Nephrology Drugs Market Synopsis:

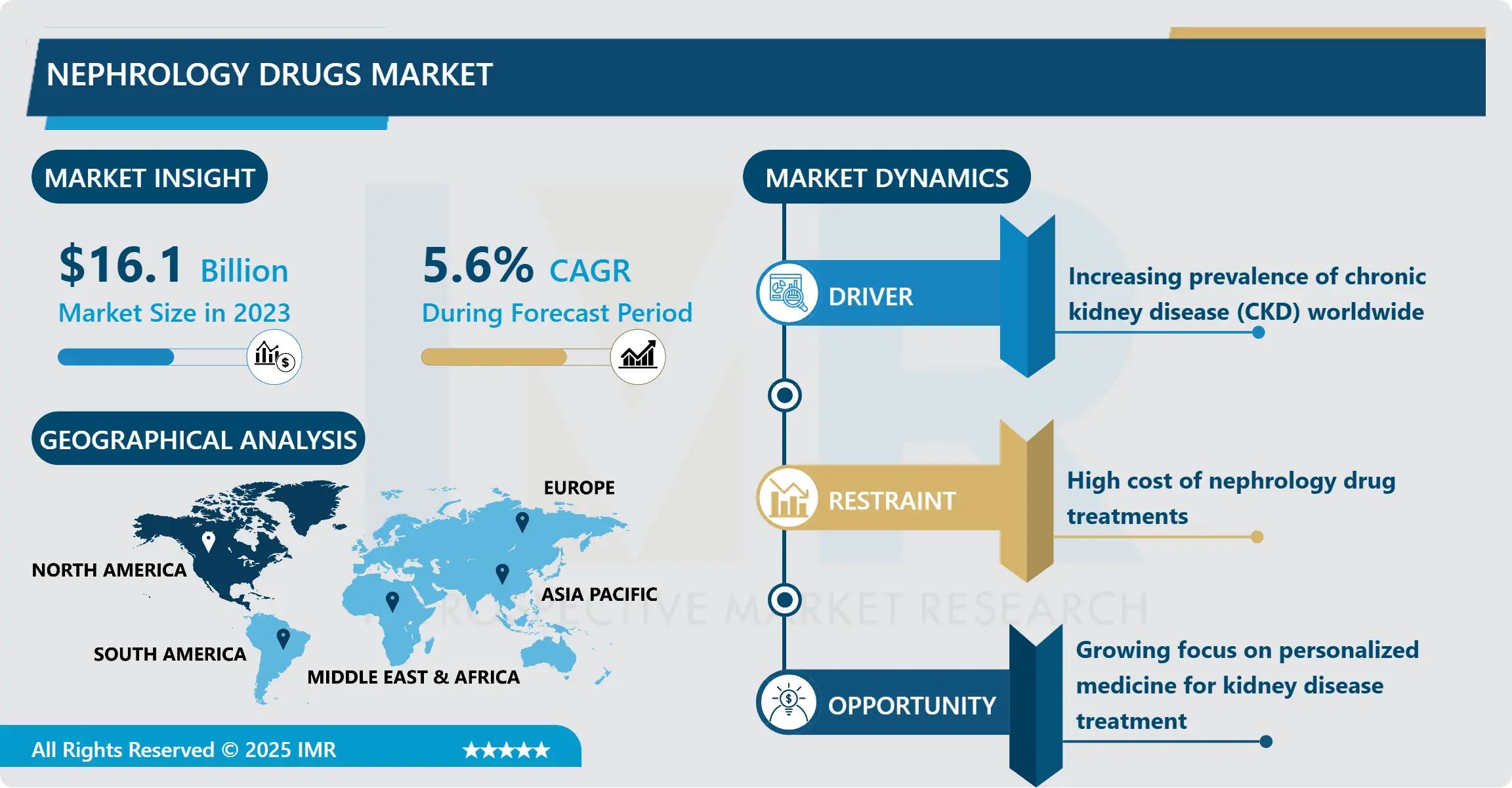

Nephrology Drugs Market Size Was Valued at USD 16.1 Billion in 2023, and is Projected to Reach USD 26.3 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

Nephrology drugs involve drugs used in the treatment of kidney disease inclusive of; Chronic kidney disease (CKD), AKT, Glomerulonephritis, and other similar renal conditions. Such medications include diuretics, ACE inhibitors, phosphate binders, immunosuppressants and countless other therapeutic classes designed to alleviate presenting symptoms, slow progression of kidney disease and enhance overall renal function. Increase in the incidence of kidney diseases and diseases related to kidneys, changes in lifestyles, increasing average age and enhancing consciousness about kidney related diseases enhanced the requirement for nephrology drugs.

