Kombucha Market Synopsis

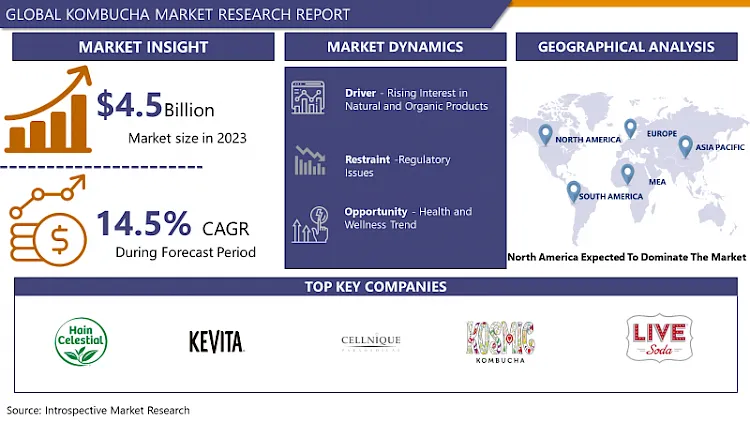

The Kombucha Market size is estimated at 5.15 billion USD in 2024 and is expected to reach 15.22 billion USD by 2032, growing at a CAGR of 14.5% during the forecast period (2025-2032)

Kombucha is a fermented tea beverage that has been consumed for centuries, and it is believed to have originated in Northeast China. The drink is made by fermenting sweetened tea with a symbiotic culture of bacteria and yeast (SCOBY). The SCOBY is a rubbery, disc-shaped mass that floats on the surface of the tea and initiates the fermentation process.

The fermentation process typically takes a week to a few weeks, during which the yeast and bacteria in the SCOBY consume the sugars in the tea, producing various by products such as organic acids, carbon dioxide, and a small amount of alcohol. The result is a fizzy, slightly effervescent beverage with a tangy flavor profile.

The growing demand from the educational sector is also driving the growth of the market. With labs being set up at many educational institutions for 3D printing, such as for engineering students to enable them to print prototypes, for biology students to allow them to study cross-sections of organs, and graphic design students to work on 3D versions of their work.

The kombucha market experienced significant growth and widespread popularity as consumers increasingly sought healthier beverage alternatives. Kombucha, a fermented tea known for its probiotic properties, gained traction due to its perceived health benefits and unique flavor profiles. The market was characterized by a surge in demand for natural and functional beverages, with kombucha fitting into the growing trend of wellness and mindful consumption.

Major players in the industry capitalized on this trend by introducing innovative flavors, packaging, and marketing strategies to attract a diverse consumer base. The market witnessed increased availability of kombucha in mainstream retail outlets, further contributing to its accessibility and market penetration.

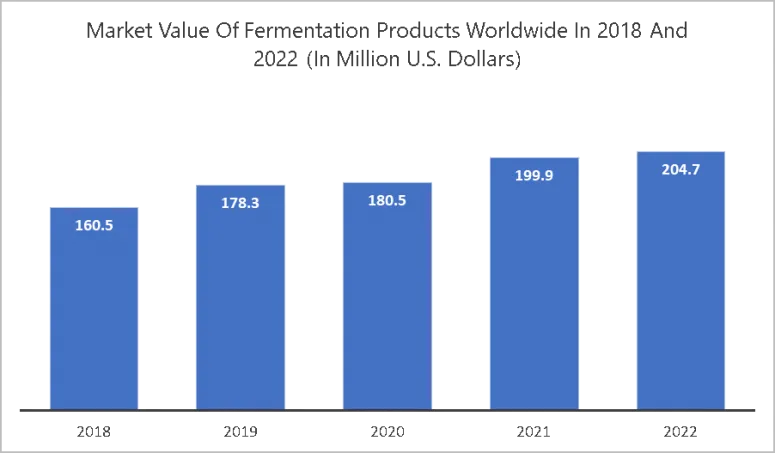

The given graph shows that the fermentation products market was valued at about 160.5 billion U.S. dollars in 2018, and increased by 204.7 billion U.S. dollars in 2022.

Kombucha Market Trend Analysis

Kombucha Market Drivers- Rising Interest in Natural and Organic Products

- The Kombucha market is experiencing a surge in popularity, and one of the driving factors behind this trend is the rising interest in natural and organic products. Consumers are becoming increasingly health-conscious and are seeking beverages that offer not only refreshment but also potential health benefits. Kombucha, a fermented tea drink, aligns well with this growing demand for natural and organic options.

