High Content Screening Market Synopsis:

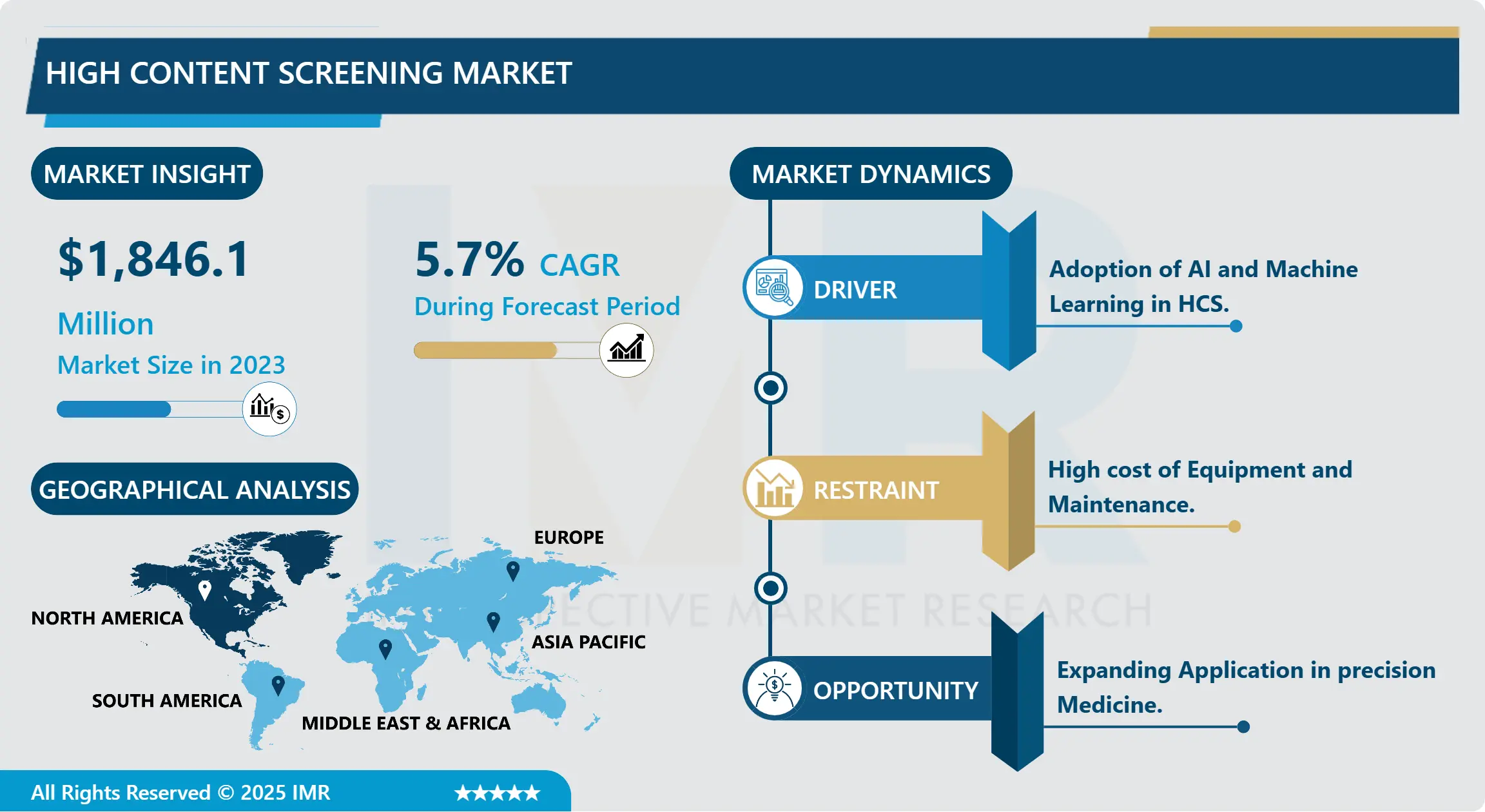

High Content Screening Market Size Was Valued at USD 1,846.1 Million in 2023, and is Projected to Reach USD 3040.3 Million by 2032, Growing at a CAGR of 5,7% From 2024-2032.

