Orthopedic Trauma Devices Market Synopsis:

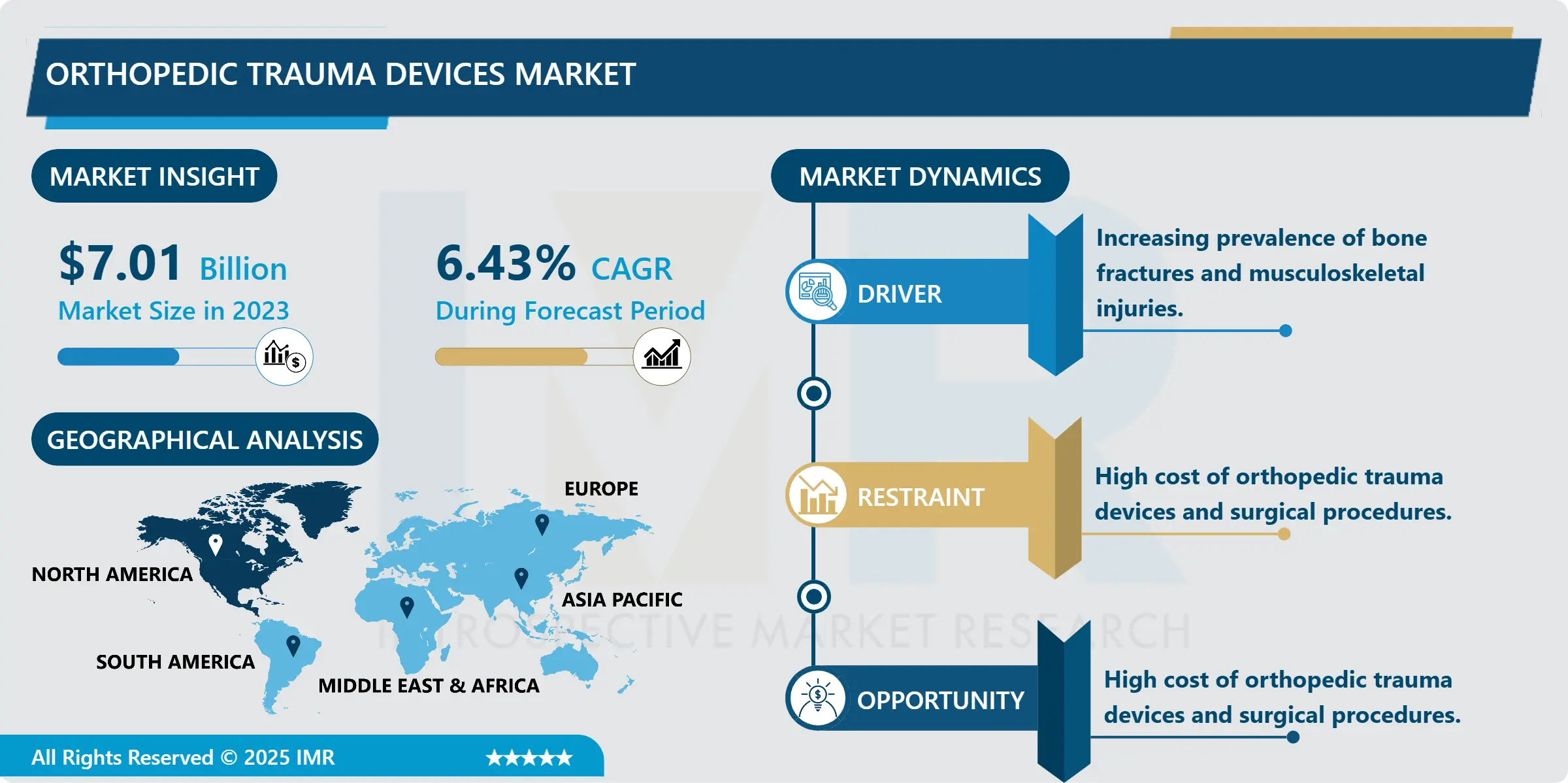

Orthopedic Trauma Devices Market Size Was Valued at USD 7.01 Billion in 2023, and is Projected to Reach USD 12.28 Billion by 2032, Growing at a CAGR of 6.43% From 2024-2032.

The orthopedic trauma devices market refers to the segment of medical devices designed to treat skeletal injuries, particularly fractures and dislocations caused by trauma. These devices help in the realignment, stabilization, and healing of broken bones through surgical procedures. Key product categories include internal fixators (plates, screws, nails), external fixators, pins, wires, and bone grafts. They are crucial in emergency medicine, orthopedic surgeries, and rehabilitation processes, serving both acute trauma cases and degenerative bone conditions.

