Ophthalmic Refractometer Market Synopsis:

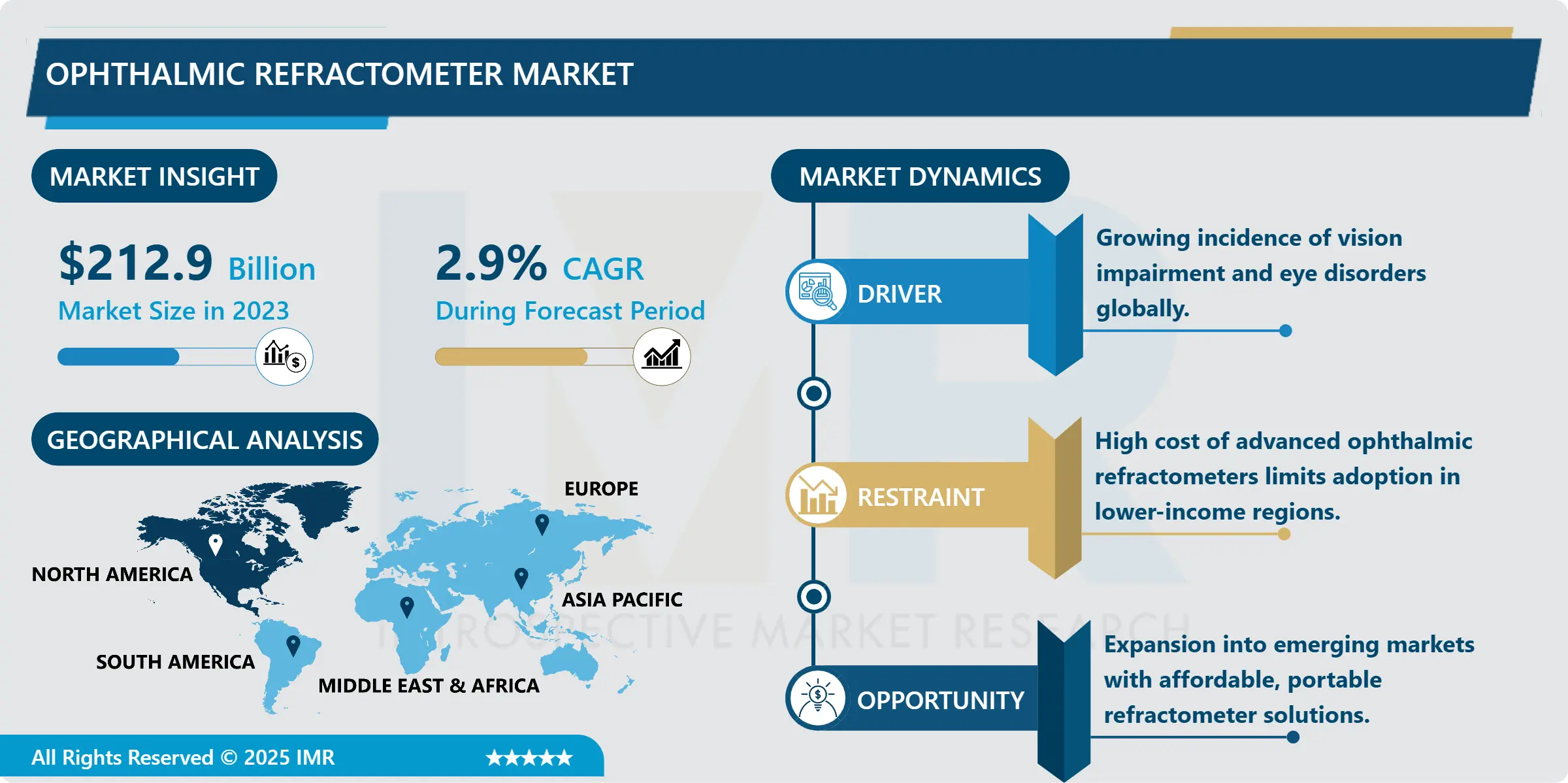

Ophthalmic Refractometer Market Size Was Valued at USD 212.9 Billion in 2023, and is Projected to Reach USD 267.60 Billion by 2032, Growing at a CAGR of 2.9% From 2024-2032.

The ophthalmic refractometer market is a crucial segment within the global healthcare industry, especially in the field of ophthalmology. Ophthalmic refractometers are medical devices used to measure the refractive errors of the eye, including conditions such as myopia, hyperopia, and astigmatism. These instruments are essential in diagnosing eye conditions and determining appropriate prescriptions for corrective lenses. With advancements in technology, the precision and efficiency of refractometers have significantly improved, making them indispensable in both clinical and optometry practices worldwide.

In recent years, the market for ophthalmic refractometers has witnessed steady growth, primarily driven by the increasing prevalence of eye-related diseases and growing awareness of eye health. As populations age and the demand for eye care services rises, refractometers are becoming a critical tool for optometrists, ophthalmologists, and healthcare providers to offer accurate diagnostics and treatment options. Additionally, the rising adoption of non-invasive diagnostic methods further contributes to the market's expansion, as patients and healthcare providers alike seek less intrusive procedures.

