Lisinopril Market Synopsis

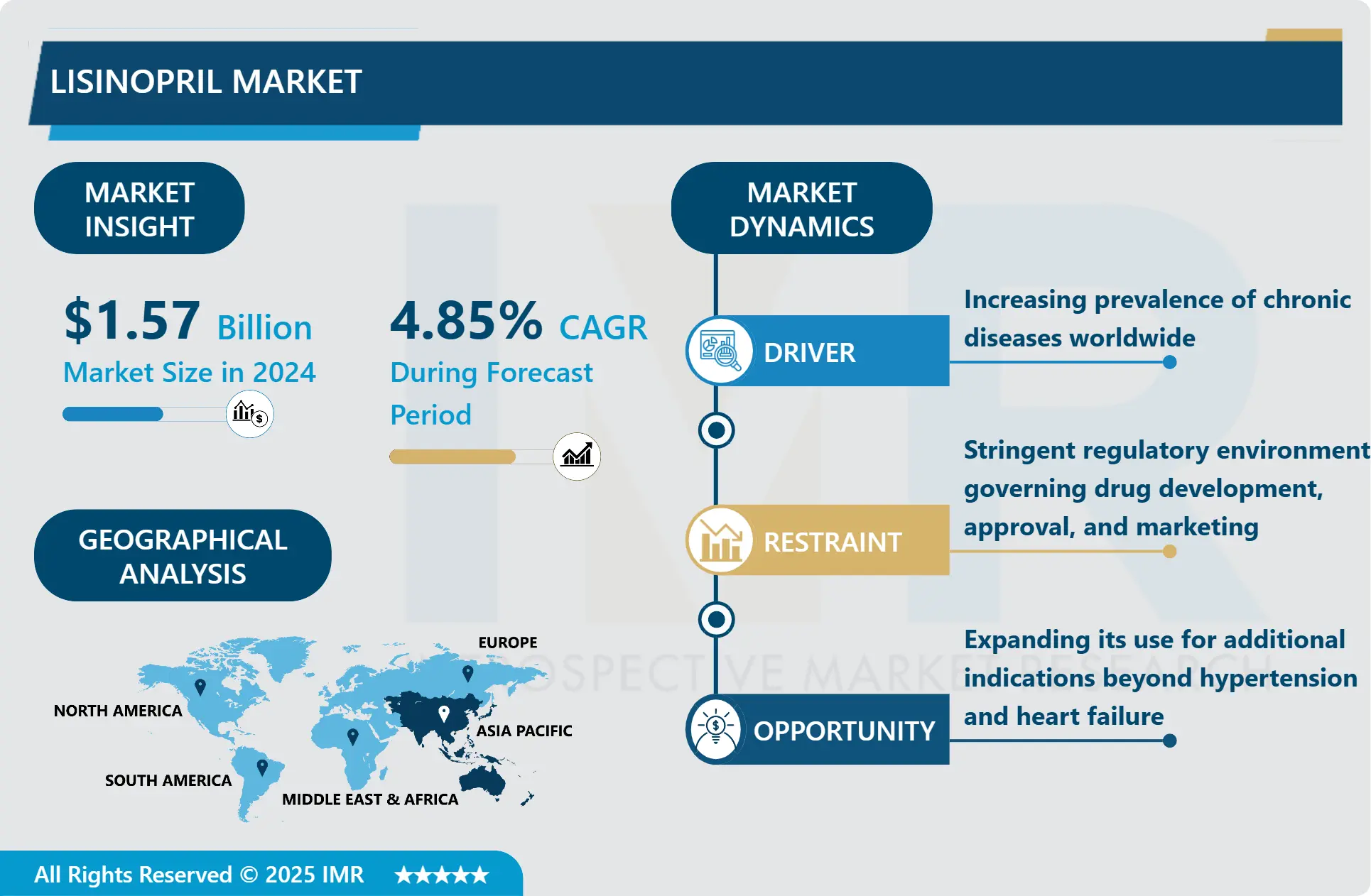

Lisinopril Market Size Was Valued at USD 1.57 Billion in 2024 and is Projected to Reach USD 2.29 Billion by 2032, Growing at a CAGR of 4.85% From 2025-2032.

Lisinopril is in the group of drugs called Angiotensin-Converting Enzyme inhibitors indicated for hypertension or high blood pressure and heart failure. It falls under a class of drugs called ACE inhibitors are considered vasodilators since they dilate or widen the blood slave; thus enhance the chances of the heart pumping blood. Lisinopril acts as an anti-angiotensin-converting enzyme that slows synthesis of angiotensin II, a chemical that commercially causes constriction of blood vessels. It also means the blood vessels are enlarged leading to a mechanism to lower the blood pressure and lot of it from the heart. Lisinopril is mainly administered in a tablet form although the tablet has to be swallowed whole. It is usually used in the treatment of hypertension and some cardiac ailments and sometimes it is employed in the treatment of possible cardiovascular system diseases.

