Pain Patch Market Synopsis:

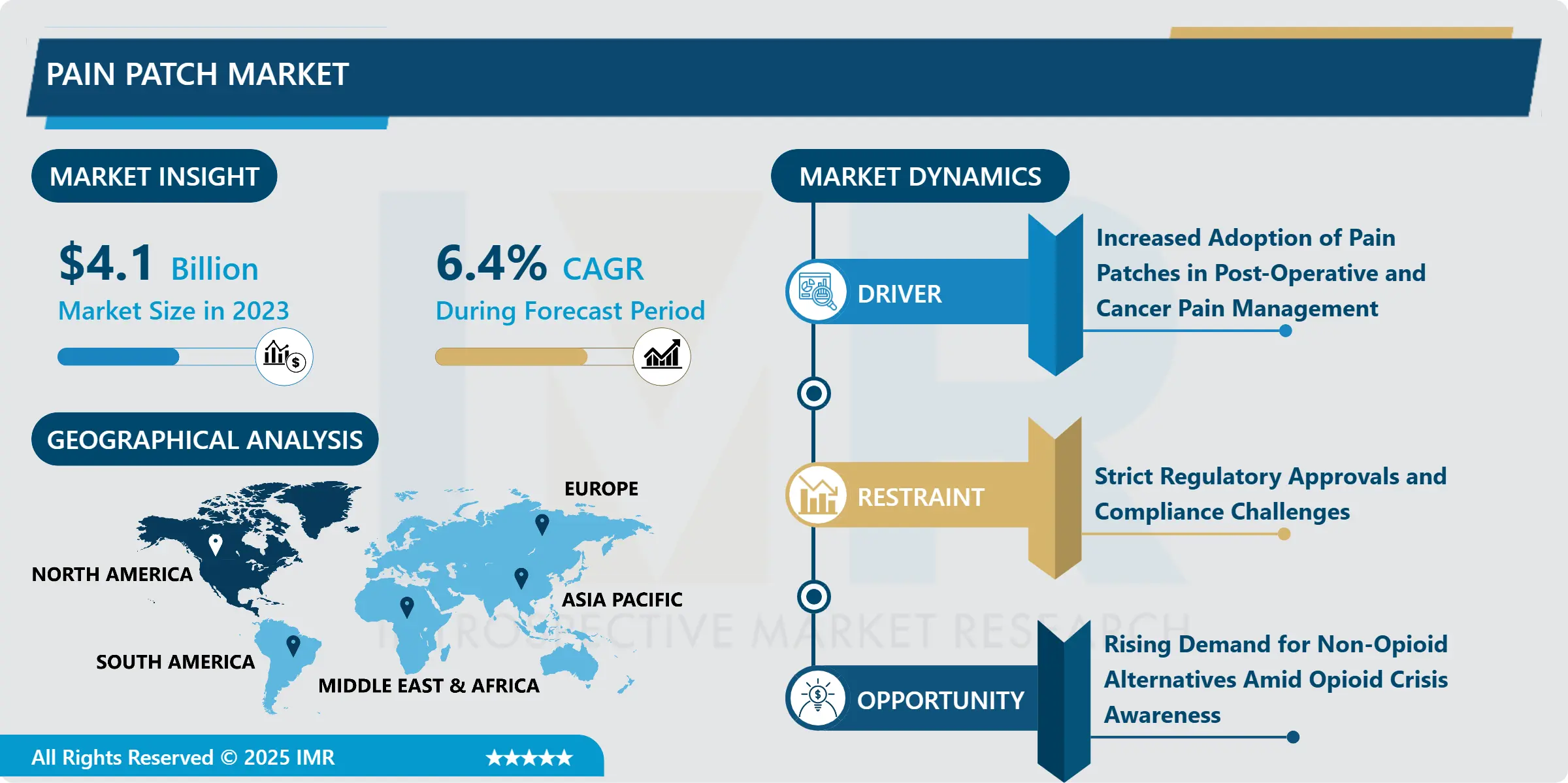

Pain Patch Market Size Was Valued at USD 4.1 Billion in 2023, and is Projected to Reach USD 7.16 Billion by 2032, Growing at a CAGR of 6.40% From 2024-2032.