The nephrology drugs market has been on the rise over the years due to rising prevalence of chronic kidney diseases across the world. As lifestyle diseases such as hypertension and diabetes increase, CKD and other kidney-related diseases are becoming more common; thereby increasing the market for nephrology treatment. Moreover, enhanced new drug delivery systems and introduction of new specialty drugs and novel focused medicines are the factors driving the market. Global interest in specific nephrology medication development is growing due to the higher demand, and various governments continue to launch health campaigns to enhance the early diagnosis and early treatment of renal diseases, thus promoting market growth.

Another factor is the growing expenditure on R & D services to develop new nephrology drugs including biologics, biosimilars for treating end stage renal diseases and other critical kidney ailments. The expansion of new drugs list – including drugs for the rare kidney disorders and the increment in clinical trial evidences are some of the dynamic features of the industry. In addition, increasing the prevalence of generics making treatments in nephrology conditions more affordable to patients in developing countries is also expected to drive the market.

Nephrology Drugs Market Trend Analysis:

Increased Focus on Biologics and Biosimilars

-

Biologics and biosimilar are now dominating the nephrology drugs market over the past few years as they show better efficacy. Due to their origin from living sources, biologics have gained a lot of prospects to treat chronic kidney diseases that are usually incurable by conventional drugs. Similarly, biosimilars, which are like other approved biologic meds are also trendy mainly due to their effectiveness compared to expensive brand biologics. Hence, this trend is anticipated to be the market’s main driver, facilitated by the increased spending by pharma companies on biologics for nephrology and the continued innovation in R&D carried out biosimilars by regulatory bodies. The use of the various improved forms of treatment is expected to bring about a change in the approach towards the management of kidney related diseases in the subsequent year.

Growing Demand for Personalized Medicine

-

The nephrology drugs market reflects vast potential in the sphere of applied individualized therapeutic and preventive strategies. With the push of precision medicine in healthcare, people are expecting the development of specific nephrology drugs in accordance with the genotype, phenotype, and lifestyle factors of a given patient population. Modern advances in technology assist such that patients experiencing kidney diseases benefit from bodily individualized medication that leads to few side-effects and durable positive outcomes. As pharmacogenomics, the science of how genes impact the effectiveness of medications, progresses, new hopes for specific nephrology treatments are coming up. Drug manufacturing firms wishing to leverage on this form of specialized medicine delivery they should seriously consider investing in personalized nephrology treatments.

Nephrology Drugs Market Segment Analysis:

Nephrology Drugs Market Segmented on the basis of Drug Class, Route of Administration, Distribution Channel, and Region.

By Drug Class, ACE Inhibitors segment is expected to dominate the market during the forecast period

-

When segmented based on the drugs, the ACE inhibitors segment is expected to account for the largest market share for the nephrology drugs market in the near future. Some of ACE (angiotensin-converting enzyme) inhibitors for conditions such as high blood pressure are common amongst CKD patients. Both of these formulations function by dilating the blood vessels, lowering blood pressure and thus the pressure that acts on the kidneys meaning that the rate of kidney deterioration is slowed. Since high blood pressure and diabetes nephropathy are on the rise worldwide, the use of ACE inhibitors will remain on the rise as well. Furthermore, data on the clinical trial of the ACE inhibitors for the reduction of CKD progression and also for avoiding end-stage renal disease have also strengthened the use of ACE inhibitors in nephrology care. Hence, it is believed that this drug class will continue to dominate the market for the next few years.