The growing global prevalence of refractive errors, such as myopia, presbyopia, and astigmatism, is a significant driver of the ophthalmic refractometer market. As populations age, the demand for accurate and early diagnosis of eye disorders increases, boosting the adoption of advanced ophthalmic refractometers. Moreover, technological innovations, such as automated and portable refractometers, are making these devices more accessible and user-friendly, driving market growth.

The increasing adoption of telemedicine and remote diagnostics presents new opportunities for the ophthalmic refractometer market. The development of smartphone-compatible refractometers, allowing for mobile eye screenings, is expected to create significant growth prospects, particularly in rural and underserved areas.

Despite technological advancements, the market faces challenges in terms of competition from other diagnostic tools, such as traditional hand-held refractors and autorefractors. Furthermore, the availability of counterfeit or low-quality refractometers may pose a challenge to the overall market's growth. However, the continued push for regulatory standards and quality assurance mechanisms will help mitigate these risks.

Ophthalmic Refractometer Market Trend Analysis:

Increasing Prevalence of Refractive Errors

-

The growing global prevalence of refractive errors, including myopia, hyperopia, and astigmatism, is a significant driver of the ophthalmic refractometer market. According to various studies, the incidence of refractive errors has been rising due to factors such as aging populations and lifestyle changes like prolonged screen exposure. This widespread issue has resulted in a greater demand for early and accurate diagnosis of these eye conditions, driving the adoption of advanced diagnostic tools, such as ophthalmic refractometers, in clinical settings.

- Furthermore, the increasing number of people requiring corrective eyewear, such as glasses and contact lenses, is contributing to the market's growth. Refractometers enable optometrists and ophthalmologists to accurately measure the refractive error and prescribe the right corrective solutions. This not only helps in improving the quality of life for patients but also facilitates the growing need for eye care services, particularly in both developed and developing markets.

Integration of Portable and Smartphone-Compatible Refractometers

-

The development and integration of portable and smartphone-compatible refractometers present a significant market opportunity. As telemedicine and remote diagnostics continue to grow in popularity, especially in rural or underserved areas, portable ophthalmic refractometers can provide quick, reliable, and non-invasive screening for refractive errors. These portable devices are often smaller, more affordable, and easier to use, making them ideal for both home care and primary healthcare settings, where access to specialized ophthalmic equipment might be limited.

- Smartphone-compatible refractometers enable remote consultations, offering convenience for both patients and healthcare providers. This integration enhances accessibility to eye care services by allowing individuals to undergo screenings and receive prescriptions from the comfort of their homes. As the demand for remote healthcare solutions continues to rise, the growth potential for portable and smartphone-enabled refractometers is immense, opening new avenues for market expansion.

Ophthalmic Refractometer Market Segment Analysis:

Ophthalmic Refractometer Market is Segmented on the basis of type, end user. and region.

By Type, Portable segment is expected to dominate the market during the forecast period

-

The portable ophthalmic refractometer segment is expected to dominate the market during the forecast period due to its growing demand for convenience, ease of use, and accessibility. Portable refractometers offer significant advantages over traditional, stationary models by providing flexibility in terms of location and application. They are particularly beneficial in field settings, rural areas, and in emergency care scenarios where access to large, stationary equipment might be limited. Their compact design and ability to be easily transported make them a preferred choice for optometrists, ophthalmologists, and healthcare providers who require mobility without sacrificing accuracy.

- Moreover, the increasing adoption of portable refractometers is driven by the growing trend of home-based eye care and remote diagnostics. With the rise of telemedicine, portable refractometers are becoming integral to offering at-home eye screenings, making eye care more accessible to people who may otherwise have difficulty visiting healthcare facilities. This segment is further boosted by technological advancements, such as Bluetooth connectivity and smartphone compatibility, which allow for seamless integration with digital health platforms, enhancing the overall patient experience and driving market growth.

By End Users, Hospitals segment expected to held the largest share

-

The hospitals segment is expected to hold the largest share of the ophthalmic refractometer market during the forecast period. Hospitals are typically the primary setting for the diagnosis and treatment of a wide range of eye conditions, and refractometers play a crucial role in these environments. They are extensively used in ophthalmology departments for accurate and precise measurements of refractive errors, ensuring proper diagnosis and effective treatment planning. Hospitals also have the resources to invest in advanced, high-quality refractometer models, which further solidifies their dominance in the market.

- Hospitals are increasingly adopting state-of-the-art ophthalmic equipment to provide comprehensive eye care services to a larger patient base. With the growing prevalence of refractive disorders and the aging population, hospitals are seeing an increased demand for ophthalmic diagnostics. The availability of skilled professionals, advanced technologies, and the capacity to handle a high volume of patients contributes to the dominance of the hospital segment. Furthermore, hospitals are well-equipped to offer a wide range of ophthalmic treatments, often using refractometers as part of a broader diagnostic and therapeutic process, thereby sustaining their leading market share.

