Neurotech Devices Market Synopsis:

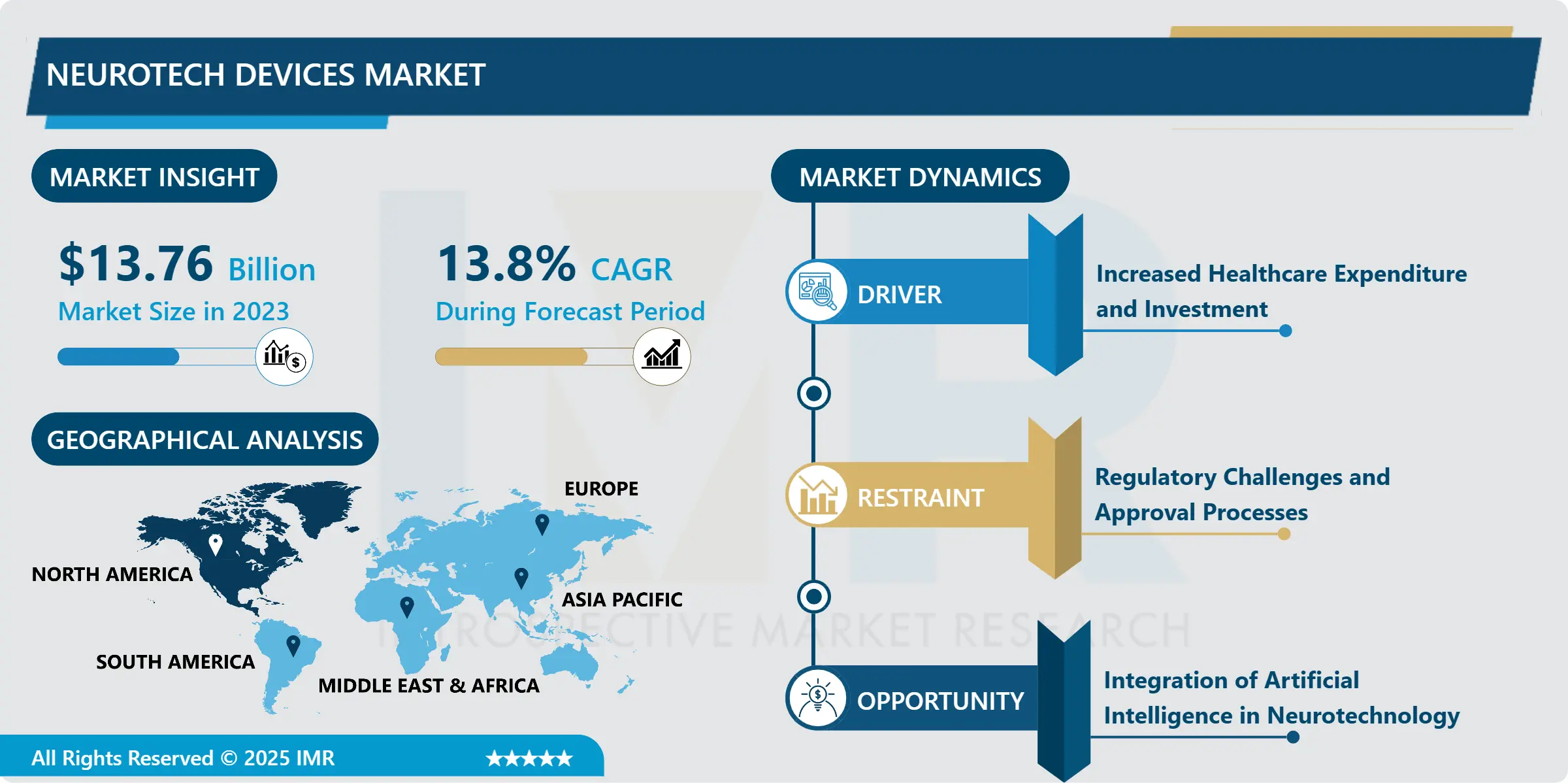

Neurotech Devices Market Size Was Valued at USD 13.76 Billion in 2023, and is Projected to Reach USD 44.07 Billion by 2032, Growing at a CAGR of 13.80% From 2024-2032.

The Neurotech Devices Market definition encompasses any devices used to interact with the nervous system, which includes neurostimulation devices, neuroprosthetics, imaging systems and diagnostics. These technologies are designed to either repair, improve, or track neurological deficits in patients with neurological diseases, providing novel therapeutic options for epilepsy; Parkinson’s disease, chronic pain; and brain injuries. A significant growth in the market is due to improvements in neuroscience, rising incidences of neurological disorders and the quest for better therapeutic interventions.

