Patient Warming System Market Synopsis:

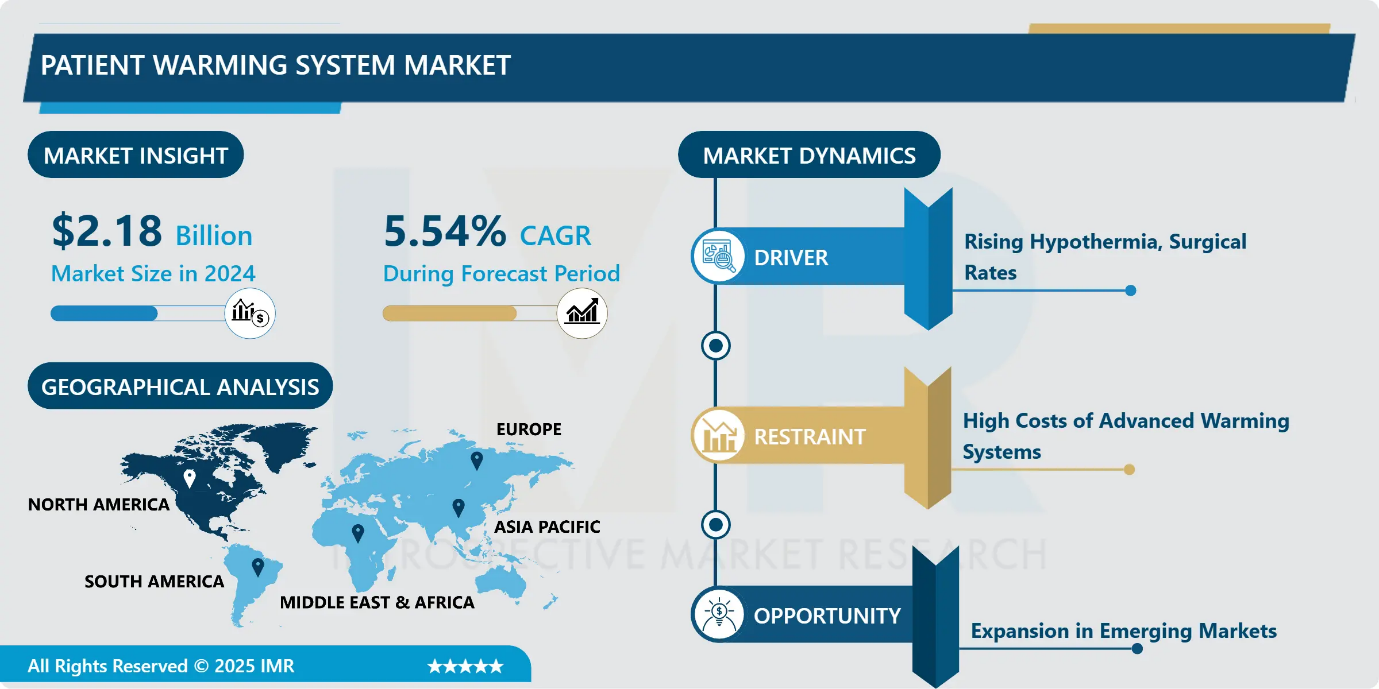

Patient Warming System Market Size Was Valued at USD 2.18 Billion in 2024, and is Projected to Reach USD 3.36 Billion by 2032, Growing at a CAGR of 5.54% from 2025-2032.

A patient warming system is defined as a medical device or an integrated system that is intended to maintain or elevate a patient's core body temperature while undergoing surgical procedures, medical treatments, or during their recovery from a procedure or medical treatment, with a particular emphasis on the prevention and treatment of hypothermia.

Patient warming systems are essential in surgical settings, the intensive care unit (ICU), and emergency care facilities, as patients are susceptible to heat loss from anaesthesia and exposure or injury. Patient warming systems utilize a variety of methods to warm a patient, including forced-air circulating blankets/wraps, heating pads or mattresses that provide conductive heating, devices that provide radiant heating, and warming devices that warm fluids delivered via infusion or transfusion, such as IV fluids and blood products, before delivery. Patient warming systems help stabilize body temperature, which helps decrease complication risks like infections at the surgical site, which improves overall patient comfort, and helps support better recovery outcomes.

The increasing number of surgical procedures being performed across the globe, increased understanding of the risks of perioperative hypothermia, and increasing investment in the development of innovative high-quality healthcare infrastructure fuel the growth of the global patient warming systems. The aging population and Technological innovations, such as energy-efficient, portable, and more accurate temperature-controlled systems, promote patient warming systems in hospitals and ambulatory surgical centres. Patient warming systems are routinely used in operating rooms to maintain normothermia during surgery and in post-anaesthesia care units (PACUs) to assist patients with recovery, and intensive care units (ICUs) to support the care of critically ill patients. Additionally, patient warming systems are essential to a successful recovery in emergencies. Patient warming systems also help stabilize body temperatures in patients suffering from severe blood loss.

