Orthodontics Market Synopsis:

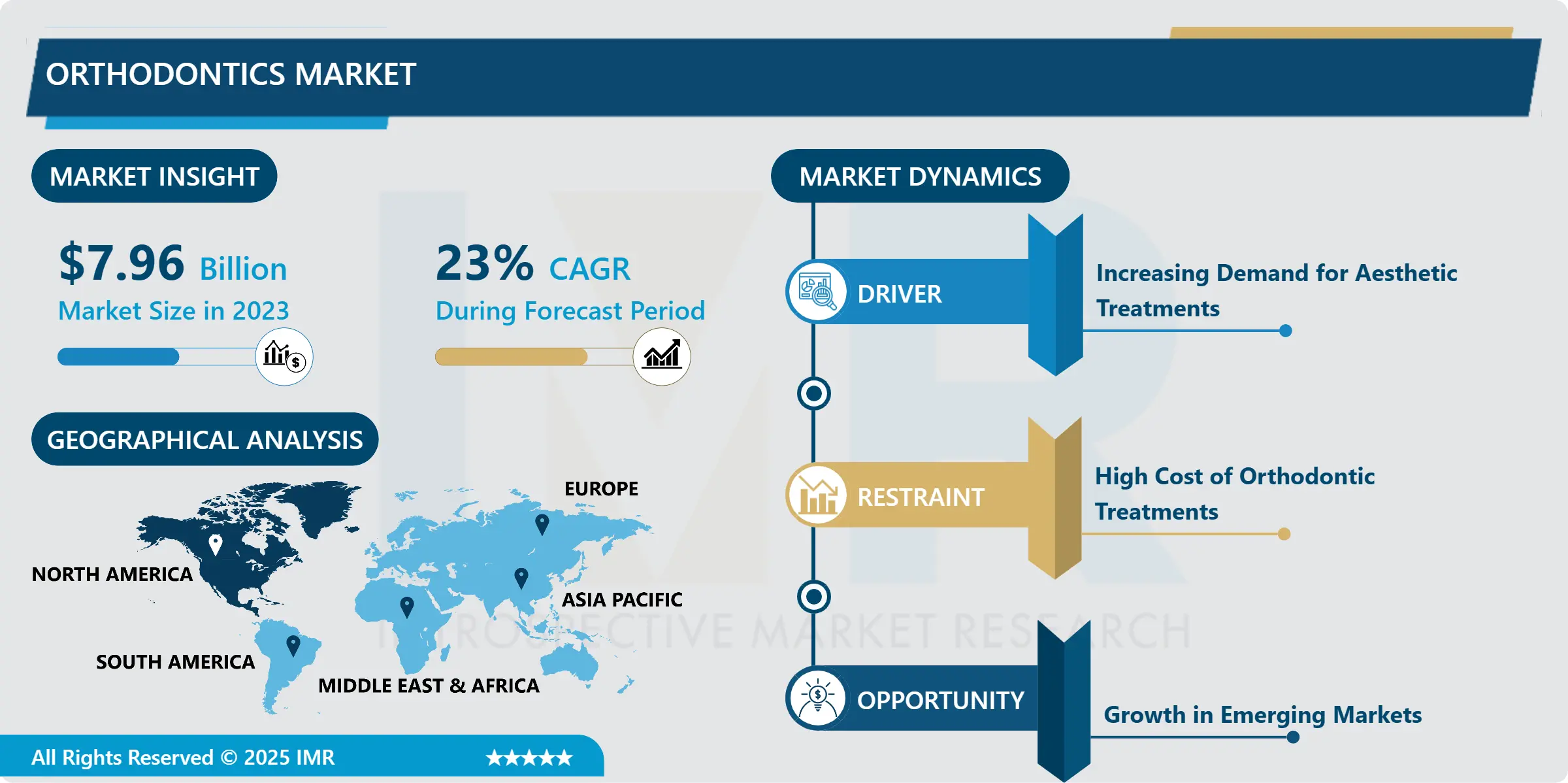

Orthodontics Market Size Was Valued at USD 7.96 Billion in 2023, and is Projected to Reach USD 44.51 Billion by 2032, Growing at a CAGR of 23 % From 2024-2032.

