on research and development. Also contributing are the significant biotechnology and pharmaceutical companies set up in the region. The region boasts of unparalleled investment in scientific research, with several institutions focused on innovative research in microbiology, cell biology, and environmental sciences. This concentration of resources has led to high demands for laboratory supplies with particular focus on the use of petri dishes especially since researchers come out with new diagnostic tools and therapeutic solutions.

- The stringent quality norms relating to laboratory products in North America also increase demand for reliable Petri dishes. Furthermore, awareness about sustainability has even impacted the purchasing decision such that laboratories have started sourcing products that meet biodegradable options which are green initiatives. The North American Petri dish market is built to take off on the heels of its technological advancements and sustainability during its future growth periods.

Active Key Players in the Petri Dish Market:

- Thermo Fisher Scientific (USA)

- Corning Incorporated (USA)

- BD (Becton, Dickinson and Company) (USA)

- VWR International (USA)

- Sartorius AG (Germany)

- Merck Group (Germany)

- Bio-Rad Laboratories (USA)

- Greiner Bio-One International GmbH (Germany)

- Eppendorf AG (Germany)

- Falcon (Becton, Dickinson and Company) (USA)

- Miltenyi Biotec (Germany)

- Nunc (Thermo Fisher Scientific) (USA)

- Other Active Players

Key Industry Developments in the Petri Dish Market:

-

In May 2023, Avantor, Inc., collaborated with Labguru, a research-to-production platform for leading global pharma, national research institutes, and others, aiming to provide high-quality products at the lab bench.

|

Global Petri Dish Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 408.2 Million |

|

Forecast Period 2024-32 CAGR: |

4.5% |

Market Size in 2032: |

USD 606.62 Million |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Size |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Petri Dish Market by Material

4.1 Petri Dish Market Snapshot and Growth Engine

4.2 Petri Dish Market Overview

4.3 Polypropylene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Polypropylene: Geographic Segmentation Analysis

4.4 Polystyrene

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Polystyrene: Geographic Segmentation Analysis

4.5 Glass

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Glass: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Petri Dish Market by Type

5.1 Petri Dish Market Snapshot and Growth Engine

5.2 Petri Dish Market Overview

5.3 Standard Petri Dishes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Standard Petri Dishes: Geographic Segmentation Analysis

5.4 Dual Chamber Petri Dishes

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Dual Chamber Petri Dishes: Geographic Segmentation Analysis

5.5 Biodegradable Petri Dishes

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Biodegradable Petri Dishes: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Petri Dish Market by Size

6.1 Petri Dish Market Snapshot and Growth Engine

6.2 Petri Dish Market Overview

6.3 Small (up to 60 mm)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Small (up to 60 mm): Geographic Segmentation Analysis

6.4 Medium (60 mm - 100 mm)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Medium (60 mm - 100 mm): Geographic Segmentation Analysis

6.5 Large (above 100 mm)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Large (above 100 mm): Geographic Segmentation Analysis

Chapter 7: Petri Dish Market by Application

7.1 Petri Dish Market Snapshot and Growth Engine

7.2 Petri Dish Market Overview

7.3 Microbiology

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Microbiology: Geographic Segmentation Analysis

7.4 Cell Culture

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Cell Culture: Geographic Segmentation Analysis

7.5 Environmental Testing

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Environmental Testing: Geographic Segmentation Analysis

7.6 Food and Beverage Testing

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Food and Beverage Testing: Geographic Segmentation Analysis

7.7 Pharmaceutical Applications

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Pharmaceutical Applications: Geographic Segmentation Analysis

7.8 Others

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Others: Geographic Segmentation Analysis

Chapter 8: Petri Dish Market by End User

8.1 Petri Dish Market Snapshot and Growth Engine

8.2 Petri Dish Market Overview

8.3 Academic and Research Institutes

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Academic and Research Institutes: Geographic Segmentation Analysis

8.4 Pharmaceutical and Biotechnology Companies

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Pharmaceutical and Biotechnology Companies: Geographic Segmentation Analysis

8.5 Clinical Laboratories

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Clinical Laboratories: Geographic Segmentation Analysis

8.6 Hospitals

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Hospitals: Geographic Segmentation Analysis

