Over the Counter Pain Medication Market Synopsis:

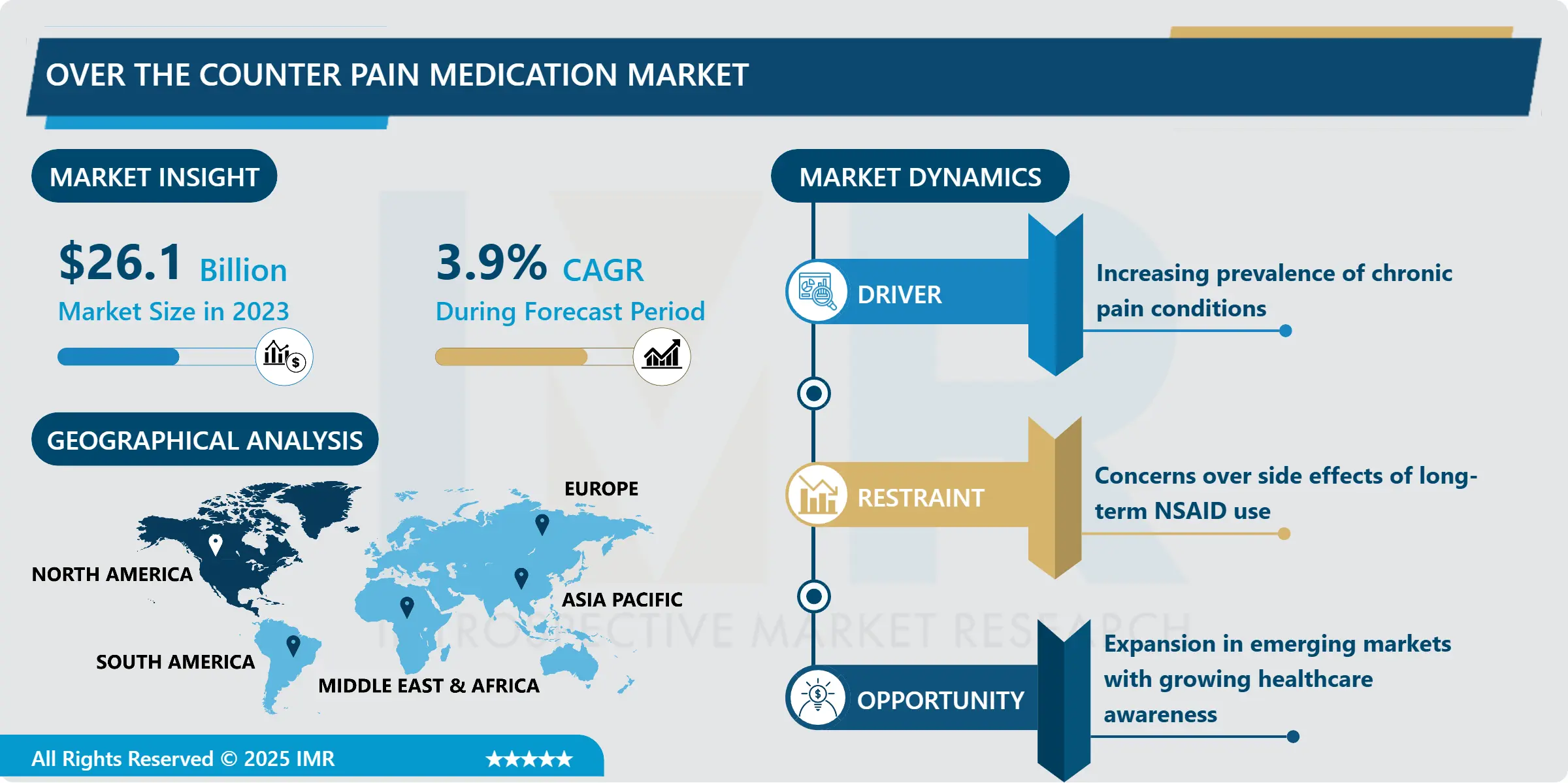

Over the Counter Pain Medication Market Size Was Valued at USD 26.10 Billion in 2023, and is Projected to Reach USD 36.83 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.

