Global Inspection Drones Market Overview

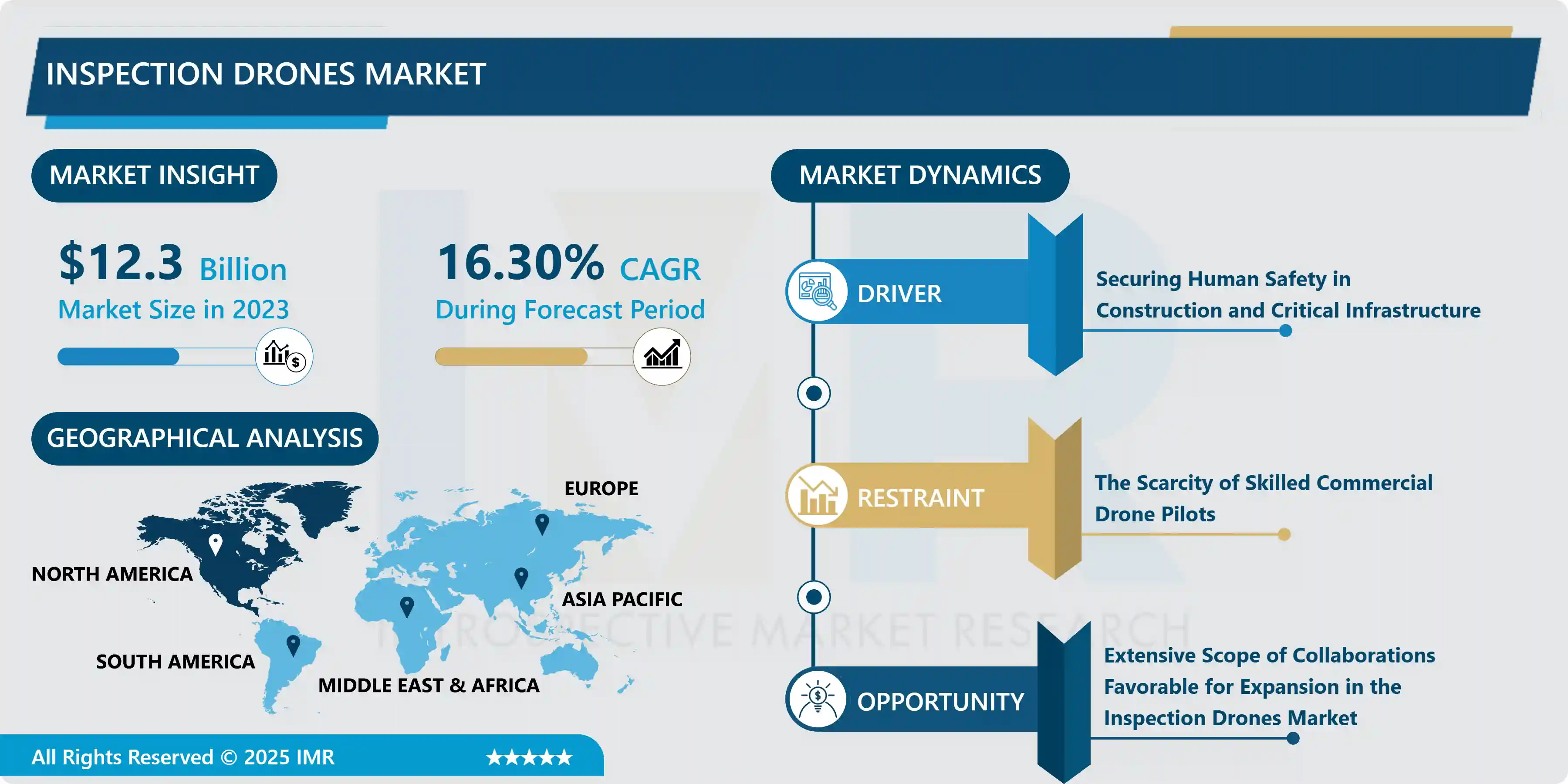

Global Inspection Drones Market size is expected to grow from USD 12.3 Billion in 2023 to USD 47.88 Billion by 2032, at a CAGR of 16.30% during the forecast period (2024-2032)

Drones are well known for their application in aerial photography, but drones are also being utilized for inspection purposes. In many industries, the inspection process mostly consists of the use of ladders, ropes, and supplies to scale large machinery and towers oversee processes, and locate bottlenecks. Also, this type of inspection process is too unsafe for inspectors. To execute an effective and harmless inspection process, drone inspections are being accomplished in almost every industry that needs visual inspections as part of its maintenance procedures. Inspection drones receive visual data on the condition of an asset. Drone inspections help inspectors avoid having to place themselves in dangerous situations.