- Consumers are becoming more aware of the potential health benefits associated with consuming natural and organic products. Kombucha is often perceived as a healthier alternative to traditional soft drinks due to its probiotic content, which may support gut health and digestion. As people prioritize overall well-being and seek products that contribute positively to their health, the demand for kombucha has seen a notable increase.

- There is a rising concern about the harmful effects of artificial additives, sweeteners, and preservatives present in many conventional beverages. Kombucha, being a fermented drink, is typically made with natural ingredients like tea, sugar, and a symbiotic culture of bacteria and yeast (SCOBY). This aligns with the preferences of consumers who are looking for beverages with simpler ingredient lists and fewer synthetic components.

- The organic movement has gained momentum, and consumers are willing to pay a premium for products that are produced sustainably and without the use of synthetic chemicals. Kombucha, when made using organic ingredients, fits into this trend, attracting environmentally conscious consumers who are seeking products that are not only good for them but also for the planet.

Kombucha Market Opportunities- Health and Wellness Trend Creates an Opportunity for Kombucha Market

- The kombucha market is thriving within the health and wellness trend, presenting ample opportunities for growth. As consumers increasingly prioritize healthier beverage options, kombucha, a fermented tea rich in probiotics, has gained popularity for its potential health benefits. The market is poised to capitalize on the growing demand for functional beverages that support digestive health, immunity, and overall well-being.

- Consumers are seeking natural and organic alternatives, and kombucha aligns with these preferences, being perceived as a wholesome, non-alcoholic, and low-sugar option. Additionally, the rising awareness of the gut-brain connection and the importance of maintaining a healthy microbiome further propels the demand for probiotic-rich beverages like kombucha.

- The market's potential is also fueled by innovations, with companies introducing diverse flavors, adaptogens, and functional ingredients to cater to evolving consumer tastes. As the global focus on preventive healthcare intensifies, kombucha's image as a wellness elixir positions it as a key player in the health-conscious beverage market.

Kombucha Market Segment Analysis:

Kombucha Market Segmented on the basis of Nature, type, Packaging, Flavor and Distribution Channel.

By Nature, Flavored segment is expected to dominate the market during the forecast period

- The flavored segment is poised to assert its dominance in the dynamic and rapidly growing kombucha market, driven by evolving consumer preferences and a penchant for diverse taste experiences. Nature has endowed kombucha with a unique versatility, allowing for the infusion of a myriad of flavors that cater to a broad spectrum of palates.

- Consumers are increasingly gravitating towards kombucha for its touted health benefits and for the delightful and varied flavor profiles it offers. The flavored segment capitalizes on this trend, offering an array of options ranging from fruity and floral notes to herbal and spicy undertones. This diversification appeals to a wide demographic, attracting both traditional kombucha enthusiasts and those new to the beverage.

By Type, Bacteria segment held the largest share in 2024

- The Bacteria segment emerges as a dominant force, poised to shape the industry's trajectory. Kombucha, a fermented beverage known for its probiotic properties, owes much of its appeal to the pivotal role played by bacteria in its production. Within the Bacteria segment, various strains such as Acetobacter, Gluconacetobacter, and Lactobacillus contribute to the fermentation process, influencing the beverage's taste, aroma, and health benefits.

- Consumers are increasingly drawn to the health-conscious trend, seeking probiotic-rich products that promote gut health and overall well-being. The Bacteria segment aligns seamlessly with this demand, as these microorganisms enhance the nutritional profile of kombucha, offering a natural and holistic approach to digestive health.

Kombucha Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America presently stands as the primary powerhouse in the global kombucha market, with a substantial market share and widespread consumer adoption. The region's kombucha market has witnessed significant growth due to increasing awareness of health and wellness trends, coupled with a rising preference for natural and functional beverages. Established brands and innovative start-ups have contributed to the market's robust expansion, offering diverse flavors and formulations to cater to evolving consumer tastes.

- The Asia-Pacific region is emerging as the epicentre of rapid growth within the kombucha market. Fueled by a burgeoning population, changing lifestyle patterns, and a heightened focus on health-conscious choices, the Asia-Pacific kombucha market is experiencing a remarkable surge. Consumers in this region are increasingly drawn to the perceived health benefits of kombucha, including digestive wellness and immune system support.

- Local manufacturers are capitalizing on this trend by introducing a variety of kombucha products tailored to regional preferences. The cultural acceptance of fermented beverages in Asia also plays a pivotal role in the beverage's success. The Asia-Pacific kombucha market is positioned as a dynamic and high-potential sector, reflecting the region's enthusiasm for wellness-focused products and its growing influence on the global stage.