8.7 Others

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Petri Dish Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 THERMO FISHER SCIENTIFIC (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 CORNING INCORPORATED (USA)

9.4 BD (BECTON

9.5 DICKINSON AND COMPANY) (USA)

9.6 VWR INTERNATIONAL (USA)

9.7 SARTORIUS AG (GERMANY)

9.8 MERCK GROUP (GERMANY)

9.9 BIO-RAD LABORATORIES (USA)

9.10 GREINER BIO-ONE INTERNATIONAL GMBH (GERMANY)

9.11 EPPENDORF AG (GERMANY)

9.12 FALCON (BECTON

9.13 DICKINSON AND COMPANY) (USA)

9.14 MILTENYI BIOTEC (GERMANY)

9.15 NUNC (THERMO FISHER SCIENTIFIC) (USA)

9.16 OTHER ACTIVE PLAYERS

Chapter 10: Global Petri Dish Market By Region

10.1 Overview

10.2. North America Petri Dish Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Material

10.2.4.1 Polypropylene

10.2.4.2 Polystyrene

10.2.4.3 Glass

10.2.4.4 Others

10.2.5 Historic and Forecasted Market Size By Type

10.2.5.1 Standard Petri Dishes

10.2.5.2 Dual Chamber Petri Dishes

10.2.5.3 Biodegradable Petri Dishes

10.2.5.4 Others

10.2.6 Historic and Forecasted Market Size By Size

10.2.6.1 Small (up to 60 mm)

10.2.6.2 Medium (60 mm - 100 mm)

10.2.6.3 Large (above 100 mm)

10.2.7 Historic and Forecasted Market Size By Application

10.2.7.1 Microbiology

10.2.7.2 Cell Culture

10.2.7.3 Environmental Testing

10.2.7.4 Food and Beverage Testing

10.2.7.5 Pharmaceutical Applications

10.2.7.6 Others

10.2.8 Historic and Forecasted Market Size By End User

10.2.8.1 Academic and Research Institutes

10.2.8.2 Pharmaceutical and Biotechnology Companies

10.2.8.3 Clinical Laboratories

10.2.8.4 Hospitals

10.2.8.5 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Petri Dish Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Material

10.3.4.1 Polypropylene

10.3.4.2 Polystyrene

10.3.4.3 Glass

10.3.4.4 Others

10.3.5 Historic and Forecasted Market Size By Type

10.3.5.1 Standard Petri Dishes

10.3.5.2 Dual Chamber Petri Dishes

10.3.5.3 Biodegradable Petri Dishes

10.3.5.4 Others

10.3.6 Historic and Forecasted Market Size By Size

10.3.6.1 Small (up to 60 mm)

10.3.6.2 Medium (60 mm - 100 mm)

10.3.6.3 Large (above 100 mm)

10.3.7 Historic and Forecasted Market Size By Application

10.3.7.1 Microbiology

10.3.7.2 Cell Culture

10.3.7.3 Environmental Testing

10.3.7.4 Food and Beverage Testing

10.3.7.5 Pharmaceutical Applications

10.3.7.6 Others

10.3.8 Historic and Forecasted Market Size By End User

10.3.8.1 Academic and Research Institutes

10.3.8.2 Pharmaceutical and Biotechnology Companies

10.3.8.3 Clinical Laboratories

10.3.8.4 Hospitals

10.3.8.5 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Petri Dish Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Material

10.4.4.1 Polypropylene

10.4.4.2 Polystyrene

10.4.4.3 Glass

10.4.4.4 Others

10.4.5 Historic and Forecasted Market Size By Type

10.4.5.1 Standard Petri Dishes

10.4.5.2 Dual Chamber Petri Dishes

10.4.5.3 Biodegradable Petri Dishes

10.4.5.4 Others

10.4.6 Historic and Forecasted Market Size By Size

10.4.6.1 Small (up to 60 mm)

10.4.6.2 Medium (60 mm - 100 mm)

10.4.6.3 Large (above 100 mm)

10.4.7 Historic and Forecasted Market Size By Application

10.4.7.1 Microbiology

10.4.7.2 Cell Culture

10.4.7.3 Environmental Testing

10.4.7.4 Food and Beverage Testing

10.4.7.5 Pharmaceutical Applications

10.4.7.6 Others

10.4.8 Historic and Forecasted Market Size By End User

10.4.8.1 Academic and Research Institutes

10.4.8.2 Pharmaceutical and Biotechnology Companies

10.4.8.3 Clinical Laboratories

10.4.8.4 Hospitals

10.4.8.5 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Petri Dish Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Material

