Key Market Highlights

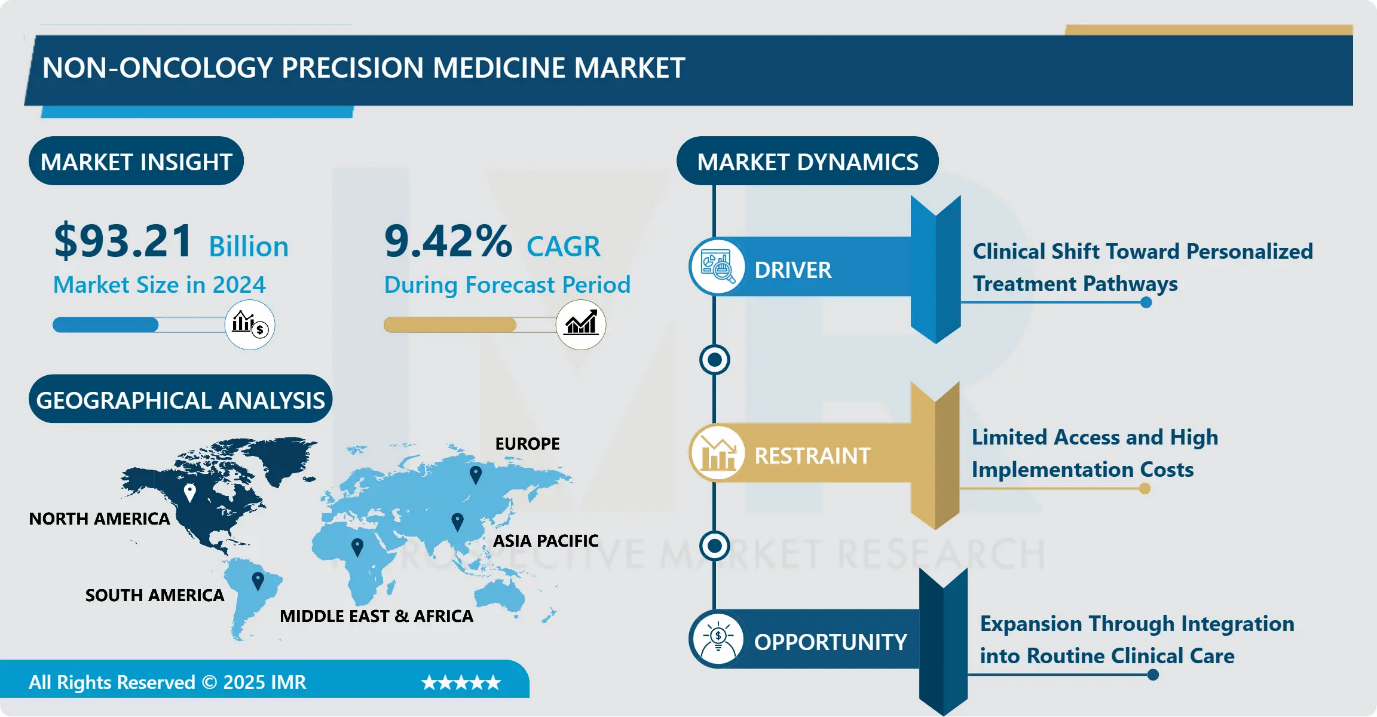

Non-Oncology Precision Medicine Market Size Was Valued at USD 93.21 Billion in 2024, and is Projected to Reach USD 262.95 Billion by 2035, Growing at a CAGR of 9.42% from 2025-2035.

- Market Size in 2024: USD 93.21 Billion

- Projected Market Size by 2035: USD 262.95 Billion

- CAGR (2025–2035): 9.42%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia Pacific

- By Product Type: The Diagnostics segment is anticipated to lead the market by accounting for 55.43% of the market share throughout the forecast period.

- By Application: The Infectious Disease segment is expected to capture 28.32% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 29.30% of the market share during the forecast period.

- Active Players: Pfizer Inc., Qiagen Inc., Quest Diagnostics Inc, Medtronic, Novartis, Laboratory Corporation of America Holdings, bioMérieux SA, Abbott Laboratories, F. Hoffmann-La Roche A, Eli Lilly & Company, and Other Active Players.

Non-Oncology Precision Medicine Market Synopsis:

Non-oncology precision medicine tailors treatments for non-cancer diseases (like heart, neurological, or autoimmune conditions) using a patient's unique genetic, lifestyle, and environmental data, moving beyond "one-size-fits-all" medicine for better outcomes by identifying specific biomarkers and genetic predispositions to guide personalized therapies and prevention. It relies on genomics, data analytics, and digital tools (like wearables) to understand individual variability, offering targeted treatments, improving efficacy, and reducing side effects in areas like cardiovascular, neurological, and rare genetic disorders

Non-Oncology Precision Medicine Market Dynamics and Trend Analysis:

Non-Oncology Precision Medicine Market Growth Driver- Clinical Shift Toward Personalized Treatment Pathways

-

A key growth driver for the non-oncology precision medicine market is the growing clinical shift toward personalized treatment pathways across chronic and complex diseases. Physicians are increasingly moving away from one-size-fits-all therapies and adopting biomarker- and genomics-guided decision-making to improve patient outcomes. In areas such as CNS disorders, immunology, and infectious diseases, patient response to treatment can vary significantly, making precision approaches essential.