The drone inspection process is more well organized, closer monitoring and control, cost-effective, and safe that gives better, without interrupting other business operations. The drone inspection services for visual inspection offers benefits such as preventive maintenance planning and optimized production, access to areas that pose health, authorized and qualified UAV-inspection personnel, safety and environmental risk to humans, an inspection of areas difficult to access, quick on-site deployment of the drone inspection system, reduced downtime. The growing adoption of inspection drones in the industrial sector would accelerate the market growth during the forecast period.

Market Dynamics and Factors for the Inspection Drones Market:

Driver:

Securing Human Safety in Construction and Critical Infrastructure

- The integration of drones into various industries has significantly impacted safety standards, particularly in construction and critical infrastructure. The adoption of inspection drones has emerged as a driving force in enhancing human safety within these sectors.

- Construction sites and critical infrastructure facilities pose inherent risks to human workers due to their often hazardous environments and complex structures. Traditional inspection methods, such as manual checks or manned aerial surveys, are not only time-consuming but also potentially dangerous.

- Inspection drones offer a safer alternative by enabling remote monitoring and inspection of construction sites, bridges, pipelines, power plants, and other critical infrastructure. Equipped with high-resolution cameras, thermal imaging sensors, and other advanced technologies, drones can quickly and efficiently assess structural integrity, detect defects, and identify potential safety hazards from a safe distance.

- By reducing the need for human workers to physically access dangerous or hard-to-reach areas, inspection drones minimize the risk of accidents and injuries. Furthermore, they enable proactive maintenance and early detection of issues, helping to prevent costly downtime and potential disasters.

Restraints:

The Scarcity of Skilled Commercial Drone Pilots

- The scarcity of skilled commercial drone pilots indeed presents a significant restraint for the inspection drones market. As industries increasingly adopt drones for various inspection tasks such as infrastructure monitoring, agriculture, and environmental assessment, the demand for qualified pilots capable of operating these drones effectively and safely continues to rise.

- The regulations and licensing requirements for commercial drone operation can be stringent and complex, deterring potential pilots from entering the field. Additionally, the specialized skills needed for different types of inspections, such as understanding data analysis or specific industry knowledge, further limit the pool of qualified candidates.

- The rapid evolution of drone technology necessitates continuous training and upskilling, making it challenging for pilots to stay abreast of the latest advancements. This dynamic landscape adds another layer of complexity to the recruitment and retention of skilled drone pilots.

Opportunities:

Extensive Scope of Collaborations Favorable for Expansion

- The inspection drone market is poised for significant growth due to the increasing demand for efficient and cost-effective inspection solutions across various industries. One of the primary opportunities lies in collaborations between drone manufacturers and technology companies specializing in artificial intelligence, sensors, and data analytics. By integrating advanced AI algorithms and high-resolution sensors into drone systems, companies can offer more sophisticated inspection capabilities, such as defect detection, predictive maintenance, and asset monitoring.

- Partnerships with regulatory bodies and industry associations can facilitate the development of standardized safety protocols and regulations for drone operations, thereby fostering trust and confidence among potential customers. Additionally, collaborations with research institutions and academic organizations can drive innovation in drone technology, leading to the introduction of new features and functionalities that address specific industry needs.

- Strategic alliances with existing players in related sectors, such as infrastructure, energy, and utilities, can expand market reach and enable drone companies to offer comprehensive inspection solutions tailored to specific verticals. Leveraging these collaborations, companies can access new markets, enhance their product offerings, and stay ahead of the competition in the rapidly evolving inspection drone market.

