Multiplex Assay Market Synopsis:

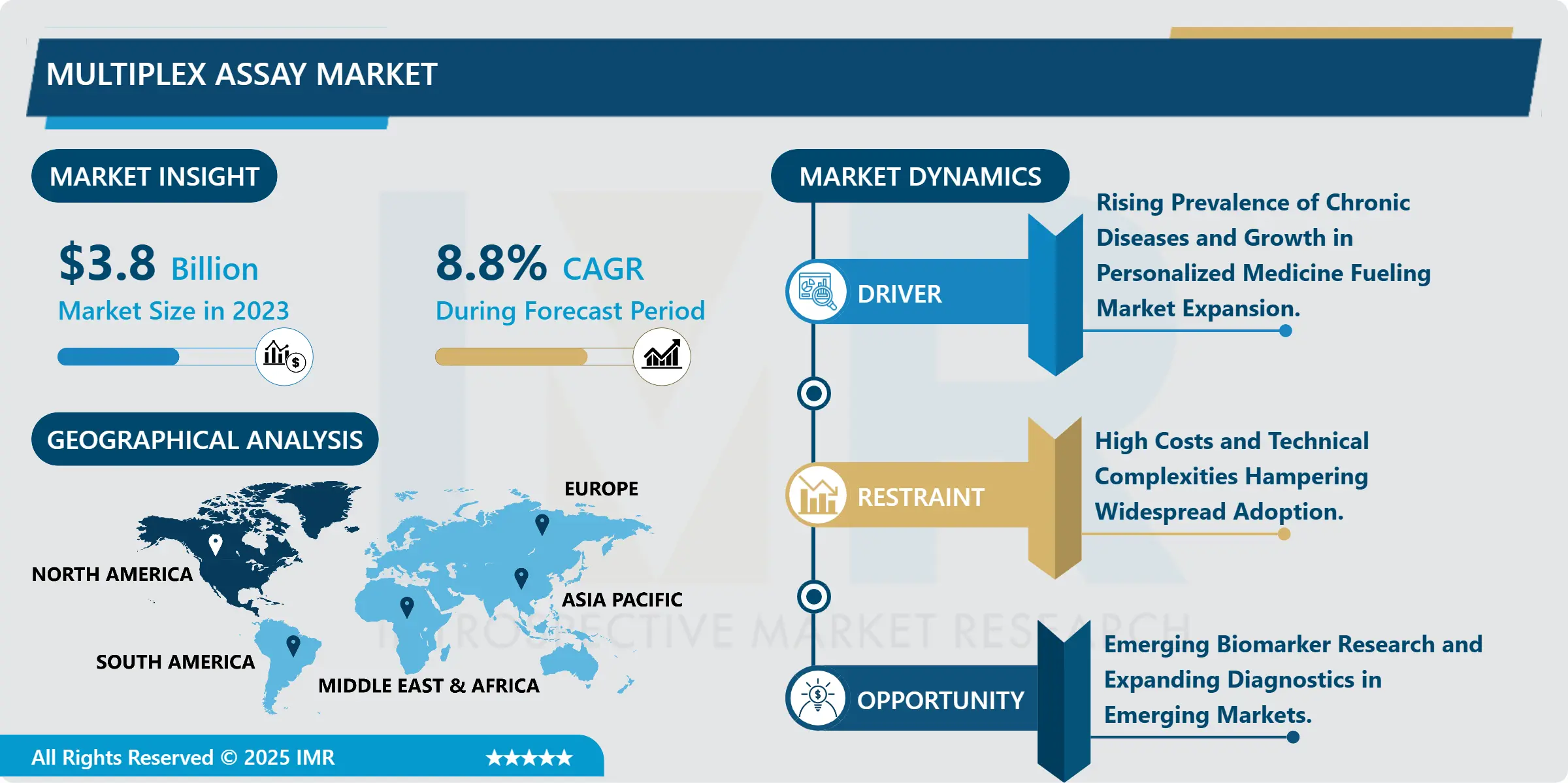

Multiplex Assay Market Size Was Valued at USD 3.8 Billion in 2023, and is Projected to Reach USD 8.13 Billion by 2032, Growing at a CAGR of 8.80% From 2024-2032.