- Advances in genomic sequencing, pharmacogenomics, and companion diagnostics now allow clinicians to identify the right therapy for the right patient at the right time. This shift not only improves treatment efficacy but also reduces adverse drug reactions and healthcare costs, driving sustained adoption of non-oncology precision medicine solutions.

Non-Oncology Precision Medicine Market Limiting Factor- Limited Access and High Implementation Costs

-

A major limiting factor for the non-oncology precision medicine market is the limited access to advanced precision technologies due to high implementation costs. Genomic testing platforms, specialized diagnostic equipment, and data interpretation tools require significant upfront investment, making adoption challenging for smaller hospitals and diagnostic centers.

- In addition, the cost of skilled professionals and bioinformatics infrastructure further increases the financial burden. In many regions, inconsistent reimbursement for precision diagnostics also discourages routine clinical use. These factors slow market penetration, particularly in emerging economies, and restrict broader adoption despite strong clinical benefits, thereby acting as a key restraint on overall market growth.

Non-Oncology Precision Medicine Market Expansion Opportunity- Expansion Through Integration into Routine Clinical Care

-

A key expansion opportunity in the non-oncology precision medicine market lies in the integration of precision approaches into routine clinical care. As genomic testing costs decline and turnaround times improve, precision diagnostics are becoming more feasible for everyday use beyond specialized centers. This creates significant opportunities in areas such as cardiovascular, neurological, and infectious diseases, where large patient populations remain underserved.

- Expanding reimbursement coverage, growing clinician awareness, and the use of digital health and AI-driven analytics further support wider adoption. Additionally, emerging markets investing in healthcare infrastructure present untapped potential. Embedding precision medicine into standard treatment guidelines can significantly broaden market reach and drive long-term growth.

Non-Oncology Precision Medicine Market Challenge and Risk- Data Complexity and Clinical Adoption Risk

-

A major challenge and risk in the non-oncology precision medicine market is managing complex genomic data while ensuring consistent clinical adoption. Precision medicine generates large volumes of genetic and biomarker data that require advanced bioinformatics tools and skilled interpretation.

- Variability in data quality, lack of standardized testing protocols, and limited clinician training can hinder accurate decision-making. In addition, integrating precision insights into existing clinical workflows remains challenging, especially in non-specialized healthcare settings. There is also a risk that unclear clinical utility or delayed results may reduce physician confidence. These factors can slow adoption rates and create uncertainty for market players despite strong technological advancement.

Non-Oncology Precision Medicine Market Trend- Shift Toward Multi-Omics and AI-Driven Precision Care

-

A key trend shaping the non-oncology precision medicine market is the shift toward multi-omics integration supported by artificial intelligence and advanced analytics. Healthcare providers are increasingly combining genomics, proteomics, metabolomics, and clinical data to gain a more comprehensive understanding of disease variability beyond oncology.

- AI-driven platforms are improving biomarker discovery, patient stratification, and treatment response prediction, particularly in CNS, immunology, and infectious diseases. At the same time, decentralized testing and point-of-care molecular diagnostics are gaining traction, enabling faster clinical decisions. This trend reflects the market’s move toward more scalable, data-driven, and clinically actionable precision medicine solutions across broader therapeutic areas.

Non-Oncology Precision Medicine Market Segment Analysis:

Non-Oncology Precision Medicine Market is segmented based on Type, Application, End-Users, and Region

By Product Type, Diagnostics segment is expected to dominate the market with around 55.43% share during the forecast period.

-

The diagnostics segment is the fastest-growing product category in the non-oncology precision medicine market. This growth is driven by the increasing clinical reliance on genetic, genomic, and biomarker-based tests to guide treatment decisions across CNS, immunology, infectious, and respiratory diseases. Healthcare providers are prioritizing early and accurate patient stratification to improve therapy outcomes and reduce trial-and-error prescribing.

- Advances in next-generation sequencing, companion diagnostics, and pharmacogenomic testing have made precision diagnostics more accessible and cost-effective. Moreover, diagnostics face shorter development timelines and faster regulatory pathways compared to therapeutics, enabling quicker market penetration. As precision medicine adoption expands beyond oncology into routine care, diagnostics continue to gain traction as the primary entry point for personalized treatment strategies.

By Application, Infectious Disease is expected to dominate with close to 28.32% market share during the forecast period.

