Optometry Equipment Market Synopsis:

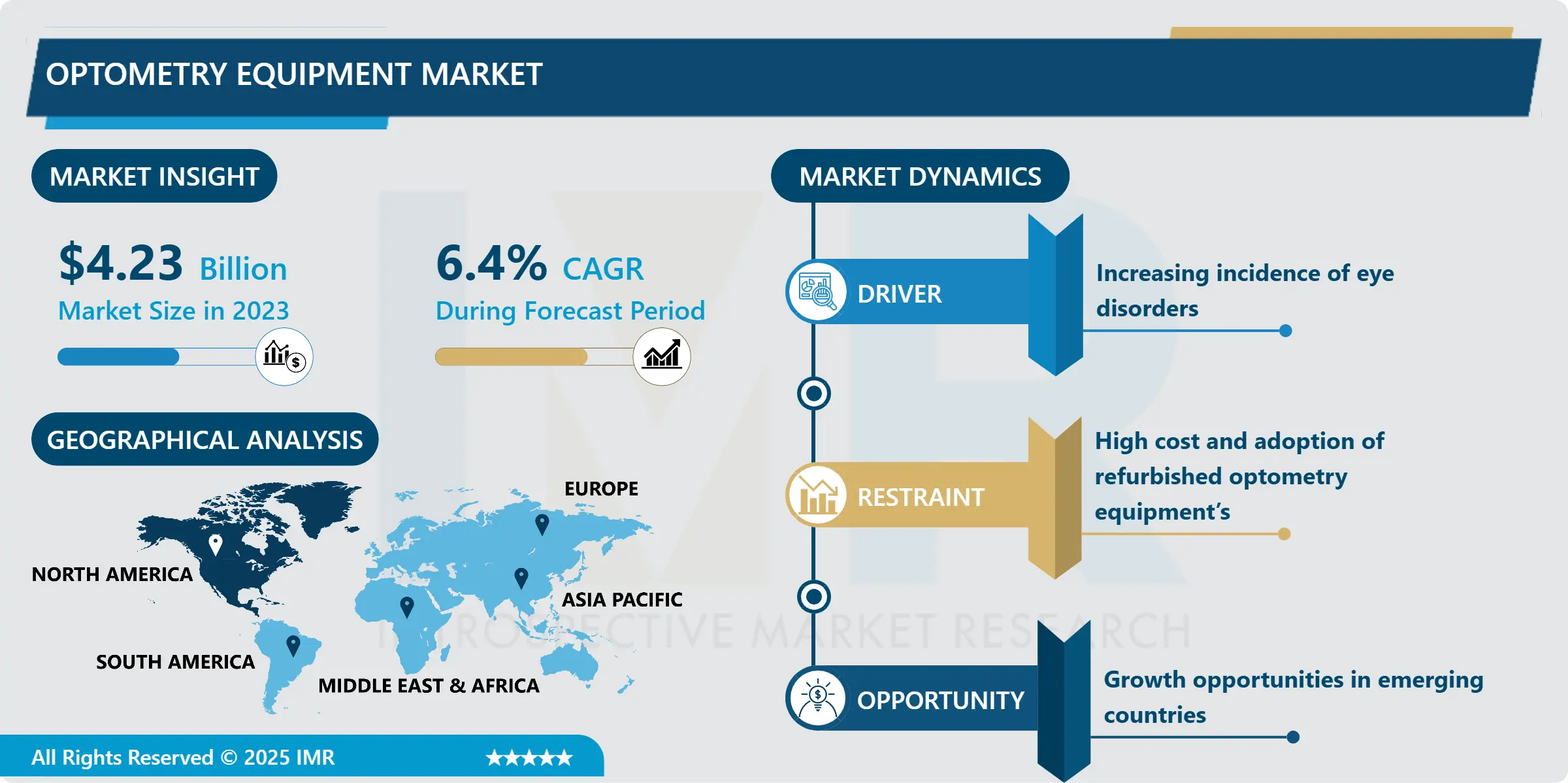

Optometry Equipment Market Size Was Valued at USD 4.23 Billion in 2023, and is Projected to Reach USD 7.39 Billion by 2032, Growing at a CAGR of 6.40% From 2024-2032.

