High Pressure Water Pump Market Synopsis

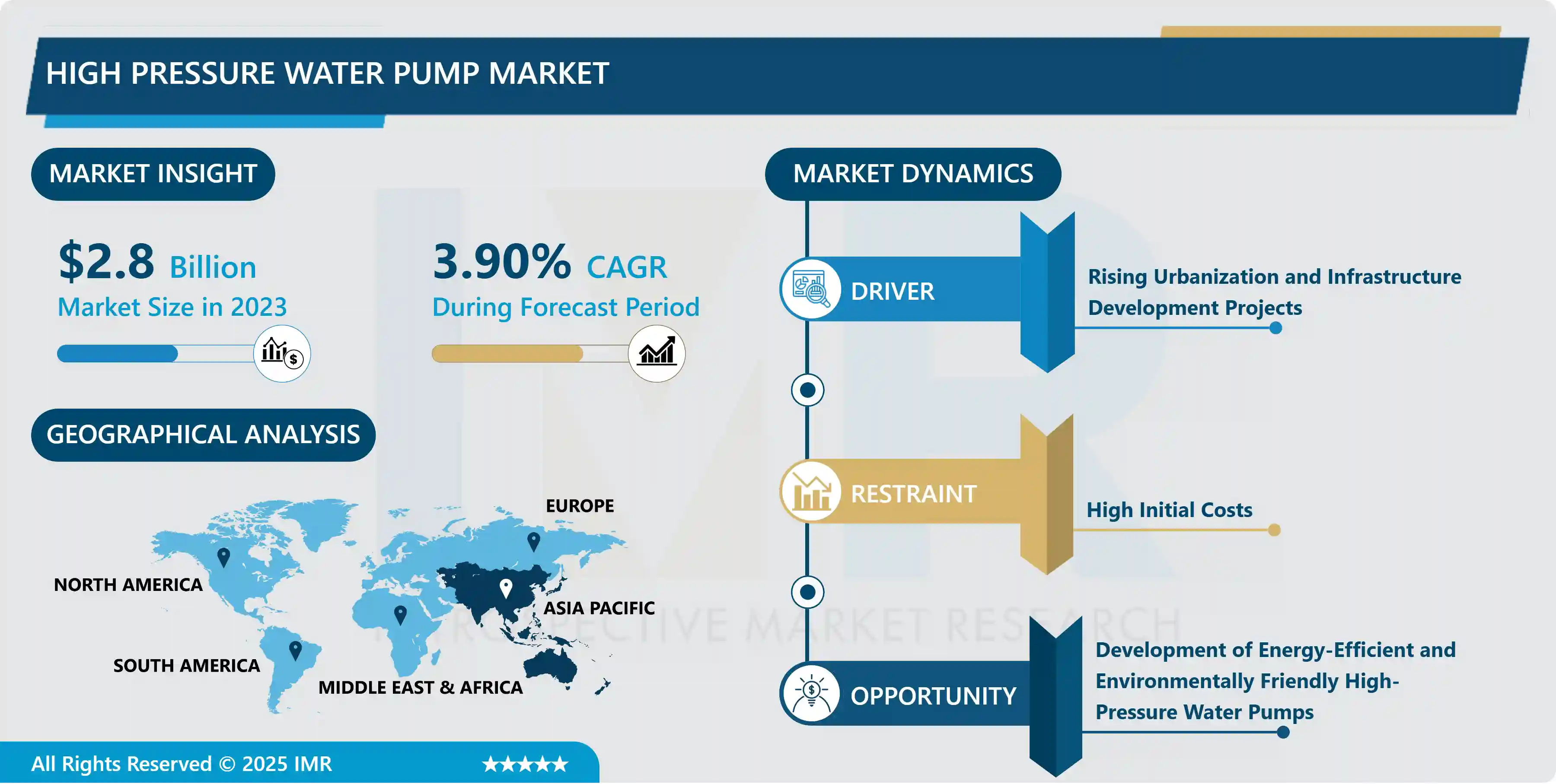

High Pressure Water Pump Market Size Was Valued at USD 2.8 Billion in 2023 and is Projected to Reach USD 3.95 Billion by 2032, Growing at a CAGR of 3.90% From 2024-2032.

A high-pressure water pump is a mechanical device designed to generate and deliver pressurized water at elevated levels, typically used in various industrial, commercial, and residential applications. These pumps utilize centrifugal or positive displacement mechanisms to achieve high-pressure water flow for tasks such as cleaning, irrigation, and industrial processes.