-

Infectious diseases represent the fastest-growing application segment in the non-oncology precision medicine market. This growth is driven by the rising need for rapid, pathogen-specific diagnostics and personalized antimicrobial therapies to address drug resistance and treatment variability. Precision medicine approaches, such as genomic sequencing and biomarker-based profiling, are increasingly used to identify strains, predict resistance patterns, and optimize therapy selection.

- Public health initiatives, increased surveillance programs, and post-pandemic investments in molecular diagnostics have further accelerated adoption. Compared to chronic therapeutic areas, infectious diseases benefit from quicker clinical decision cycles and higher testing volumes, supporting faster market uptake. As healthcare systems prioritize accurate, timely interventions, precision medicine in infectious diseases continues to gain strong momentum.

Non-Oncology Precision Medicine Market Regional Insights:

North America region is estimated to lead the market with around 29.30% share during the forecast period.

-

North America’s leadership is driven by advanced healthcare infrastructure, high adoption of genomic diagnostics, strong presence of precision medicine companies, and favorable reimbursement for molecular testing. The region also benefits from early integration of pharmacogenomics into routine clinical practice and robust research funding.

- In contrast, Asia Pacific is witnessing rapid growth due to expanding diagnostic capabilities, rising healthcare investments, growing awareness of personalized therapies, and a large patient population with unmet medical needs. Government initiatives supporting genomics and precision healthcare are further accelerating adoption, positioning Asia Pacific as a key growth engine over the forecast period.

Non-Oncology Precision Medicine Market Active Players:

- Abbott Laboratories, (USA)

- Biomérieux SA, (France)

- Eli Lilly & Company, (USA)

- F. Hoffmann-La Roche AG (Roche) (Switzerland)

- Medtronic Plc, (USA)

- Novartis AG, (Switzerland)

- Other Active Players

- Pfizer Inc, (USA)

- Qiagen Inc (QIAGEN NV), (Germany)

- Quest Diagnostics Inc, (USA)

Key Industry Developments in the Non-Oncology Precision Medicine Market:

- In November 2025, Abbott agreed to acquire Exact Sciences for about $23 billion to strengthen its cancer diagnostics portfolio and accelerate growth in non-invasive screening markets.

- In February 2024, Novartis completed a €2.7 billion acquisition of MorphoSys, strengthening its biologics and precision therapy pipeline, positioning it for growth across multiple therapeutic market

Molecular-Driven Care Transforming Precision Medicine Beyond Oncology

-

The non-oncology precision medicine market is evolving through the integration of advanced diagnostics, data analytics, and targeted therapeutic approaches across multiple disease areas.

- Technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and multi-omics platforms are enabling deeper insights into genetic variations, biomarkers, and disease mechanisms beyond cancer.

- In clinical practice, pharmacogenomics is increasingly used to guide drug selection and dosing in CNS, immunology, cardiovascular, and infectious diseases, improving treatment efficacy while reducing adverse reactions.

- On the therapeutic side, precision biologics, RNA-based therapies, and gene-modulated treatments are gaining traction as they target specific molecular pathways linked to disease progression.

- The growing use of artificial intelligence and bioinformatics tools is further enhancing data interpretation, patient stratification, and clinical decision-making. In parallel, cloud-based platforms are supporting data sharing across hospitals, diagnostic centers, and research institutions.

|

Non-Oncology Precision Medicine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 93.21 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.42 % |

Market Size in 2035: |

USD 262.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Non Oncology Precision Medicine Market by Product (2018-2035)

4.1 Non Oncology Precision Medicine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Diagnostics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Therapeutics

Chapter 5: Non Oncology Precision Medicine Market by Application (2018-2035)

5.1 Non Oncology Precision Medicine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oncology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 CNS

5.5 Immunology

5.6 Respiratory

5.7 Infectious Diseases

5.8 Neurology

5.9 Others

Chapter 6: Non Oncology Precision Medicine Market by End-use (2018-2035)

6.1 Non Oncology Precision Medicine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diagnostic Centers

6.5 Research & Academic Institutes

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Non Oncology Precision Medicine Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 BIOMÉRIEUX SA (FRANCE)

7.4 ELI LILLY & COMPANY (USA)

7.5 F HOFFMANN-LA ROCHE AG (SWITZERLAND)

7.6 MEDTRONIC PLC (USA)

7.7 NOVARTIS AG (SWITZERLAND)

7.8 PFIZER INC (USA)

7.9 QIAGEN INC (GERMANY)

7.10 QUEST DIAGNOSTICS INC (USA)

7.11 AND OTHER ACTIVE PLAYERS.

Chapter 8: Global Non Oncology Precision Medicine Market By Region

8.1 Overview

8.2. North America Non Oncology Precision Medicine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Non Oncology Precision Medicine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Non Oncology Precision Medicine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Non Oncology Precision Medicine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Non Oncology Precision Medicine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Non Oncology Precision Medicine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Non-Oncology Precision Medicine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 93.21 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.42 % |

Market Size in 2035: |

USD 262.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||