The global Neurotech Devices Market is primarily fueled by the continually increasing tendency of neurological diseases. Diseases like Alzheimer’s disease, epilepsy and Parkinson’s disease are on the rise as the global demography ages, the global population adopts unhealthy lifestyles, and people inherit unhealthy genes. These disorders are still affecting more people and patients with SCZ, ADHD, and OCD need better modern neurotechnological approaches for the control of symptoms and enhancing the quality of life, so this drives the market higher.

Secondly, the growth in neurotechnology and the enhancement in the neuro interface and neuromodulation, such as advanced technology of BCI, are fueling the demand. All these advancements apart from improving the outcomes of existing therapeutic methods also opens for new possibilities for the use of stem cells. However, as the research continues and new data is revealed the probability of using neurotech devices to deliver patient- and disorder-specific therapies rises which in turn stimulates funding and concern with this field.

Neurotech Devices Market Trend Analysis:

Increasing integration of artificial intelligence (AI) and machine learning in neurotechnological solutions.

-

One trend emerging with the Neurotech Devices Market is the inclusion of artificial intelligence and machine learning into neurotechnological tools. AI technologies are used to improve diagnostic capabilities, better treatment outcomes as well as to monitor patient care. Neuro imaging and patient records provide enormous data for AI to find ‘the needle in the hay stack’ and define a course of action that may be otherwise invisible or unnoticed due to the limitation of human perception.

- Another trend is in the increase of interest in the less invasive and minimally invasive neurotechnology. When people and doctors look for less radical solutions to most surgical operations, the manufacturers design these devices that can produce the same effect as those surgeries without the negative consequences of surgery. It is forcing changes in product development and extending market reach to a wider range of patients who might opt for the non-surgical procedures.

Healthcare infrastructure improves and access to medical technologies increases

-

It has been identified that the Neurotech Devices Market has a high potential for growth in the global Markets with particular reference to newly industrialised countries. Due to successful investments in healthcare and advancement of the technologies needed to hold specialist equipment and implement neurotechnologies, there is a growing demand from countries in Asia Pacific and Latin America. This demand has been bolstered by the growth of knowledge of neurological conditions, the advancements in healthcare, and the apprecation of mental health. The growing patient population in these markets can be valuable for companies that decide to enter these markets and thus participate in the neurotech market’s growth on a global scale.

- Further, external opportunities are derivable from the relationship between the tech firms and the health care organizations. This way, experience of the players from the two industries can be brought to bear as companies look to come up with unique innovative solutions that will make a positive impact in the delivery of healthcare. Taking this into consideration, such partnerships can contribute to the creation of improved and enhanced devices to fit future requirements of patients and clinicians where the value of neurotechnology is already expressed.

Neurotech Devices Market Segment Analysis:

Neurotech Devices Market is Segmented on the basis of Device type, Technology, application, End User, and Region.

By Device Type, Neurostimulation Devices segment is expected to dominate the market during the forecast period

-

Neurotech Devices Market is segmented into different types of devices aimed at treating neurological diseases and improving patients live. Neurostimulation electrodes use electricity to temporarily change the nerve signals, and they are employed for treating pain and disorders including epilepsy and Parkinson. Neuroprosthetics have the purpose of either substituting lost sensory or motor faculties for patients with certain disabilities or provided them with means for movement or speaking again. MRI and CT scanners are imaging technologies that show the depiction of the brain and nervous system used for diagnosing or planning the treatment process. Diagnosis tool includes tools that help in diagnosing neurological disorders while the monitoring tool is used continuously to document patients’ neurological and other essential clinical signs that inform the ongoing patient management. These device types form an integrated system of care and management as well as a diagnostic and therapeutic model for neurologic disorders.

By Application, Pain Management segment expected to held the largest share

-

Neurotechnology devices market found its use in various applications that refer to treating certain neurological diseases and disorders. Pain control is another broader use of neurostimulation devices where the system targets and interrupts pain signals to the brain for chronic pain patients. For instance, in Parkinson’s disease, through neurostimulation, doctors are able to lessen the symptoms including shaking and rigidity which therefore will enhance the patient’s quality of life. This intervention in epilepsy medication therapy is through neuro-stimulation or diagnostic that homeowner to control seizures besides monitoring of brain activity. Cognitive therapy has been present for some time, today depression is also treated with neuromodulation therapies which make traditional therapies more effective. Application concerning traumatic brain injury are and primarily concerned with rehabilitation and, the use of neurotechnology devices with the aim of assisting a person and rebuilding his or her functional capability. Furthermore, the market also includes other applications such as cognitive disorders, neurodegenerative diseases, and a whole range of mental health issues, which proves the extent of neurotechnology application to the human’s health.