10.5.4.1 Polypropylene

10.5.4.2 Polystyrene

10.5.4.3 Glass

10.5.4.4 Others

10.5.5 Historic and Forecasted Market Size By Type

10.5.5.1 Standard Petri Dishes

10.5.5.2 Dual Chamber Petri Dishes

10.5.5.3 Biodegradable Petri Dishes

10.5.5.4 Others

10.5.6 Historic and Forecasted Market Size By Size

10.5.6.1 Small (up to 60 mm)

10.5.6.2 Medium (60 mm - 100 mm)

10.5.6.3 Large (above 100 mm)

10.5.7 Historic and Forecasted Market Size By Application

10.5.7.1 Microbiology

10.5.7.2 Cell Culture

10.5.7.3 Environmental Testing

10.5.7.4 Food and Beverage Testing

10.5.7.5 Pharmaceutical Applications

10.5.7.6 Others

10.5.8 Historic and Forecasted Market Size By End User

10.5.8.1 Academic and Research Institutes

10.5.8.2 Pharmaceutical and Biotechnology Companies

10.5.8.3 Clinical Laboratories

10.5.8.4 Hospitals

10.5.8.5 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Petri Dish Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Material

10.6.4.1 Polypropylene

10.6.4.2 Polystyrene

10.6.4.3 Glass

10.6.4.4 Others

10.6.5 Historic and Forecasted Market Size By Type

10.6.5.1 Standard Petri Dishes

10.6.5.2 Dual Chamber Petri Dishes

10.6.5.3 Biodegradable Petri Dishes

10.6.5.4 Others

10.6.6 Historic and Forecasted Market Size By Size

10.6.6.1 Small (up to 60 mm)

10.6.6.2 Medium (60 mm - 100 mm)

10.6.6.3 Large (above 100 mm)

10.6.7 Historic and Forecasted Market Size By Application

10.6.7.1 Microbiology

10.6.7.2 Cell Culture

10.6.7.3 Environmental Testing

10.6.7.4 Food and Beverage Testing

10.6.7.5 Pharmaceutical Applications

10.6.7.6 Others

10.6.8 Historic and Forecasted Market Size By End User

10.6.8.1 Academic and Research Institutes

10.6.8.2 Pharmaceutical and Biotechnology Companies

10.6.8.3 Clinical Laboratories

10.6.8.4 Hospitals

10.6.8.5 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Petri Dish Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Material

10.7.4.1 Polypropylene

10.7.4.2 Polystyrene

10.7.4.3 Glass

10.7.4.4 Others

10.7.5 Historic and Forecasted Market Size By Type

10.7.5.1 Standard Petri Dishes

10.7.5.2 Dual Chamber Petri Dishes

10.7.5.3 Biodegradable Petri Dishes

10.7.5.4 Others

10.7.6 Historic and Forecasted Market Size By Size

10.7.6.1 Small (up to 60 mm)

10.7.6.2 Medium (60 mm - 100 mm)

10.7.6.3 Large (above 100 mm)

10.7.7 Historic and Forecasted Market Size By Application

10.7.7.1 Microbiology

10.7.7.2 Cell Culture

10.7.7.3 Environmental Testing

10.7.7.4 Food and Beverage Testing

10.7.7.5 Pharmaceutical Applications

10.7.7.6 Others

10.7.8 Historic and Forecasted Market Size By End User

10.7.8.1 Academic and Research Institutes

10.7.8.2 Pharmaceutical and Biotechnology Companies

10.7.8.3 Clinical Laboratories

10.7.8.4 Hospitals

10.7.8.5 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Petri Dish Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 408.2 Million |

|

Forecast Period 2024-32 CAGR: |

4.5% |

Market Size in 2032: |

USD 606.62 Million |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Size |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||