The High Content Screening (HCS) market can be defined as the market for automated microscopy technologies coupled with high-end imaging modalities used to capture and quantify cellular or molecular responses to multiple parameters. This approach allows for rapid processing of large biological data in drug development, toxicity assessment, and cellular biology. HCS technology is especially employed for measuring cell-based assays, imaging phenotypic alteration and different cellular responses such as gene expression, protein relocalization and signal transduction pathways. Recent development of artificial intelligence and machine learning has also enhanced the use of HCS platforms in biomedical research and clinic diagnosis.

The global High Content Screening HCS market has grown rapidly as there is a great demand for the cell based assay and high throughput screening system within the pharmaceutical and Biotechnology sector. With advanced drug discovery process being increasingly biological in nature and with bioassays and screening demanding more accurate and high throughput tests, HCS has evolved. Modern identification of drug candidates as well as researchers and pharmaceutical firms find HCS technologies as a powerful, accurate and high-throughput system capable of monitoring several biological processes at a time.

Moreover, the increased incidence of chronic diseases and the requirements of the pharmaceutical industry for better methods for evaluating drug candidates also factor into advancing the market. HCS provide a strong tool in early phase drug discovery, including the potential toxicities or off-target effects. It helps the scientists to provide cellular profiling of a higher throughput than they can handle, which helps in shortening the drug development cycle. The incorporation of such tools as the automated microscopy systems, AI integrated image analysis, and improved data analyses tools have made HCS a more effective tool in all research and clinical laboratories around the world.

High Content Screening Market Trend Analysis:

Adoption of AI and Machine Learning in HCS

-

It is transformative that the techniques of artificial intelligence (AI) and machine learning (ML) are incorporated into HCS platforms. AI and ML technologies are being used to strengthen cellular image data interpretation and understand multicellularity through cell simulation. These technologies involve the ability to obtain quantitative information from image databases which in the past required a lot of time and could be achieved with high levels of errors. Advanced technological models can now discern fine infractions in met raters, define biomarkers and trace drug reactions in detail. This trend should soon revolutionize drug discovery and cellular research by enhancing their efficiency and offering a better understanding of various biological impact at the cellular level. Accordingly, advanced HCS platforms integrated with AI are getting increasingly complex to provide researchers with nearly real-time, usable data than ever before.

Expanding Applications in Precision Medicine

-

Of all the trends currently shaping High Content Screening (HCS), the one with the highest potential for growth is the connection to precision medicine. It was therefore apparent that as health care deliveries progress to personalized medicine there is usually a rise in the calls for tailor made drugs based on genetics as well as cellular biology. High-throughput screening of patient-derived cells is another area where HCS technology can come into its own, as this shift will make it easier to predict how a particular drug or therapy will perform in a particular patient. This application is perhaps most useful in oncology as well as neurology since tumors and CNS disorders are highly heterogeneous. The capability of screening and examining these cells in a high content and multi parametric way could highly aid the effort put into the implementation of personalized medicine thus improving the patients condition.

High Content Screening Market Segment Analysis:

High Content Screening Market is Segmented on the basis of Product Type, Application, End User, and Region

By Product Type, cell Imaging And Analysis Equipment segment is expected to dominate the market during the forecast period

-

The basic segments of HCS refer to cell imaging and analysis instruments namely those with utility in capturing the image of a cell and its behavior at a very high level of resolution. This category involves different kinds of microscopes, high content screening systems, and automated image analysers that permit real time characterisation of cellular reactions to stimuli.

- These systems often integrate confocal microscopy, fluorescence microscopy, and brightfield imaging to capture images with high resolution, allowing for the identification of cellular structures, protein localization, and morphological changes. Furthermore, multiplexed imaging allows simultaneous detection of multiple biomarkers within a single sample, increasing the amount of data that can be collected during a screening experiment. The increasing adoption of live-cell imaging systems, which allow researchers to observe cellular processes over time without disrupting the cells, has significantly contributed to the growth of this segment, especially in dynamic and longitudinal studies such as drug development and disease modeling.

By Application ,Primary Screening, segment expected to held the largest share

-

High Content Screening or HCS is incorporated in drug discovery with primary screening in significant value as an early stage application. In this phase, the researchers utilize the HCS technologies to search for possible biological activity form very large library or compounds. The aim of primary screening is mainly to find active compounds which induce the required biological effects such as interaction with target protein or a particular signaling cascade or which elicit the required change in cell signaling or behaviour. HCS is particularly suitable for primary screening since multiple parameters of cellular responses can be assessed in parallel at a much faster rate than those using conventional approaches. Some of the changes that can be assessed are rapid and allow investigators to immediately identify what compounds may be attractive for therapy.