Patient Warming System Market Growth and Trend Analysis:

Patient Warming System Market Growth Driver- Rising Hypothermia, Surgical Rates

-

The patient warming system market is growing rapidly, driven by the increased incidence of perioperative hypothermia and increased volumes of surgical procedures in countries around the globe. According to the WHO, there are over 234 million major surgeries that occur each year, the majority of which require thermal management to minimize complications for the patients. Hypothermia is common during surgery due to the effects of anaesthesia and the cool environment of the surgical room. Complications from hypothermia range from increased rates of infection to an extended hospital stay, as well as an increase in healthcare costs.

- Healthcare facilities are focusing on patient warming technologies to maintain normothermia. The market is moving forward due to advancements in forced-air warming, conductive heating, and fluid warming devices. Hospitals and ambulatory surgical centers are introducing new patient warming systems into the operating room and post-anaesthesia care units. This is supported as clinical awareness grows along with regulatory guidance on peri-operative temperature management, showing that patient warming systems will be the focus in promoting better surgical outcomes and improving patient safety.

Patient Warming System Market Limiting Factor- High Costs of Advanced Warming Systems

-

The patient warming system market is primarily driven by the acquisition and life-cycle costs associated with high technologies. The forced-air and conductive warming systems captured above are sophisticated devices that represent a significant cost when purchased and often entail ongoing expenditures from maintenance costs. Therefore, purchasing these systems can impose a financial burden on healthcare providers.

- This challenge is particularly salient in cost-sensitive markets where operational budgets guide purchasing decisions, highlighting public hospitals and small and mid-sized healthcare facilities in developing regions. Their reluctance to acquire these systems is directly tied to their limited financial resources. While patient warming systems have strong evidence in reducing perioperative hypothermia and improving patient outcomes, the latter-mentioned financial burden continues to overshadow any perceived benefits. Therefore, patient warming system use remains limited, requiring significant political and establishment shifts to promote the widespread use of these systems.

Patient Warming System Market Expansion Opportunity- Expansion in Emerging Markets

-

The global patient warming systems market is experiencing strong growth, particularly in emerging economies. Rising healthcare expenditures, improvement in surgical infrastructure, and increasing awareness of perioperative care are driving the demand. For instance, in 2023, a large hospital in India shifted from rudimentary warming methods to advanced warming systems that meet international requirements.

- This transition produced substantial changes in their surgical care, demonstrating the clinical value of current patient warming technologies. Emerging markets (India, Brazil, and Southeast Asia) are investing heavily in hospital modernization, which creates opportunities for global manufacturers. Also, the trend towards the growth of surgical volumes from aging populations and greater access to healthcare continues to promote the need for effective thermal management, too. While governments and investors continue to focus on quality care and infection control, patient warming systems are becoming a market imperative, and manufacturers will benefit from the growth of developing regions.

Patient Warming System Market Challenge Barrier- Product Recall and Safety Concern

-

The patient warming sector is experiencing turbulence related to recalls and safety issues, especially for forced-air warming systems, which can be a contaminant that causes surgical site infections. For instance, 3M's Bair Hugger system has been involved in thousands of lawsuits alleging it caused infections during surgeries. These product safety concerns not only continue to delay the launch of products that are deemed to be contaminated but also impact hospital purchasing decisions and build distrust from health care providers.

- All of these issues are supporting regulatory authorities, such as the FDA, to increase scrutiny on whether the products are safe (and not creating an additional risk to patients), only delaying the approvals. The product recalls are costly, but these issues also inhibit innovation in this market as manufacturers now have compliance burdens, not daring to innovate. The continuing call for companies to provide safer products in this climate will cost more and add time to ramping up product sales through revenue and to build confidence in their future R&D and beyond.

Patient Warming System Market Segment Analysis:

The Patient Warming System Market is segmented based on Type, Application, End-Users, and Region

By Type, the Forced-Air Warming Systems Segment is Expected to Dominate the Market During the Forecast Period

-

Forced-Air Warming Systems dominated the global patient warming system market in 2024. They have the largest market share due to their effectiveness and high adoption rate in clinical settings. Forced-air warming or active warming works by circulating warm air through a special blanket that is used on either side of a patient (above or below the patient).

- The warm air is circulated in a way that allows for proper heat distribution, making it extremely dependable. Hospitals and surgical centers prefer forced-air warming systems due to their ease of use, demonstrated safety, and consistency with patients of various demographics and types of surgical operation protocols. The clinical effectiveness of forced-air warming systems, operational simplicity, and strong trust by institutions continue to prefer patient warming system technology, globally.

By Application, the Perioperative Segment Held the Largest Share in 2024

-

The Perioperative Segment holds the largest segment in the global patient warming system market in 2024, as it relates to surgical procedures. Normothermia, or maintaining normothermia during surgical procedures, is essential to avoid adverse events, including but not limited to surgical site infections, excessive blood loss, and lengthy hospitalization. For this reason, warming technology has recently received more attention in the perioperative phase by healthcare providers.

