Medical Electronics Market Synopsis:

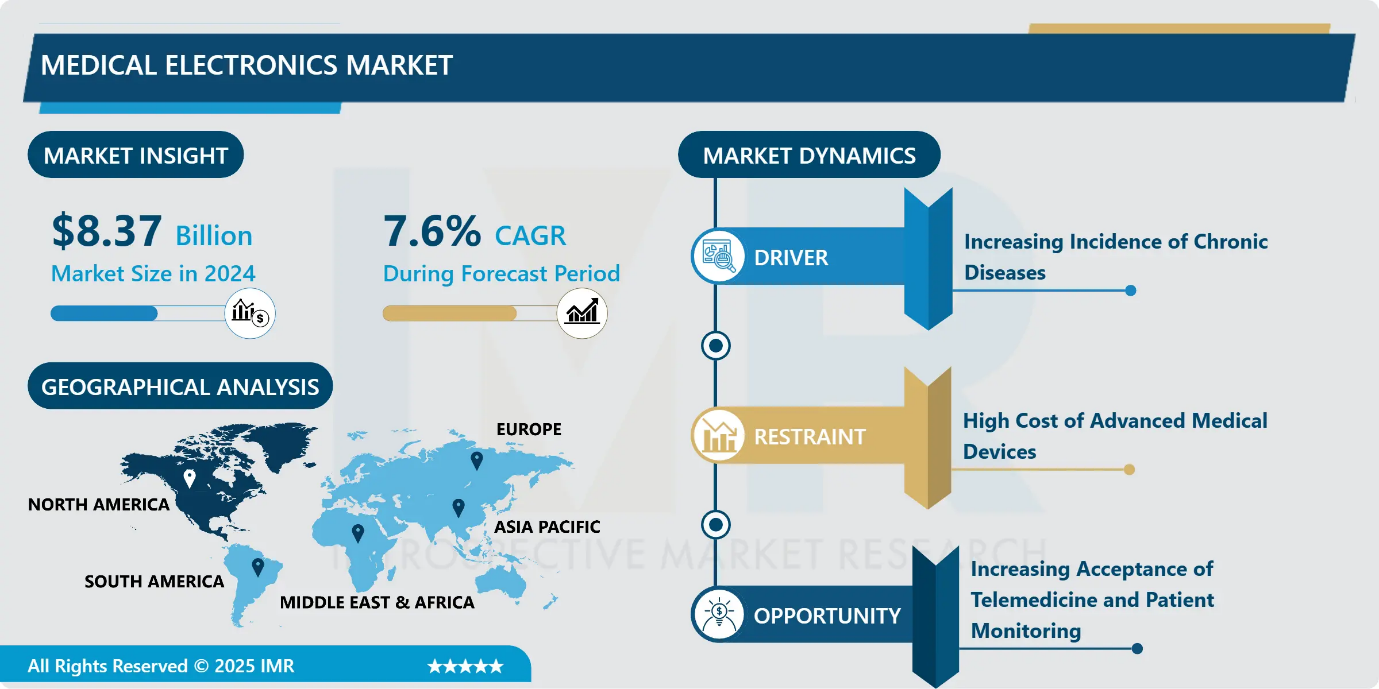

The Medical Electronics Market Size Was Valued at USD 8.37 billion in 2024, and is projected to reach USD 15.02 billion by 2032, growing at a CAGR of 7.6% from 2025-2032.

Medical Electronics is the field of electronics that involves the design, development, and utilization of electronic devices and systems for medical purposes like diagnosis, monitoring, treatment, and research, and maintaining the health and well-being of patients.

Medical Electronics are widely used in monitoring electronic devices that constantly monitor vital signs such as heart rate, blood pressure, and oxygen levels, particularly in intensive care units (ICUs) and operating rooms. Therapeutic uses of medical electronics also involve treating patients using devices such as pacemakers for the control of heartbeats, defibrillators for the correction of irregular heart rhythms, and infusion pumps for controlled drug administration. Moreover, they support rehabilitation using devices like hearing aids, prosthetic limb controllers, and neuromuscular stimulators. With telemedicine and wearable technology becoming more prevalent, medical electronics also facilitate remote patient monitoring, providing improved management of chronic diseases and easier access to healthcare services.

According to an article published in the BMC Pulmonary Medicine Journal, it has been noted that a chest x-ray was employed to diagnose and track COVID-19 pneumonia patients. Therefore, with the easing of restrictions, resumed diagnostic and treatment activities, and the extensive uptake of medical imaging devices, the demand for medical electronics has grown in the post-pandemic period. The Medical Electronics Market is experiencing significant growth driven by several factors, like a rise in chronic diseases, such as cancer, diabetes, and cardiovascular diseases, which are driving the need for equipment like pacemakers, insulin pumps, and imaging equipment. A second factor is the global aging population, which is boosting the demand for medical electronics since older people are generally in need of more intensive and more frequent healthcare.