Kombucha Market Top Key Players:

- Hain Celestial Group (US)

- KeVita Inc. (US)

- Cell - Nique Corporation (US)

- Kosmic Kombucha (US)

- LIVE Soda LLC (US)

- GT's Kombucha (US)

- Makana Beverages Inc. (US)

- Nesalla Kombucha (US)

- Mother Kombucha (US)

- Pure Steeps Beverage LLC (US)

- Reeds Inc. (US)

- Revive Kombucha (US)

- The Humm Kombucha LLC (US)

- Townshend's Tea Company (US)

- Brew Dr. Kombucha (US)

- BB Kombucha (France)

- København Kombucha (Europe)

- MOMO KOMBUCHA (U.K.)

- Real Kombucha (U.K.)

- Equinox Kombucha (U.K.)

- Brothers and Sisters (U.K.)

- Red Bull GmbH (Austria)

- Remedy Drinks (Australia)

- Læsk (Australia)

- Other Active Players

Key Industry Developments in the Kombucha Market:

- In April 2023, Brew Dr. Kombucha unveiled its latest product launch, showcasing a revamped branding and packaging design. The updated appearance features a modernized logo, redesigned labels, and the exciting addition of two enticing flavors: Strawberry Fields and Pineapple Paradise.

- In June 2022, Remedy Drinks, the leading global maker of gut-friendly and no-sugar live-cultured drinks, announced its expansion throughout the U.S. with its presence across national retailers and multiple distribution channels. Additionally, the brand has also announced a new flavor, Mango Passion, to its refreshing range of sparkling kombucha drinks that will be craft-made and authentically brewed, and will be produced in small-batchs.

- In July 2021, Nova Easy Kombucha, a brand manufacturing innovative beverage, launched its new product line of high-performance non-alcoholic kombucha that features a pre-workout ‘Power’ kombucha blend comprising naturally-derived caffeine to boost performance, and ‘Recovery’ blend, formulated with probiotics to promote a healthy gut. The products are designed for health-conscious consumers seeking an all-natural, and low-sugar option.

|

Global Kombucha Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.15 Bn. |

|

Forecast Period 2024-2032 CAGR: |

14.5 % |

Market Size in 2032: |

USD 15.22 Bn |

|

Segments Covered: |

By Nature |

|

|

|

By Type |

|

||

|

By Packaging |

|

||

|

By Flavor |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Kombucha Market by Nature (2018-2032)

4.1 Kombucha Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Traditional

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Flavoured

Chapter 5: Kombucha Market by Type (2018-2032)

5.1 Kombucha Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bacteria

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Yeast

5.5 Mold

Chapter 6: Kombucha Market by Packaging (2018-2032)

6.1 Kombucha Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Glass Bottles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plastic Bottles

6.5 Cans

Chapter 7: Kombucha Market by Flavor (2018-2032)

7.1 Kombucha Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Herbs & Spices

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Citrus

7.5 Berries

7.6 Apple

7.7 Coconut & Mangoes

7.8 Flowers

Chapter 8: Kombucha Market by Distribution Channel (2018-2032)

8.1 Kombucha Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Supermarkets & Hypermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Specialty Stores

8.5 Convenience Stores

8.6 Online Retail

8.7 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Kombucha Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 RIO TINTO (UK)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BHP GROUP (AUSTRALIA)

9.4 VALE S.A. (BRAZIL)

9.5 GLENCORE (SWITZERLAND)

9.6 ANGLO AMERICAN PLC (UK)

9.7 BARRICK GOLD CORPORATION (CANADA)

9.8 NEWMONT CORPORATION (USA)

9.9 FREEPORT-MCMORAN INC. (USA)

9.10 TECK RESOURCES LIMITED (CANADA)

9.11 CHINA SHENHUA ENERGY COMPANY LIMITED (CHINA)

9.12 OTHERS KEY PLAYER

Chapter 10: Global Kombucha Market By Region

10.1 Overview

10.2. North America Kombucha Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Nature

10.2.4.1 Traditional

10.2.4.2 Flavoured

10.2.5 Historic and Forecasted Market Size by Type

10.2.5.1 Bacteria

10.2.5.2 Yeast

10.2.5.3 Mold

10.2.6 Historic and Forecasted Market Size by Packaging

10.2.6.1 Glass Bottles

10.2.6.2 Plastic Bottles

10.2.6.3 Cans

10.2.7 Historic and Forecasted Market Size by Flavor

10.2.7.1 Herbs & Spices

10.2.7.2 Citrus

10.2.7.3 Berries

10.2.7.4 Apple

10.2.7.5 Coconut & Mangoes

10.2.7.6 Flowers

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Supermarkets & Hypermarkets

10.2.8.2 Specialty Stores

10.2.8.3 Convenience Stores

10.2.8.4 Online Retail

10.2.8.5 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Kombucha Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Nature