High-pressure water pumps have diverse applications across multiple industries, offering numerous advantages and driving future demand growth. their primary applications are in industrial settings, where they are used for surface cleaning, paint removal, and concrete cutting due to their ability to generate intense water pressure. In the commercial sector, high-pressure water pumps find use in pressure washing, vehicle cleaning, and building maintenance tasks, offering efficient and effective cleaning solutions. Additionally, in residential settings, these pumps are utilized for activities like garden watering, car washing, and household cleaning, providing convenience and versatility for homeowners.

High-pressure water pumps include their ability to deliver high-pressure water flow, which is essential for tackling tough cleaning tasks and achieving thorough results. They are also energy-efficient compared to traditional cleaning methods, reducing operational costs and environmental impact. Moreover, high-pressure water pumps are versatile and adaptable, suitable for a wide range of applications across different industries, making them a preferred choice for various cleaning and water supply tasks.

High-pressure water pumps are expected to be driven by factors such as increasing industrialization, infrastructure development, and water management initiatives worldwide. Industries such as oil & gas, construction, agriculture, and water treatment are anticipated to contribute significantly to the demand for these pumps. Additionally, advancements in pump technology, including energy-efficient designs and smart pump systems, are likely to further fuel market growth by enhancing performance, reliability, and operational efficiency.

High Pressure Water Pump Market Trend Analysis

Rising Urbanization and Infrastructure Development Projects

- The growth of the high-pressure water pump market is significantly driven by rising urbanization and infrastructure development projects globally. As urban areas expand, there is a heightened demand for efficient water supply systems, wastewater treatment facilities, and industrial cleaning solutions, all of which rely on high-pressure water pumps. Infrastructure projects such as the construction of skyscrapers, roads, bridges, and public utilities also require high-pressure water pumps for tasks like concrete cutting, surface cleaning, and hydrostatic testing.

- In urban and infrastructure development contexts is their ability to deliver intense water pressure, essential for various construction and cleaning applications. They offer a versatile and effective solution for tasks that require precision and efficiency, contributing to the successful completion of infrastructure projects. Moreover, high-pressure water pumps are energy-efficient compared to alternative methods, making them a sustainable choice for urban development initiatives.

- The urbanization and ongoing infrastructure development projects worldwide are expected to sustain the demand for high-pressure water pumps. Emerging economies and developing regions, in particular, are witnessing rapid urban growth and infrastructure investments, driving the market for high-pressure pumps. Advancements in pump technology, coupled with increasing awareness of water conservation and environmental sustainability, further contribute to the positive outlook for the high-pressure water pump market in the context of urbanization and infrastructure development.

Development of Energy-Efficient and Environmentally Friendly High-Pressure Water Pumps

- The development of energy-efficient and environmentally friendly high-pressure water pumps presents a significant opportunity for the growth of the high-pressure water pump market. As industries and consumers increasingly prioritize sustainability and environmental stewardship, there is a growing demand for pumps that minimize energy consumption and reduce environmental impact. Energy-efficient high-pressure water pumps not only lower operational costs for end-users but also contribute to reduced carbon emissions and resource conservation.

- Energy-efficient high-pressure water pumps can achieve the same level of performance while using less energy compared to traditional pumps. This makes them a preferred choice for industries seeking to improve operational efficiency and comply with stringent energy regulations. Additionally, environmentally friendly pumps that employ sustainable materials and design practices align with sustainability goals, attracting environmentally conscious consumers and businesses.

- The market opportunity for energy-efficient and environmentally friendly high-pressure water pumps extends beyond traditional industries to emerging sectors such as renewable energy, water management, and green building. Renewable energy projects, water treatment plants, and sustainable infrastructure developments require efficient and eco-friendly pumping solutions. Manufacturers that innovate in this space by introducing advanced technologies, smart pump systems, and green materials are well-positioned to capitalize on the growing demand for sustainable high-pressure water pumps and drive market growth.

High Pressure Water Pump Market Segment Analysis:

High Pressure Water Pump Market is Segmented based on Type, Pressure, application, and End-User.

By Type, Positive Displacement Pumps segment is expected to dominate the market during the forecast period

- The positive displacement pumps segment is poised to dominate the growth of the high-pressure water pump market. These pumps operate by trapping a specific volume of liquid and forcing it into a discharge pipe at high pressure, making them ideal for applications requiring precise flow control and consistent pressure output. One of the key advantages of positive displacement pumps is their ability to maintain constant flow rates regardless of system pressure, ensuring reliable performance in various industrial, commercial, and residential applications.

- Several factors contribute to the dominance of the positive displacement pumps segment in the high-pressure water pump market. Their versatility and suitability for high-pressure applications, such as water jet cutting, oil & gas extraction, and hydrostatic testing, make them a preferred choice across different industries. Moreover, advancements in positive displacement pump technology, including enhanced durability, energy efficiency, and automation capabilities, further drive their market dominance by meeting the evolving demands of end-users for efficient and reliable pumping solutions.