Neurotech Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Geographically, North America continues to be the largest market in the Neurotech Devices Market due to its well-established health care industry, implementation of robust health care policies and standards ng, and high health care spending. Currently, the United States is the most advanced country in neurotechnology adaption and invention with a number of research centers and companies focused on neurotech development and market entry. The circumstances of market development in the region are additionally supported by a well-established and developed system of regulation for the introduction of new devices.

- However, technological advancement, increase in neurological disorders, and knowledge of the impact of mental health on population in North America boosts the need of neurotechnology devices. In recent years, global spending to fund knowledge production has increased through research and development initiatives, resulting in new product development and enhancement of current technologies. With this, North America is to remain as the leading market in future while fostering new technological advancements in neurotechnology and enhancing treatment procedures for neurological disorders.

Active Key Players in the Neurotech Devices Market:

- Medtronic (United States)

- Boston Scientific Corporation (United States)

- Abbott Laboratories (United States)

- NeuroPace, Inc. (United States)

- Stryker Corporation (United States)

- Nervive, Inc. (United States)

- LivaNova PLC (United Kingdom)

- Cerebral Therapeutics (United States)

- Nexstim PLC (Finland)

- ElectroCore, Inc. (United States)

- Other Active Players

|

Global Neurotech Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.76 Billion |

|

Forecast Period 2024-32 CAGR: |

13.80 % |

Market Size in 2032: |

USD 44.07 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Neurotech Devices Market by Device Type

4.1 Neurotech Devices Market Snapshot and Growth Engine

4.2 Neurotech Devices Market Overview

4.3 Neurostimulation Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Neurostimulation Devices: Geographic Segmentation Analysis

4.4 Neuroprosthetics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Neuroprosthetics: Geographic Segmentation Analysis

4.5 Imaging Devices

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Imaging Devices: Geographic Segmentation Analysis

4.6 Diagnostic Devices

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Diagnostic Devices: Geographic Segmentation Analysis

4.7 Monitoring Devices

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Monitoring Devices: Geographic Segmentation Analysis

Chapter 5: Neurotech Devices Market by Technology

5.1 Neurotech Devices Market Snapshot and Growth Engine

5.2 Neurotech Devices Market Overview

5.3 Brain-Computer Interface (BCI)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Brain-Computer Interface (BCI): Geographic Segmentation Analysis

5.4 Neuromodulation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Neuromodulation: Geographic Segmentation Analysis

5.5 Neuroimaging

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Neuroimaging: Geographic Segmentation Analysis

Chapter 6: Neurotech Devices Market by Application

6.1 Neurotech Devices Market Snapshot and Growth Engine

6.2 Neurotech Devices Market Overview

6.3 Pain Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pain Management: Geographic Segmentation Analysis

6.4 Parkinson's Disease

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Parkinson's Disease: Geographic Segmentation Analysis

6.5 Epilepsy

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Epilepsy: Geographic Segmentation Analysis

6.6 Depression

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Depression: Geographic Segmentation Analysis

6.7 Traumatic Brain Injury

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Traumatic Brain Injury: Geographic Segmentation Analysis

6.8 Other

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Other: Geographic Segmentation Analysis

Chapter 7: Neurotech Devices Market by End User

7.1 Neurotech Devices Market Snapshot and Growth Engine

7.2 Neurotech Devices Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Clinics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Clinics: Geographic Segmentation Analysis

7.5 Research Institutions

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Research Institutions: Geographic Segmentation Analysis

7.6 Home Care Settings

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Home Care Settings: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Neurotech Devices Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MEDTRONIC (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BOSTON SCIENTIFIC CORPORATION (UNITED STATES)

8.4 ABBOTT LABORATORIES (UNITED STATES)

8.5 NEUROPACE INC. (UNITED STATES)

8.6 STRYKER CORPORATION (UNITED STATES)

8.7 NERVIVE INC. (UNITED STATES)

8.8 LIVANOVA PLC (UNITED KINGDOM)

8.9 CEREBRAL THERAPEUTICS (UNITED STATES)

8.10 NEXSTIM PLC (FINLAND)

8.11 ELECTROCORE INC. (UNITED STATES)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Neurotech Devices Market By Region

