Medical Swabs Market Overview

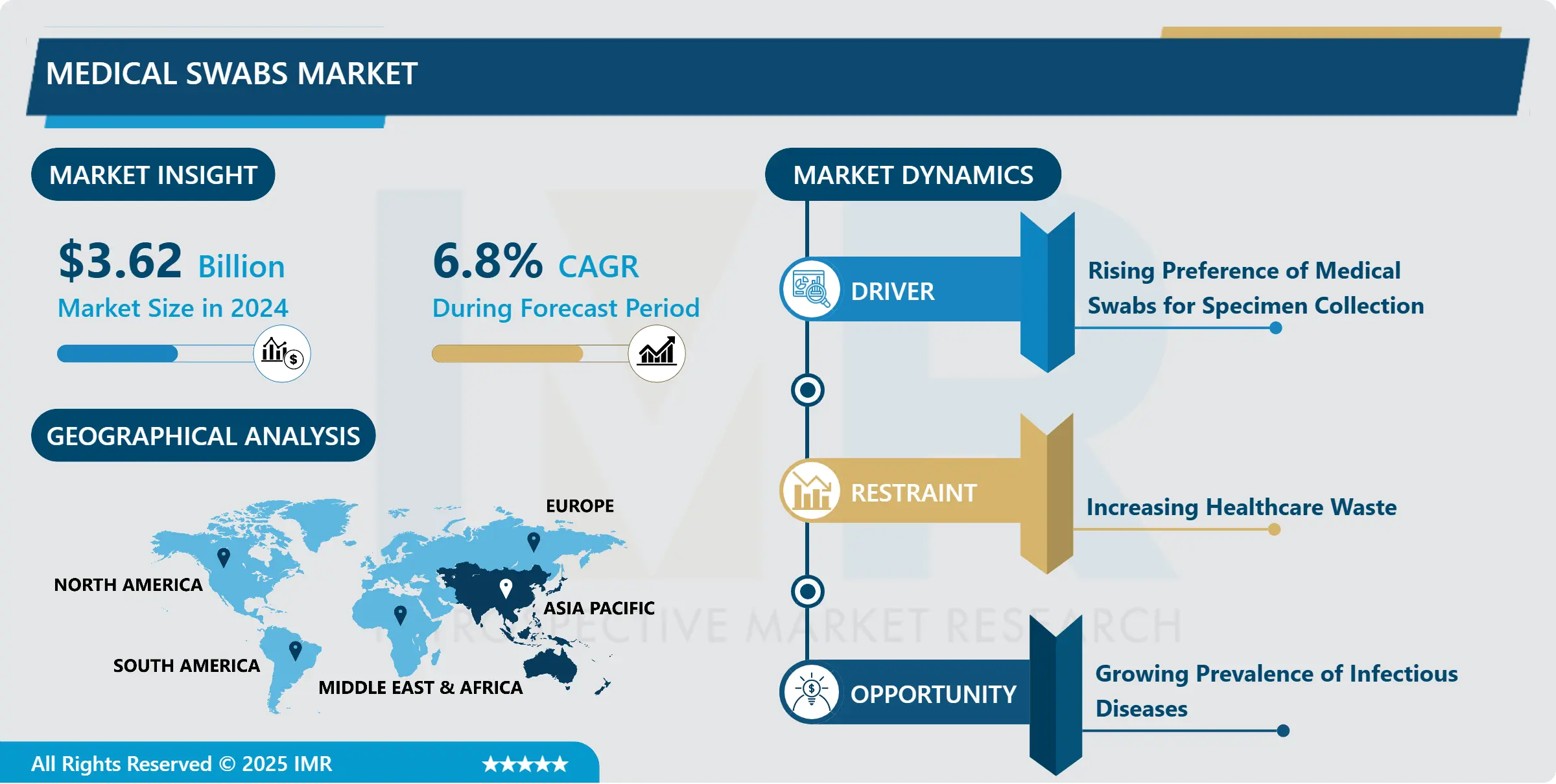

Medical Swabs Market Size Was Valued at USD 3.62 Billion in 2024, and is Projected to Reach USD 7.46 Billion by 2035, Growing at A CAGR of 6.8% From 2025 to 2035.

