Oral & Dental Probiotics Market Synopsis

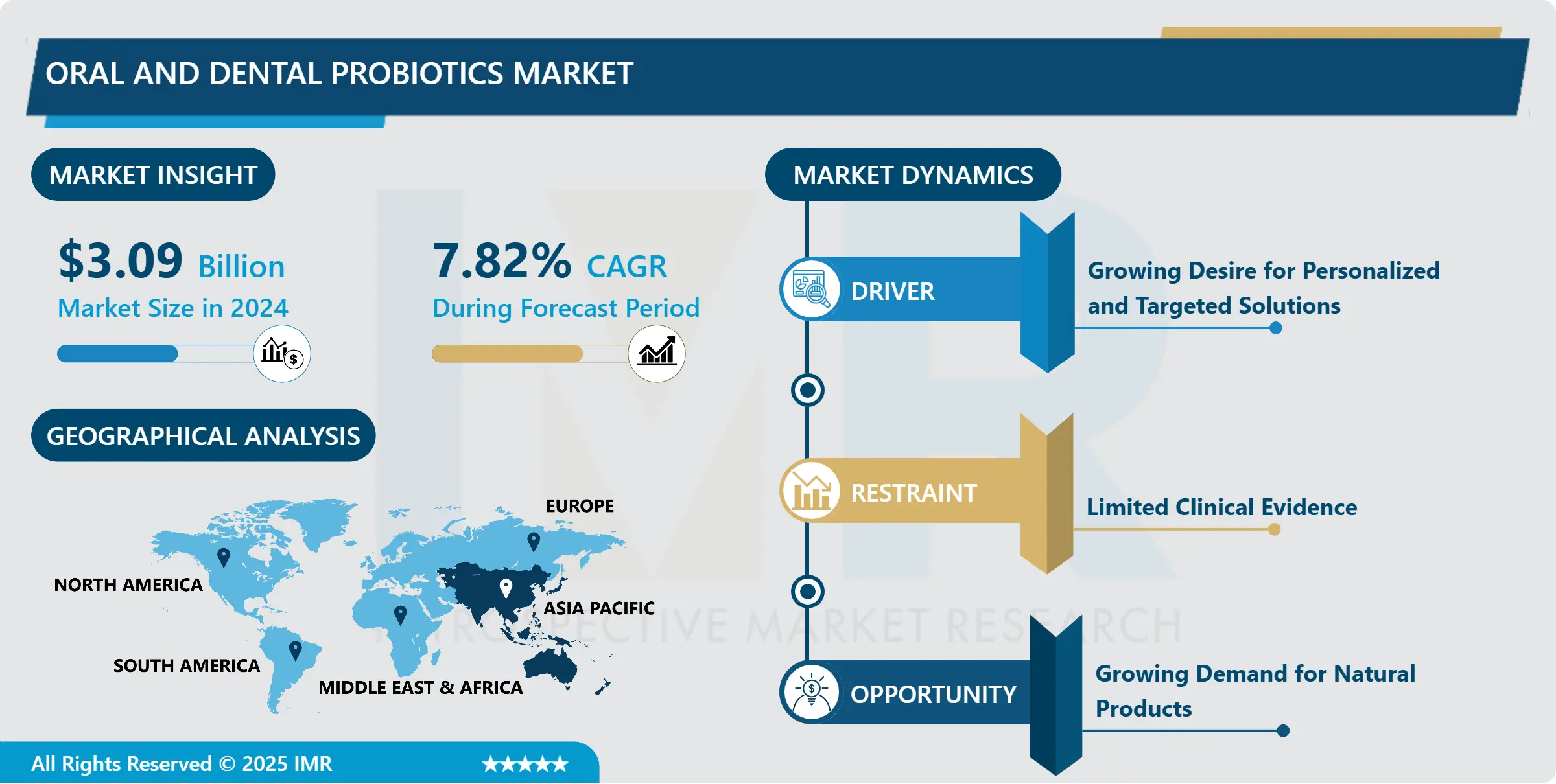

Oral & Dental Probiotics Market Size Was Valued at USD 3.09 Billion in 2024, and is Projected to Reach USD 7.07 Billion by 2035, Growing at a CAGR of 7.82% From 2025-2035.