By Pressure, the 30 to 100 Bar segments held the largest share of 54.22% in 2022

- The 30 to 100 bar segments have held the largest share in driving the growth of the high-pressure water pump market. This segment refers to pumps capable of generating pressure levels between 30 and 100 bar, which are commonly used in a wide range of applications across industries such as manufacturing, construction, and water treatment. These pumps provide the necessary pressure to perform tasks like surface cleaning, concrete cutting, and high-pressure washing effectively.

- This pressure range caters to the majority of applications in industrial and commercial settings, making it a highly sought-after segment. Secondly, pumps within this range strike a balance between power and versatility, allowing for efficient performance in various tasks without excessive energy consumption. Additionally, advancements in pump technology have led to the development of more reliable, durable, and energy-efficient pumps within this pressure range, further driving their market share and growth.

High Pressure Water Pump Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is anticipated to dominate as the leading region for the growth of the high-pressure water pump market. This region encompasses rapidly growing economies, such as China, India, Japan, and Southeast Asian nations, which are witnessing significant industrialization, urbanization, and infrastructure development. The demand for high-pressure water pumps in Asia Pacific is driven by diverse industries including manufacturing, construction, oil & gas, agriculture, and water treatment, among others.

- The region's expanding industrial sector requires high-pressure pumps for tasks such as equipment cleaning, surface preparation, and material handling, driving the market growth. Secondly, the increasing emphasis on water management, environmental sustainability, and infrastructure projects creates opportunities for high-pressure pumps in water treatment, wastewater management, and municipal applications. Lastly, technological advancements and investments in energy-efficient pump solutions further bolster market demand in the Asia Pacific, making it a key region for the growth of the high-pressure water pump market.

High Pressure Water Pump Market Top Key Players:

- Cat Pumps (U.S.)

- Pentair (U.S.)

- Flowserve Corporation (U.S.)

- Xylem Inc. (U.S.)

- Franklin Electric Co., Inc. (U.S.)

- Baker Hughes Company (U.S.)

- Maximator GmbH (Germany)

- SEEPEX GmbH (Germany)

- Atlas Copco AB (Sweden)

- Grundfos (Denmark)

- Andritz AG (Austria)

- COMET S.p.A. (Italy)

- Sulzer Ltd (Switzerland)

- Ebara Corporation (Japan)

- Tsurumi Manufacturing Co., Ltd. (Japan)

- KSB Limited (India)

- Kirloskar Brothers Limited (India), and Other Major Players

Key Industry Developments in the High Pressure Water Pump Market:

- In May 2023, Kirloskar Brothers Limited introduced the advanced 'AQUA TORRENT-10 FCL' pump series. This 1.0 HP single-phase monobloc pump, designed for domestic applications, features high suction lift, energy efficiency, and corrosion resistance due to its Cathodic Electro Deposition (CED) coating. Its dynamically balanced rotating parts minimize vibrations, enhancing durability. Ideal for overhead tank filling, garden watering, RO plants, construction sites, hotels, lawn sprinklers, and car washing.

- In August 23, 2023, KSB Limited, a leading pump and valve manufacturer in India, launched an energy-efficient range of pumps for the agriculture and domestic segments. The launch, held during a Dealer Conference in Lonavala, Maharashtra, included products like KSTP sewage pumps, KGP Control Panel, UMN series oil-filled pump sets, UPFN borewell pump sets, Ultra Plus Series monoblock pump sets, and KMR series open well pumps.

|

Global High Pressure Water Pump Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023 : |

USD 2.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.90% |

Market Size in 2032 : |

USD 3.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Pressure |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High Pressure Water Pump Market by Type (2018-2032)

4.1 High Pressure Water Pump Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Positive Displacement Pumps

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Centrifugal Pumps

Chapter 5: High Pressure Water Pump Market by Pressure (2018-2032)

5.1 High Pressure Water Pump Market Snapshot and Growth Engine

5.2 Market Overview

5.3 30 to 100 Bar

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 101 to 500 Bar

5.5 Above 500 Bar

Chapter 6: High Pressure Water Pump Market by Application (2018-2032)

6.1 High Pressure Water Pump Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Residential

Chapter 7: High Pressure Water Pump Market by End-User (2018-2032)

7.1 High Pressure Water Pump Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Oil & Gas

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Manufacturing

7.5 Chemical & Pharmaceuticals

7.6 Agriculture

7.7 Power Generation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 High Pressure Water Pump Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HONEYWELL INTERNATIONAL INC. (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SYNAPTICS INC. (U.S.)