10.3.4.1 Traditional

10.3.4.2 Flavoured

10.3.5 Historic and Forecasted Market Size by Type

10.3.5.1 Bacteria

10.3.5.2 Yeast

10.3.5.3 Mold

10.3.6 Historic and Forecasted Market Size by Packaging

10.3.6.1 Glass Bottles

10.3.6.2 Plastic Bottles

10.3.6.3 Cans

10.3.7 Historic and Forecasted Market Size by Flavor

10.3.7.1 Herbs & Spices

10.3.7.2 Citrus

10.3.7.3 Berries

10.3.7.4 Apple

10.3.7.5 Coconut & Mangoes

10.3.7.6 Flowers

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Supermarkets & Hypermarkets

10.3.8.2 Specialty Stores

10.3.8.3 Convenience Stores

10.3.8.4 Online Retail

10.3.8.5 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Kombucha Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Nature

10.4.4.1 Traditional

10.4.4.2 Flavoured

10.4.5 Historic and Forecasted Market Size by Type

10.4.5.1 Bacteria

10.4.5.2 Yeast

10.4.5.3 Mold

10.4.6 Historic and Forecasted Market Size by Packaging

10.4.6.1 Glass Bottles

10.4.6.2 Plastic Bottles

10.4.6.3 Cans

10.4.7 Historic and Forecasted Market Size by Flavor

10.4.7.1 Herbs & Spices

10.4.7.2 Citrus

10.4.7.3 Berries

10.4.7.4 Apple

10.4.7.5 Coconut & Mangoes

10.4.7.6 Flowers

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Supermarkets & Hypermarkets

10.4.8.2 Specialty Stores

10.4.8.3 Convenience Stores

10.4.8.4 Online Retail

10.4.8.5 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Kombucha Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Nature

10.5.4.1 Traditional

10.5.4.2 Flavoured

10.5.5 Historic and Forecasted Market Size by Type

10.5.5.1 Bacteria

10.5.5.2 Yeast

10.5.5.3 Mold

10.5.6 Historic and Forecasted Market Size by Packaging

10.5.6.1 Glass Bottles

10.5.6.2 Plastic Bottles

10.5.6.3 Cans

10.5.7 Historic and Forecasted Market Size by Flavor

10.5.7.1 Herbs & Spices

10.5.7.2 Citrus

10.5.7.3 Berries

10.5.7.4 Apple

10.5.7.5 Coconut & Mangoes

10.5.7.6 Flowers

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Supermarkets & Hypermarkets

10.5.8.2 Specialty Stores

10.5.8.3 Convenience Stores

10.5.8.4 Online Retail

10.5.8.5 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Kombucha Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Nature

10.6.4.1 Traditional

10.6.4.2 Flavoured

10.6.5 Historic and Forecasted Market Size by Type

10.6.5.1 Bacteria

10.6.5.2 Yeast

10.6.5.3 Mold

10.6.6 Historic and Forecasted Market Size by Packaging

10.6.6.1 Glass Bottles

10.6.6.2 Plastic Bottles

10.6.6.3 Cans

10.6.7 Historic and Forecasted Market Size by Flavor

10.6.7.1 Herbs & Spices

10.6.7.2 Citrus

10.6.7.3 Berries

10.6.7.4 Apple

10.6.7.5 Coconut & Mangoes

10.6.7.6 Flowers

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Supermarkets & Hypermarkets

10.6.8.2 Specialty Stores

10.6.8.3 Convenience Stores

10.6.8.4 Online Retail

10.6.8.5 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Kombucha Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Nature

10.7.4.1 Traditional

10.7.4.2 Flavoured

10.7.5 Historic and Forecasted Market Size by Type

10.7.5.1 Bacteria

10.7.5.2 Yeast

10.7.5.3 Mold

10.7.6 Historic and Forecasted Market Size by Packaging

10.7.6.1 Glass Bottles

10.7.6.2 Plastic Bottles

10.7.6.3 Cans

10.7.7 Historic and Forecasted Market Size by Flavor

10.7.7.1 Herbs & Spices

10.7.7.2 Citrus

10.7.7.3 Berries

10.7.7.4 Apple

10.7.7.5 Coconut & Mangoes

10.7.7.6 Flowers

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Supermarkets & Hypermarkets

10.7.8.2 Specialty Stores

10.7.8.3 Convenience Stores

10.7.8.4 Online Retail

10.7.8.5 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Kombucha Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.15 Bn. |

|

Forecast Period 2024-2032 CAGR: |

14.5 % |

Market Size in 2032: |

USD 15.22 Bn |

|

Segments Covered: |

By Nature |

|

|

|

By Type |

|

||

|

By Packaging |

|

||

|

By Flavor |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||