- The increase in surgical procedures throughout the world, based on a growing aging population, chronic diseases, and technological advancement in minimally invasive surgical techniques, is the foundation of the continued future growth of warming systems. Hospitals and ambulatory surgical centers are continuing to invest significantly in perioperative warming solutions to meet clinical safety standards and better patient care outcomes. There continues to be a practical clinical care need, combined with the ongoing development of the warming technologies themselves. Thus, the perioperative care segment continued to be the strongest area of opportunity for the total market in 2024.

Patient Warming System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America dominated the patient warming market in 2024. North America retains its position as the foremost region in the global market for patient warming systems due to its advanced healthcare facilities and infrastructure, and high acceptance of advanced medical technology. Both the United States and Canada have established a culture of using modern patient care solutions, such as a warming system that will be used during surgery to reduce the incidence of hypothermia.

- There is a continued growth in the number of surgical procedures, especially in large hospitals and ambulatory care surgery centers, and demand has increased. Increased education and awareness campaigns on perioperative hypothermia and its consequences have encouraged healthcare providers to emphasize temperature regulation. The presence of world-class manufacturers in North America makes the region incredibly accessible and innovative in offering new products. The U.S. is the most significant end-user consumer in North America due to its investment in healthcare, focus on improving patient outcomes, and openness to technologically advanced medical devices, especially concerns over hypothermia-related injuries. All of these factors solidify North America's position as the de facto leader in the global patient sandwich systems market in 2024.

Patient Warming System Market Active Players:

-

3M (US)

- Bair Hugger (US)

- Becton Dickinson (US)

- Belmont Medical Technologies (Canada)

- BHV (France)

- Ecolab (US)

- EMIT Corporation (US)

- Gentherm (US)

- Huntleigh Healthcare (UK)

- LivaNova PLC (UK)

- Medtronic (US)

- Mennen Medical (Israel)

- Paragon Medical Supply, Inc. (US)

- Smiths Medical (US)

- Solventum (Canada)

- Stryker (US)

- The Surgical Company (Netherlands)

- Thermogenesis (US)

- Zodiac Aerospace (France)

- ZOLL Medical Corporation (US)

- Other Active Players

Key Industry Developments in the Patient Warming System Market:

-

In October 2024, Belmont Medical Technologies secured a significant agreement with Premier Inc. for patient warming and blood/fluid management systems, enhancing its presence in the U.S. healthcare market. This development underscored Belmont's growing role in the patient warming system sector, addressing critical needs in surgical and emergency care.

- In February 2024, Medtronic decided to retain its Patient Monitoring and Respiratory Interventions businesses and chose to combine these two businesses into the Acute Care & Monitoring unit. This shift added to its presence in the patient warming system space by consolidating critical care capabilities and sharpening acute care solutions and resources.

|

Global Patient Warming System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.54 % |

Market Size in 2032: |

USD 3.36 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Patient Warming System Market Market by Product Type (2018-2032)

4.1 Patient Warming System Market Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Forced-Air Warming Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fluid Warming System

4.5 Hybrid Warming System

4.6 Surface Warming Systems and Others

Chapter 5: Patient Warming System Market Market by Application (2018-2032)

5.1 Patient Warming System Market Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Acute Care

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 New Born Care

5.5 Perioperative Care and Others

Chapter 6: Patient Warming System Market Market by End-User (2018-2032)

6.1 Patient Warming System Market Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 and Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Patient Warming System Market Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 3M (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 BAIR HUGGER (US)

7.4 BECTON DICKINSON (US)

7.5 BELMONT MEDICAL TECHNOLOGIES (CANADA)

7.6 BHV (FRANCE)

7.7 ECOLAB (US)

7.8 EMIT CORPORATION (US)

7.9 GENTHERM (US)

7.10 HUNTLEIGH HEALTHCARE (UK)

7.11 LIVANOVA PLC (UK)

7.12 MEDTRONIC (US)

7.13 MENNEN MEDICAL (ISRAEL)

7.14 PARAGON MEDICAL SUPPLY

7.15 INC. (US)

7.16 SMITHS MEDICAL (US)

7.17 SOLVENTUM (CANADA)

7.18 STRYKER (US)

7.19 THE SURGICAL COMPANY (NETHERLANDS)

7.20 THERMOGENESIS (US)

7.21 ZODIAC AEROSPACE (FRANCE)

7.22 ZOLL MEDICAL CORPORATION (US)

7.23 AND OTHER ACTIVE PLAYERS

Chapter 8: Global Patient Warming System Market Market By Region

8.1 Overview

8.2. North America Patient Warming System Market Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Patient Warming System Market Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Patient Warming System Market Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Patient Warming System Market Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Patient Warming System Market Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Patient Warming System Market Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Global Patient Warming System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.54 % |

Market Size in 2032: |

USD 3.36 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||