9.1 Overview

9.2. North America Neurotech Devices Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Device Type

9.2.4.1 Neurostimulation Devices

9.2.4.2 Neuroprosthetics

9.2.4.3 Imaging Devices

9.2.4.4 Diagnostic Devices

9.2.4.5 Monitoring Devices

9.2.5 Historic and Forecasted Market Size By Technology

9.2.5.1 Brain-Computer Interface (BCI)

9.2.5.2 Neuromodulation

9.2.5.3 Neuroimaging

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Pain Management

9.2.6.2 Parkinson's Disease

9.2.6.3 Epilepsy

9.2.6.4 Depression

9.2.6.5 Traumatic Brain Injury

9.2.6.6 Other

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals

9.2.7.2 Clinics

9.2.7.3 Research Institutions

9.2.7.4 Home Care Settings

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Neurotech Devices Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Device Type

9.3.4.1 Neurostimulation Devices

9.3.4.2 Neuroprosthetics

9.3.4.3 Imaging Devices

9.3.4.4 Diagnostic Devices

9.3.4.5 Monitoring Devices

9.3.5 Historic and Forecasted Market Size By Technology

9.3.5.1 Brain-Computer Interface (BCI)

9.3.5.2 Neuromodulation

9.3.5.3 Neuroimaging

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Pain Management

9.3.6.2 Parkinson's Disease

9.3.6.3 Epilepsy

9.3.6.4 Depression

9.3.6.5 Traumatic Brain Injury

9.3.6.6 Other

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals

9.3.7.2 Clinics

9.3.7.3 Research Institutions

9.3.7.4 Home Care Settings

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Neurotech Devices Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Device Type

9.4.4.1 Neurostimulation Devices

9.4.4.2 Neuroprosthetics

9.4.4.3 Imaging Devices

9.4.4.4 Diagnostic Devices

9.4.4.5 Monitoring Devices

9.4.5 Historic and Forecasted Market Size By Technology

9.4.5.1 Brain-Computer Interface (BCI)

9.4.5.2 Neuromodulation

9.4.5.3 Neuroimaging

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Pain Management

9.4.6.2 Parkinson's Disease

9.4.6.3 Epilepsy

9.4.6.4 Depression

9.4.6.5 Traumatic Brain Injury

9.4.6.6 Other

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals

9.4.7.2 Clinics

9.4.7.3 Research Institutions

9.4.7.4 Home Care Settings

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Neurotech Devices Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Device Type

9.5.4.1 Neurostimulation Devices

9.5.4.2 Neuroprosthetics

9.5.4.3 Imaging Devices

9.5.4.4 Diagnostic Devices

9.5.4.5 Monitoring Devices

9.5.5 Historic and Forecasted Market Size By Technology

9.5.5.1 Brain-Computer Interface (BCI)

9.5.5.2 Neuromodulation

9.5.5.3 Neuroimaging

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Pain Management

9.5.6.2 Parkinson's Disease

9.5.6.3 Epilepsy

9.5.6.4 Depression

9.5.6.5 Traumatic Brain Injury

9.5.6.6 Other

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals

9.5.7.2 Clinics

9.5.7.3 Research Institutions

9.5.7.4 Home Care Settings

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Neurotech Devices Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Device Type

9.6.4.1 Neurostimulation Devices

9.6.4.2 Neuroprosthetics

9.6.4.3 Imaging Devices

9.6.4.4 Diagnostic Devices

9.6.4.5 Monitoring Devices

9.6.5 Historic and Forecasted Market Size By Technology

9.6.5.1 Brain-Computer Interface (BCI)

9.6.5.2 Neuromodulation

9.6.5.3 Neuroimaging

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Pain Management

9.6.6.2 Parkinson's Disease

9.6.6.3 Epilepsy

9.6.6.4 Depression

9.6.6.5 Traumatic Brain Injury

9.6.6.6 Other

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals

9.6.7.2 Clinics

9.6.7.3 Research Institutions

9.6.7.4 Home Care Settings

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Neurotech Devices Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Device Type

9.7.4.1 Neurostimulation Devices

9.7.4.2 Neuroprosthetics

9.7.4.3 Imaging Devices

9.7.4.4 Diagnostic Devices

9.7.4.5 Monitoring Devices

9.7.5 Historic and Forecasted Market Size By Technology

9.7.5.1 Brain-Computer Interface (BCI)

9.7.5.2 Neuromodulation

9.7.5.3 Neuroimaging

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Pain Management

9.7.6.2 Parkinson's Disease

9.7.6.3 Epilepsy

9.7.6.4 Depression

9.7.6.5 Traumatic Brain Injury

9.7.6.6 Other

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals

9.7.7.2 Clinics

9.7.7.3 Research Institutions

9.7.7.4 Home Care Settings

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Neurotech Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.76 Billion |

|

Forecast Period 2024-32 CAGR: |

13.80 % |

Market Size in 2032: |

USD 44.07 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||