The global orthopedic trauma devices market has been witnessing robust growth, driven by the rising number of traumatic injuries from road accidents, falls, violence, and sports activities. According to the WHO, road traffic injuries rank among the top 10 causes of death globally, especially in low- and middle-income countries. Coupled with an increasingly active lifestyle and growing sports participation across all age groups, the demand for trauma management solutions has surged. Orthopedic trauma devices have become a medical necessity in emergency departments and trauma care units across hospitals worldwide.

An additional factor propelling market growth is the rising prevalence of osteoporosis and other bone-weakening conditions among the aging population. With improvements in life expectancy, the number of elderly individuals is increasing rapidly, especially in developed nations. Older adults are more vulnerable to fractures, particularly hip and vertebral fractures, which require immediate orthopedic intervention. As a result, there is a significant demand for implants that provide long-term fixation, faster recovery, and fewer complications. Furthermore, regulatory approvals and standardization of device quality across regions ensure better adoption and trust in device safety.

From a technological perspective, the orthopedic trauma devices industry is undergoing a significant transformation. Innovations such as 3D-printed implants, bioabsorbable materials, robotic-assisted surgeries, and AI-powered monitoring systems are reshaping surgical practices. Custom-fitted implants and navigation-assisted fixation are enhancing precision and surgical outcomes. As medical tourism and healthcare infrastructure grow in emerging economies like India, Brazil, and Southeast Asia, the market is expanding beyond developed countries. Additionally, investments from both private and public sectors in trauma care centers are creating new growth avenues for device manufacturers.

Orthopedic Trauma Devices Market Trend Analysis:

Rising Geriatric Population and Osteoporosis Prevalence

-

The most critical drivers of the orthopedic trauma devices market is the growing geriatric population globally. According to the United Nations, the number of people aged 65 and older is projected to double by 2050, reaching over 1.5 billion. With age, bones lose density and become fragile, making elderly individuals more prone to fractures—even from minor incidents like slipping or bumping. Hip fractures, in particular, are a serious concern in this age group, often leading to hospitalization and surgical intervention. This demographic shift ensures a sustained demand for trauma devices in both inpatient and outpatient care settings.

- Furthermore, the burden of osteoporosis often termed the "silent disease" has increased alarmingly. It affects approximately 200 million women worldwide and leads to more than 8.9 million fractures annually. This has heightened the need for preventive and corrective orthopedic solutions. Governments and healthcare organizations are raising awareness and supporting early diagnosis and treatment, driving demand for internal fixators, plates, and bone grafts. As such, trauma device manufacturers are focusing on designing elderly-friendly implants with enhanced biocompatibility and easier surgical application.

Technological Advancements in Smart Orthopedic Devices

-

A major opportunity lies in integrating orthopedic trauma devices with smart technologies, creating intelligent systems that can track bone healing, monitor device integrity, and even send real-time data to surgeons. These smart devices use embedded sensors and wireless connectivity to reduce follow-up visits and allow for remote diagnostics. As healthcare transitions towards value-based care, smart trauma implants can reduce complications, optimize healing time, and improve overall patient outcomes.

- In addition, advancements in 3D printing and robotics allow for custom-made implants and minimally invasive surgeries, revolutionizing the traditional approach to trauma treatment. Robotic-assisted orthopedic procedures enhance precision and reduce recovery time. AI and machine learning are also enabling pre-operative planning, personalized implant selection, and predictive analytics for fracture risk. These innovations are expected to gain traction especially in developed markets, with strong interest from venture capital and med-tech startups entering the orthopedic space.

Orthopedic Trauma Devices Market Segment Analysis:

Orthopedic Trauma Devices Market Segmented based on Type, Application, End User, and Region.

By Product Type, the Internal Fixators segment is expected to dominate the market during the forecast period

-

Internal fixators have become a foundational aspect of modern orthopedic trauma treatment, offering significant advantages over external devices. These devices are used in procedures where bones need to be stabilized from the inside, particularly after fractures in the long bones like the femur, tibia, and humerus. Internal fixators, which include intramedullary nails, plates, and screws, are inserted directly into the bone to provide a stable environment for healing. These devices not only reduce the healing time but also decrease the risk of infection because they are placed internally, minimizing exposure to external elements. Their use in high-energy trauma cases or fractures with complex configurations ensures a higher success rate and improved functional outcomes for patients. Moreover, as surgical techniques evolve, the ability to customize internal fixators for specific patient needs, such as tailored plates and screws for bone structure, is enhancing the precision and effectiveness of treatments.