By Route of Administration, Oral segment expected to held the largest share

-

Based on the route of administration, the oral segment of nephrology drugs is expected to occupy the largest market share. Oral drugs are more preferred by the patients when compared to other routes such as intravenous (IV) etc. because patients can adhere to the regime more easily, time consuming factor also comes in picture where in chronic diseases away from hospital care long terms treatments are more effective. The above trend is further backed by the emergence of new and enhanced oral formulations for drug, which increase the drug’s bioavailability and efficacy. Diuretics, ACE inhibitors and phosphate binders are examples of oral preparations commonly used in management of kidney diseases and are well accepted both by physicians and patients. This coupled with factors such as cost and access brings out the fact that oral drugs remains by far the most dominant segment for nephrology market.

Nephrology Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

For the same year, North America is projected to have the largest share of the nephrology drugs market due to factors such as high incidence of kidney diseases, enhance health facilities, and increased government campaigns for check up and prevention of kidney diseases. The region has already developed a strong pharma market considering higher investment in research and development of nephrology drugs make it a leader in this market.

- According to market research, North America is expected to possess more than 40% market of the global nephrology drugs. Other drivers of the market in the region include the presence of key players and rising number of clinical trials involving innovative nephrology treatments. Further, the reimbursement policies continue to support nephrology and the existence of newly launched therapies is promoting the use of nephrology drugs in the United States and Canada.

Active Key Players in the Nephrology Drugs Market:

- AbbVie Inc. (USA)

- Amgen Inc. (USA)

- AstraZeneca (UK)

- Bayer AG (Germany)

- Bristol-Myers Squibb (USA)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- GlaxoSmithKline plc (UK)

- Johnson & Johnson (USA)

- Merck & Co., Inc. (USA)

- Novartis AG (Switzerland)

- Otsuka Holdings Co., Ltd. (Japan)

- Pfizer Inc. (USA)

- Sanofi (France)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Other Active Players

|

Global Nephrology Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.1 Billion |

|

Forecast Period 2024-32 CAGR: |

5.6% |

Market Size in 2032: |

USD 26.3 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nephrology Drugs Market by Drug Class

4.1 Nephrology Drugs Market Snapshot and Growth Engine

4.2 Nephrology Drugs Market Overview

4.3 ACE Inhibitors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 ACE Inhibitors: Geographic Segmentation Analysis

4.4 Angiotensin Receptor Blockers (ARBs)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Angiotensin Receptor Blockers (ARBs): Geographic Segmentation Analysis

4.5 B-Blockers

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 B-Blockers: Geographic Segmentation Analysis

4.6 Calcium Channel Blockers

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Calcium Channel Blockers: Geographic Segmentation Analysis

4.7 Loop Diuretics

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Loop Diuretics: Geographic Segmentation Analysis

4.8 Erythropoiesis-Stimulating Agents (ESAs)

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Erythropoiesis-Stimulating Agents (ESAs): Geographic Segmentation Analysis

4.9 Phosphate Binders

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Phosphate Binders: Geographic Segmentation Analysis

4.10 Others

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Others: Geographic Segmentation Analysis

Chapter 5: Nephrology Drugs Market by Route of Administration

5.1 Nephrology Drugs Market Snapshot and Growth Engine

5.2 Nephrology Drugs Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oral: Geographic Segmentation Analysis

5.4 Subcutaneous

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Subcutaneous: Geographic Segmentation Analysis

5.5 Intravenous

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Intravenous: Geographic Segmentation Analysis

Chapter 6: Nephrology Drugs Market by Distribution Channel

6.1 Nephrology Drugs Market Snapshot and Growth Engine

6.2 Nephrology Drugs Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacies: Geographic Segmentation Analysis

6.5 Online Pharmacies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Nephrology Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBVIE INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMGEN INC. (USA)

7.4 ASTRAZENECA (UK)

7.5 BAYER AG (GERMANY)

7.6 BRISTOL-MYERS SQUIBB (USA)

7.7 FRESENIUS MEDICAL CARE AG & CO. KGAA (GERMANY)

7.8 GLAXOSMITHKLINE PLC (UK)

7.9 JOHNSON & JOHNSON (USA)

7.10 MERCK & CO. INC. (USA)

7.11 NOVARTIS AG (SWITZERLAND)

7.12 OTSUKA HOLDINGS CO. LTD. (JAPAN)

7.13 PFIZER INC. (USA)

7.14 SANOFI (FRANCE)

7.15 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

7.16 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Nephrology Drugs Market By Region