The Pain Patch Market holds the transdermal patches for the administration of acute or chronic pain-relieving analgesic, anti-inflammatory, or anesthetic drugs through the skin. Patches represent an efficient substitute to oral preparations and other types of interventions for relieving pain, such as musculoskeletal, neuropathic, and cancer pain. It deals with varied type of pain patches such as Lidocaine pain patches, Diclofenac pain patches and Fentanyl pain patches, which are available depending on the level of pain, length of pain and method of application.

The demand for pain patches is mainly attributed by increase in elderly people across the globe with complicated health complications and also by growing prevalence of chronic pain. older people often experience chronic diseases like arthritis, back pain, and neuropathic diseases for which efficient and easily accessible pain relief is paramount. Pain patches have advantages as they have a long acting formulation and are thus less invasive and patients can apply them easily. In addition, the patches minimize side impacts of traditional oral pain medicines such as stomach complications, which increases the use of the patches in pain control.

One more important factor is the rising use of P patches for postoperative pain and cancer pain control. This is because many healthcare providers see transdermal patches as a technique that is less invasive than other techniques of administering medicine that causes a burst of active medicine in the body that has often caused bothersome side effects; patches are also considered to deliver medication consistently over time, making post-operative or cancer patients comfortable with patch use. As healthcare organizations work at enhancing the health of their patients and reducing the cases of hospital re-admission, pain patches are perceived as an effective means for managing pain at home, thus impacting on the market growth.

Pain Patch Market Trend Analysis:

Technological advancements

-

Technological advancements have been identified as a key trend in the Pain Patch Market. Advances made in drug delivery systems have resulted in better permeable patches that increase the number of pain-relieving agents that enters the body and accuracy in the amount to be delivered. This has led to high usage of drug-in-adhesive and matrix patches; these patch styles give out even drug distribution throughout the skin layer. They are also testing various approaches of multi-layer and reservoir to address the need of multiple-dose regimens applied in treatment of patients who need consistent pain control for a long period.

- The other trend defining the market is the use of natural and herbal products concerning pain patches. As consumers’ awareness of the side effects of conventional medicines increases, patch producers are incorporating natural components such as menthol, capsaicin and essential oils into patches because these have some pain-relieving properties. This trend complies with consumption of wellness-based products and targets the patient who look for non-pharmacological methods of treatment of mild to moderate pain hence extending the market niche of pain patches.

Growth in Non-Opioid Pain Management Solutions

-

An appealing opportunity that defines growth in the Pain Patch Market is the opportunity offered by the emerging markets. Asia-Pacific, especially developing countries in this region, Latin America and some parts of the Middle East are expected to record higher demand for pain management related products due to improving healthcare systems and rising per capita income. The potential customer base is relatively unexplored in these markets and providers of pain patch are strategically establishing distribution channels and creating product awareness for topicals as an effective strategy for pain management among the population.

- Since the issue of opioid dependency and its implications are being attracted increasingly throughout the world today, the option of non-opioid analgesic options such as the patches are a significant opportunity. Authorities in charge of regulating textile corporations and healthcare institutions are favoring the adoption of less dangerous substitutes to opioids thereby spiking demand for transdermal patches. For non-opioid related therapies, which have been the major thrust of healthcare policies in recent years, the pain patch market has vast potential for growth, especially those with non-narcotic ingredients such as diclofenac and lidocaine.

Pain Patch Market Segment Analysis:

Pain Patch Market Segmented on the basis of Product type, Technology, application and Region.

By Product Type, Lidocaine Patches segment is expected to dominate the market during the forecast period

-

The Pain Patch Market can be bifurcated by type of product available in the market which is specially formulated for certain types of pain relief. Lidocaine patches are primarily used for the management of localised pain with observed efficiency in neuropathic pain since the patches give an anaesthetic effect for several hours. A topical diclofenac patch can be used to alleviate joint and muscular pain – arthritis and soft tissue injuries; it is NSAID – nonsteroidal anti-inflammatory. Methyl salicylate patches apply heat with which to soothe muscle and joint pain, and ketoprofen patches, which have prolonged anti-inflammatory actions for acute musculoskeletal pain. Capsaicin patches are gotten from chili peppers and used in management of neuropathic and other chronic pain by reducing nerve sensitivity over time. Fentanyl patches are strong medications used only for serious and persistent pain, including that which is cancer related, and the medication releases opioids in a controlled manner. Finally, there are other pain patches available to the market with either different formulations or combinations, to cater for different levels of pain as well as needs.

