Hemoglobin A1C Testing Devices Market Synopsis:

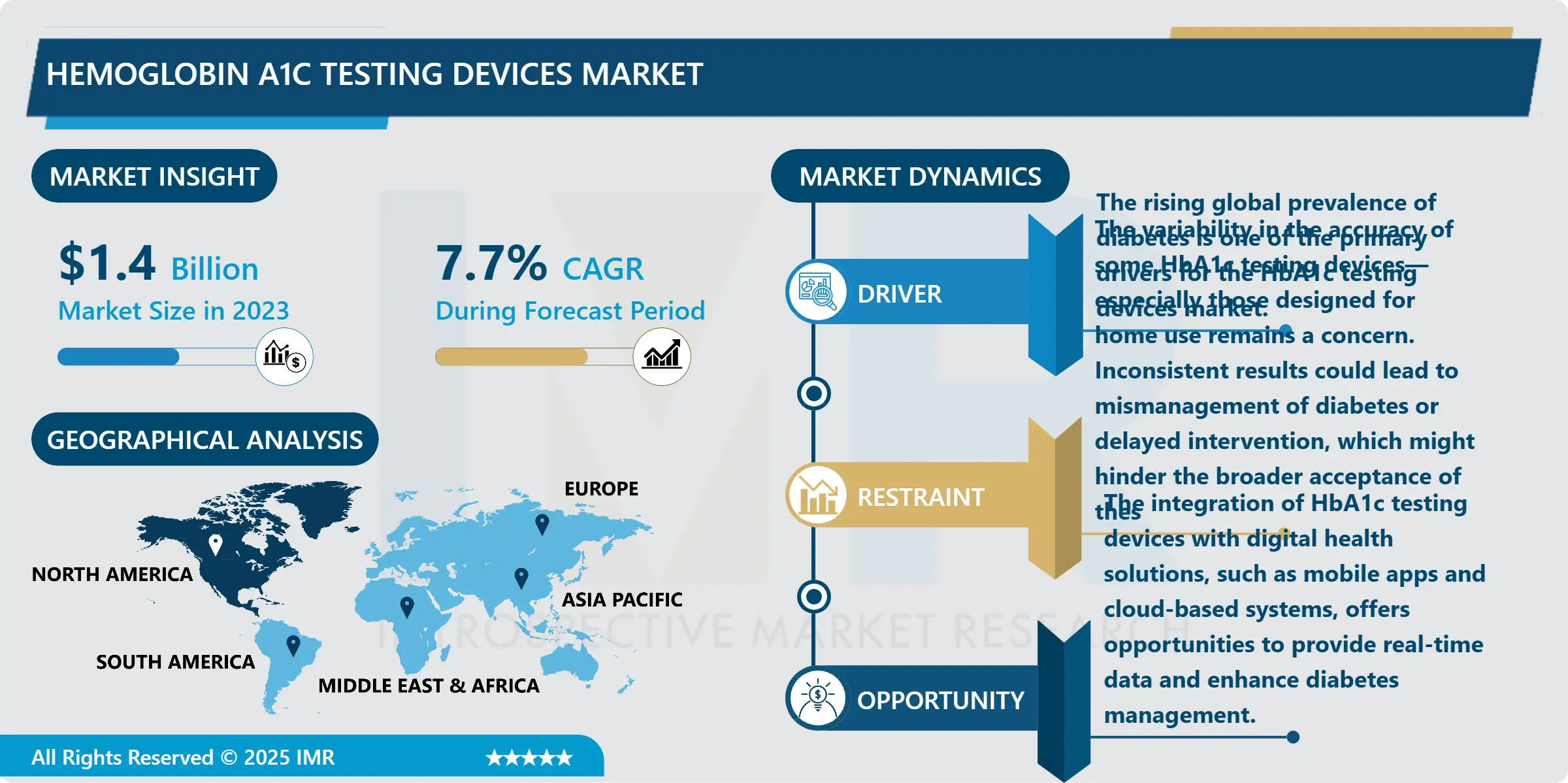

Hemoglobin A1c Testing Devices Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 2.87 Billion by 2032, Growing at a CAGR of 7.7% from 2024-2032.