Lisinopril is quite popular since it belongs to the basic treatment for hypertension and heart failure and the market of this kind of medication is constant and continues to increase. As a result, lisinopril has become an active participant in the world market and, at the same time, a specific tool for treating cardiovascular diseases. One way or the other, such aspects as increase in the prevalence of hypertension, a somewhat less active life, and a growing number of people with increased age need lisinopril. Moreover it has futuristic picture in terms of effectiveness, cheaper rate and lesser side- effects make a bulk market for the specific drug.

In various ways the health systems have improved and the knowledge for when it comes to cardiovascular health the LISINOPRIL market has improved as well. But it has given the proper way to the accessibility and the most important, the improved dimension to the cost and affordability in the developing part of the world. Most of the health care organizations will remain to give basic care and concentrating on chronic illness diseases so, lisinopril will have a large group of customers to serve and provide effective medication to the patients and reduce hypertension and possibly cardiovascular events related to it.

Lisinopril Market Trend Analysis

Lisinopril Market Trend Growth Driver- Increasing focus on personalized medicine and precision dosing

- Over the last couple of years the advance of technology in the health sector has influenced the options available and it feels like every couple of years the explanation of how genetic conditions in an individual lead to a particular manner in which some medicine is assimilated in the body is further refined. It is paving the way to effective pharmacogenomic systems of medication that correspond to that patient’s genetically determined potential for the metabolic rate of lisinopril and other drugs. This information on genes can be used again in the healthcare provider’s usage of lisinopril in expectation of the patient’s response to the specific amount required if used in the treatment of the disease without unwanted effects. This is not only helpful in the best interest of patients but also worried about the general improvement of efficiency in managing the system of health with the decrease of possibility of trial-and-error in medicine.

Lisinopril Market Trend opportunity- Expanding its use for additional indications beyond hypertension and heart failure

- However, for these conditions’ treatment, lisationopril is best recommended but subsequent comparative studies may discover new areas of use for this drug.. Which is why within such opportunity one can decide for instance, to learn how to use Lisinopril in an attempt to decrease potential diabetic complications such as chronic renal failure for instance, or cardiovascular diseases in diabetic patients for instance. Some of these studies have provided clues that the use of lisinopril may beUG somewhat protective on kidneys and cardiovascular diseases among diabetics.

- For that reason, the following points highlight how this opportunity could further the we-can market lisinopril with diabetic requirements that are definitely fellow vulnerable to related complications. Therefore, more research needs to be conducted to identify other forms of interaction of this or other synergy effects of lisinopril with other medicines or in populations of different types of patients in order to reveal other sources of potential yields of the medicine through certain forms of delivery of medicinal services.

Lisinopril Market Segment Analysis:

Lisinopril Market is segmented on the basis of type and application.

By Type, 2.5mg segment is expected to dominate the market during the forecast period

- Examples of the threats the competition poses to the lisinopril market are as follows: The second most current producer of lisinopril is Aventis, who offers Annoteq 2. 5mg segment will hold a significant share during the forecast period in online pharmacy industry. Those reasons were postulated to include; changing to individual therapy or pharmacogenom and dose standardizing in particular with reference to micro level say, 2. A patient with mild and moderate hypertension, a hypersensitive patient or patient that may react yielding to the side effect of this drug may require only 5mg. Moreover, 2.5mg dosage may be useful because it can be titration in relation to hypertension need of the clients and even interdose effect in cases of dose elevations or reductions based on the blood pressure of the client to optimize blood pressure management and minimize side effects.

- In addition, it has also been discovered that option availability should be at least 2. They include the brand drug and the generic and is packaged in sties of 5mg and is cheaper to the users and thus closely favously. The health care personnel will then be compelled to adopt treatment modalities within the availability of the patient needs while the patient is trying to search for the best approach to managing hypertension then 2. 5mg segment is predicted to record rapid growth and is likely to become the largest lisinopril segment in future.

By Application, Hospital segment expected to held the largest share

- The same has to be said about the application area as the position of lisinopril market will be oriented on the hospital segment and dominate the share in the demand. Consumer touchpoint is also highly important in the healthcare facilities dacing, treating and managing different forms of cardiovascular diseases for condition like hypertension as well as heart failure lisinopril is recommended. These conditions, which accelerate the increase of the above parameters and, therefore, raise the world burden of cardiovascular diseases, also show the large demand of the hospitals for lisinopril.

- Once more, due to the variety of diseases among patients, the community becoming aware of the necessity of at least attempting to prevent the development of cardiovascular diseases is vast, and lisinopril is one of the medications used by hospitals. Furthermore, for the hospital segment there are health-care persons in charge of supervising the patients or changing something in case the results are not favorable for the utilization of lisinopril is favorable for the defined segment. As care facilities remain the primary source through which management of cardiovascular diseases and their complications primarily is delivered, this market segment should provide relatively solid support for lisinopril.