By Application, Musculoskeletal Pain segment expected to held the largest share

-

The Pain Patch Market can be divided by its applicability to meet different pain management requirements. Musculoskeletal pain patches are commonly employed for arthritis, back aches, and soft tissue injuries; they apply topical analgesia to help people herein control everyday pain. Neuropathic pain patches are specially designed to minimize neuropathic further peripheral nerve pain, including peripheral neuropathy or post herpetic neuralgia. Pain patches help with recovery since patients don’t require taking pills which may be oral and thus helpful in cases wherein the patient is in pain after a surgery. Cancer pain patches, usually attached to medium or highly potent opioids, are used to manage moderate to severe breakthrough pain in oncology patients, to maintain a high level of patient comfort where other interventions may be ineffective. Other patches as well is designed for general pain relieving, appropriate for numerous mld to moderate pain conditions, allowing choice flexibility in the treatment.

Pain Patch Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America has the largest market share of pain patch due to the increasing incidence of chronic pain ailments and an advanced health care facility. Conditions like arthritis, lower back pain and post-surgery pain are prevalent in countries like USA continuing the demand for efficient and easy to administer pain relieving solutions. Further to this, leading industry players’ base, combined with the awareness level of pain patch products among the consumer, has placed North America in the lead.

- Also, the increasing numbers of regulatory activities and proper healthcare policies in the United States and Canada also support the market growth. Because of the emphasis on decreasing the prescription use of opioids and the boosting of alternatives, pain patches have thus found themselves to be safe and efficient as a solution to pain solutions. Hence, there is high expenditure towards the healthcare sector, and a forward-looking approach towards non-invasive treatments; and thus, the pain patch market in North America remains the most dominating at the global front.

Active Key Players in the Pain Patch Market:

-

Acorda Therapeutics, Inc. (USA)

- Endo International plc (Ireland)

- GlaxoSmithKline plc (UK)

- Hisamitsu Pharmaceutical Co., Inc. (Japan)

- Johnson & Johnson (USA)

- Mylan N.V. (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Sanofi S.A. (France)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Other Active Players

|

Global Pain Patch Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.10 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40 % |

Market Size in 2032: |

USD 7.16 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pain Patch Market by Product Type

4.1 Pain Patch Market Snapshot and Growth Engine

4.2 Pain Patch Market Overview

4.3 Lidocaine Patches

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Lidocaine Patches: Geographic Segmentation Analysis

4.4 Diclofenac Patches

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Diclofenac Patches: Geographic Segmentation Analysis

4.5 Methyl Salicylate Patches

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Methyl Salicylate Patches: Geographic Segmentation Analysis

4.6 Ketoprofen Patches

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Ketoprofen Patches: Geographic Segmentation Analysis

4.7 Capsaicin Patches

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Capsaicin Patches: Geographic Segmentation Analysis

4.8 Fentanyl Patches

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Fentanyl Patches: Geographic Segmentation Analysis

4.9 Others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Others: Geographic Segmentation Analysis

Chapter 5: Pain Patch Market by Technology

5.1 Pain Patch Market Snapshot and Growth Engine

5.2 Pain Patch Market Overview

5.3 Matrix

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Matrix: Geographic Segmentation Analysis

5.4 Drug-in-Adhesive

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Drug-in-Adhesive: Geographic Segmentation Analysis

5.5 Reservoir

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Reservoir: Geographic Segmentation Analysis

5.6 Vapor Patch

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Vapor Patch: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Pain Patch Market by Application

6.1 Pain Patch Market Snapshot and Growth Engine

6.2 Pain Patch Market Overview

6.3 Musculoskeletal Pain

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Musculoskeletal Pain: Geographic Segmentation Analysis

6.4 Neuropathic Pain

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Neuropathic Pain: Geographic Segmentation Analysis

6.5 Post-Surgical Pain

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Post-Surgical Pain: Geographic Segmentation Analysis

6.6 Cancer Pain

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Cancer Pain: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pain Patch Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACORDA THERAPEUTICS INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ENDO INTERNATIONAL PLC (IRELAND)

