Key Market Highlights

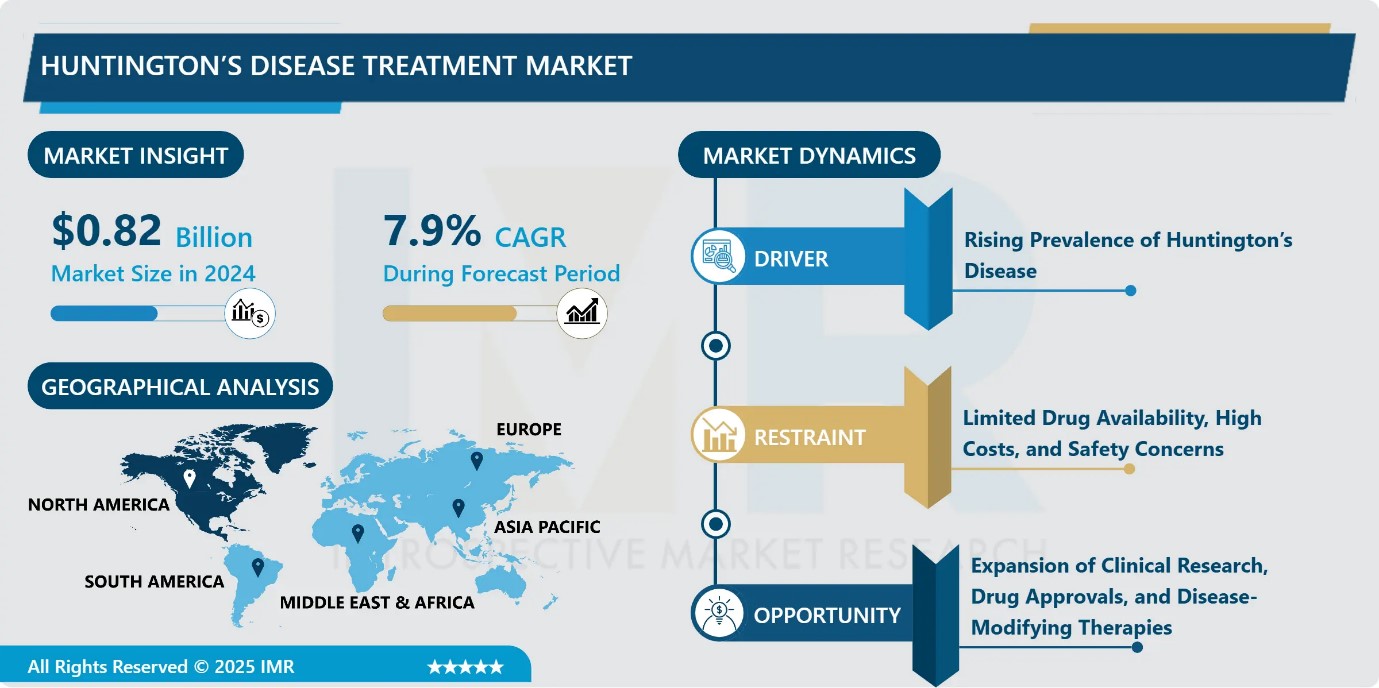

Huntington’s Disease Treatment Market Size Was Valued at USD 0.82 Billion in 2024, and is Projected to Reach USD 1.89 Billion by 2035, Growing at a CAGR of 7.9% from 2025-2035.

- Market Size in 2024: USD 0.82 Billion

- Projected Market Size by 2035: USD 1.89 Billion

- CAGR (2025–2035): 7.9%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Treatment: The Symptomatic Treatment segment is anticipated to lead the market by accounting for 57.3% of the market share throughout the forecast period.

- By Distribution Channel: The Hospital Pharmacies segment is expected to capture 31.4% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 32.8% of the market share during the forecast period.

- Active Players: Alnylam Pharmaceuticals, Inc. (U.S.), Amneal Pharmaceuticals LLC (U.S.), Apotex Inc. (Canada), Bausch Health Companies Inc. (Canada), Dr. Reddy’s Laboratories Ltd. (India), and Other Active Players.

Huntington’s Disease Treatment Market Synopsis:

Huntington’s disease (HD) is a rare, inherited, progressive neurodegenerative disorder caused by a mutation in the HTT gene, leading to the gradual degeneration of nerve cells in the brain and resulting in motor, cognitive, and psychiatric impairments. Globally, the United States represents the largest market, accounting for more than 70% of cases across the seven major markets, with over 81,000 prevalent patients. As there is currently no cure or approved disease-modifying therapy, treatment primarily focuses on symptom management using medications such as tetrabenazine, deutetrabenazine, and valbenazine to control chorea and associated behavioral symptoms. The market condition reflects a strong unmet medical need, driven by rising prevalence, increasing genetic testing, expanding research initiatives, and the growing pipeline of innovative therapies aimed at slowing disease progression and improving long-term patient outcomes.