The Global Over-the-Counter (OTC) Pain Medication Market includes non-prescription drugs used to relieve pain, such as headaches, muscle aches, arthritis, and minor injuries. These medications are easily accessible in pharmacies, supermarkets, and online stores without requiring a doctor’s prescription, making them a convenient option for self-care.

The market has witnessed steady growth due to increasing consumer preference for self-medication and the rising incidence of common pain-related conditions. Urbanization, sedentary lifestyles, and the growing aging population globally have contributed to higher demand for quick and effective pain relief options. Consumers are increasingly leaning toward OTC solutions to avoid the cost and time of medical consultations.

Innovation in formulations, including fast-acting gels, liquid capsules, and natural ingredient-based pain relievers, is also fueling market expansion. Additionally, e-commerce platforms are playing a significant role in improving product availability and accessibility, particularly in emerging markets.

Despite strong growth, the industry faces challenges such as risks of drug misuse, stringent regulatory frameworks, and rising competition from alternative therapies. However, with increasing health awareness and expanding retail presence, the OTC pain medication market is expected to remain resilient and grow steadily over the next few years.

Over the Counter Pain Medication Market Trend Analysis:

Rising Geriatric Population and Chronic Pain Incidence

- The global increase in the aging population is a significant driver for the OTC pain medication market. According to the WHO, the population aged 60 years and above is expected to double by 2050, reaching over 2 billion. With aging comes a higher prevalence of chronic conditions such as arthritis, osteoporosis, and general musculoskeletal pain, which require consistent pain management. OTC pain medications, particularly NSAIDs and topical analgesics, offer an accessible and affordable means for elderly individuals to manage recurring discomfort without the need for frequent medical consultations.

- Moreover, many older adults prefer OTC medications due to their familiarity, ease of use, and the ability to avoid long waiting times in healthcare systems, especially in developing regions. The convenience of self-medication aligns with the needs of this demographic group, many of whom are managing multiple health issues simultaneously. As healthcare systems worldwide promote responsible self-care to reduce burdens on clinics and hospitals, the demand for OTC pain relief options is poised to grow significantly in line with the aging global population.

Growing Demand for Natural and Herbal Pain Relief Products

- A growing trend in the OTC pain medication market is the increasing consumer shift toward natural and herbal alternatives. This shift is largely driven by rising health consciousness, concerns about side effects from prolonged use of synthetic drugs, and the popularity of holistic wellness. Natural ingredients such as menthol, capsaicin, eucalyptus oil, turmeric, and arnica are being used in various topical and oral OTC formulations. These products are perceived as safer and more sustainable, especially among millennials and Gen Z consumers who value clean-label and plant-based options.

- In response, manufacturers are actively investing in research and development to expand their herbal pain relief product lines, positioning them as both effective and gentle alternatives. The marketing of such products often highlights attributes like non-addictiveness, fewer side effects, and alignment with natural lifestyles. This trend is also supported by regulatory shifts in favor of traditional medicine in countries like India and China. As natural OTC pain relievers gain popularity, they are gradually carving out a distinct and fast-growing niche within the broader pain management landscape.

Over the Counter Pain Medication Market Segment Analysis:

Over the Counter Pain Medication Market Segmented on the basis of Product Type, Formulation, Application, Distribution Channel, Route of Administration, and Region.

By Product Type, NSAIDs segment is expected to dominate the market during the forecast period

- Among the product types, Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) dominate the global OTC pain medication market. NSAIDs, including ibuprofen, naproxen, and aspirin, are widely recognized for their dual-action properties — offering both pain relief and anti-inflammatory benefits. This makes them highly effective for treating a broad spectrum of conditions such as headaches, menstrual cramps, muscle aches, arthritis, and minor injuries. Their versatility, rapid onset of action, and long-standing consumer trust have cemented their place as the most preferred OTC pain relief solution worldwide.