The orthodontics market refers to the segment of the dental industry that focuses on the diagnosis, prevention, and correction of misaligned teeth and jaws. It includes various products and services such as braces, aligners, retainers, and orthodontic instruments. Orthodontics aims to improve the aesthetic appearance and functionality of a patient's smile and bite, with treatments designed to address conditions like overcrowded teeth, underbites, overbites, and other dental irregularities.

The global orthodontics market has experienced significant growth due to increasing awareness about dental aesthetics and the rising demand for cosmetic dental treatments. Factors such as the aging population, an increase in dental issues like malocclusion, and greater emphasis on oral health are driving the market. As more individuals seek orthodontic care to improve both their appearance and dental function, demand for advanced orthodontic products, particularly clear aligners, is surging.

Technological advancements, such as 3D imaging and digital scanning, are transforming the orthodontics market by providing more precise and comfortable treatment options. Clear aligners, in particular, have revolutionized the industry, offering a more discreet alternative to traditional braces, especially among adult patients. This shift in treatment preference has intensified competition among manufacturers, fostering innovation in product offerings.

The market is also witnessing a surge in the adoption of orthodontic care in emerging markets, as disposable incomes rise and access to dental healthcare improves. With expanding insurance coverage and an increasing number of orthodontic professionals, the market is poised for further growth. In addition, the increasing trend toward preventive dentistry and early intervention is likely to expand the orthodontic care market, especially in regions where dental care awareness is growing.

Orthodontics Market Trend Analysis:

Increasing Demand for Aesthetic Treatments

-

A significant driver of the orthodontics market is the growing demand for aesthetic dental treatments, particularly among adults and teenagers. As cosmetic dentistry becomes more popular, individuals are increasingly seeking orthodontic solutions to improve their appearance and boost self-esteem. In particular, the rise of clear aligners, which offer a more discreet treatment option than traditional metal braces, has made orthodontic care more appealing to a broader demographic. This trend is reinforced by social media influencers, celebrities, and public figures openly discussing and showcasing their orthodontic journeys, further promoting the acceptance of orthodontic treatments in daily life.

-

Furthermore, the desire for a beautiful smile and improved facial aesthetics is becoming a key priority for many, leading to higher treatment adoption rates. As individuals become more conscious of how their smiles impact their overall appearance, the demand for orthodontic treatments, especially those that are minimally invasive and less noticeable, is expected to continue growing. This driver is particularly important as more adults, who previously might have avoided braces due to social stigma, are now choosing orthodontic treatments to enhance their self-confidence and social standing.

Growth in Emerging Markets

-

An emerging opportunity in the orthodontics market lies in the rapid growth of dental care in developing economies. Rising disposable incomes, urbanization, and improved access to healthcare are driving an increased demand for dental and orthodontic treatments in countries such as China, India, Brazil, and parts of Africa. As the middle class in these regions expands, more individuals are able to afford orthodontic care, which was previously considered a luxury for a limited segment of the population. In addition, growing awareness of oral health and hygiene, coupled with an influx of international dental professionals, has led to an increased interest in orthodontics.

-

The expansion of insurance coverage in many developing countries is also making orthodontic treatments more accessible. As local healthcare systems improve and dental insurance policies become more prevalent, more individuals are seeking orthodontic care. This presents a significant opportunity for global orthodontics companies to tap into new markets, offer affordable treatment options, and educate consumers on the benefits of orthodontics. By tailoring products and services to the specific needs of these regions, businesses can capitalize on the untapped potential of emerging markets and establish themselves as key players in the global orthodontics industry.

Orthodontics Market Segment Analysis:

Orthodontics Market Segmented based on Type, Age Group, End User, and Region.

By Type. the Fixed Instruments and Supplies segment is expected to dominate the market during the forecast period

-

Among the various types of orthodontic products, fixed instruments and supplies, particularly brackets, bands, buccal tubes, and archwires, dominate the market. These fixed appliances are the traditional and most widely used in orthodontics, especially for treating complex dental issues such as severe malocclusion, overcrowded teeth, or bite misalignments. Fixed devices are typically more effective for long-term adjustments and are commonly used in both adolescent and adult patients. Brackets and archwires, in particular, have seen continuous innovation in design, with materials like ceramic and stainless steel, which improve comfort, aesthetic appeal, and treatment efficiency.