7.4 GLAXOSMITHKLINE PLC (UK)

7.5 HISAMITSU PHARMACEUTICAL CO. INC. (JAPAN)

7.6 JOHNSON & JOHNSON (USA)

7.7 MYLAN N.V. (USA)

7.8 NOVARTIS AG (SWITZERLAND)

7.9 PFIZER INC. (USA)

7.10 SANOFI S.A. (FRANCE)

7.11 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Pain Patch Market By Region

8.1 Overview

8.2. North America Pain Patch Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Lidocaine Patches

8.2.4.2 Diclofenac Patches

8.2.4.3 Methyl Salicylate Patches

8.2.4.4 Ketoprofen Patches

8.2.4.5 Capsaicin Patches

8.2.4.6 Fentanyl Patches

8.2.4.7 Others

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 Matrix

8.2.5.2 Drug-in-Adhesive

8.2.5.3 Reservoir

8.2.5.4 Vapor Patch

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Musculoskeletal Pain

8.2.6.2 Neuropathic Pain

8.2.6.3 Post-Surgical Pain

8.2.6.4 Cancer Pain

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pain Patch Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Lidocaine Patches

8.3.4.2 Diclofenac Patches

8.3.4.3 Methyl Salicylate Patches

8.3.4.4 Ketoprofen Patches

8.3.4.5 Capsaicin Patches

8.3.4.6 Fentanyl Patches

8.3.4.7 Others

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 Matrix

8.3.5.2 Drug-in-Adhesive

8.3.5.3 Reservoir

8.3.5.4 Vapor Patch

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Musculoskeletal Pain

8.3.6.2 Neuropathic Pain

8.3.6.3 Post-Surgical Pain

8.3.6.4 Cancer Pain

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pain Patch Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Lidocaine Patches

8.4.4.2 Diclofenac Patches

8.4.4.3 Methyl Salicylate Patches

8.4.4.4 Ketoprofen Patches

8.4.4.5 Capsaicin Patches

8.4.4.6 Fentanyl Patches

8.4.4.7 Others

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 Matrix

8.4.5.2 Drug-in-Adhesive

8.4.5.3 Reservoir

8.4.5.4 Vapor Patch

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Musculoskeletal Pain

8.4.6.2 Neuropathic Pain

8.4.6.3 Post-Surgical Pain

8.4.6.4 Cancer Pain

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pain Patch Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Lidocaine Patches

8.5.4.2 Diclofenac Patches

8.5.4.3 Methyl Salicylate Patches

8.5.4.4 Ketoprofen Patches

8.5.4.5 Capsaicin Patches

8.5.4.6 Fentanyl Patches

8.5.4.7 Others

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 Matrix

8.5.5.2 Drug-in-Adhesive

8.5.5.3 Reservoir

8.5.5.4 Vapor Patch

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Musculoskeletal Pain

8.5.6.2 Neuropathic Pain

8.5.6.3 Post-Surgical Pain

8.5.6.4 Cancer Pain

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pain Patch Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Lidocaine Patches

8.6.4.2 Diclofenac Patches

8.6.4.3 Methyl Salicylate Patches

8.6.4.4 Ketoprofen Patches

8.6.4.5 Capsaicin Patches

8.6.4.6 Fentanyl Patches

8.6.4.7 Others

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 Matrix

8.6.5.2 Drug-in-Adhesive

8.6.5.3 Reservoir

8.6.5.4 Vapor Patch

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Musculoskeletal Pain

8.6.6.2 Neuropathic Pain

8.6.6.3 Post-Surgical Pain

8.6.6.4 Cancer Pain

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pain Patch Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Lidocaine Patches

8.7.4.2 Diclofenac Patches

8.7.4.3 Methyl Salicylate Patches

8.7.4.4 Ketoprofen Patches

8.7.4.5 Capsaicin Patches

8.7.4.6 Fentanyl Patches

8.7.4.7 Others

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 Matrix

8.7.5.2 Drug-in-Adhesive

8.7.5.3 Reservoir

8.7.5.4 Vapor Patch

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Musculoskeletal Pain

8.7.6.2 Neuropathic Pain

8.7.6.3 Post-Surgical Pain

8.7.6.4 Cancer Pain

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pain Patch Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.10 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40 % |

Market Size in 2032: |

USD 7.16 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||