Pain Management Devices Market Synopsis:

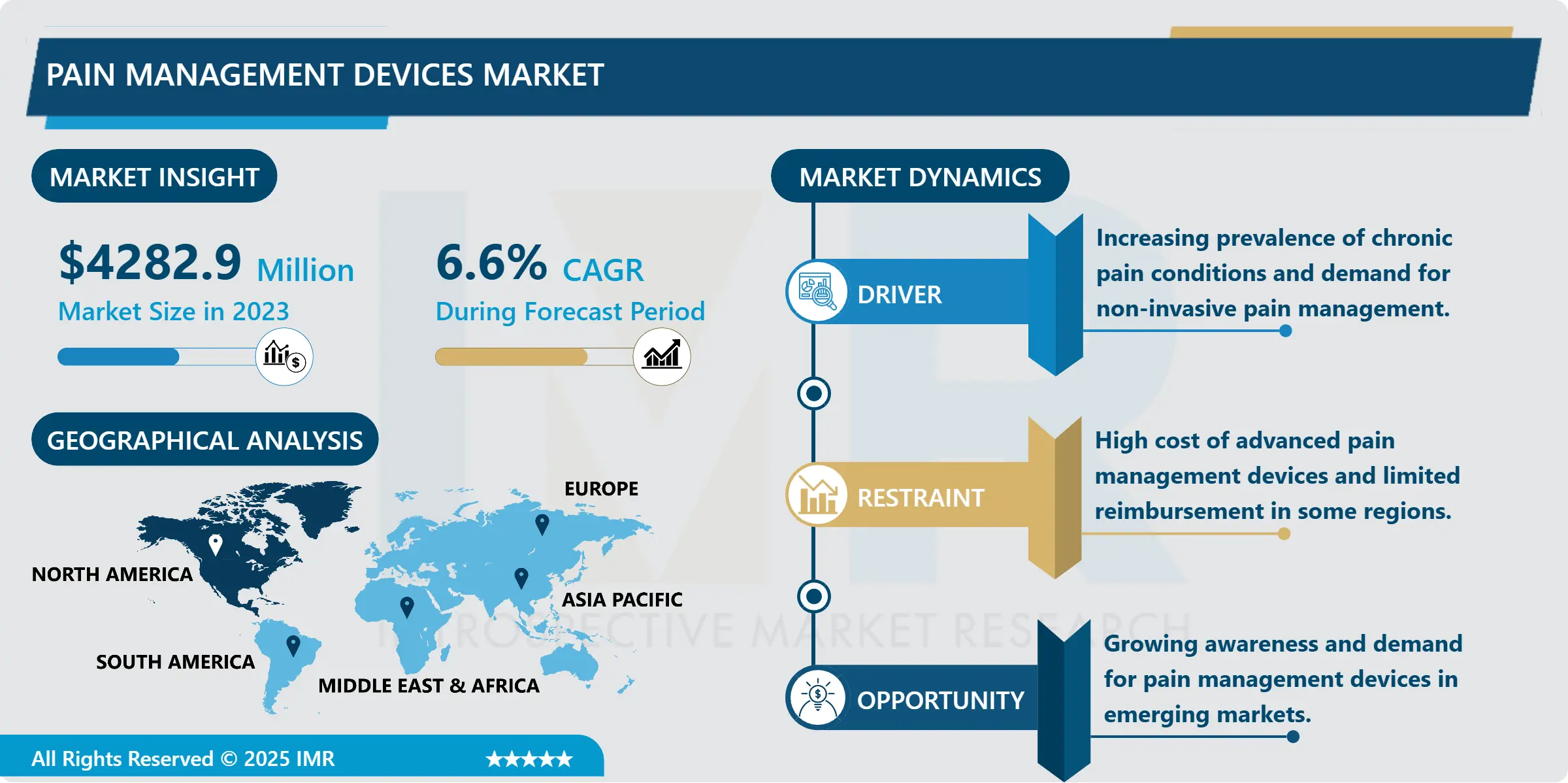

Pain Management Devices Market Size Was Valued at USD4.282.9 Million in 2023, and is Projected to Reach USD 7,612.95 Million by 2032, Growing at a CAGR of 6.6 % From 2024-2032.

The pain management devices market includes devices that are intended to target chronic and acute pain without the use of opioids or other drugs. They function through several mechanisms some of them are neurostimulation, infusion pump and ablation that is the treatment of the nerves or areas of the problem. Superset Pain management devices are employed for neoplastic and neuropathic pain, cancer associated pain, arthritis pain, musculoskeletal pain and postoperative pain. The need for these devices is rising with rise in the demand for invasive; -durable and effective ways of dealing with pain.