8.4 ANALOG DEVICES INC. (U.S.)

8.5 MOLEX LLC (U.S.)

8.6 VISHAY INTERTECHNOLOGY INC. (U.S.)

8.7 MICROCHIP TECHNOLOGY INC. (U.S.)

8.8 STMICROELECTRONICS (SWITZERLAND)

8.9 SCHNEIDER ELECTRIC (FRANCE)

8.10 NXP SEMICONDUCTORS (NETHERLANDS)

8.11 INFINEON TECHNOLOGIES AG (GERMANY)

8.12 OMRON CORPORATION (JAPAN)

8.13 PANASONIC CORPORATION (JAPAN)

8.14 MURATA MANUFACTURING COLTD (JAPAN)

8.15 ALPS ALPINE COLTD (JAPAN)

8.16 SHARP CORPORATION (JAPAN)

8.17 FUJITSU LIMITED (JAPAN)

8.18 SAMSUNG ELECTRONICS COLTD. (SOUTH KOREA)

8.19

Chapter 9: Global High Pressure Water Pump Market By Region

9.1 Overview

9.2. North America High Pressure Water Pump Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Positive Displacement Pumps

9.2.4.2 Centrifugal Pumps

9.2.5 Historic and Forecasted Market Size by Pressure

9.2.5.1 30 to 100 Bar

9.2.5.2 101 to 500 Bar

9.2.5.3 Above 500 Bar

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Industrial

9.2.6.2 Commercial

9.2.6.3 Residential

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Oil & Gas

9.2.7.2 Manufacturing

9.2.7.3 Chemical & Pharmaceuticals

9.2.7.4 Agriculture

9.2.7.5 Power Generation

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe High Pressure Water Pump Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Positive Displacement Pumps

9.3.4.2 Centrifugal Pumps

9.3.5 Historic and Forecasted Market Size by Pressure

9.3.5.1 30 to 100 Bar

9.3.5.2 101 to 500 Bar

9.3.5.3 Above 500 Bar

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Industrial

9.3.6.2 Commercial

9.3.6.3 Residential

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Oil & Gas

9.3.7.2 Manufacturing

9.3.7.3 Chemical & Pharmaceuticals

9.3.7.4 Agriculture

9.3.7.5 Power Generation

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe High Pressure Water Pump Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Positive Displacement Pumps

9.4.4.2 Centrifugal Pumps

9.4.5 Historic and Forecasted Market Size by Pressure

9.4.5.1 30 to 100 Bar

9.4.5.2 101 to 500 Bar

9.4.5.3 Above 500 Bar

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Industrial

9.4.6.2 Commercial

9.4.6.3 Residential

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Oil & Gas

9.4.7.2 Manufacturing

9.4.7.3 Chemical & Pharmaceuticals

9.4.7.4 Agriculture

9.4.7.5 Power Generation

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific High Pressure Water Pump Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Positive Displacement Pumps

9.5.4.2 Centrifugal Pumps

9.5.5 Historic and Forecasted Market Size by Pressure

9.5.5.1 30 to 100 Bar

9.5.5.2 101 to 500 Bar

9.5.5.3 Above 500 Bar

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Industrial

9.5.6.2 Commercial

9.5.6.3 Residential

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Oil & Gas

9.5.7.2 Manufacturing

9.5.7.3 Chemical & Pharmaceuticals

9.5.7.4 Agriculture

9.5.7.5 Power Generation

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa High Pressure Water Pump Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Positive Displacement Pumps

9.6.4.2 Centrifugal Pumps

9.6.5 Historic and Forecasted Market Size by Pressure

9.6.5.1 30 to 100 Bar

9.6.5.2 101 to 500 Bar

9.6.5.3 Above 500 Bar

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Industrial

9.6.6.2 Commercial

9.6.6.3 Residential

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Oil & Gas

9.6.7.2 Manufacturing

9.6.7.3 Chemical & Pharmaceuticals

9.6.7.4 Agriculture

9.6.7.5 Power Generation

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America High Pressure Water Pump Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Positive Displacement Pumps

9.7.4.2 Centrifugal Pumps

9.7.5 Historic and Forecasted Market Size by Pressure

9.7.5.1 30 to 100 Bar

9.7.5.2 101 to 500 Bar

9.7.5.3 Above 500 Bar

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Industrial

9.7.6.2 Commercial

9.7.6.3 Residential

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Oil & Gas

9.7.7.2 Manufacturing

9.7.7.3 Chemical & Pharmaceuticals

9.7.7.4 Agriculture

9.7.7.5 Power Generation

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global High Pressure Water Pump Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023 : |

USD 2.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.90% |

Market Size in 2032 : |

USD 3.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Pressure |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||