The Multiplex Assay Market concern a laboratory methodology of identifying and quantifying several analytes in a single biological sample. These uses different diseases diagnosis, drugs discovery, clinical trial, biomarker identification, and others. Multiplex assays are used in high-throughput screening, lower costs and are hence useful in the pharmaceutical, biotechnological and clinical laboratories.

The global multiplex assay market growth is mainly attributed to the rising rates of chronic disorders like cancer, diabetes, and autoimmune disorders. Because these conditions necessitate early identification and repeated testing, multiplex assays represent a valuable technique for detecting a number of biomarkers simultaneously. Also, the increasing consciousness towards the niche segment of pharmacogenomics and toxicogenomic, which makes a need for exact diagnostic tools for effective treatment, fuels the growth of multiplex assays in different levels of studies.

One of them is a growing interest in the investment in drug development and clinical trials in the Asian market. The multiplex assays have thus found widespread use in drug discovery processes of Pharmaceutical and biotech companies because the various pharmaceutical interactions can be analyzed at once. This does not only foster increased speed in the discovery process but also, minimize overall expenses, making multiplex assay technologies even more popular rising throughout the world.

Multiplex Assay Market Trend Analysis:

The shift towards automation and integration with advanced technologies such as artificial intelligence.

-

A major trend that is already beginning to arise in the multiplex assay market is the automation and coupling with other technologies like artificial intelligence (AI) and machine learning. Multiplex assay systems are automating rooftops of the laboratories, and increasing rates of accuracy as well as scaling up data analysis. Moreover, multiple assay integration with AI algorithms has been employed to help interpret the big data that is obtained furthering the technology usage in precision medicine and diagnostics.

- Another trend is the general tendency of multiplication of POC multiplex assays in diagnostics. As demands for faster, point of care testing continue to rise, multiplex assays are being created for portable platforms that can provide results in real time. This trend has more implications in the low-end scenarios where unfortunately, centralized laboratories are not easily accessible, or during emergency medical situations where the results are needed on the double.

The increasing focus on personalized therapies.

-

The shifting focus away from global protein profiling through the implementation of biomarker-based research is expected to provide multiple opportunities to the multiplex assay market. High demand for multiplex assays in recent years is due to growing attention towards individualised therapy, and especially in one-myology. This presents an opportunity for market players to innovate next generation multiplex platforms built for certain diseases or therapeutic areas that would address increasing trends in precision medicine.

- In addition to that, other regions such as Asia-Pacific and Latin America have vast growth opportunities for future growth. These regions are anticipated to become promising markets for multiplex assay products as government policies for the development of heath care infrastructure and adoption of advanced diagnostic tools emerges. However, those firms that can take advantage of these markets and partnerships with local health care and research institutions will definitely benefit.

Multiplex Assay Market Segment Analysis:

Multiplex Assay Market is Segmented on the basis of Product Type, Technology, Application, End User, and Region.

By Product Type, Consumables segment is expected to dominate the market during the forecast period

-

Based on the product type the Multiplex Assay Market can be segmented into consumables, instruments and software and services. Specific accessories like reagents for multiplex assays and assay kits or microplates used often make repeated orders necessary. Instruments are analytical machines such as multiplex assay analyzers and readers through which the assays are carried out and data obtained. Because these assays generate large volumes of data, software and services for data handling, analysis and interpretation purposes have been developed to provide solutions for data management and application in the research and clinical setting where these assays are applied.

By Application, Research & Development segment expected to held the largest share

-

Sub-type wise, the Multiplex Assay Market is categorized by its applications as follows: research purposes & outings, diagnostics, companion diagnostics and many more. In research & development, multiple assays are very useful in analyzing several biomarkers and biological pathways at once that speeds up the drug discovery & overall scientific process. The clinical diagnostics use multiplex assays, which are used in the detection and control of diseases since they are rapid and efficient ways of testing several parameters at one instance. The companion diagnostic provides multiplex assays, mainly in the field of personalized medicine, with specific aims at identifying patients most likely to benefit from particular treatments. The applications within the “others” category include food safety testing and environmental monitoring applications.