- The innovation in internal fixation technology continues to fuel its market growth, particularly through the development of lightweight, corrosion-resistant, and bioabsorbable materials. These advancements have increased the appeal of internal fixators among both patients and healthcare providers. Bioabsorbable materials, in particular, are gaining attention because they eliminate the need for a second surgery to remove the hardware once the bone has healed. This not only reduces the risk of post-operative complications but also helps in reducing the overall cost of treatment. Additionally, materials such as titanium and carbon fiber are being increasingly used for their strength-to-weight ratio and biocompatibility, providing patients with better outcomes and faster recovery times. These innovations, combined with growing awareness of their benefits, are driving the continuous growth and demand for internal fixators in the orthopedic trauma devices market.

By Application, Hip Fractures segment expected to held the largest share

-

Hip fractures represent a major orthopedic trauma concern, particularly among the elderly. These fractures are typically caused by low-impact falls or accidents, often in patients with weakened bones due to osteoporosis. The recovery process for hip fractures is often complicated and can result in long-term disability, especially in elderly patients. Surgical intervention is necessary to realign the bones and stabilize them. For this, devices such as cannulated screws, dynamic hip screws, and intramedullary nails are commonly used to provide stability and promote healing. These fixation devices allow the bone to heal properly while maintaining the proper anatomical alignment. Given the severity of hip fractures and their high risk of complications, prompt and effective treatment is crucial to reducing the incidence of long-term mobility issues.

- With the aging global population, the incidence of hip fractures is expected to rise significantly in the coming decades. In fact, hip fractures are among the most common types of fractures in older adults, and their frequency is rising in correlation with the increasing number of elderly people worldwide. This growing demographic trend has driven a heightened focus on advanced orthopedic trauma devices designed specifically for hip fracture treatments. Hospitals, orthopedic centers, and even outpatient surgical centers are increasingly adopting next-generation hip fixation technologies to improve patient outcomes. These newer devices not only provide better fixation and support but are also designed to minimize post-operative complications, such as dislocation or infection. In addition, advanced technologies such as robot-assisted surgery and 3D-printed implants are enhancing the precision and customization of hip surgeries, which further boosts the demand for innovative hip trauma devices. The focus is on improving patient mobility, reducing recovery times, and enhancing the overall quality of life after hip fractures.

Orthopedic Trauma Devices Market Regional Insights:

North America is expected to dominate the Market Over the Forecast period

-

North America is projected to maintain its dominance in the global orthopedic trauma devices market throughout the forecast period. This leadership is underpinned by several factors, including a strong healthcare ecosystem, advanced surgical infrastructure, and a high prevalence of osteoporosis and traumatic injuries. The U.S., in particular, accounts for the largest share of procedures involving orthopedic trauma devices, supported by rising sports injuries and increasing orthopedic surgical volumes.

- Moreover, the region is home to several leading medical device manufacturers who continuously innovate and bring new products to market. Favorable reimbursement policies under Medicare and private insurance schemes also encourage early adoption of high-end trauma devices. Furthermore, robust R&D investments, clinical trials, and early regulatory approvals from the U.S. FDA give North American manufacturers a global advantage. These elements collectively position North America as a lucrative and influential market in the orthopedic trauma segment.

Active Key Players in the Orthopedic Trauma Devices Market:

-

Acumed LLC (USA)

- Arthrex, Inc. (USA)

- B. Braun Melsungen AG (Germany)

- BioTek Instruments (USA)

- CONMED Corporation (USA)

- DePuy Synthes – Johnson & Johnson (USA)

- DJO Global, Inc. (USA)

- Double Medical Technology Inc. (China)

- Globus Medical, Inc. (USA)

- Integra LifeSciences Holdings Corporation (USA)

- Medtronic plc (Ireland)

- NuVasive, Inc. (USA)

- Orthofix Medical Inc. (USA)

- Orthopaedic Implant Company (USA)

- OsteoMed (USA)

- Smith & Nephew plc (UK)

- Stryker Corporation (USA)

- Wright Medical Group N.V. (Netherlands)

- ZAVATION Medical Products (USA)

- Zimmer Biomet Holdings, Inc. (USA), and Other Active Players

|

Global Orthopedic Trauma Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.01 Billion |

|

Forecast Period 2024-32 CAGR: |

6.43% |

Market Size in 2032: |

USD 12.28 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Orthopedic Trauma Devices Market by Product Type

4.1 Orthopedic Trauma Devices Market Snapshot and Growth Engine

4.2 Orthopedic Trauma Devices Market Overview

4.3 Internal Fixators

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Internal Fixators: Geographic Segmentation Analysis

4.4 External Fixators

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 External Fixators: Geographic Segmentation Analysis

4.5 Bone Grafts

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Bone Grafts: Geographic Segmentation Analysis