8.1 Overview

8.2. North America Nephrology Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Class

8.2.4.1 ACE Inhibitors

8.2.4.2 Angiotensin Receptor Blockers (ARBs)

8.2.4.3 B-Blockers

8.2.4.4 Calcium Channel Blockers

8.2.4.5 Loop Diuretics

8.2.4.6 Erythropoiesis-Stimulating Agents (ESAs)

8.2.4.7 Phosphate Binders

8.2.4.8 Others

8.2.5 Historic and Forecasted Market Size By Route of Administration

8.2.5.1 Oral

8.2.5.2 Subcutaneous

8.2.5.3 Intravenous

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Hospital Pharmacies

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Nephrology Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Class

8.3.4.1 ACE Inhibitors

8.3.4.2 Angiotensin Receptor Blockers (ARBs)

8.3.4.3 B-Blockers

8.3.4.4 Calcium Channel Blockers

8.3.4.5 Loop Diuretics

8.3.4.6 Erythropoiesis-Stimulating Agents (ESAs)

8.3.4.7 Phosphate Binders

8.3.4.8 Others

8.3.5 Historic and Forecasted Market Size By Route of Administration

8.3.5.1 Oral

8.3.5.2 Subcutaneous

8.3.5.3 Intravenous

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Hospital Pharmacies

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Nephrology Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Class

8.4.4.1 ACE Inhibitors

8.4.4.2 Angiotensin Receptor Blockers (ARBs)

8.4.4.3 B-Blockers

8.4.4.4 Calcium Channel Blockers

8.4.4.5 Loop Diuretics

8.4.4.6 Erythropoiesis-Stimulating Agents (ESAs)

8.4.4.7 Phosphate Binders

8.4.4.8 Others

8.4.5 Historic and Forecasted Market Size By Route of Administration

8.4.5.1 Oral

8.4.5.2 Subcutaneous

8.4.5.3 Intravenous

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Hospital Pharmacies

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Nephrology Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Class

8.5.4.1 ACE Inhibitors

8.5.4.2 Angiotensin Receptor Blockers (ARBs)

8.5.4.3 B-Blockers

8.5.4.4 Calcium Channel Blockers

8.5.4.5 Loop Diuretics

8.5.4.6 Erythropoiesis-Stimulating Agents (ESAs)

8.5.4.7 Phosphate Binders

8.5.4.8 Others

8.5.5 Historic and Forecasted Market Size By Route of Administration

8.5.5.1 Oral

8.5.5.2 Subcutaneous

8.5.5.3 Intravenous

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Hospital Pharmacies

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Nephrology Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Class

8.6.4.1 ACE Inhibitors

8.6.4.2 Angiotensin Receptor Blockers (ARBs)

8.6.4.3 B-Blockers

8.6.4.4 Calcium Channel Blockers

8.6.4.5 Loop Diuretics

8.6.4.6 Erythropoiesis-Stimulating Agents (ESAs)

8.6.4.7 Phosphate Binders

8.6.4.8 Others

8.6.5 Historic and Forecasted Market Size By Route of Administration

8.6.5.1 Oral

8.6.5.2 Subcutaneous

8.6.5.3 Intravenous

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Hospital Pharmacies

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Nephrology Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Class

8.7.4.1 ACE Inhibitors

8.7.4.2 Angiotensin Receptor Blockers (ARBs)

8.7.4.3 B-Blockers

8.7.4.4 Calcium Channel Blockers

8.7.4.5 Loop Diuretics

8.7.4.6 Erythropoiesis-Stimulating Agents (ESAs)

8.7.4.7 Phosphate Binders

8.7.4.8 Others

8.7.5 Historic and Forecasted Market Size By Route of Administration

8.7.5.1 Oral

8.7.5.2 Subcutaneous

8.7.5.3 Intravenous

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Hospital Pharmacies

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Nephrology Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.1 Billion |

|

Forecast Period 2024-32 CAGR: |

5.6% |

Market Size in 2032: |

USD 26.3 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||