Medical Electronics Market Growth and Trend Analysis:

Medical Electronics Market Growth Driver

Increasing Incidence of Chronic Diseases

-

The rising incidence of chronic diseases is a major growth impetus for the market for medical electronics. Today, an estimated 830 million people across the globe suffer from diabetes. Cardiovascular conditions are still the major cause of mortality across the world, claiming around 18 million lives every year. The medical electronics market is growing at a rapid pace.

- This is driven by the development in wearable wellness devices, remote monitoring technologies, and AI-based diagnostics, which assist with early diagnosis and control over chronic diseases. Firms such as Dexcom and Abbott are developing continuous glucose monitoring technologies to make them more user-friendly and accessible. Not only do these advancements enhance the outcome of the patient, but also, they also decrease healthcare expenses by allowing proactive disease management.

Medical Electronics Market Limiting Factor

High Cost of Advanced Medical Devices

-

The high cost of advanced medical devices is restraining the growth of the medical electronics market. Advanced equipment like MRI scanners and robotic surgery systems tends to be more expensive for most hospitals, particularly in the developing world.

- Moreover, maintenance, software upgrades, and specialized training costs continue to drive the overall cost even higher. Strict regulatory standards contribute to the cost burden since compliance involves many tests and documentation. All these elements combined prevent the mass use of advanced medical electronics, making them less available and affecting aggregate market growth.

Medical Electronics Market Expansion Opportunity

Increasing Acceptance of Telemedicine and Patient Monitoring

-

The growing use of telemedicine and patient monitoring is a huge opportunity for the medical electronics market. Telehealth consultation and remote monitoring of patients require IoT-based, technologically advanced medical devices. The company is concentrating on making such devices to enhance precision and connectivity in readings of patients' vital This growth is facilitated by increased adoption of digital healthcare, government backing, and inclusion of AI in healthcare devices.

- These technological advancements boost real-time health monitoring, early disease detection, and active health management, thus driving the demand for sophisticated medical electronic devices and systems. Telemedicine's growing trend assists in controlling various chronic diseases and enhancing healthcare services in urban and rural settings. This trend generates a demand for advanced medical devices and drives the medical electronics market.

Medical Electronics Market Challenge Barrier

Data Insecurity in Advanced Medical Devices

-

The growing cybersecurity risks in sophisticated medical equipment pose a significant threat to the expansion of the medical electronics market. According to a 2024 report, 75% of hospital-connected equipment, such as infusion pumps and imaging systems, has documented security vulnerabilities, which expose them to potential unauthorized access and data breaches. Additionally, the U.S. FDA found cybersecurity threats in some patient monitors, warning that the devices may be accessed and interfered with by hackers.

- However, the difficulty in securing legacy medical devices that usually operate on legacy software adds to the problem. Such problems require heavy investments in cybersecurity solutions, which can hamper the process of adopting advanced medical electronics, particularly in environments with limited resources.

Medical Electronics Market Segment Analysis:

The Medical Electronics Market is segmented based on Type, Application, End-Users, and Region

By Product, the MRI Segment is Expected to Dominate the Market During the Forecast Period

The magnetic resonance imaging (MRI) segment is experiencing a huge growth in the medical electronics market during the forecast period due to reasons like the development of sophisticated MRI systems and the increasing uptake of MRI systems in emerging markets. Many of the rising economies are highly populated nations with developing healthcare infrastructures, and the adoption of MRI systems within these economies is projected to rise over the years based on the high disease burden of diseases such as cancer, musculoskeletal and neurological disorders, and others, as well as the rising population age.

The rising development of technologically sophisticated systems and their expanding use and product releases enhance the availability of such systems in the market and are anticipated to enhance the market segment growth during the forecast period. For example, in February 2021, the Brazilian HRA ANVISA granted market approval to Insightec for its Exablate 4000 (Exablate Neuro) platform, which is based on MR-guided focused ultrasound and accurately ablates tissue deep inside the brain without the need for incisions and will make treatment of essential tremor and tremor-dominant Parkinson's disease possible.

By End-User, the Hospital Segment Held the Largest Share in 2024

-

The hospitals segment generated the largest market share in 2024. The increasing rate of hospital admissions is due to several factors, such as increasing cases of CVDs, neurological diseases, increasing cases of road traffic accidents, and an increasing geriatric population. This dominance is driven by hospitals' high-volume capabilities in treating many patients who need diagnostic and ongoing monitoring services, including both inpatient and outpatient care.

- The growing incidence of long-term diseases, including cardiovascular and respiratory diseases, has enormously increased the demand for therapeutic equipment in healthcare facilities. These hospitals are adequately staffed with qualified staff and infrastructure required to run such advanced systems, solidifying their position of leadership in the fast-changing medical electronics industry The growing investments in multi-specialty hospital development and outsourcing to them with state-of-the-art medical equipment are a key driver that has added immense momentum to the growth of the hospitals in the medical electronics industry.