The Optometry Equipment Market refers to the sector involved in the manufacturing, distribution, and sale of devices and instruments used by optometrists to examine, diagnose, and treat various eye conditions and visual disorders. These include diagnostic instruments like autorefractors, fundus cameras, visual field analyzers, and equipment used for corrective procedures such as phoropters and lensometers.

The optometry equipment market is driven by the increasing prevalence of eye-related health issues, such as refractive errors, cataracts, and age-related macular degeneration, alongside rising awareness of eye health. Technological advancements in diagnostic tools and equipment that offer better accuracy, speed, and patient comfort are further fueling market growth. Additionally, the aging population globally is contributing to a growing demand for eye care services, expanding the need for optometry equipment.

The market is characterized by a wide range of products catering to both routine eye examinations and specialized diagnostic procedures. There is also a growing trend toward adopting automated and digitalized equipment, which helps in enhancing efficiency and improving patient outcomes. This technological shift is contributing to the expansion of the market, with optometry clinics and hospitals increasingly upgrading their equipment to stay ahead of industry demands.

Moreover, the increasing adoption of telemedicine and online consultations in the healthcare sector is expected to provide new growth opportunities for the optometry equipment market. With the shift to virtual consultations, there is an uptick in demand for portable and remote diagnostic devices that can be used outside traditional clinical settings, offering a new avenue for market development.

Optometry Equipment Market Trend Analysis:

Increasing Prevalence of Eye Conditions

-

The growing global prevalence of eye-related conditions, such as refractive errors, cataracts, and age-related macular degeneration, is a significant driver for the optometry equipment market. As the world’s population ages, the demand for eye care services is escalating, which in turn increases the need for advanced diagnostic and treatment equipment. Eye diseases are becoming more common, especially in older populations, creating a strong market for tools that can accurately assess visual impairments. This trend is particularly evident in developed and developing regions with aging demographics, where eye care is prioritized for the elderly.

-

An increasing awareness of the importance of regular eye check-ups and early diagnosis further contributes to market growth. As consumers become more conscious of the need for preventative eye care, they are more likely to seek professional help from optometrists. This growing awareness, combined with the rising incidence of eye conditions, creates a steady demand for optometry equipment, boosting market growth and innovation in diagnostic tools and therapeutic devices.

Advancements in Tele-optometry and Remote Diagnostics

-

Advancements in tele-optometry and remote diagnostic technologies present a significant opportunity for the optometry equipment market. With the rise of digital health solutions and telemedicine, the optometry field is shifting toward offering remote consultations and diagnostic services. This transformation is driven by the increasing adoption of digital platforms and mobile health apps, which allow optometrists to conduct eye examinations, monitor patients' conditions, and prescribe corrective lenses remotely. As a result, there is growing demand for portable, user-friendly diagnostic equipment that can be used outside of traditional clinic settings, creating an opportunity for innovative products.

-

Furthermore, the global reach of tele-optometry opens up new markets, particularly in underserved or remote regions where access to eye care is limited. By offering remote diagnostic tools, optometrists can extend their services to these areas, addressing the need for eye care in locations with fewer healthcare resources. This expansion into new geographical areas, combined with the convenience and cost-effectiveness of remote diagnostics, creates a valuable opportunity for companies in the optometry equipment market to develop specialized products that cater to this growing trend in virtual eye care.

Optometry Equipment Market Segment Analysis:

Optometry Equipment Market Segmented based on Type, Application, End Use, and Region.

By Type, the Retina and Glaucoma Examination Products segment is expected to dominate the market

-

The Retina and Glaucoma Examination Products segment is expected to dominate the optometry equipment market during the forecast period due to the increasing prevalence of retinal diseases and glaucoma globally. As the population ages, conditions such as age-related macular degeneration, diabetic retinopathy, and glaucoma are becoming more common, driving the demand for specialized diagnostic equipment. Instruments like optical coherence tomography (OCT), fundus cameras, and tonometers are critical in diagnosing these conditions early, enabling optometrists to provide timely treatments that can prevent further deterioration of vision. The growing awareness about the importance of early detection and the rising prevalence of eye diseases are major factors contributing to the segment's dominance.