-

The demand for fixed orthodontic appliances remains strong due to their versatility and long-established efficacy in orthodontic treatment. While clear aligners are rising in popularity, fixed appliances still dominate in terms of comprehensive and complex treatments, especially for cases where aligners are not suitable. Furthermore, as patients require more consistent and durable solutions for their dental issues, fixed appliances continue to be the go-to choose for orthodontists, ensuring their dominant position in the market.

By End User, the Dentist & Orthodontist Owned Practices segment is expected to hold the largest share

-

The Dentist & Orthodontist Owned Practices segment dominates the orthodontics market in terms of end users. This category includes private dental practices and orthodontic clinics that specialize in providing comprehensive orthodontic care. The demand for orthodontic treatments, such as braces and aligners, is consistently high in these practices, driven by the expertise and personalized care provided by trained professionals. Additionally, the wide range of services offered, from diagnostic imaging to post-treatment follow-up, ensures that orthodontist-owned practices remain the primary destination for orthodontic care.

-

These practices benefit from strong patient relationships, repeat business, and the ability to tailor treatments to individual needs, which contributes to their dominance in the market. Furthermore, orthodontists in these practices are typically well-equipped with advanced tools and technologies that support precise treatment planning and execution. As orthodontic treatments become more advanced and demand for personalized care increases, dentist and orthodontist-owned practices are well-positioned to remain leaders in the orthodontics industry.

Orthodontics Market Regional Insights:

North America is expected to dominate the Market Over the Forecast period

-

North America is expected to dominate the global orthodontics market during the forecast period, primarily driven by a combination of high demand for advanced dental treatments and a well-established healthcare infrastructure. The region is home to a large population that places a high value on cosmetic dentistry, with many individuals seeking orthodontic care to improve their appearance and oral health. Technological advancements, such as 3D imaging, digital scanning, and the increasing popularity of clear aligners, have further propelled the demand for orthodontic treatments. Additionally, the availability of skilled orthodontists and dental professionals ensures high-quality care, contributing to the region's strong market presence.

-

Furthermore, the growing emphasis on oral health awareness, coupled with extensive insurance coverage for orthodontic treatments, is also fueling market growth in North America. The increasing adoption of orthodontics among adults, along with an aging population requiring dental care, further supports the demand for these services. With the U.S. and Canada leading in terms of both market size and technological advancements, North America is expected to remain at the forefront of the orthodontics market, attracting investments from both local and global orthodontic companies.

Active Key Players in the Orthodontics Market:

- 3M (USA)

- Align Technology, Inc. (USA)

- American Orthodontics (USA)

- Biolase, Inc. (USA)

- Bisco Dental Products (USA)

- ClearCorrect (USA)

- Danaher Corporation (USA)

- Dental Wings (Canada)

- Dentsply Sirona (USA)

- GC Orthodontics (Japan)

- Henry Schein, Inc. (USA)

- Kavo Kerr (USA)

- Ormco Corporation (USA)

- Rocky Mountain Orthodontics (USA)

- Shinyei Kaisha (Japan)

- SmileDirectClub (USA)

- Straumann (Switzerland)

- TP Orthodontics, Inc. (USA)

- Ultradent Products, Inc. (USA)

- Other Active Players

|

Global Orthodontics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.96 Billion |

|

Forecast Period 2024-32 CAGR: |

23 % |

Market Size in 2032: |

USD 44.51 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Age Group |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Orthodontics Market by Type

4.1 Orthodontics Market Snapshot and Growth Engine

4.2 Orthodontics Market Overview

4.3 Instruments and Supplies {Fixed (Brackets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Instruments and Supplies {Fixed (Brackets: Geographic Segmentation Analysis

4.4 Bands & Buccal Tubes

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Bands & Buccal Tubes: Geographic Segmentation Analysis

4.5 Archwires

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Archwires: Geographic Segmentation Analysis

4.6 and Others) and Removable (Aligners

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Others) and Removable (Aligners: Geographic Segmentation Analysis

4.7 Retainers

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Retainers: Geographic Segmentation Analysis

4.8 and Others)

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 and Others): Geographic Segmentation Analysis

Chapter 5: Orthodontics Market by Age Group

5.1 Orthodontics Market Snapshot and Growth Engine

5.2 Orthodontics Market Overview

5.3 Teens and Adults)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Teens and Adults): Geographic Segmentation Analysis