Huntington’s Disease Treatment Market Dynamics and Trend Analysis:

Huntington’s Disease Treatment Market Growth Driver-Rising Prevalence of Huntington’s Disease

- The increasing prevalence of Huntington’s disease (HD) across key regions is a major driver of market growth. HD is a rare, inherited neurodegenerative disorder with no curative therapy, creating sustained demand for effective symptom-management treatments. Prevalence rates are notably high in North America and Europe, with estimates indicating higher incidence compared to other regions.

- Additionally, improved diagnostic capabilities and growing awareness are leading to higher detection rates globally. Emerging economies such as India and China are also reporting rising case numbers due to better healthcare access and genetic screening. As the patient pool expands, the demand for advanced and long-term therapeutic interventions is expected to significantly boost the Huntington’s disease treatment market.

Huntington’s Disease Treatment Market Limiting Factor-Limited Drug Availability, High Costs, and Safety Concerns

- The growth of the Huntington’s disease treatment market is constrained by the limited availability of approved therapies and stringent regulatory requirements. Several drug development programs have been discontinued due to lack of efficacy or safety concerns, delaying innovation and reducing treatment options.

- Additionally, long-term use of available medications is associated with adverse effects, including psychiatric and cardiovascular risks, which may limit patient adoption. The ultra-high cost of emerging gene and cell therapies further restricts accessibility and reimbursement, particularly in developing regions. Low disease awareness in certain geographies and complex regulatory pathways continue to pose challenges, collectively restraining overall market expansion.

Huntington’s Disease Treatment Market Expansion Opportunity-Expansion of Clinical Research, Drug Approvals, and Disease-Modifying Therapies

- The Huntington’s disease treatment market presents significant growth opportunities driven by increasing clinical research activity, rising drug approvals, and advancements in disease-modifying therapies. Pharmaceutical and biotechnology companies are actively conducting clinical trials to develop innovative treatments targeting the underlying pathology of the disease, including monoclonal antibodies, gene-based approaches, and stem cell therapies.

- Regulatory approvals in new geographies are further expanding patient access and commercial potential. In parallel, growing investments in research and development, supported by public and private funding, are accelerating innovation. These advancements are expected to transform treatment paradigms beyond symptomatic care, creating strong long-term growth opportunities for the market.

Huntington’s Disease Treatment Market Challenge and Risk-Genetic Complexity and Disease Heterogeneity

- The Huntington’s disease treatment market faces significant challenges due to the disorder’s complex genetic and pathophysiological nature. The disease is caused by a specific genetic mutation, requiring highly precise therapeutic targeting to avoid unintended effects on healthy genes, which complicates drug development.

- Additionally, Huntington’s disease presents heterogeneous motor, cognitive, and psychiatric symptoms that vary widely among patients, limiting the effectiveness of standardized treatment approaches. The absence of validated biomarkers further complicates clinical trial design and outcome measurement, increasing development risks and timelines. These scientific and clinical complexities raise R&D costs, slow innovation, and create uncertainty in regulatory approvals, thereby restraining overall market progress.

Huntington’s Disease Treatment Market Trend-Shift Toward Gene-Based and Personalized Therapies

- The Huntington’s disease treatment market is witnessing a clear shift toward gene-centric and personalized therapeutic approaches. Advances in genetic testing, biomarkers, and precision medicine are enabling tailored treatment strategies that target the underlying cause of the disease rather than only managing symptoms. Gene-editing and gene-silencing technologies, including RNA-based therapies and emerging gene therapy platforms, are gaining strong research momentum.

- In parallel, digital health tools such as telemedicine and remote patient monitoring are improving disease management and treatment adherence. Increasing collaborations among pharmaceutical companies, biotech firms, and academic institutions are accelerating innovation, signaling a transformative trend toward long-term, disease-modifying solutions.

Huntington’s Disease Treatment Market Segment Analysis:

Huntington’s Disease Treatment Market is segmented based on Treatment type, Drug Class, Route of Administration, Distribution Channel, End User and Region.

By Treatment, Symptomatic treatment segment is expected to dominate the market with around 57.3% share during the forecast period.

- The symptomatic treatment segment dominated the Huntington’s disease treatment market in 2024, accounting for the largest revenue share due to its established clinical use and immediate therapeutic benefits. These therapies focus on managing motor, psychiatric, and behavioral symptoms using antidepressants, antipsychotics, and movement-control drugs such as tetrabenazine, deutetrabenazine, and valbenazine.