Specialized oral and dental probiotics comprise carefully formulated blends of beneficial bacteria, such as Lactobacillus and Bifidobacterium strains. Their purpose is to foster a harmonious microorganism balance within the oral cavity and to promote optimal oral hygiene.

Innovative formulations of oral and dental probiotics feature beneficial bacteria, particularly strains of Lactobacillus and Bifidobacterium, carefully designed to cultivate a balanced microbial environment within the oral cavity. These probiotics find application in various oral care products, including toothpaste, mouthwash, and supplements. Their role in oral care revolves around sustaining a well-balanced microbiome, effectively preventing the overgrowth of harmful bacteria linked to dental problems such as cavities and gum diseases. Their mechanism involves hindering the colonization of pathogenic bacteria, thereby fostering a healthier oral ecosystem.

The advantages of integrating oral and dental probiotics into daily hygiene routines are noteworthy. These probiotics play a role in preventing dental caries by generating antimicrobial substances and supporting the remineralization of tooth enamel. Furthermore, they contribute to gum health by mitigating inflammation and promoting optimal immune responses. Addressing bad breath concerns, probiotics tackle the root cause of odour-producing bacteria. As a natural and complementary approach to traditional oral care, these probiotics provide a means of sustaining overall oral health and hygiene. Consistent use serves as a valuable addition to oral care practices, promoting a proactive and preventive approach to dental wellness.

Oral & Dental Probiotics Market Trend Analysis:

Growing Desire for Personalized and Targeted Solutions

- The increasing demand for personalized and targeted solutions in oral care is a significant factor driving the expansion of the Oral and Dental Probiotics market. Consumers are more inclined towards customized approaches to address their specific oral health needs, recognizing the limitations of one-size-fits-all solutions. This trend aligns with the broader shift towards personalized healthcare, where individuals prioritize products that closely align with their unique health goals and preferences.

- The adaptability of Oral and Dental Probiotics in meeting diverse oral health requirements adds to their attractiveness as personalized solutions. Whether it's preventing cavities, addressing gum diseases, or tackling bad breath, consumers value the targeted benefits offered by probiotic formulations. Manufacturers are responding to this demand by creating a variety of oral probiotic products, including toothpaste, mouthwash, and supplements, each tailored to address specific oral concerns. This emphasis on customization enhances consumer engagement and loyalty, contributing to the market's growth.

- Furthermore, the increasing awareness of the connection between oral health and overall well-being is driving the demand for personalized oral care solutions. Consumers understand that maintaining a healthy oral microbiome not only contributes to dental health but also impacts systemic health. As this awareness deepens, the preference for oral probiotics as a personalized and preventive measure is anticipated to fuel sustained growth in the Oral and Dental Probiotics market.

Growing Demand for Natural Products

- The increasing preference for natural products has emerged as a significant opportunity for the growth of the oral and dental probiotics market. Consumers are increasingly searching for oral care alternatives that align with their inclination towards natural and sustainable solutions. This shift in consumer behavior is fueled by a heightened awareness of potential adverse effects linked to certain synthetic ingredients commonly found in traditional oral care products. Consequently, there is a growing preference for products that leverage the benefits of natural components, with oral and dental probiotics emerging as a promising choice.

- Probiotics, derived from beneficial bacteria such as Lactobacillus and Bifidobacterium, provide a natural approach to oral health by fostering a balanced microbial environment in the mouth. The market is responding to this demand by developing probiotic-based toothpaste, mouthwash, and supplements. These products not only aim to prevent common dental issues but also address consumer concerns regarding the long-term impact of chemical-laden oral care products. With an increasing emphasis on overall well-being and preventive healthcare, the demand for natural oral and dental probiotics is anticipated to experience significant growth, driven by consumers seeking effective and nature-derived solutions.

- The opportunity to meet the demand for natural oral care products extends beyond individual preferences. It aligns with broader trends in the health and wellness sector, where consumers actively seek products that resonate with their holistic approach to self-care.

Oral & Dental Probiotics Market Segment Analysis:

Oral & Dental Probiotics Market Segmented on the basis of Type, Formulation, Application End-User and Distribution Channel

By Type, Mouthwash segment is expected to dominate the market during the forecast period

- The mouthwash sector is predicted to establish its dominance in the Oral & Dental Probiotics market, primarily due to its ease of use and direct application to oral care routines. Mouthwashes incorporating probiotics present a focused approach to addressing oral concerns such as dental caries, gum diseases, and halitosis. There is a growing consumer preference for daily oral care products that are both effective and user-friendly, and probiotic-infused mouthwashes cater to this demand. The liquid formulation of these mouthwashes facilitates thorough coverage of the oral cavity, reaching areas that may pose challenges for other oral care items.