Multiplex Assay Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America holds the largest share in the multiplex assay market across the world. This dominance is as a result of enhanced infrastructure in healthcare, advanced biotechnology, and have the highest research and development investment. The US alone has many market leaders involved in the research and marketing of multiplex assay technologies, which is a considerable asset to market control. Furthermore, the growth in the rate of chronic diseases and the increased utilization of personalized medicine have also attributed to the continuous steep need for multiplex assays in the same region.

- This is because the regulatory framework of the market starting with North America particularly the United States supports the dominance of the market tremendously. Flourishing regulatory policies guarantee the high quality and security of diagnostic devices and thus apply multiplex assays in clinical diagnosis as well as experimental studies. The availability of key players in the volume involved pharmaceutical firms and academic research facilities in the North American market also fuels the development of the multiplex assay market.

Active Key Players in the Multiplex Assay Market:

- Luminex Corporation (United States)

- Bio-Rad Laboratories, Inc. (United States)

- Thermo Fisher Scientific Inc. (United States)

- QIAGEN (Netherlands)

- Meso Scale Diagnostics, LLC. (United States)

- Merck KGaA (Germany)

- Seegene, Inc. (South Korea)

- PerkinElmer, Inc. (United States)

- Becton, Dickinson and Company (United States)

- Abcam plc (United Kingdom)

- Other Active Players

|

Global Multiplex Assay Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.80 Billion |

|

Forecast Period 2024-32 CAGR: |

8.80% |

Market Size in 2032: |

USD 8.13 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Multiplex Assay Market by Product Type

4.1 Multiplex Assay Market Snapshot and Growth Engine

4.2 Multiplex Assay Market Overview

4.3 Consumables

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Consumables: Geographic Segmentation Analysis

4.4 Instruments

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Instruments: Geographic Segmentation Analysis

4.5 Software and Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Software and Services: Geographic Segmentation Analysis

Chapter 5: Multiplex Assay Market by Technology

5.1 Multiplex Assay Market Snapshot and Growth Engine

5.2 Multiplex Assay Market Overview

5.3 Flow Cytometry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Flow Cytometry: Geographic Segmentation Analysis

5.4 Fluorescence Detection

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fluorescence Detection: Geographic Segmentation Analysis

5.5 Luminescence

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Luminescence: Geographic Segmentation Analysis

5.6 Multiplex RT-PCR

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Multiplex RT-PCR: Geographic Segmentation Analysis

5.7 Others)

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others): Geographic Segmentation Analysis

Chapter 6: Multiplex Assay Market by Application

6.1 Multiplex Assay Market Snapshot and Growth Engine

6.2 Multiplex Assay Market Overview

6.3 Research & Development

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Research & Development: Geographic Segmentation Analysis

6.4 Clinical Diagnostics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinical Diagnostics: Geographic Segmentation Analysis

6.5 Companion Diagnostics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Companion Diagnostics: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Multiplex Assay Market by End User

7.1 Multiplex Assay Market Snapshot and Growth Engine

7.2 Multiplex Assay Market Overview

7.3 Pharmaceutical & Biotechnology Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Pharmaceutical & Biotechnology Companies: Geographic Segmentation Analysis

7.4 Hospitals & Research Institutes

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Hospitals & Research Institutes: Geographic Segmentation Analysis

7.5 Reference Laboratories

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Reference Laboratories: Geographic Segmentation Analysis

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Multiplex Assay Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LUMINEX CORPORATION (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BIO-RAD LABORATORIES INC. (UNITED STATES)