This has caused a relatively small period for the growth of the pain management devices market mainly due to elongated pain conditions in the global market the increasing awareness of the other forms of relief apart from pills. Sex hormone associated pain, neurological pain, breast cancer and bone joint pain have come out to be on high demand in chronic pain linked to different diseases. Patients and diverse care givers are therefore looking for device-based management of pain in a bid to do away with opioids and therefore do away with side effects that are severally associated with opioids. Increased elderly citizens were also anticipated to boost the number of people with Chronic Pain thus the need to these devices. In addition, the new pain relief gadgets available in the market are enhanced as they are easier to operate, efficient and are being installed in various healthcare centers.

Market growth is further supported with enhancements in the market’s healthcare facilities and also with better reimbursement in some areas too. Pain control is becoming popular and driving more market growth due to the more frequent innovations in portable, wearable, and minimally invasive equipment. Such treatment devices have become popular as the government has grieved on the opioid problem while craving for non-drug treatment of pain. Thus, the market of pain management devices also has a good outlook in the following years as more players make endeavours to promote production of new products in relation to painless treatment.

Pain Management Devices Market Trend Analysis:

Increasing Adoption of Non-Invasive Pain Management Solutions

- Another key advantages of pain management devices market are changing toward non-surgical methods. Patients and care givers choose non-invasive devices since they possess minimal risk impacts a shortened healing process moreover; they are not related to the side effects of surgeries or medications. Transcranial magnetic stimulation together with exterior wearable devices are more prevalent; the patients can have a safer and less intrusive procedure to control the pain at their home or clinic. This aspect is expected to continue in the future because of advancement in technology that makes manufacturers develop machines that enhance speedy recovery with minimal side effects so more persons are likely to seek the services.

Expanding Market in Emerging Regions

- Currently there are new emerging regions that present a large market opportunity in the pain management devices market. As health care likeliness improves and rises, and awareness rises in Asia-Pacific, Latin America and Middle East, patients are demanding better consume management. This need is supported by such factors as increase in demand for approved pharmaceutical products resulting from investments made by government regarding health care structures as well as increase in number of chronic pain diseases. Furthermore, these areas because disposable income levels rise so individuals have the capability to purchase device-based pain treatment rises as well. This is an opportunity that can be capitalised by firms that can enter channels of distribution and alliance with healthcare sector in such areas.

Pain Management Devices Market Segment Analysis:

Pain Management Devices Market Segmented on the basis of type, application, end user and region.

By Type, Neuromodulation & Neurostimulation segment is expected to dominate the market during the forecast period

- Neuromodulation & Neurostimulation is set to emerge as the biggest segment in the pain management devices market up to the forecast year. These neuro-electrical/neuromodulation/neurostimulation devices work because they block pain signals that nerves send to the brain. These benefits are useful in conditions and diseases that cause chronic or persistent pain, including neuropathic pain, spinal pain and fibromyalgia. To expand the understanding of the segment, it is crucial to know the reasons for the increased interest; it has a high probability of success, may provide permanent relief and enables users to avoid painkiller intake. Moreover, the advancement in technology has led to implantable/ wearable Neurostimulation sharpened enough to make them available in many patients who require them in different health organizations.

By Application, the Neuropathic Pain segment expected to held the largest share

- Neuropathic Pain segment forms the largest market share in pain management devices market. Musculoskeletal pain which results from nerve injury due to diseases such as diabetes, shingles, or multiple sclerosis is relatively widespread among patients and therefore, may require individual attention. Neurostimulation devices applied in the treatment of patients with pain are beneficial primarily in the neuropathic pain and mean long-term pain alleviation for the patients, who take no medicine. High frequency of diseases related to neuropathy pain entails the development of new devices capable of delivering long term drug-free analgesic care, boosting this segment’s growth.

Pain Management Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American pain management devices market should also remain the leader in the analgesic market throughout the forecast period because of the tendencies in the healthcare industry, the rising number of patients with chronic pain, and technological advancements in pain control. Namely, the USA remains a potential market for those devices due to the high number of arthritis, cancer, or neuropathy patients. In addition, the opiate crisis in North America has only shifted a brighter emphasis on the search for suitable non-opioid pain relief for chronic pain more than ever before because not only the federal and state governments and the health care systems but also the patients themselves are looking for non-addictive ways to manage their pain.

- Heavier presence of major market players, better research & development facilities, and government approval for device-based interventions for managing pain stabilizes the market position in this region. North America also has fairly friendly and favorable regulations as well as reimbursement policies that allow patients to gain access to pain management devices. Frequent implementation of advanced technologies and increased demand for the instruments used in nonopioid pain management would keep North America ahead in the global pain management devices market.