- Moreover, the incorporation of probiotics in mouthwashes indicates a proactive shift toward preventive oral healthcare, appealing to individuals seeking to improve their overall oral hygiene practices. This trend is expected to gain momentum with increasing awareness of the advantages of probiotics and their positive influence on the oral microbiome, positioning the mouthwash segment at the forefront of the Oral & Dental Probiotics market.

By Formulation, Capsules segment held the largest share of 43.20% in 2022

- The capsules category has emerged as the predominant force in the Oral & Dental Probiotics market, securing the largest market share. This dominance can be attributed to various factors, including consumer preference for a convenient and easily consumable form of probiotics. Capsules provide a hassle-free way to incorporate probiotics into daily oral health routines, catering to individuals seeking a simple and portable solution. The encapsulation of probiotics ensures stability and efficacy, protecting the live bacteria from external factors that could compromise their potency.

- Additionally, capsules enable precise dosing, allowing users to maintain consistent probiotic intake for optimal oral care. As awareness of the vital role of oral microbiota in overall health increases, it is anticipated that the capsules segment will continue to lead in the Oral & Dental Probiotics market, meeting the preferences of a diverse range of consumers prioritizing both convenience and effectiveness in their oral health regimen.

Oral & Dental Probiotics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is positioned to lead the Oral & Dental Probiotics market, showcasing robust growth and dominance in the foreseeable future. This projected dominance is driven by factors such as the region's growing population, rising disposable income, and an increasing awareness of preventive healthcare practices. Economic development in Asia Pacific has led to heightened consumer awareness of oral hygiene, resulting in an increased demand for innovative dental products, particularly those infused with probiotics.

- Additionally, the cultural emphasis on traditional medicine and holistic health practices in many Asian countries aligns well with the utilization of probiotics for oral well-being. The presence of key players in the market, combined with proactive government initiatives promoting oral health, further establishes Asia Pacific as a leader in shaping the evolving landscape of the Oral & Dental Probiotics market.

Oral & Dental Probiotics Market Top Key Players:

- Hyperbiotics (U.S.)

- OraTicx (U.S.)

- Great Oral Health (U.S.)

- Church & Dwight Co., Inc. (Therabreath) (U.S.)

- NatureWise (U.S.)

- Swanson (U.S.)

- Jarrow Formulas, Inc. (U.S.)

- Revitin (U.S.)

- Dessert Essence (U.S.)

- Burst (U.S.)

- Riven (U.S.)

- ProDentim (U.S.)

- Designs for Health, Inc. (U.S.)

- Luvbiotics (UK)

- Pure Research Restore Limited (UK)

- Gallinee (UK)

- BioGaia AB (Sweden)

- Blis Probiotics (New Zealand), and Other Major Players

Key Industry Developments in the Oral & Dental Probiotics Market:

- In January 2023, Oragenics, Inc., a renowned developer of innovative antibiotics and oral care probiotics. ProBioraPlus, launched, is a mint-flavored tablet featuring a patented blend of three probiotic strains designed to naturally support gum and tooth health, freshen breath, and enhance teeth whitening. This product is readily available both online and in select retail outlets. Oragenics, Inc. asserts that ProBioraPlus has distinguished as the sole oral care probiotic product containing the same beneficial bacteria found in healthy oral environments.

|

Oral & Dental Probiotics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.09 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.82% |

Market Size in 2035: |

USD 7.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oral & Dental Probiotics Market by Type (2018-2032)

4.1 Oral & Dental Probiotics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Toothpaste

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Mouthwash

4.5 Supplements

Chapter 5: Oral & Dental Probiotics Market by Application (2018-2032)

5.1 Oral & Dental Probiotics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dental Caries Prevention

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gum Disease Management

5.5 Bad Breath Control

5.6 Orthodontic Care

Chapter 6: Oral & Dental Probiotics Market by End-User (2018-2032)