8.4 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

8.5 QIAGEN (NETHERLANDS)

8.6 MESO SCALE DIAGNOSTICS LLC. (UNITED STATES)

8.7 MERCK KGAA (GERMANY)

8.8 SEEGENE INC. (SOUTH KOREA)

8.9 PERKINELMER INC. (UNITED STATES)

8.10 BECTON

8.11 DICKINSON AND COMPANY (UNITED STATES)

8.12 ABCAM PLC (UNITED KINGDOM)

8.13 OTHER ACTIVE PLAYERS

Chapter 9: Global Multiplex Assay Market By Region

9.1 Overview

9.2. North America Multiplex Assay Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Consumables

9.2.4.2 Instruments

9.2.4.3 Software and Services

9.2.5 Historic and Forecasted Market Size By Technology

9.2.5.1 Flow Cytometry

9.2.5.2 Fluorescence Detection

9.2.5.3 Luminescence

9.2.5.4 Multiplex RT-PCR

9.2.5.5 Others)

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Research & Development

9.2.6.2 Clinical Diagnostics

9.2.6.3 Companion Diagnostics

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Pharmaceutical & Biotechnology Companies

9.2.7.2 Hospitals & Research Institutes

9.2.7.3 Reference Laboratories

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Multiplex Assay Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Consumables

9.3.4.2 Instruments

9.3.4.3 Software and Services

9.3.5 Historic and Forecasted Market Size By Technology

9.3.5.1 Flow Cytometry

9.3.5.2 Fluorescence Detection

9.3.5.3 Luminescence

9.3.5.4 Multiplex RT-PCR

9.3.5.5 Others)

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Research & Development

9.3.6.2 Clinical Diagnostics

9.3.6.3 Companion Diagnostics

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Pharmaceutical & Biotechnology Companies

9.3.7.2 Hospitals & Research Institutes

9.3.7.3 Reference Laboratories

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Multiplex Assay Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Consumables

9.4.4.2 Instruments

9.4.4.3 Software and Services

9.4.5 Historic and Forecasted Market Size By Technology

9.4.5.1 Flow Cytometry

9.4.5.2 Fluorescence Detection

9.4.5.3 Luminescence

9.4.5.4 Multiplex RT-PCR

9.4.5.5 Others)

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Research & Development

9.4.6.2 Clinical Diagnostics

9.4.6.3 Companion Diagnostics

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Pharmaceutical & Biotechnology Companies

9.4.7.2 Hospitals & Research Institutes

9.4.7.3 Reference Laboratories

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Multiplex Assay Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Consumables

9.5.4.2 Instruments

9.5.4.3 Software and Services

9.5.5 Historic and Forecasted Market Size By Technology

9.5.5.1 Flow Cytometry

9.5.5.2 Fluorescence Detection

9.5.5.3 Luminescence

9.5.5.4 Multiplex RT-PCR

9.5.5.5 Others)

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Research & Development

9.5.6.2 Clinical Diagnostics

9.5.6.3 Companion Diagnostics

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Pharmaceutical & Biotechnology Companies

9.5.7.2 Hospitals & Research Institutes

9.5.7.3 Reference Laboratories

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Multiplex Assay Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Consumables

9.6.4.2 Instruments

9.6.4.3 Software and Services

9.6.5 Historic and Forecasted Market Size By Technology

9.6.5.1 Flow Cytometry

9.6.5.2 Fluorescence Detection

9.6.5.3 Luminescence

9.6.5.4 Multiplex RT-PCR

9.6.5.5 Others)

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Research & Development

9.6.6.2 Clinical Diagnostics

9.6.6.3 Companion Diagnostics

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Pharmaceutical & Biotechnology Companies

9.6.7.2 Hospitals & Research Institutes

9.6.7.3 Reference Laboratories

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Multiplex Assay Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Consumables

9.7.4.2 Instruments

9.7.4.3 Software and Services

9.7.5 Historic and Forecasted Market Size By Technology

9.7.5.1 Flow Cytometry

9.7.5.2 Fluorescence Detection

9.7.5.3 Luminescence

9.7.5.4 Multiplex RT-PCR

9.7.5.5 Others)

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Research & Development

9.7.6.2 Clinical Diagnostics

9.7.6.3 Companion Diagnostics

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Pharmaceutical & Biotechnology Companies

9.7.7.2 Hospitals & Research Institutes

9.7.7.3 Reference Laboratories

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Multiplex Assay Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.80 Billion |

|

Forecast Period 2024-32 CAGR: |

8.80% |

Market Size in 2032: |

USD 8.13 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||