-

Advancements in retinal and glaucoma diagnostic technologies are enhancing the accuracy and efficiency of exams, which is further boosting their adoption in optometry clinics and hospitals. The ability to detect changes in the retina and intraocular pressure through non-invasive, high-resolution imaging systems has revolutionized how these conditions are managed. As the demand for better diagnostic tools grows, this segment is expected to continue its growth trajectory, as healthcare providers invest in cutting-edge technologies to meet the increasing need for reliable, early detection methods in retinal and glaucoma care.

By End Use, the Hospitals segment expected to hold the largest share

-

The Hospitals segment is expected to hold the largest share of the optometry equipment market due to the growing demand for comprehensive eye care services and specialized treatments in these settings. Hospitals typically have a wide array of patients requiring advanced diagnostic and treatment options for a variety of eye conditions, ranging from routine eye exams to complex procedures like retinal surgeries and glaucoma management. As hospitals continue to expand their eye care departments and integrate state-of-the-art optometry equipment, the demand for advanced devices like optical coherence tomography (OCT) scanners, fundus cameras, and visual field analyzers is expected to rise significantly. This trend is fueled by the increasing number of patients seeking specialized care and the ability of hospitals to invest in high-end diagnostic equipment.

-

Hospitals are likely to continue driving market growth due to the increasing healthcare infrastructure investments and advancements in medical technology. With the expansion of both public and private healthcare facilities, hospitals are becoming central hubs for optometry services. The need for accurate diagnostics and effective treatment methods to cater to a wide range of eye conditions will keep fueling the demand for optometry equipment in these facilities. As hospitals become the primary centers for advanced eye care, they will continue to play a pivotal role in maintaining the largest share in the optometry equipment market.

Optometry Equipment Market Regional Insights:

North America is expected to dominate the Market Over the Forecast period

-

North America is expected to dominate the optometry equipment market over the forecast period due to the region’s advanced healthcare infrastructure, high adoption rate of new technologies, and increasing prevalence of eye conditions among its aging population. The United States, in particular, has a well-established healthcare system that heavily invests in cutting-edge medical devices, including optometry equipment. The demand for advanced diagnostic and treatment devices like optical coherence tomography (OCT), fundus cameras, and visual field analyzers is high, as eye care services are widely accessible and increasingly recognized as essential for overall health. The growing aging demographic in North America, combined with rising awareness of eye health, further contributes to the increasing need for optometry equipment.

-

The presence of leading manufacturers and key market players in North America strengthens the region's position as a dominant market. Companies based in the U.S. and Canada are at the forefront of developing and producing innovative optometry devices, often setting trends in terms of quality and technology. Moreover, healthcare policies and reimbursement programs that support the adoption of advanced medical technologies in this region are helping to drive growth in the optometry equipment market. As the region continues to experience technological advancements and increasing healthcare demand, North America is expected to maintain its dominance throughout the forecast period.

Active Key Players in the Optometry Equipment Market

- AMETEK, Inc. (USA)

- Bon Optic (Germany)

- Canon Inc. (Japan)

- Essilor International (France)

- Haag-Streit Group (Switzerland)

- Hoya Corporation (Japan)

- Kowa Company, Ltd. (Japan)

- Luneau Technology (France)

- MediWorks (China)

- Mirante Vision Technologies (USA)

- Nidek Co., Ltd. (Japan)

- Optometric Supply, Inc. (USA)

- Optovue (USA)

- Phoenix Medical Systems (India)

- Reichert Technologies (USA)

- Rhein Medical (USA)

- Topcon Corporation (Japan)

- Vmax Vision (USA)

- Welch Allyn (USA)

- Zeiss International (Germany)

- Other Active Players.

Key Industry Developments in the Optometry Equipment Market:

In August 2023, Carl Zeiss launched the ZEISS trifocal technology on a glistening-free hydrophobic C-loop platform and a fully preloaded injector for safe and reliable implantation.

|

Global Optometry Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.23 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40% |

Market Size in 2032: |

USD 7.39 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Optometry Equipment Market by Type

4.1 Optometry Equipment Market Snapshot and Growth Engine

4.2 Optometry Equipment Market Overview

4.3 Retina and Glaucoma Examination Products

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Retina and Glaucoma Examination Products: Geographic Segmentation Analysis