6.1 Oral & Dental Probiotics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Adults

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Children

Chapter 7: Oral & Dental Probiotics Market by Distribution Channel (2018-2032)

7.1 Oral & Dental Probiotics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmacies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Supermarkets and Hypermarkets

7.5 E-commerce

7.6 Dental Clinics

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Oral & Dental Probiotics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ILLUMINA

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 F. HOFFMAN-LA ROCHE LTDQIAGEN

8.4 THERMO FISHER SCIENTIFIC INCBIO-RAD LABORATORIES INCOXFORD NANOPORE TECHNOLOGIES

8.5 PIERIANDX

8.6 GENOMATIX GMBH

8.7 DNASTAR INCPERKIN ELMER INCEUROFINS GATC BIOTECH GMBH

8.8 BGI

8.9 OTHER KEY PLAYERS

Chapter 9: Global Oral & Dental Probiotics Market By Region

9.1 Overview

9.2. North America Oral & Dental Probiotics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Toothpaste

9.2.4.2 Mouthwash

9.2.4.3 Supplements

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Dental Caries Prevention

9.2.5.2 Gum Disease Management

9.2.5.3 Bad Breath Control

9.2.5.4 Orthodontic Care

9.2.6 Historic and Forecasted Market Size by End-User

9.2.6.1 Adults

9.2.6.2 Children

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Pharmacies

9.2.7.2 Supermarkets and Hypermarkets

9.2.7.3 E-commerce

9.2.7.4 Dental Clinics

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Oral & Dental Probiotics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Toothpaste

9.3.4.2 Mouthwash

9.3.4.3 Supplements

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Dental Caries Prevention

9.3.5.2 Gum Disease Management

9.3.5.3 Bad Breath Control

9.3.5.4 Orthodontic Care

9.3.6 Historic and Forecasted Market Size by End-User

9.3.6.1 Adults

9.3.6.2 Children

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Pharmacies

9.3.7.2 Supermarkets and Hypermarkets

9.3.7.3 E-commerce

9.3.7.4 Dental Clinics

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Oral & Dental Probiotics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Toothpaste

9.4.4.2 Mouthwash

9.4.4.3 Supplements

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Dental Caries Prevention

9.4.5.2 Gum Disease Management

9.4.5.3 Bad Breath Control

9.4.5.4 Orthodontic Care

9.4.6 Historic and Forecasted Market Size by End-User

9.4.6.1 Adults

9.4.6.2 Children

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Pharmacies

9.4.7.2 Supermarkets and Hypermarkets

9.4.7.3 E-commerce

9.4.7.4 Dental Clinics

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Oral & Dental Probiotics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Toothpaste

9.5.4.2 Mouthwash

9.5.4.3 Supplements

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Dental Caries Prevention

9.5.5.2 Gum Disease Management

9.5.5.3 Bad Breath Control

9.5.5.4 Orthodontic Care

9.5.6 Historic and Forecasted Market Size by End-User

9.5.6.1 Adults

9.5.6.2 Children

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Pharmacies

9.5.7.2 Supermarkets and Hypermarkets

9.5.7.3 E-commerce

9.5.7.4 Dental Clinics

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Oral & Dental Probiotics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Toothpaste

9.6.4.2 Mouthwash

9.6.4.3 Supplements

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Dental Caries Prevention

9.6.5.2 Gum Disease Management

9.6.5.3 Bad Breath Control

9.6.5.4 Orthodontic Care

9.6.6 Historic and Forecasted Market Size by End-User

9.6.6.1 Adults

9.6.6.2 Children

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Pharmacies

9.6.7.2 Supermarkets and Hypermarkets

9.6.7.3 E-commerce

9.6.7.4 Dental Clinics

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Oral & Dental Probiotics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Toothpaste

9.7.4.2 Mouthwash

9.7.4.3 Supplements

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Dental Caries Prevention

9.7.5.2 Gum Disease Management

9.7.5.3 Bad Breath Control

9.7.5.4 Orthodontic Care

9.7.6 Historic and Forecasted Market Size by End-User

9.7.6.1 Adults

9.7.6.2 Children

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Pharmacies

9.7.7.2 Supermarkets and Hypermarkets

9.7.7.3 E-commerce

9.7.7.4 Dental Clinics

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Oral & Dental Probiotics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.09 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.82% |

Market Size in 2035: |

USD 7.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||