- This is particularly significant where high throughput screening is used implying that large numbers of compounds have to be screened and their effects on the organism analyzed in a relatively short time. Further, HCS preserves the cell functionality which allows for the identification of off-target effects and cellular toxicity very early during the screening process and thus minimize potential false positives, making drug discovery a more effective and reliable process. Consequently with high throughput screening that is based on HCS, primary screening is becoming essential for the identification and validation of potential drug products in pharmaceutical and biotechnology industries.

High Content Screening Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

According to the analysis, the High Content Screening (HCS) market share, is still expected to be dominated by North America in 2023. This has made North America carve a niche in this market with USA for instance being at the forefront due to its advanced pharmaceutical and biotechnology industries, research in biomedical sciences and most research and clinical laboratories relying on advance technologies. The region stood at an estimated $75-80 billion market volume and had a market share of about 45-50% in 2023. The dominance is also supported by sustained capital expenditure on research and development, favourable government policies on innovation and presence of major players such as Thermo Fisher Scientific Inc, PerkinElmer and BD Biosciences have branched well in this region. Also, North America is a preferred location for early innovative drug discovery and screening due to a high density of academy- research institutions and renowned pharma companies.

- Europe also has a higher demand for HCS but it is still toppled down by North America in terms of market percentage. The region is experiencing a gradual expansion especially in some of the countries with well-developed life science industry prominent ones being Germany, UK, and France. Although, a totally new market, Asia-Pacific, especially countries like China and Japan are demonstrating a fabulous growth prospect in a featuring a growing pharmaceutical market and higher investments in biotechnology.

Active Key Players in the High Content Screening Market:

-

Agilent Technologies (USA)

- BD Biosciences (USA)

- BioTek Instruments (USA)

- Cellomics, Inc. (USA)

- Corning Incorporated (USA)

- Essen BioScience (USA)

- GE Healthcare (UK)

- Leica Microsystems (Germany)

- Lonza Group (Switzerland)

- Merck KGaA (Germany)

- Nikon Corporation (Japan)

- Olympus Corporation (Japan)

- PerkinElmer, Inc. (USA)

- Promega Corporation (USA)

- Thermo Fisher Scientific (USA)

- Other Active Players.

|

High Content Screening Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1,846.1 Million |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 3040.3 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High Content Screening Market by Product Type

4.1 High Content Screening Market Snapshot and Growth Engine

4.2 High Content Screening Market Overview

4.3 Cell Imaging and Analysis Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cell Imaging and Analysis Equipment : Geographic Segmentation Analysis

4.4 Consumables

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Consumables : Geographic Segmentation Analysis

4.5 HCS Software

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 HCS Software : Geographic Segmentation Analysis

4.6 HCS Services

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 HCS Services: Geographic Segmentation Analysis

Chapter 5: High Content Screening Market by Application

5.1 High Content Screening Market Snapshot and Growth Engine

5.2 High Content Screening Market Overview

5.3 Primary Screening

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Primary Screening : Geographic Segmentation Analysis

5.4 Target Identification & Validation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Target Identification & Validation : Geographic Segmentation Analysis

5.5 Toxicity Studies

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Toxicity Studies : Geographic Segmentation Analysis

5.6 Compound Profiling

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Compound Profiling : Geographic Segmentation Analysis

5.7 Others End User (Pharmaceutical Organizations

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others End User (Pharmaceutical Organizations : Geographic Segmentation Analysis

5.8 Biotechnology Organizations

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Biotechnology Organizations : Geographic Segmentation Analysis

5.9 Research Institutes

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Research Institutes : Geographic Segmentation Analysis

5.10 Independent CRO

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Independent CRO : Geographic Segmentation Analysis

5.11 Government Organizations

5.11.1 Introduction and Market Overview

5.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.11.3 Key Market Trends, Growth Factors and Opportunities

5.11.4 Government Organizations : Geographic Segmentation Analysis

5.12 Others)

5.12.1 Introduction and Market Overview

5.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.12.3 Key Market Trends, Growth Factors and Opportunities

5.12.4 Others) : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 High Content Screening Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AGILENT TECHNOLOGIES (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BD BIOSCIENCES (USA)