Ophthalmic Refractometer Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the ophthalmic refractometer market over the forecast period, driven by the region’s advanced healthcare infrastructure, high healthcare spending, and a well-established presence of key market players. The region has a large number of ophthalmology clinics and hospitals equipped with cutting-edge diagnostic tools, including ophthalmic refractometers. With increasing awareness about eye health and the rising prevalence of refractive errors, such as myopia and hyperopia, there is a consistent demand for precise and efficient diagnostic equipment in North America. The presence of technologically advanced healthcare systems and a growing focus on early diagnosis further strengthens the market position in this region.

- North America benefits from high adoption rates of innovative ophthalmic devices due to significant investments in research and development. The U.S. and Canada, in particular, are experiencing an uptick in the demand for non-invasive diagnostic technologies, with hospitals and clinics upgrading their equipment to improve patient outcomes. The integration of telemedicine and smartphone-compatible refractometers also adds to the growth in North America, where there is a strong emphasis on offering convenient and accessible healthcare solutions. These factors collectively make North America the dominant market for ophthalmic refractometers during the forecast period.

Active Key Players in the Ophthalmic Refractometer Market:

-

AMETEK Inc. (USA)

- Canon Inc. (Japan)

- Carl Zeiss Meditec AG (Germany)

- Essilor International (France)

- Haag-Streit AG (Switzerland)

- Inami & Co., Ltd. (Japan)

- Keeler Limited (UK)

- Kowa Company Ltd. (Japan)

- Luneau Technology (France)

- Marco Ophthalmic (USA)

- Medmont International Pty Ltd. (Australia)

- NIDEK Co., Ltd. (Japan)

- Optomed (Finland)

- Reichert Technologies (USA)

- Roche Diagnostics (Switzerland)

- Rudy Optics (Italy)

- Sonomed Escalon (USA)

- Tomey Corporation (Japan)

- Topcon Corporation (Japan)

- Zhejiang University (China), and Other Active Players.

|

Global Ophthalmic Refractometer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 212.9 Billion |

|

Forecast Period 2024-32 CAGR: |

2.9 % |

Market Size in 2032: |

USD 267.60 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ophthalmic Refractometer Market by Product

4.1 Ophthalmic Refractometer Market Snapshot and Growth Engine

4.2 Ophthalmic Refractometer Market Overview

4.3 Portable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Portable: Geographic Segmentation Analysis

4.4 Non- portable

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Non- portable: Geographic Segmentation Analysis

Chapter 5: Ophthalmic Refractometer Market by End User

5.1 Ophthalmic Refractometer Market Snapshot and Growth Engine

5.2 Ophthalmic Refractometer Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals: Geographic Segmentation Analysis

5.4 Clinics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Clinics: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Ophthalmic Refractometer Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AMETEK (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ARL ZEISS MEDITEC (GERMANY)

6.4 BAUSCH + LOMB (USA)

6.5 CANON INC. (JAPAN)

6.6 ESSILOR INTERNATIONAL (FRANCE)

6.7 HEINE OPTOTECHNIK (GERMANY)

6.8 HUVITZ CO. LTD. (SOUTH KOREA)

6.9 LUNEAU TECHNOLOGY (FRANCE)

6.10 NIDEK CO. LTD. (JAPAN)

6.11 OCULUS OPTIKGERÄTE GMBH (GERMANY)

6.12 REICHERT TECHNOLOGIES (USA)

6.13 SHIN-NIPPON (JAPAN)

6.14 TOMEY CORPORATION (JAPAN)

6.15 TOPCON CORPORATION (JAPAN)

6.16 WELCH ALLYN (USA)

6.17

6.18 OTHER ACTIVE PLAYERS

Chapter 7: Global Ophthalmic Refractometer Market By Region

7.1 Overview

7.2. North America Ophthalmic Refractometer Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product

7.2.4.1 Portable

7.2.4.2 Non- portable

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals

7.2.5.2 Clinics

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Ophthalmic Refractometer Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product

7.3.4.1 Portable

7.3.4.2 Non- portable

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals

7.3.5.2 Clinics

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Ophthalmic Refractometer Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product

7.4.4.1 Portable

7.4.4.2 Non- portable

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals

7.4.5.2 Clinics

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Ophthalmic Refractometer Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product

7.5.4.1 Portable

7.5.4.2 Non- portable

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals

7.5.5.2 Clinics

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Ophthalmic Refractometer Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product

7.6.4.1 Portable

7.6.4.2 Non- portable

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals

7.6.5.2 Clinics

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Ophthalmic Refractometer Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product

7.7.4.1 Portable

7.7.4.2 Non- portable

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals

7.7.5.2 Clinics

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Ophthalmic Refractometer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 212.9 Billion |

|

Forecast Period 2024-32 CAGR: |

2.9 % |

Market Size in 2032: |

USD 267.60 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||