- The dominance of this segment is driven by the absence of approved disease-modifying therapies, high demand for effective chorea management, and broad patient eligibility across disease stages. Continuous improvements in drug formulations, supportive therapies, and surgical interventions further strengthen adoption. While disease-modifying therapies are emerging rapidly, symptomatic treatments remain the primary standard of care, sustaining their leading market position.

By Distribution Channel, Hospital Pharmacy is expected to dominate with close to 31.4% market share during the forecast period.

- The hospital pharmacy segment led the Huntington’s disease treatment market in 2024, accounting for over 31.4% of total revenue. This dominance is driven by hospitals’ advanced healthcare infrastructure, availability of specialized neurological care, and the presence of trained professionals capable of managing complex treatment regimens. Huntington’s disease often requires comprehensive diagnostic evaluation, inpatient care, and close monitoring, all of which favor hospital-based dispensing.

- Hospital pharmacies also ensure timely access to newly launched and high-cost therapies, including advanced symptomatic and emerging gene-based treatments, supported by favorable reimbursement frameworks. Multidisciplinary care models and insurance coverage further strengthen hospital pharmacies’ central role, making them the preferred distribution channel for Huntington’s disease therapies.

Huntington’s Disease Treatment Market Regional Insights:

North America region is estimated to lead the market with around 32.8% share during the forecast period.

- North America dominates the Huntington’s disease treatment market, accounting for over 32.8% of global revenue in 2024. This leadership is driven by a high disease burden, strong healthcare infrastructure, and substantial healthcare spending. The United States plays a central role due to widespread disease awareness, early diagnosis, and robust long-term care systems. Market dominance is further supported by active R&D initiatives, numerous clinical trials, and regulatory incentives such as FDA orphan drug and fast-track designations. The presence of major pharmaceutical companies, strong collaborations, patient advocacy support, and recent drug approvals, including valbenazine, continue to strengthen North America’s leading position in the Huntington’s disease treatment market.

Huntington’s Disease Treatment Market Active Players:

- Alnylam Pharmaceuticals, Inc. (U.S.)

- Amneal Pharmaceuticals LLC (U.S.)

- Apotex Inc. (Canada)

- Bausch Health Companies Inc. (Canada)

- Dr. Reddy’s Laboratories Ltd. (India)

- H. Lundbeck A/S (Denmark)

- Hikma Pharmaceuticals PLC (U.K.)

- Lupin Limited (India)

- Neurocrine Biosciences, Inc. (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Prilenia Therapeutics (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- uniQure NV (Netherlands)

- Other Active Players

Key Industry Developments in the Huntington’s Disease Treatment Market:

- In April 2025: uniQure secured FDA Breakthrough Therapy designation for AMT-130 after clinical data showed an approximately 80% reduction in disease progression compared with external control groups.

- In December 2024: Novartis entered into a strategic collaboration with PTC Therapeutics to develop and commercialize PTC518 for Huntington’s disease. PTC 518 is an oral small-molecule therapy designed to selectively lower mutant huntingtin (mHTT) protein levels, targeting the underlying cause of neuronal degeneration.

Technical Overview: Huntington’s Disease Treatment Market

- The Huntington’s disease (HD) treatment market is defined by a sophisticated and evolving therapeutic landscape addressing a rare, inherited neurodegenerative disorder caused by CAG repeat expansions in the HTT gene. Treatment strategies are classified into symptomatic therapies and disease-modifying therapies. Symptomatic treatments, including tetrabenazine, deutetrabenazine, and valbenazine, primarily manage chorea, while antidepressants and antipsychotics target psychiatric symptoms such as depression and irritability. Emerging disease-modifying approaches focus on addressing the root cause of HD through gene therapies (e.g., AMT-130), antisense oligonucleotides, RNA interference, and viral vector-based platforms aimed at reducing mutant huntingtin protein expression.

- Administration routes include oral, intravenous, and intrathecal delivery, with gene therapies requiring specialized hospital or research facilities. The market is driven by expanding clinical trials, regulatory incentives, and R&D investment. Constraints include limited drug approvals, high therapy costs, adverse events, and the disease’s complex pathophysiology, which pose challenges to clinical development and adoption.

|

Huntington’s Disease Treatment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.82 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.9% |

Market Size in 2035: |

USD 1.89 Bn. |

|

Segments Covered: |

By Treatment Type |

|

|

|

By Drug Class

|

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Therapeutic Area |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Huntington’s Disease Treatment Market by Treatment Type (2018-2035)

4.1 Huntington’s Disease Treatment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Symptomatic Treatment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Disease-Modifying Therapies

Chapter 5: Huntington’s Disease Treatment Market by Drug Class (2018-2035)

5.1 Huntington’s Disease Treatment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tetrabenazine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Deutetrabenazine