Chapter 6: Orthodontics Market by End User

6.1 Orthodontics Market Snapshot and Growth Engine

6.2 Orthodontics Market Overview

6.3 Dentist & Orthodontist Owned Practices

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Dentist & Orthodontist Owned Practices: Geographic Segmentation Analysis

6.4 and Others

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Orthodontics Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M COMPANY (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALIGN TECHNOLOGY INC. (USA)

7.4 ARGEN CORPORATION (USA)

7.5 CLEARCORRECT (USA)

7.6 DANAHER CORPORATION (USA)

7.7 DENTAL WINGS (CANADA)

7.8 DENTSPLY SIRONA INC. (USA)

7.9 GC CORPORATION (JAPAN)

7.10 HENRY SCHEIN INC. (USA)

7.11 KAVO KERR (GERMANY)

7.12 MIDMARK CORPORATION (USA)

7.13 ORMCO CORPORATION (USA)

7.14 PATTERSON COMPANIES INC. (USA)

7.15 SMILEDIRECTCLUB LLC (USA)

7.16 SONICARE (PHILIPS) (NETHERLANDS)

7.17 STRAUMANN GROUP (SWITZERLAND)

7.18 SURGITEL (USA)

7.19 ULTRADENT PRODUCTS INC. (USA)

7.20 OTHER ACTIVE PLAYERS

Chapter 8: Global Orthodontics Market By Region

8.1 Overview

8.2. North America Orthodontics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Instruments and Supplies {Fixed (Brackets

8.2.4.2 Bands & Buccal Tubes

8.2.4.3 Archwires

8.2.4.4 and Others) and Removable (Aligners

8.2.4.5 Retainers

8.2.4.6 and Others)

8.2.5 Historic and Forecasted Market Size By Age Group

8.2.5.1 Teens and Adults)

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Dentist & Orthodontist Owned Practices

8.2.6.2 and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Orthodontics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Instruments and Supplies {Fixed (Brackets

8.3.4.2 Bands & Buccal Tubes

8.3.4.3 Archwires

8.3.4.4 and Others) and Removable (Aligners

8.3.4.5 Retainers

8.3.4.6 and Others)

8.3.5 Historic and Forecasted Market Size By Age Group

8.3.5.1 Teens and Adults)

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Dentist & Orthodontist Owned Practices

8.3.6.2 and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Orthodontics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Instruments and Supplies {Fixed (Brackets

8.4.4.2 Bands & Buccal Tubes

8.4.4.3 Archwires

8.4.4.4 and Others) and Removable (Aligners

8.4.4.5 Retainers

8.4.4.6 and Others)

8.4.5 Historic and Forecasted Market Size By Age Group

8.4.5.1 Teens and Adults)

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Dentist & Orthodontist Owned Practices

8.4.6.2 and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Orthodontics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Instruments and Supplies {Fixed (Brackets

8.5.4.2 Bands & Buccal Tubes

8.5.4.3 Archwires

8.5.4.4 and Others) and Removable (Aligners

8.5.4.5 Retainers

8.5.4.6 and Others)

8.5.5 Historic and Forecasted Market Size By Age Group

8.5.5.1 Teens and Adults)

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Dentist & Orthodontist Owned Practices

8.5.6.2 and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Orthodontics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Instruments and Supplies {Fixed (Brackets

8.6.4.2 Bands & Buccal Tubes

8.6.4.3 Archwires

8.6.4.4 and Others) and Removable (Aligners

8.6.4.5 Retainers

8.6.4.6 and Others)

8.6.5 Historic and Forecasted Market Size By Age Group

8.6.5.1 Teens and Adults)

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Dentist & Orthodontist Owned Practices

8.6.6.2 and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Orthodontics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Instruments and Supplies {Fixed (Brackets

8.7.4.2 Bands & Buccal Tubes

8.7.4.3 Archwires

8.7.4.4 and Others) and Removable (Aligners

8.7.4.5 Retainers

8.7.4.6 and Others)

8.7.5 Historic and Forecasted Market Size By Age Group

8.7.5.1 Teens and Adults)

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Dentist & Orthodontist Owned Practices

8.7.6.2 and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Orthodontics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.96 Billion |

|

Forecast Period 2024-32 CAGR: |

23 % |

Market Size in 2032: |

USD 44.51 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Age Group |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||