The term Hemoglobin A1c (HbA1c) Testing Devices Market encompasses the businesses that design, manufacture, and market products employed in testing the Hemoglobin A1c levels that is crucial in preliminary diagnosing and monitoring of the Diabetes. HbA1c or glycosylated haemoglobin gives a perspective of the average blood glucose values in the preceding two to three months and hence is more important in evaluating duration control of hyperglycaemia in diabetics. Point of care devices, laboratory based analysers and portable testing devices form the market of HbA1c testing devices that offer the physicians as well as the patient’s quick and accurate results for glycaemic control. These devices employ several methods including immunoassays, High-performance liquid chromatography (HPLC), turbid metric inhibition immunoassay and capillary electrophoresis to estimate the HbA1c concentration. The growth in the incidence of diabetes, awareness towards SMBG systems, technological advances for decentralised testing or Point of care testing are few major drivers which are fueling this market. Besides, new technologies including non invasive diagnosing of HbA1c kits, and technological adoption in patient monitoring inclusive of mobile applications and cloud based data processing are helping to shape this market. Furthermore, the evolving diabetes care management to focus more on expanded early diagnosis, early and recurrent chronic disease monitoring and moving focus to preventing diabetes complications increasing HbA1c testing. With global rises of diabetes patients, the need for HbA1c testing devices also increases; in addition, new advancements of testing technologies expand the convenience, effectiveness and simplicity.

The global market for Hemoglobin A1c (HbA1c) Testing Devices is also growing rapidly due to the changing lifestyles and global increase in diabetes, improved healthcare awareness and the ongoing development of new testing devices. The capillary blood HbA1c assay represents an essential component of diabetes treatment and diagnosing since it reveals performance indicators on a patient’s glycemic control during the previous 2–3 months. At the present time, more than 460 million individuals globally are diagnosed with diabetes, numbers which are expected to rise in the future. This has increased patient population hence the need for accurate, reliable and approaching near point of care testing solutions that would aid in early detection of diabetes, monitoring and managing the disease through HbA1c testing devices.

The market has diverse products and equipment including Point of Care (POC), laboratory equipment, and home-use products. Especially, the point of care testing devices have been highly demanded because they are easy to use, do not need concentration and which can give the results at the same time of testing. Also, a growth of self--monitoring home-use chip technology for accurate HbA1c testing is encouraging patients with diabetes to perform HbA1c checks outside hospitals or doctors’ appointments. The increasing trend in non-invasive diagnostic systems or technologies like some devices that incorporate infrared spectroscopy or biosensors is also contributing to market change in terms of providing patients with more mentions and easy to use options than the standard blood tests. Moreover, advancement like connective technologies whereby the results of the test is synchronized within the mobile apps or cloud based platforms for constant monitoring of the health status of the people are extending the applicability of the HbA1c test in with the greater digital health solutions.Market drivers are a growing incidence of diabetes, the focus on HbA1c testing for managing diabetes related complications, and an increase in healthcare spending. Increased awareness of government activities in diabetes management coupled with an emerging focus toward preventive health and timely diagnosis are providing an added boost to the market. But certain linkages may hamper the market growth in some regions, including the high price of some sophisticated HbA1c testing equipment, the lack of wider access to testing in rural or low-income population, and emerging issues related to the approval of such devices. However, the trends towards the constant renewal of testing approaches and the increased need for personalized patients’ solutions are likely to foster the market growth and, the market is expectived to grow considerably in the next decade.

Hemoglobin A1c Testing Devices Market Trend Analysis:

Self-Monitoring of HbA1c Levels Gaining Popularity Among Diabetes Patients

- Self-monitoring of HbA1c is also and already becoming a strong trend in many patients with diabetes exploring desires for enhanced self-directed control and availability and improved ease in home-use technologies available for self-testing. HbA1c testing used to be done onsite in clinics, which often called by the name ‘point of care’ and still involves somehow going to laboratories to have blood drawn. However, with emerging home-use HbA1c testing kits, it has become easier for a person to monitor his or her long-term blood sugar levels and control diabetes at home. These devices are intended to give the patient an instant and precise reading of a particular disease so that he or she could easily modify their treatment or change their lifestyle altogether.

- Self-monitoring is on the increase, more so because patient-centered care is gaining ground in healthcare, with improved emphasis on proactive care. The number of diabetic patients has increased to an alarming rate across the world, and this has been coupled by increased demand of easy to use, affordable and frequent monitoring of glycemic index. Besides, self-testing tools allow avoiding regular doctor appointments, which is very helpful for people who live in the countryside or have no chance to attend medical centers often. Him looking at Bluetooth enabled devices that interact with his mobile applications and support constant monitoring while the capacity to transfer the results of his monitoring to his physicians conveniently and without interruption enhances the concept of digital health. As the penetration of HbA1c testing continues to common, this is likely to drive trends that bring better disease management, patient interaction, and likely, improved total results across the diabetic populace.