The swab is a medical device that is utilized to collect biological samples from the human body and to transport and preserve the samples. All swabs used to obtain microbiological samples are considered invasive medical devices that must adhere to the Medical Devices Directive 93/42/EEC. The tube with the medium must comply with Directive 98/79/EC on in vitro diagnostic medical devices in the case of swabs with transport medium. A medical swab is made up of two parts: a head and a shaft. Natural fibers (such as cotton) or inorganic and inert fibers (such as viscose, polyester, and flocked fibers) can be utilized to make the swab head. Depending on the intended usage, each material has distinct properties that must be evaluated by a healthcare professional. Flocked fiber-headed swabs are ideal for use with liquid transport media because they have the best sample absorption and elution capability. The swab shaft can be manufactured of a variety of materials, including wood, polystyrene, and aluminum, and is selected based on the sampling point. The shaft of flocked swabs is constructed of polystyrene, and different shafts and head shapes are available based on their intended application, such as nasopharyngeal, urethral, pediatric, and standard. The growing cases of viral disorders that require swab collections are the main factor propelling the growth of the medical swabs market.

Market Dynamics And Key Factors for Medical Swabs Market

Drivers:

- The rising prevalence of COVID-19 cases is the major factor driving the development of the medical swabs market. The outbreak of COVID-19 that originated in China rapidly spread to other parts of the world. As of March 25, 2022, 478 million positive cases were reported globally. Medical swabs played an important role in specimen collection. For instance, the flocked swab was a significant advancement in microbiology since its properties make it a lot more user-friendly and efficient product, both in PCR and for seeding machine automation. Microbiological testing laboratories appreciate its numerous advantages over traditional swabs, including compatibility with new automated inoculation and sample seeding equipment, as well as the ease with which it collects, transports, and processes microbiological samples, all of which contribute to the growth of the medical swabs market.

- Medical swabs with a foam tip can be utilized for disinfection. When it comes to cleaning, foam is a powerhouse. Due to its high absorbency, it's ideal for removing debris and particles. Most cleaning chemicals are suitable for this type of swab. Even acetone can be used with chemical-resistant foam swabs. Foam tip swabs' handles can be made of several materials, including firm wood and stiff-molded polypropylene, as well as a hollow or solid flexible plastic. The tip is solidly connected to survive rigorous use, including industrial cleaning or specimen collection applications, even though it is designed for single usage. Precision manufacturing, fiber optics, electronics, semiconductors, printing, aerospace, biotechnology, and pharmaceuticals are just a few of the industries where foam-tipped applicators are utilized thus, strengthening the development of the medical swabs market in the forecasted timeframe.

Restraints:

- About 85% of the waste created by healthcare activities is general, non-hazardous waste. The remaining 15% is designated as hazardous waste, which may contain infectious, toxic, or radioactive materials. Infectious waste includes waste contaminated with blood and other bodily fluids (e.g., swabs, bandages, and disposable medical devices), cultures and stocks of infectious agents from laboratory work (e.g., waste from autopsies and infected animals from laboratories), and waste from patients with infections (e.g., swabs, bandages, and disposable medical devices). With the growing number of COVID-19 tests, the debris generated by swabs was also higher. Any mishandling while disposing of infectious swabs may result in medical havoc thus, hampering the growth of the medical swabs market.

Opportunities:

- The growing prevalence of infectious diseases and the outbreak of COVID-19 created a profitable opportunity for the market players. RT-PCR was the major test done to conclude, whether an individual is suffering from COVID-19 or not. For PCR testing a nasal pharyngeal swab or a pharyngeal swab is taken. Moreover, medical swabs are also utilized for disinfection purposes. With the growing healthcare infrastructure, the demand for medical swabs is expected to increase. The increasing prevalence of influenza and COVID-19 cases will create a profitable opportunity for the market players.