Market Segmentation

Global Inspection Drones Market Research report comprises of Porter's five forces analysis to do the detail study about its each segmentation like Product segmentation, End user/application segment analysis and Major key players analysis mentioned as below;

Segmentation Analysis of Inspection Drones Market:

- Based on Component, the transmitters & receivers’ segment is the expected dominant segment of the inspection drone's market. Among the components, the flight controllers' segment is anticipated to hold the second-largest share of the global inspection drones' market, concerning the revenue, over the forecast period.

- Based on the Distribution Channels, the inspection drones' market has been classified into online and offline. The offline sales channel segment is anticipated to continue its dominance during the projected period.

- Based on the End-User, the military & defense segment dominates the global inspection drones market and is expected to continue its dominance over the forecast period. Over the world, investments toward the development of power grid infrastructure, and the growth and advancement of renewable energy infrastructure are growing. This factor is also anticipated to increase the adoption of inspection drones in the upcoming years.

- Based on the Application, the border security application segment is expected to dominate the market during the forecast period owing to highly beneficial for the monitoring and surveillance at the border of the country to defend from any hazardous activities.

Regional Analysis of Inspection Drones Market:

- North America has emerged as a dominant force, leveraging cutting-edge technology and robust infrastructure to lead the market. North America boasts a thriving ecosystem of drone manufacturers, software developers, and service providers, fostering innovation and driving advancements in drone technology. Additionally, stringent regulatory frameworks ensure safety and compliance, instilling confidence in businesses to adopt drone solutions for inspection purposes.

- The diverse range of industries in North America, including energy, utilities, construction, agriculture, and infrastructure, presents a vast array of opportunities for drone deployment. These industries recognize the cost-effectiveness, efficiency, and safety benefits offered by inspection drones, further fueling market growth.

- North America's commitment to research and development, coupled with strategic investments in drone technology, reinforces its position at the forefront of the global market. Collaborations between academia, government agencies, and industry players contribute to continuous innovation and the development of specialized drone solutions tailored to various inspection needs.

Players Covered in Inspection Drones market are :

- DJI

- MIR Innovation

- Airwing

- MicroMultiCopter Aero Technology

- Parrot

- JYU

- AEE

- 3D Robotics

- AscTec

- XAIRCRAFT

- Zero Tech

- AeroVironment and other major key players.

Key Industry Development:

- In March 2024: Aerones, a pioneer in robotic wind turbine inspection and maintenance services, advances its drone visual inspection service by introduced the Autonomous drone visual inspection. With this solution time required for visual inspection will be reduced even further.

- In May 2023: XTEND the developer of XOS, a human-guided autonomous operating system that is revolutionizing 'human to machine' interaction, has acquired Performance Rotors, the Singapore-based leading drone inspection specialists, in a move that will boost XTEND's ability to offer human-guided, remote interactive operations in a range of inspection scenarios, and grow its global business. Financial terms of the transaction were not disclosed.

- In March 2023: Rohde & Schwarz launched its R&S EVSD1000 VHF/UHF nav/drone analyzer at Airspace World 2023 in Geneva from March 8 to 10, 2023. The analyzer provides highly accurate and efficient drone inspection of terrestrial navigation and communications systems along with outstanding accuracy and the measurement repeatability customers need.

|

Global Inspection Drones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.30 % |

Market Size in 2032: |

USD 47.88 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Inspection Drones Market by Type (2018-2032)

4.1 Inspection Drones Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Transmitters & Receivers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Mainframe

4.5 Brushless Motors & ESC

4.6 Flight Controllers

Chapter 5: Inspection Drones Market by Application (2018-2032)

5.1 Inspection Drones Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oil & Gas Pipeline Inspection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Critical Infrastructure Inspection

5.5 Power Line & Windmill Inspection

5.6 Border Security

5.7 Others

Chapter 6: Inspection Drones Market by End-User (2018-2032)

6.1 Inspection Drones Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Mining & Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Energy & Utilities

6.5 Oil

6.6 Gas & Petroleum

6.7 Military & Defense

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Inspection Drones Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GOOGLE (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MICROSOFT (US)