Medical Electronics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America is anticipated to lead the market during the forecast period due to reasons like the increasing incidence of chronic disease burden among the population, growth in the usage of sophisticated technology within healthcare infrastructure, availability of a robust healthcare infrastructure base, and high expenditure on healthcare. Furthermore, the increasing demand for minimally invasive treatments and increasing technological developments in medical electronics are also anticipated to enhance market growth during the forecast period.

- The rising incidence and burden of chronic illnesses are the major driving forces behind the demand for medical electronics in the North America region. According to the data published by the CDC, approximately 35 million United States adults were projected to have arthritis by 2040. This is likely to drive demand for medical electronics that offer quality images of the joint and tissues around it that assist in the early detection of the condition, thus enhancing the market growth. Thus, owing to factors such as the high burden of arthritis and cancer among the population, as well as growing company activities in the region, the North American market dominated the medical electronics market over the forecast period.

Medical Electronics Market Active Players:

-

77 Elektronika Ltd (Hungary)

- Abbott Laboratories (US)

- Analog Devices Inc (US)

- Baxter (US)

- BTL Industries (Bulgaria)

- Delrus (Russia)

- Fujifilm Corporation (Japan)

- GE Healthcare (US)

- Innomed Medical Zrt (Hungary)

- Johnson & Johnson (US)

- Koninklijke Philips N.V. (Netherlands)

- Medline (Canada)

- Medtronic (US)

- Mindray (China)

- NIPK Electron (Russia)

- NXP Semiconductors (Netherlands)

- Philips Healthcare Pvt Ltd (US)

- Renesas Electronic Corporation (Japan)

- Siemens Healthcare GmbH (Germany)

- ST Microelectronics (Switzerland)

- Teckscan Inc (US)

- Texas Instruments Incorporated (US)

- Other Active Players

Key Industry Developments in the Medical Electronics Market:

-

In April 2025, Medtronic launched Simplera Sync: A single-use, all-in-one CGM that removes the requirement for fingersticks and overtape. It has an easy, two-step insertion and is smaller than the sensors that came before it. MiniMed 780G: An automated insulin delivery system that includes meal detection technology and automatic sugar level adjustments every five minutes.

- In April 2024, GE Healthcare announced an acquisition with MIM Software, substantially expanding its offerings of solutions by bringing together sophisticated AI-driven image analysis capabilities with sophisticated workflow solutions in a broad range of medical specialties such as oncology, urology, neurology, and cardiology. The acquisition fully supports GE's broader precision care strategy, which is committed to providing integrated and automated solutions that enable clinicians in their daily practice.

|

Global Medical Electronics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 8.37 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.6 % |

Market Size in 2032: |

USD 15.02 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Medical Electronics Market Market by Product (2018-2032)

4.1 Medical Electronics Market Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pacemakers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Endoscopes

4.5 ECG

4.6 Glucometers

4.7 MRI

4.8 and Others

Chapter 5: Medical Electronics Market Market by Application (2018-2032)

5.1 Medical Electronics Market Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Therapeutics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diagnostic

5.5 and Monitoring

Chapter 6: Medical Electronics Market Market by End-User (2018-2032)

6.1 Medical Electronics Market Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals and Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medical Electronics Market Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 77 ELEKTRONIKA LTD (HUNGARY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ABBOTT LABORATORIES (US)

7.4 ANALOG DEVICES INC (US)

7.5 BAXTER (US)

7.6 BTL INDUSTRIES (BULGARIA)

7.7 DELRUS (RUSSIA)

7.8 FUJIFILM CORPORATION (JAPAN)

7.9 GE HEALTHCARE (US)

7.10 INNOMED MEDICAL ZRT (HUNGARY)

7.11 JOHNSON & JOHNSON (US)

7.12 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

7.13 MEDLINE (CANADA)

7.14 MEDTRONIC (US)

7.15 MINDRAY (CHINA)

7.16 NIPK ELECTRON (RUSSIA)

7.17 NXP SEMICONDUCTORS (NETHERLANDS)

7.18 PHILIPS HEALTHCARE PVT LTD (US)

7.19 RENESAS ELECTRONIC CORPORATION (JAPAN)

7.20 SIEMENS HEALTHCARE GMBH (GERMANY)

7.21 ST MICROELECTRONICS (SWITZERLAND)

7.22 TECKSCAN INC (US)

7.23 TEXAS INSTRUMENTS INCORPORATED (US) AND OTHER ACTIVE PLAYERS

Chapter 8: Global Medical Electronics Market Market By Region

8.1 Overview

8.2. North America Medical Electronics Market Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Medical Electronics Market Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Medical Electronics Market Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Medical Electronics Market Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Medical Electronics Market Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Medical Electronics Market Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Global Medical Electronics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 8.37 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.6 % |

Market Size in 2032: |

USD 15.02 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Companies Covered in the Report: |

|

||