Segmentation Analysis of Medical Swabs Market

- By Type, the cotton-tipped segment is anticipated to have the highest share of the medical swabs market over the forecast period. The cotton tip of the medical cotton swab has strong water absorption. The disinfectant can wipe the skin even when it is full of disinfectant to achieve the disinfection effect. It can be used for cosmetics and makeup removal, as well as skin disinfection and surgical dressing during injections. The medical cotton swab has a smooth texture and is comprised of 100 percent natural high-quality cotton. It is clean and hygienic after high-temperature treatment. Cotton tipped medical swabs are utilized for specimen collection as these are properly sterilized thus, supporting the growth of the segment.

- By Application, the specimen collection segment is expected to dominate the medical swabs market throughout the projected timeframe. The increasing prevalence of diseases and the outbreak of the COVID-19 pandemic has stimulated the growth of the segment. For instance, 782 million samples for COVID-19 were tested as of March 21, 2022. Similar tests were conducted across the European and American regions. The usage of cotton-tipped swabs for respiratory specimen collection is included in the WHO's general guidelines for respiratory specimen collection, and it has been reported to be reliable for respiratory retroviruses like influenza specifically. An increase in the number of individuals suffering from influenza and COVID-19 has stimulated the demand for medical swabs for specimen collection purposes.

- By End-User, the hospitals & clinics segment is expected to have the highest share of the medical swabs market in the projected timeframe. Most of the individuals prefer hospitals and clinics for swab sampling. Hospitals have special rooms for swab collection. Additionally, they conduct safety management strategies in aspects of specimen collection environment, collectors, sampling methods, and specimen management resulting in reduced infection risk of suspected cases and nursing staff, improving the standardization of biological specimen collection and ensuring the quality of specimens thus, supporting the growth of the segment.

Regional Analysis Of Medical Swabs Market

- The medical swabs market in the Asia-Pacific region is anticipated to develop at the highest CAGR throughout the projected timeframe attributed to the outbreak of COVID-19 in this region. China and India are the two major highly populated countries in this region. 782, 160, 90, 82, 65, and 53 million swab tests were conducted in India, China, Indonesia, Vietnam, Australia, and Malaysia respectively. The outbreak of viral infections has also promoted the usage of medical swabs for the accurate diagnosis of a specific disease. The usage of medical swabs for the spreading of culture on agar media has prompted manufacturers to develop lab-grade medical swabs thus, boosting the growth of the market in this region.

- The North American region is anticipated to have the highest share of the medical swabs market during the forecast period. Medical swans are utilized by individuals in this region for various purposes such as specimen collection and disinfection. For instance, Foam swabs can be used dry or moistened with isopropyl alcohol or deionized water. Tips come in a range of shapes and sizes and handle come in a variety of lengths and materials. These swabs' versatility makes them perfect for a variety of cleaning tasks, especially in hard-to-reach areas. Approximately 972 million swabs in the US and 16 million swabs in Mexico were collected for specimen sampling. Thus, the increasing cases of COVID-19 and other influenza diseases are expected to boost the growth of the medical swabs market in this region.

- The European region is expected to have the second-highest share of the medical swabs market in the projected timeframe. The UK, Spain, France, Italy, and Austria are the prominent countries driving the growth of the market in this region. Approximately 495, 471, 246, 195, and 170 million tests were conducted in the respective countries till March 21, 2022. The outbreak of COVID-19 is the main factor supporting the growth of the medical swabs market in this region. Moreover, the prevalence of influenza in European countries has stimulated the demand for medical swabs. Approximately 3 million individuals were tested for influenza season for 2021-2022. The rise in the number of COVID-19 and influenza cases is the major factor supporting the development of the medical swabs market.

Players Covered In Medical Swabs Market are

- BD (U.S.)

- 3M (U.S.)

- Copan Diagnostics Inc. (U.S.)