7.4 IBM (US)

7.5 AWS (US)

7.6 AT&T (US)

7.7 BAIDU (CHINA)

7.8 NUANCE COMMUNICATIONS (US)

7.9 ISPEECH (US)

7.10 NEOSPEECH (US)

7.11 CEREPROC (SCOTLAND)

7.12 CEPSTRAL (US)

7.13 LYREBIRD (CANADA)

7.14 KATA.AI (INDONESIA)

7.15 ALT INC. (JAPAN)

7.16 ARISTECH GMBH (GERMANY)

7.17 ACAPELA GROUP (BELGIUM)

7.18 VOCALID (US)

7.19 VOICERY (US)

7.20 VOCTRO LABS (SPAIN)

7.21 EXCLONE (US)

7.22 CANDYVOICE (FRANCE)

7.23 LUMENVOX (US)

7.24 RSPEAK (NETHERLANDS)

7.25 SMARTBOX ASSISTIVE TECHNOLOGY (UK)

7.26 VIVOTEXT(ISRAEL)

7.27 OTHER KEY PLAYERS

Chapter 8: Global Inspection Drones Market By Region

8.1 Overview

8.2. North America Inspection Drones Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Transmitters & Receivers

8.2.4.2 Mainframe

8.2.4.3 Brushless Motors & ESC

8.2.4.4 Flight Controllers

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Oil & Gas Pipeline Inspection

8.2.5.2 Critical Infrastructure Inspection

8.2.5.3 Power Line & Windmill Inspection

8.2.5.4 Border Security

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Mining & Construction

8.2.6.2 Energy & Utilities

8.2.6.3 Oil

8.2.6.4 Gas & Petroleum

8.2.6.5 Military & Defense

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Inspection Drones Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Transmitters & Receivers

8.3.4.2 Mainframe

8.3.4.3 Brushless Motors & ESC

8.3.4.4 Flight Controllers

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Oil & Gas Pipeline Inspection

8.3.5.2 Critical Infrastructure Inspection

8.3.5.3 Power Line & Windmill Inspection

8.3.5.4 Border Security

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Mining & Construction

8.3.6.2 Energy & Utilities

8.3.6.3 Oil

8.3.6.4 Gas & Petroleum

8.3.6.5 Military & Defense

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Inspection Drones Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Transmitters & Receivers

8.4.4.2 Mainframe

8.4.4.3 Brushless Motors & ESC

8.4.4.4 Flight Controllers

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Oil & Gas Pipeline Inspection

8.4.5.2 Critical Infrastructure Inspection

8.4.5.3 Power Line & Windmill Inspection

8.4.5.4 Border Security

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Mining & Construction

8.4.6.2 Energy & Utilities

8.4.6.3 Oil

8.4.6.4 Gas & Petroleum

8.4.6.5 Military & Defense

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Inspection Drones Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Transmitters & Receivers

8.5.4.2 Mainframe

8.5.4.3 Brushless Motors & ESC

8.5.4.4 Flight Controllers

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Oil & Gas Pipeline Inspection

8.5.5.2 Critical Infrastructure Inspection

8.5.5.3 Power Line & Windmill Inspection

8.5.5.4 Border Security

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Mining & Construction

8.5.6.2 Energy & Utilities

8.5.6.3 Oil

8.5.6.4 Gas & Petroleum

8.5.6.5 Military & Defense

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Inspection Drones Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Transmitters & Receivers

8.6.4.2 Mainframe

8.6.4.3 Brushless Motors & ESC

8.6.4.4 Flight Controllers

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Oil & Gas Pipeline Inspection

8.6.5.2 Critical Infrastructure Inspection

8.6.5.3 Power Line & Windmill Inspection

8.6.5.4 Border Security

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Mining & Construction

8.6.6.2 Energy & Utilities

8.6.6.3 Oil

8.6.6.4 Gas & Petroleum

8.6.6.5 Military & Defense

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Inspection Drones Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Transmitters & Receivers

8.7.4.2 Mainframe

8.7.4.3 Brushless Motors & ESC

8.7.4.4 Flight Controllers

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Oil & Gas Pipeline Inspection

8.7.5.2 Critical Infrastructure Inspection

8.7.5.3 Power Line & Windmill Inspection

8.7.5.4 Border Security

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Mining & Construction

8.7.6.2 Energy & Utilities

8.7.6.3 Oil

8.7.6.4 Gas & Petroleum

8.7.6.5 Military & Defense

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Inspection Drones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.30 % |

Market Size in 2032: |

USD 47.88 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||