Lisinopril Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- According to the current SCO it was found that Asia Pacific region is expected to account for maximum market share for lisinopril in the upcoming years. The following reasons explain this projected dominance; The region isoccupied by a relatively big population that is growing at a very fast rate Hypertension and Cardiovascular diseases are on the rise in the region Health care cost in the region is on the rise. Also, the advancement in the medical sector concerning health care and the consciousness that long-passing diseases demand recurrent treatment maintain the needs for such drugs as lisinopril. However, owing to some of the major pharmaceutical Industry investment coupled with the government concern towards the acquisition of reasonable medical facilities is anticipated to boost the Market. As many countries in Asia pacific are now becoming industrialized and attaining economic development, the corresponding market for lisinopril would automatically expand, which reasonably means having a huge market share for Asia pacific lisinopril market.

Active Key Players in the Lisinopril Market

- Actavis Elizabeth (USA)

- Apotex (Canada)

- Aurobindo Pharma (India)

- Ivax Pharmaceuticals (USA)

- Lek Pharmaceuticals (Slovenia)

- Lupin (India)

- Mylan Pharmaceuticals (USA)

- Ranbaxy Pharmaceuticals (India)

- Novartis (Switzerland)

- Teva Pharmaceuticals (Israel)

- Vintage Pharmaceuticals (USA)

- Watson Laboratories (USA)

- West Ward Pharmaceutical (USA)

- Wockhardt (India)

- Merck Research Laboratories (USA)

- Astrazeneca (UK/Sweden)

- Alvogen (Iceland)

- Hikma (Jordan)

- Prinston (USA)

- Accord Healthcare (UK)

- CASI Pharms (USA)

- Invagen Pharms (USA)

- SUN Pharm (India)

- Other Active Players

|

Global Lisinopril Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.57 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.85% |

Market Size in 2032: |

USD 2.29 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Lisinopril Market by Type (2018-2032)

4.1 Lisinopril Market Snapshot and Growth Engine

4.2 Market Overview

4.3 2.5mg

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 5mg

4.5 10mg

4.6 20mg

4.7 30mg

4.8 40mg

Chapter 5: Lisinopril Market by Application (2018-2032)

5.1 Lisinopril Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospital

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Drug Store

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Lisinopril Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ACTAVIS ELIZABETH (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 APOTEX (CANADA)

6.4 AUROBINDO PHARMA (INDIA)

6.5 IVAX PHARMACEUTICALS (USA)

6.6 LEK PHARMACEUTICALS (SLOVENIA)

6.7 LUPIN (INDIA)

6.8 MYLAN PHARMACEUTICALS (USA)

6.9 RANBAXY PHARMACEUTICALS (INDIA)

6.10 NOVARTIS (SWITZERLAND)

6.11 TEVA PHARMACEUTICALS (ISRAEL)

6.12 VINTAGE PHARMACEUTICALS (USA)

6.13 WATSON LABORATORIES (USA)

6.14 WEST WARD PHARMACEUTICAL (USA)

6.15 WOCKHARDT (INDIA)

6.16 MERCK RESEARCH LABORATORIES (USA)

6.17 ASTRAZENECA (UK/SWEDEN)

6.18 ALVOGEN (ICELAND)

6.19 HIKMA (JORDAN)

6.20 PRINSTON (USA)

6.21 ACCORD HEALTHCARE (UK)

6.22 CASI PHARMS (USA)

6.23 INVAGEN PHARMS (USA)

6.24 SUN PHARM (INDIA)

6.25 OTHER KEY PLAYERS

Chapter 7: Global Lisinopril Market By Region

7.1 Overview

7.2. North America Lisinopril Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 2.5mg

7.2.4.2 5mg

7.2.4.3 10mg

7.2.4.4 20mg

7.2.4.5 30mg

7.2.4.6 40mg

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Hospital

7.2.5.2 Drug Store

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Lisinopril Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 2.5mg

7.3.4.2 5mg

7.3.4.3 10mg

7.3.4.4 20mg

7.3.4.5 30mg

7.3.4.6 40mg

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Hospital

7.3.5.2 Drug Store

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Lisinopril Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 2.5mg

7.4.4.2 5mg

7.4.4.3 10mg

7.4.4.4 20mg

7.4.4.5 30mg

7.4.4.6 40mg

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Hospital

7.4.5.2 Drug Store

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Lisinopril Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 2.5mg

7.5.4.2 5mg

7.5.4.3 10mg

7.5.4.4 20mg

7.5.4.5 30mg

7.5.4.6 40mg

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Hospital

7.5.5.2 Drug Store

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Lisinopril Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 2.5mg

7.6.4.2 5mg

7.6.4.3 10mg

7.6.4.4 20mg

7.6.4.5 30mg

7.6.4.6 40mg

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Hospital

7.6.5.2 Drug Store

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Lisinopril Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 2.5mg

7.7.4.2 5mg

7.7.4.3 10mg

7.7.4.4 20mg

7.7.4.5 30mg

7.7.4.6 40mg

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Hospital

7.7.5.2 Drug Store

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Lisinopril Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.57 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.85% |

Market Size in 2032: |

USD 2.29 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||