- Roche Diagnostics (Switzerland)

- FL MEDICAL SRL (Italy)

- DLS Medical (U.K.)

- Dynarex (U.S.)

- Avacare Pharma (India)

- Puritan Medical Products (U.S.) and other major players.

Key Industry Developments In Medical Swabs Market

- In July 2023, Rhinostics launched a new innovation in automated sample collection with the introduction of the patent-pending ELEstic™ swab collection device and the revolutionary ELEbot™ Decapper.

- In January 2023, the University of South Florida (USF) received the prestigious Patents for Humanity award from the U.S. Patent and Trademark Office (USPTO). The recognition was for its innovative 3D-printed nasopharyngeal (NP) swab, developed early in the COVID-19 pandemic to address disruptions in the commercial supply of traditional flocked NP swabs, which are essential for diagnostic testing.

|

Medical Swabs Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8% |

Market Size in 2035: |

USD 7.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Swabs Market by Type (2018-2035)

4.1 Medical Swabs Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cotton Tipped

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Foam Tipped

4.5 Non-woven

4.6 Others

Chapter 5: Medical Swabs Market by Application (2018-2035)

5.1 Medical Swabs Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Specimen Collection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Disinfection

5.5 Others

Chapter 6: Medical Swabs Market by End-User (2018-2032)

6.1 Medical Swabs Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Laboratories & Diagnostic Centers

6.5 Research Institutes s

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medical Swabs Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NESTLÉ

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SOYLENT

7.4 ABBOTT

7.5 HERBALIFE INTERNATIONAL OF AMERICA INCSLIMFAST

7.6 BLUE DIAMOND GROWERS

7.7 GLANBIA PLCGENERAL MILLS INCORGAIN INCBOB’S RED MILL NATURAL FOODS

7.8 HEALTHY 'N FIT INTERNATIONAL INCKELLOGG NA COENCORE

7.9 PEPSICO

7.10 LABRADA.COM

7.11 VEGA

7.12 ICONIC PROTEIN

7.13 UNITED STATES NUTRITION INCMET-RX SUBSTRATE TECHNOLOGY INCWORLDPANTRY.COM INCCYTOSPORT INCOWYN

7.14 PREMIER NUTRITION CORPORATION

Chapter 8: Global Medical Swabs Market By Region

8.1 Overview

8.2. North America Medical Swabs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Cotton Tipped

8.2.4.2 Foam Tipped

8.2.4.3 Non-woven

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Specimen Collection

8.2.5.2 Disinfection

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Laboratories & Diagnostic Centers

8.2.6.3 Research Institutes s

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Medical Swabs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Cotton Tipped

8.3.4.2 Foam Tipped

8.3.4.3 Non-woven

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Specimen Collection

8.3.5.2 Disinfection

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Laboratories & Diagnostic Centers

8.3.6.3 Research Institutes s

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Medical Swabs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Cotton Tipped

8.4.4.2 Foam Tipped

8.4.4.3 Non-woven

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Specimen Collection

8.4.5.2 Disinfection

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Laboratories & Diagnostic Centers

8.4.6.3 Research Institutes s

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Medical Swabs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Cotton Tipped

8.5.4.2 Foam Tipped

8.5.4.3 Non-woven

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Specimen Collection

8.5.5.2 Disinfection

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Laboratories & Diagnostic Centers

8.5.6.3 Research Institutes s

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Medical Swabs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Cotton Tipped

8.6.4.2 Foam Tipped

8.6.4.3 Non-woven

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Specimen Collection

8.6.5.2 Disinfection

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Laboratories & Diagnostic Centers

8.6.6.3 Research Institutes s

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Medical Swabs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Cotton Tipped

8.7.4.2 Foam Tipped

8.7.4.3 Non-woven

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Specimen Collection

8.7.5.2 Disinfection

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Laboratories & Diagnostic Centers

8.7.6.3 Research Institutes s

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Medical Swabs Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8% |

Market Size in 2035: |

USD 7.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||