- The dominance of NSAIDs is further supported by their extensive availability across retail pharmacies, supermarkets, and e-commerce platforms. These medications are often included in household first-aid kits and are frequently recommended by pharmacists for temporary pain management. Additionally, the strong brand equity of leading NSAID products, such as Advil (ibuprofen) and Aleve (naproxen), contributes to consistent consumer demand. Regulatory bodies in most countries allow easy access to low-dose NSAIDs without prescriptions, which also reinforces their widespread use. Overall, the combination of clinical effectiveness, affordability, and market familiarity has enabled NSAIDs to maintain a leading position within the OTC pain medication market.

By Application, the Headache & Migraine segment expected to hold the largest share

- Within the application segments, Headache & Migraine dominate the global OTC pain medication market. Headaches, including tension headaches and migraines, are among the most common ailments globally, affecting millions of people across all age groups. The high frequency and unpredictability of headache episodes drive consumers to keep OTC medications on hand for quick relief. Products such as acetaminophen and NSAIDs are widely used for this purpose due to their rapid efficacy and accessibility without the need for a prescription. The chronic nature of migraines in some individuals further contributes to recurring purchases, fueling this segment’s continued dominance.

- The growing prevalence of lifestyle-related triggers—such as screen exposure, poor posture, stress, and irregular sleep—has led to a significant rise in headache and migraine complaints, especially among working professionals and students. The widespread marketing and brand familiarity of headache relief medications also make this segment more consumer-friendly. Many OTC brands offer specific headache relief variants, further reinforcing this application’s leading role in the market. Combined with the low cost, ease of access, and increasing consumer awareness about self-medication, the Headache & Migraine segment remains the most robust application area in the OTC pain medication landscape.

Over the Counter Pain Medication Market Regional Insights:

North America Leads the Global OTC Pain Medication Market

- North America, particularly the United States, dominates the global OTC pain medication market. This leadership is driven by several factors, including high healthcare awareness, widespread self-medication practices, and easy access to OTC products through well-established retail and pharmacy chains. Consumers in the U.S. and Canada are highly accustomed to using OTC drugs for immediate relief of common ailments like headaches, joint pain, and muscle soreness. Furthermore, the region has a strong presence of leading pharmaceutical companies such as Johnson & Johnson, Pfizer, and Bayer, which actively market and distribute OTC pain relief brands like Tylenol, Advil, and Aleve.

- The region benefits from favorable regulatory frameworks that allow the sale of a wide range of OTC pain medications without prescriptions, encouraging consumer autonomy in managing mild to moderate pain. E-commerce growth, coupled with robust insurance coverage for some OTC products through Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs), further strengthens market penetration. The aging population, increasing cases of chronic pain, and active lifestyle trends also contribute to sustained demand. As a result, North America continues to lead both in terms of revenue and innovation within the OTC pain medication market.

Active Key Players in the Over-the-Counter Pain Medication Market:

- Abbott Laboratories (USA)

- Alembic Pharmaceuticals Ltd. (India)

- Aspen Pharmacare Holdings Limited (South Africa)

- Aurobindo Pharma Limited (India)

- Bayer AG (Germany)

- Boehringer Ingelheim GmbH (Germany)

- Bristol-Myers Squibb Company (USA)

- Cipla Limited (India)

- Dr. Reddy's Laboratories Ltd. (India)

- Endo International plc (Ireland)

- GlaxoSmithKline plc (UK)

- Glenmark Pharmaceuticals Ltd. (India)

- Johnson & Johnson (USA)

- Lupin Limited (India)

- Mallinckrodt Pharmaceuticals (USA)

- Mylan N.V. (USA)

- Novartis AG (Switzerland)

- Perrigo Company plc (Ireland)

- Pfizer Inc. (USA)

- Reckitt Benckiser Group plc (UK)

- Sanofi S.A. (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel), and Other Active Players.

|

Global Over The Counter Pain Medication Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.10 Billion |

|

Forecast Period 2024-32 CAGR: |

3.9% |

Market Size in 2032: |

USD 36.83 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Route of Administration |

|

||

|

By Formulation |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Over The Counter Pain Medication Market by Drug Class