Growing Shift Toward Preventive Healthcare to Increase Demand

- Increased public focus on early diagnosis of the disease and condition is hugely driving the global demand for HbA1c testing devices as preventive measures get the thumbs up in the global discourse on health. Preventive health emphasizes early established signs or experiences of ailments and diseases that will make it easier to deal with them, minimizing the prevalence of chronic diseases. Due to increasing rates of diabetes around the world and in particular in ageing populations and in developing countries where the rate of urbanization is increasing, early screening of blood glucose is now an important aspect of intervention and prevention measures. HbA1c testing that reveals the average blood glucose concentration in a patient the 2-3 months prior to the testing is a crucial diagnostic tool in identifying patients at risk of getting type 2 diabetes and assists the healthcare givers in making decisions on what changes in the lifestyle and medical treatments are necessary.

- This trend towards preventive management is boosted by governments, healthcare institutions, and medical professions pushing for enhanced use of HbA1c as part of the annual health check-ups especially on people who are deemed to be high risk diabetes patients. With Non-Dma devices turning out available and affordable with home testing, people can be constantly checking their HbA1c level which means that patients can easily be participating in enhancing their health condition. With increasing patient activation in the management of their conditions and systems shifting towards reimbursing for the costs of complications of diabetes symptomatic care, there will be an increasing need for easy to use HbA1c testing devices for self-monitoring/point of care testing. But this trend is also valuable to patients in that it supplies the tools that patients have to monitor their health status; it is also beneficial for some companies, who could invest in and bring out new testing solutions to address the rising necessity of preventive care in diabetes.

Hemoglobin A1c Testing Devices Market Segment Analysis:

Hemoglobin A1c Testing Devices Market is Segmented on the basis of Type, Application, End User, and Region

By Type, Assay-Based Devices segment is expected to dominate the market during the forecast period

- The market for Hemoglobin A1c testing devices has been divided into two segments, namely Point of Care Devices and Assay-Based Devices, among which, Assay-Based Devices is possibly going to hold the largest share for the period ranging from 2017 to 2022 due to its high usage and sound evidential backing. These devices employ immunochemical assays, enzymantical assays, and other assays techniques in order to determine the HbA1c with a good precision. Compared to most conventional methods such as chromatography, the assay-based devices are faster, cheaper, and easier to use making them suitable for point-of-care (POC) testing. Lab based devices are favored in healthcare centers – hospitals, clinics and especially in diabetes clinics because they provide quick test results which can be used to make instant decisions on the patients’ management. Further, these devices are commonly devoid of the need for complex sample preparation and can be implemented in any type of area such as the remote or limited-resource area, making them highly portable and used extensively.

- A constantly increasing number of patients who prefer self-monitoring and diabetes home treatment are acting as a catalyst to the development of the assay-based devices segment. Due to the current and further increased incidence of diabetes worldwide, the demand for easier, less expensive, and more convenient testing methods is increasing. Most of the currently available home-use HbA1c testing kits utilize assay-based technologies and anyone can perform the test at home without the help of a professional. These are fast becoming efficient due to the enhancement being put in place with the enhanced use of mobile applications in digital health where the patient can monitor and manage his/her condition in real-time. This is to the effect that, driven by increasing adoption of preventive care and repeat HBA1C measurement by patients and healthcare prescribers, the assay based devices segment remains optimally positioned to preserve its pole position owing to factors such as ergonomic ability, precision and availability of products in the global market.

By Application, Clinical Diagnostics segment expected to held the largest share

- Hypotonic saline segment accounted for the largest share of the Hemoglobin A1c Testing Devices Market due to the increasing significance of HbA1c tests in diagnosing diabetes. HbA1c tests play critical roles in clinical practice for the evaluation of long term glycaemic control, as a confirmation of diabetes diagnoses and for assessing the responsiveness of the diabetes treatment plans. Due to the ever growing rates of type 2 diabetes, practitioners continue to implement the use of HbA1c in optimizing patient treatment plans and averting severe consequences resulting from high blood sugar levels. Originally designed for use in the highly specialised environments like hospital and clinic ambient environments, and laboratory testing systems, these devices are now core tools in managing patient care through the measurement of HbA1c. Also, the increasing concern towards the preventive healthcare and early diagnosis of diabetes also, strengthens the need for clinical diagnostic products.

- The growth of the segment in the clinical diagnostics market is also associated with the increasing use of point of care (POC) and laboratory based test devices. Specifically, innovative systems of the health care delivery are being developed with focus on speed, accuracy and efficiency for chronic diseases and it is demonstrated that the usage of HbA1c testing devices will expand in clinical settings. Furthermore, there has been innovation in the assay-based and non-invasive testing that makes these tests more available, precise and less challenging to conduct during diagnosis. It is applied not only for diagnosing diabetes but also for detecting patients’ glycemic control, diagnosing prediabetes, or estimating cardiovascular dangers. Based on these factors, the clinical diagnostics segment is expected to sustain the highest market share while contributing to the growth of HbA1c testing devices market.