4.4 General Examination Products and Cornea and Cataract Examination Products

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 General Examination Products and Cornea and Cataract Examination Products: Geographic Segmentation Analysis

Chapter 5: Optometry Equipment Market by Application

5.1 Optometry Equipment Market Snapshot and Growth Engine

5.2 Optometry Equipment Market Overview

5.3 General Examination

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 General Examination: Geographic Segmentation Analysis

5.4 Cataract

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cataract: Geographic Segmentation Analysis

5.5 Glaucoma

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Glaucoma: Geographic Segmentation Analysis

5.6 Age-related Macular Degeneration (AMD) and Other Applications

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Age-related Macular Degeneration (AMD) and Other Applications: Geographic Segmentation Analysis

Chapter 6: Optometry Equipment Market by End Use

6.1 Optometry Equipment Market Snapshot and Growth Engine

6.2 Optometry Equipment Market Overview

6.3 Eye Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Eye Clinics: Geographic Segmentation Analysis

6.4 Hospitals and Other End Users

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Hospitals and Other End Users: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Optometry Equipment Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARL ZEISS MEDITEC AG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ESSILORLUXOTTICA (FRANCE)

7.4 ALCON (SWITZERLAND)

7.5 TOPCON CORPORATION (JAPAN)

7.6 BAUSCH HEALTH COMPANIES INC. (CANADA)

7.7

7.8 OTHER ACTIVE PLAYERS

Chapter 8: Global Optometry Equipment Market By Region

8.1 Overview

8.2. North America Optometry Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Retina and Glaucoma Examination Products

8.2.4.2 General Examination Products and Cornea and Cataract Examination Products

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 General Examination

8.2.5.2 Cataract

8.2.5.3 Glaucoma

8.2.5.4 Age-related Macular Degeneration (AMD) and Other Applications

8.2.6 Historic and Forecasted Market Size By End Use

8.2.6.1 Eye Clinics

8.2.6.2 Hospitals and Other End Users

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Optometry Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Retina and Glaucoma Examination Products

8.3.4.2 General Examination Products and Cornea and Cataract Examination Products

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 General Examination

8.3.5.2 Cataract

8.3.5.3 Glaucoma

8.3.5.4 Age-related Macular Degeneration (AMD) and Other Applications

8.3.6 Historic and Forecasted Market Size By End Use

8.3.6.1 Eye Clinics

8.3.6.2 Hospitals and Other End Users

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Optometry Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Retina and Glaucoma Examination Products

8.4.4.2 General Examination Products and Cornea and Cataract Examination Products

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 General Examination

8.4.5.2 Cataract

8.4.5.3 Glaucoma

8.4.5.4 Age-related Macular Degeneration (AMD) and Other Applications

8.4.6 Historic and Forecasted Market Size By End Use

8.4.6.1 Eye Clinics

8.4.6.2 Hospitals and Other End Users

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Optometry Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Retina and Glaucoma Examination Products

8.5.4.2 General Examination Products and Cornea and Cataract Examination Products

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 General Examination

8.5.5.2 Cataract

8.5.5.3 Glaucoma

8.5.5.4 Age-related Macular Degeneration (AMD) and Other Applications

8.5.6 Historic and Forecasted Market Size By End Use

8.5.6.1 Eye Clinics

8.5.6.2 Hospitals and Other End Users

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Optometry Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Retina and Glaucoma Examination Products

8.6.4.2 General Examination Products and Cornea and Cataract Examination Products

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 General Examination

8.6.5.2 Cataract

8.6.5.3 Glaucoma

8.6.5.4 Age-related Macular Degeneration (AMD) and Other Applications

8.6.6 Historic and Forecasted Market Size By End Use

8.6.6.1 Eye Clinics

8.6.6.2 Hospitals and Other End Users

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Optometry Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Retina and Glaucoma Examination Products

8.7.4.2 General Examination Products and Cornea and Cataract Examination Products

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 General Examination

8.7.5.2 Cataract

8.7.5.3 Glaucoma

8.7.5.4 Age-related Macular Degeneration (AMD) and Other Applications

8.7.6 Historic and Forecasted Market Size By End Use

8.7.6.1 Eye Clinics

8.7.6.2 Hospitals and Other End Users

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Optometry Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.23 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40% |

Market Size in 2032: |

USD 7.39 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||