6.4 BIOTEK INSTRUMENTS (USA)

6.5 CELLOMICS INC. (USA)

6.6 CORNING INCORPORATED (USA)

6.7 ESSEN BIOSCIENCE (USA)

6.8 GE HEALTHCARE (UK)

6.9 LEICA MICROSYSTEMS (GERMANY)

6.10 LONZA GROUP (SWITZERLAND)

6.11 MERCK KGAA (GERMANY)

6.12 NIKON CORPORATION (JAPAN)

6.13 OLYMPUS CORPORATION (JAPAN)

6.14 PERKINELMER INC. (USA)

6.15 PROMEGA CORPORATION (USA)

6.16 THERMO FISHER SCIENTIFIC (USA)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global High Content Screening Market By Region

7.1 Overview

7.2. North America High Content Screening Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product Type

7.2.4.1 Cell Imaging and Analysis Equipment

7.2.4.2 Consumables

7.2.4.3 HCS Software

7.2.4.4 HCS Services

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Primary Screening

7.2.5.2 Target Identification & Validation

7.2.5.3 Toxicity Studies

7.2.5.4 Compound Profiling

7.2.5.5 Others End User (Pharmaceutical Organizations

7.2.5.6 Biotechnology Organizations

7.2.5.7 Research Institutes

7.2.5.8 Independent CRO

7.2.5.9 Government Organizations

7.2.5.10 Others)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe High Content Screening Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product Type

7.3.4.1 Cell Imaging and Analysis Equipment

7.3.4.2 Consumables

7.3.4.3 HCS Software

7.3.4.4 HCS Services

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Primary Screening

7.3.5.2 Target Identification & Validation

7.3.5.3 Toxicity Studies

7.3.5.4 Compound Profiling

7.3.5.5 Others End User (Pharmaceutical Organizations

7.3.5.6 Biotechnology Organizations

7.3.5.7 Research Institutes

7.3.5.8 Independent CRO

7.3.5.9 Government Organizations

7.3.5.10 Others)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe High Content Screening Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product Type

7.4.4.1 Cell Imaging and Analysis Equipment

7.4.4.2 Consumables

7.4.4.3 HCS Software

7.4.4.4 HCS Services

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Primary Screening

7.4.5.2 Target Identification & Validation

7.4.5.3 Toxicity Studies

7.4.5.4 Compound Profiling

7.4.5.5 Others End User (Pharmaceutical Organizations

7.4.5.6 Biotechnology Organizations

7.4.5.7 Research Institutes

7.4.5.8 Independent CRO

7.4.5.9 Government Organizations

7.4.5.10 Others)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific High Content Screening Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product Type

7.5.4.1 Cell Imaging and Analysis Equipment

7.5.4.2 Consumables

7.5.4.3 HCS Software

7.5.4.4 HCS Services

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Primary Screening

7.5.5.2 Target Identification & Validation

7.5.5.3 Toxicity Studies

7.5.5.4 Compound Profiling

7.5.5.5 Others End User (Pharmaceutical Organizations

7.5.5.6 Biotechnology Organizations

7.5.5.7 Research Institutes

7.5.5.8 Independent CRO

7.5.5.9 Government Organizations

7.5.5.10 Others)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa High Content Screening Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product Type

7.6.4.1 Cell Imaging and Analysis Equipment

7.6.4.2 Consumables

7.6.4.3 HCS Software

7.6.4.4 HCS Services

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Primary Screening

7.6.5.2 Target Identification & Validation

7.6.5.3 Toxicity Studies

7.6.5.4 Compound Profiling

7.6.5.5 Others End User (Pharmaceutical Organizations

7.6.5.6 Biotechnology Organizations

7.6.5.7 Research Institutes

7.6.5.8 Independent CRO

7.6.5.9 Government Organizations

7.6.5.10 Others)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America High Content Screening Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product Type

7.7.4.1 Cell Imaging and Analysis Equipment

7.7.4.2 Consumables

7.7.4.3 HCS Software

7.7.4.4 HCS Services

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 Primary Screening

7.7.5.2 Target Identification & Validation

7.7.5.3 Toxicity Studies

7.7.5.4 Compound Profiling

7.7.5.5 Others End User (Pharmaceutical Organizations

7.7.5.6 Biotechnology Organizations

7.7.5.7 Research Institutes

7.7.5.8 Independent CRO

7.7.5.9 Government Organizations

7.7.5.10 Others)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

High Content Screening Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1,846.1 Million |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 3040.3 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||