4.1 Over The Counter Pain Medication Market Snapshot and Growth Engine

4.2 Over The Counter Pain Medication Market Overview

4.3 Non-steroidal Anti-inflammatory Drug (NSAIDSs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Non-steroidal Anti-inflammatory Drug (NSAIDSs): Geographic Segmentation Analysis

4.4 Local Anaesthetics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Local Anaesthetics: Geographic Segmentation Analysis

4.5 Salicylates

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Salicylates: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Over The Counter Pain Medication Market by Route of Administration

5.1 Over The Counter Pain Medication Market Snapshot and Growth Engine

5.2 Over The Counter Pain Medication Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oral: Geographic Segmentation Analysis

5.4 Topical

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Topical: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Over The Counter Pain Medication Market by Distribution Channel

6.1 Over The Counter Pain Medication Market Snapshot and Growth Engine

6.2 Over The Counter Pain Medication Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacies: Geographic Segmentation Analysis

6.5 Online Pharmacies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Over The Counter Pain Medication Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BAYER AG (GERMANY)

7.4 BOEHRINGER INGELHEIM (GERMANY)

7.5 GLAXOSMITHKLINE (UK)

7.6 JOHNSON & JOHNSON (USA)

7.7 MYLAN N.V. (USA)

7.8 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

7.9 PFIZER INC. (USA)

7.10 PROCTER & GAMBLE CO. (USA)

7.11 RECKITT BENCKISER GROUP PLC (UK)

7.12 SANOFI S.A. (FRANCE)

7.13 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

7.14 TAISHO PHARMACEUTICAL CO. LTD. (JAPAN)

7.15 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

7.16 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.17

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Over The Counter Pain Medication Market By Region

8.1 Overview

8.2. North America Over The Counter Pain Medication Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Class

8.2.4.1 Non-steroidal Anti-inflammatory Drug (NSAIDSs)

8.2.4.2 Local Anaesthetics

8.2.4.3 Salicylates

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size By Route of Administration

8.2.5.1 Oral

8.2.5.2 Topical

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Hospital Pharmacies

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Over The Counter Pain Medication Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Class

8.3.4.1 Non-steroidal Anti-inflammatory Drug (NSAIDSs)

8.3.4.2 Local Anaesthetics

8.3.4.3 Salicylates

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size By Route of Administration

8.3.5.1 Oral

8.3.5.2 Topical

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Hospital Pharmacies

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Over The Counter Pain Medication Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Class

8.4.4.1 Non-steroidal Anti-inflammatory Drug (NSAIDSs)

8.4.4.2 Local Anaesthetics

8.4.4.3 Salicylates

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size By Route of Administration

8.4.5.1 Oral

8.4.5.2 Topical

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Hospital Pharmacies

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Over The Counter Pain Medication Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Class

8.5.4.1 Non-steroidal Anti-inflammatory Drug (NSAIDSs)

8.5.4.2 Local Anaesthetics

8.5.4.3 Salicylates

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size By Route of Administration

8.5.5.1 Oral

8.5.5.2 Topical

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Hospital Pharmacies

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Over The Counter Pain Medication Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Class

8.6.4.1 Non-steroidal Anti-inflammatory Drug (NSAIDSs)

8.6.4.2 Local Anaesthetics

8.6.4.3 Salicylates

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size By Route of Administration

8.6.5.1 Oral

8.6.5.2 Topical

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Hospital Pharmacies

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Over The Counter Pain Medication Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Class

8.7.4.1 Non-steroidal Anti-inflammatory Drug (NSAIDSs)

8.7.4.2 Local Anaesthetics

8.7.4.3 Salicylates

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size By Route of Administration

8.7.5.1 Oral

8.7.5.2 Topical

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Hospital Pharmacies

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Over The Counter Pain Medication Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.10 Billion |

|

Forecast Period 2024-32 CAGR: |

3.9% |

Market Size in 2032: |

USD 36.83 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Route of Administration |

|

||

|

By Formulation |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||