5.5 Valbenazine

5.6 Antipsychotics

5.7 Antidepressants

5.8 Mood Stabilizers

5.9 Neurologics

5.10 Genetic Therapies

5.11 Others

Chapter 6: Huntington’s Disease Treatment Market by Route of Administration (2018-2035)

6.1 Huntington’s Disease Treatment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Oral

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Parenteral

6.5 Intravenous

6.6 Subcutaneous

6.7 Topical

6.8 Others

Chapter 7: Huntington’s Disease Treatment Market by Distribution Channel (2018-2035)

7.1 Huntington’s Disease Treatment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospital Pharmacies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Retail Pharmacies

7.5 Online Pharmacies

7.6 E-commerce

Chapter 8: Huntington’s Disease Treatment Market by End User (2018-2035)

8.1 Huntington’s Disease Treatment Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Clinics

8.5 Specialty Clinics

8.6 Homecare Settings

8.7 Research Centers

8.8 Others

Chapter 9: Huntington’s Disease Treatment Market by Therapeutic Area (2018-2035)

9.1 Huntington’s Disease Treatment Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Neurological Disorders

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Psychiatric Disorders

9.5 Genetic Disorders

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Huntington’s Disease Treatment Market Share by Manufacturer/Service Provider(2024)

10.1.3 Industry BCG Matrix

10.1.4 PArtnerships, Mergers & Acquisitions

10.2 ALNYLAM PHARMACEUTICALS

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Recent News & Developments

10.2.10 SWOT Analysis

10.3 INC. (U.S.)

10.4 AMNEAL PHARMACEUTICALS LLC (U.S.)

10.5 APOTEX INC. (CANADA)

10.6 BAUSCH HEALTH COMPANIES INC. (CANADA)

10.7 DR. REDDY’S LABORATORIES LTD. (INDIA)

10.8 H. LUNDBECK A/S (DENMARK)

10.9 HIKMA PHARMACEUTICALS PLC (U.K.)

10.10 LUPIN LIMITED (INDIA)

10.11 NEUROCRINE BIOSCIENCES

10.12 INC. (U.S.)

10.13 NOVARTIS AG (SWITZERLAND)

10.14 PFIZER INC. (U.S.)

10.15 PRILENIA THERAPEUTICS (ISRAEL)

10.16 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

10.17 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

10.18 UNIQURE NV (NETHERLANDS)

10.19 AND OTHER ACTIVE PLAYERS.

Chapter 11: Global Huntington’s Disease Treatment Market By Region

11.1 Overview

11.2. North America Huntington’s Disease Treatment Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecast Market Size by Country

11.2.4.1 US

11.2.4.2 Canada

11.2.4.3 Mexico

11.3. Eastern Europe Huntington’s Disease Treatment Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecast Market Size by Country

11.3.4.1 Russia

11.3.4.2 Bulgaria

11.3.4.3 The Czech Republic

11.3.4.4 Hungary

11.3.4.5 Poland

11.3.4.6 Romania

11.3.4.7 Rest of Eastern Europe

11.4. Western Europe Huntington’s Disease Treatment Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecast Market Size by Country

11.4.4.1 Germany

11.4.4.2 UK

11.4.4.3 France

11.4.4.4 The Netherlands

11.4.4.5 Italy

11.4.4.6 Spain

11.4.4.7 Rest of Western Europe

11.5. Asia Pacific Huntington’s Disease Treatment Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecast Market Size by Country

11.5.4.1 China

11.5.4.2 India

11.5.4.3 Japan

11.5.4.4 South Korea

11.5.4.5 Malaysia

11.5.4.6 Thailand

11.5.4.7 Vietnam

11.5.4.8 The Philippines

11.5.4.9 Australia

11.5.4.10 New Zealand

11.5.4.11 Rest of APAC

11.6. Middle East & Africa Huntington’s Disease Treatment Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecast Market Size by Country

11.6.4.1 Turkiye

11.6.4.2 Bahrain

11.6.4.3 Kuwait

11.6.4.4 Saudi Arabia

11.6.4.5 Qatar

11.6.4.6 UAE

11.6.4.7 Israel

11.6.4.8 South Africa

11.7. South America Huntington’s Disease Treatment Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecast Market Size by Country

11.7.4.1 Brazil

11.7.4.2 Argentina

11.7.4.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Our Thematic Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

15.1 Sources

15.2 List of Tables and figures

15.3 Short Forms and Citations

15.4 Assumption and Conversion

15.5 Disclaimer

|

Huntington’s Disease Treatment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.82 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.9% |

Market Size in 2035: |

USD 1.89 Bn. |

|

Segments Covered: |

By Treatment Type |

|

|

|

By Drug Class

|

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Therapeutic Area |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||