4.6 Plates and Screws

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Plates and Screws: Geographic Segmentation Analysis

4.7 Pins and Wires

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Pins and Wires: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Orthopedic Trauma Devices Market by Application

5.1 Orthopedic Trauma Devices Market Snapshot and Growth Engine

5.2 Orthopedic Trauma Devices Market Overview

5.3 Hip Fractures

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hip Fractures: Geographic Segmentation Analysis

5.4 Spine Fractures

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Spine Fractures: Geographic Segmentation Analysis

5.5 Knee Fractures

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Knee Fractures: Geographic Segmentation Analysis

5.6 Arm Fractures

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Arm Fractures: Geographic Segmentation Analysis

5.7 Ankle Fractures

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Ankle Fractures: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Orthopedic Trauma Devices Market by End User

6.1 Orthopedic Trauma Devices Market Snapshot and Growth Engine

6.2 Orthopedic Trauma Devices Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

6.5 Orthopedic Clinics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Orthopedic Clinics: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Orthopedic Trauma Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACUMED (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARTHREX INC. (USA)

7.4 B. BRAUN MELSUNGEN AG (GERMANY)

7.5 BIOMET INC. (USA)

7.6 DE PUY SYNTHES (USA)

7.7 EVOLUTION LTD (UK)

7.8 GLOBUS MEDICAL (USA)

7.9 JOHNSON & JOHNSON (USA)

7.10 KARL STORZ GMBH & CO. KG (GERMANY)

7.11 MEDTRONIC PLC (IRELAND)

7.12 ORTHOFIX MEDICAL INC. (USA)

7.13 STRYKER CORPORATION (USA)

7.14 SMITH & NEPHEW PLC (UK)

7.15 ZIMMER BIOMET HOLDINGS INC. (USA)

7.16 WRIGHT MEDICAL GROUP N.V. (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Orthopedic Trauma Devices Market By Region

8.1 Overview

8.2. North America Orthopedic Trauma Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Internal Fixators

8.2.4.2 External Fixators

8.2.4.3 Bone Grafts

8.2.4.4 Plates and Screws

8.2.4.5 Pins and Wires

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Hip Fractures

8.2.5.2 Spine Fractures

8.2.5.3 Knee Fractures

8.2.5.4 Arm Fractures

8.2.5.5 Ankle Fractures

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Orthopedic Clinics

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Orthopedic Trauma Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Internal Fixators

8.3.4.2 External Fixators

8.3.4.3 Bone Grafts

8.3.4.4 Plates and Screws

8.3.4.5 Pins and Wires

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Hip Fractures

8.3.5.2 Spine Fractures

8.3.5.3 Knee Fractures

8.3.5.4 Arm Fractures

8.3.5.5 Ankle Fractures

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Orthopedic Clinics

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Orthopedic Trauma Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Internal Fixators

8.4.4.2 External Fixators

8.4.4.3 Bone Grafts

8.4.4.4 Plates and Screws

8.4.4.5 Pins and Wires

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Hip Fractures

8.4.5.2 Spine Fractures

8.4.5.3 Knee Fractures

8.4.5.4 Arm Fractures

8.4.5.5 Ankle Fractures

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Orthopedic Clinics

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Orthopedic Trauma Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Internal Fixators

8.5.4.2 External Fixators

8.5.4.3 Bone Grafts

8.5.4.4 Plates and Screws

8.5.4.5 Pins and Wires

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Hip Fractures

8.5.5.2 Spine Fractures

8.5.5.3 Knee Fractures

8.5.5.4 Arm Fractures

8.5.5.5 Ankle Fractures

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Orthopedic Clinics

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Orthopedic Trauma Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Internal Fixators

8.6.4.2 External Fixators

8.6.4.3 Bone Grafts

8.6.4.4 Plates and Screws

8.6.4.5 Pins and Wires

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Hip Fractures

8.6.5.2 Spine Fractures

8.6.5.3 Knee Fractures

8.6.5.4 Arm Fractures

8.6.5.5 Ankle Fractures

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Orthopedic Clinics

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Orthopedic Trauma Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Internal Fixators

8.7.4.2 External Fixators

8.7.4.3 Bone Grafts

8.7.4.4 Plates and Screws

8.7.4.5 Pins and Wires

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Hip Fractures

8.7.5.2 Spine Fractures

8.7.5.3 Knee Fractures

8.7.5.4 Arm Fractures

8.7.5.5 Ankle Fractures

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Orthopedic Clinics

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Orthopedic Trauma Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.01 Billion |

|

Forecast Period 2024-32 CAGR: |

6.43% |

Market Size in 2032: |

USD 12.28 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||