Active Key Players in the Pain Management Devices Market:

- Abbott Laboratories (United States)

- B. Braun Melsungen AG (Germany)

- Baxter International Inc. (United States)

- Boston Scientific Corporation (United States)

- DJO Global, Inc. (United States)

- Halyard Health, Inc. (United States)

- Medtronic plc (Ireland)

- Nevro Corp. (United States)

- Omron Healthcare Inc. (Japan)

- Pfizer, Inc. (United States)

- SPR Therapeutics (United States)

- Stryker Corporation (United States)

- Teleflex Incorporated (United States)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Zynex Medical Inc. (United States)

- Other Active Players

|

Global Pain Management Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4,282.9 Million |

|

Forecast Period 2024-32 CAGR: |

6.6 % |

Market Size in 2032: |

USD 7,612.95 Million |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pain Management Devices Market by Type

4.1 Pain Management Devices Market Snapshot and Growth Engine

4.2 Pain Management Devices Market Overview

4.3 Neuromodulation & Neurostimulation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Neuromodulation & Neurostimulation: Geographic Segmentation Analysis

4.4 Devices Analgesic Infusion Pumps Ablation Devices

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Devices Analgesic Infusion Pumps Ablation Devices: Geographic Segmentation Analysis

Chapter 5: Pain Management Devices Market by Application

5.1 Pain Management Devices Market Snapshot and Growth Engine

5.2 Pain Management Devices Market Overview

5.3 Neuropathic Pain

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Neuropathic Pain: Geographic Segmentation Analysis

5.4 Cancer Pain

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cancer Pain: Geographic Segmentation Analysis

5.5 Facial & Migraine Pain Musculoskeletal Pain

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Facial & Migraine Pain Musculoskeletal Pain : Geographic Segmentation Analysis

5.6 Other

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other: Geographic Segmentation Analysis

Chapter 6: Pain Management Devices Market by End User

6.1 Pain Management Devices Market Snapshot and Growth Engine

6.2 Pain Management Devices Market Overview

6.3 Hospitals Clinics Others

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals Clinics Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pain Management Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 B. BRAUN MELSUNGEN AG (GERMANY)

7.4 BAXTER INTERNATIONAL INC. (UNITED STATES)

7.5 BOSTON SCIENTIFIC CORPORATION (UNITED STATES)

7.6 DJO GLOBAL INC. (UNITED STATES)

7.7 HALYARD HEALTH INC. (UNITED STATES)

7.8 MEDTRONIC PLC (IRELAND)

7.9 NEVRO CORP. (UNITED STATES)

7.10 OMRON HEALTHCARE INC. (JAPAN)

7.11 PFIZER INC. (UNITED STATES)

7.12 SPR THERAPEUTICS (UNITED STATES)

7.13 STRYKER CORPORATION (UNITED STATES)

7.14 TELEFLEX INCORPORATED (UNITED STATES)

7.15 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.16 ZYNEX MEDICAL INC. (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Pain Management Devices Market By Region

8.1 Overview

8.2. North America Pain Management Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Neuromodulation & Neurostimulation

8.2.4.2 Devices Analgesic Infusion Pumps Ablation Devices

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Neuropathic Pain

8.2.5.2 Cancer Pain

8.2.5.3 Facial & Migraine Pain Musculoskeletal Pain

8.2.5.4 Other

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals Clinics Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pain Management Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Neuromodulation & Neurostimulation

8.3.4.2 Devices Analgesic Infusion Pumps Ablation Devices

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Neuropathic Pain

8.3.5.2 Cancer Pain

8.3.5.3 Facial & Migraine Pain Musculoskeletal Pain

8.3.5.4 Other

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals Clinics Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pain Management Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Neuromodulation & Neurostimulation

8.4.4.2 Devices Analgesic Infusion Pumps Ablation Devices

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Neuropathic Pain

8.4.5.2 Cancer Pain

8.4.5.3 Facial & Migraine Pain Musculoskeletal Pain

8.4.5.4 Other

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals Clinics Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pain Management Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Neuromodulation & Neurostimulation

8.5.4.2 Devices Analgesic Infusion Pumps Ablation Devices

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Neuropathic Pain

8.5.5.2 Cancer Pain

8.5.5.3 Facial & Migraine Pain Musculoskeletal Pain

8.5.5.4 Other

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals Clinics Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pain Management Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Neuromodulation & Neurostimulation

8.6.4.2 Devices Analgesic Infusion Pumps Ablation Devices

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Neuropathic Pain

8.6.5.2 Cancer Pain

8.6.5.3 Facial & Migraine Pain Musculoskeletal Pain

8.6.5.4 Other

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals Clinics Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pain Management Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Neuromodulation & Neurostimulation

8.7.4.2 Devices Analgesic Infusion Pumps Ablation Devices

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Neuropathic Pain

8.7.5.2 Cancer Pain

8.7.5.3 Facial & Migraine Pain Musculoskeletal Pain

8.7.5.4 Other

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals Clinics Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pain Management Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4,282.9 Million |

|

Forecast Period 2024-32 CAGR: |

6.6 % |

Market Size in 2032: |

USD 7,612.95 Million |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||