Hemoglobin A1c Testing Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to hold the largest share over the forecast period in the Hemoglobin A1c Testing Devices Market due to high incidence rates of diabetes, coupled by advanced facilities in the region. Currently, the largest market share is attributed to the United States due to active use of diagnostic tests, including HbA1c, both in healthcare centers and home-for-home care. As there are 33.96 million people and 88 million people diagnosed with diabetes and prediabetes respectively, in the United States there is a strong need in accurate and reliable equipment for HbA1c testing. Furthermore, growing emphasis on early diagnosis as well as preventive measures has lead to the use of point-of-care and self-testing monitoring devices, which enhance a persons ability to monitor the disease from the onset. Proliferation of a patient-centric focus in health care and a rise in investments in health care technology make North America the market’s main propeller.

- Besides the large number of diabetic patients, North America has favourable regulatory conditions, as well as the high health care expenses. The FDA is primarily responsible for safeguarding the consumer through providing examination of medical devices, which contributes to the promotion of development of improved testing techniques. In addition, the incorporation of mobile and Web applications in HbA1c testing devices and related solutions is most notable for North America. All of these innovations help patients and caregivers obtain timely data and information on the management of diabetes and support for better and continued healthcare. This is because the health care setting of the region is shifting its emphasis to chronic disease control such as improved management of diabetes hence the need for HbA1c testing devices. Therefore, North America is expected to continue its market dominance in the HbA1c testing devices market throughout the forecast period and will further boost the global market.

Active Key Players in the Hemoglobin A1c Testing Devices Market:

- A. Menarini Diagnostics (Italy)

- Abbott Laboratories (United States)

- Arkray, Inc. (Japan)

- Bayer Healthcare (Germany)

- Bio-Rad Laboratories (United States)

- Danaher Corporation (United States)

- DCA Laboratories (United States)

- F. Hoffmann-La Roche AG (Switzerland)

- Helena Laboratories (United States)

- LifeScan, Inc. (United States)

- Lonza Group (Switzerland)

- Merck Group (Germany)

- Pocmed Healthcare (China)

- Roche Diagnostics (Switzerland)

- Siemens Healthineers (Germany)

- Thermo Fisher Scientific (United States)

- Trinity Biotech (Ireland)

- Yokogawa Electric Corporation (Japan)

- Other Active Players

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.4 Billion |

|

Forecast Period 2024-32 CAGR: |

7.7 % |

Market Size in 2032: |

USD 2.87 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hemoglobin A1c Testing Devices Market by Type

4.1 Hemoglobin A1c Testing Devices Market Snapshot and Growth Engine

4.2 Hemoglobin A1c Testing Devices Market Overview

4.3 Assay

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Assay: Geographic Segmentation Analysis

4.4 Chromatography

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Chromatography: Geographic Segmentation Analysis

Chapter 5: Hemoglobin A1c Testing Devices Market by Application

5.1 Hemoglobin A1c Testing Devices Market Snapshot and Growth Engine

5.2 Hemoglobin A1c Testing Devices Market Overview

5.3 Clinical Diagnostics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Clinical Diagnostics: Geographic Segmentation Analysis

5.4 Screening and Monitoring

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Screening and Monitoring: Geographic Segmentation Analysis

5.5 Research & Development

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Research & Development: Geographic Segmentation Analysis

Chapter 6: Hemoglobin A1c Testing Devices Market by End User

6.1 Hemoglobin A1c Testing Devices Market Snapshot and Growth Engine

6.2 Hemoglobin A1c Testing Devices Market Overview

6.3 Hospitals and Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals and Clinics: Geographic Segmentation Analysis

6.4 Home Care/Individual Users

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Home Care/Individual Users: Geographic Segmentation Analysis

6.5 Diagnostic Laboratories

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Diagnostic Laboratories: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hemoglobin A1c Testing Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 A. MENARINI DIAGNOSTICS (ITALY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ABBOTT LABORATORIES (UNITED STATES)

7.4 ARKRAY INC. (JAPAN)

7.5 BAYER HEALTHCARE (GERMANY)

7.6 BIO-RAD LABORATORIES (UNITED STATES)

7.7 DANAHER CORPORATION (UNITED STATES)

7.8 DCA LABORATORIES (UNITED STATES)

7.9 F. HOFFMANN-LA ROCHE AG (SWITZERLAND)

7.10 HELENA LABORATORIES (UNITED STATES)

7.11 LIFESCAN INC. (UNITED STATES)

7.12 LONZA GROUP (SWITZERLAND)

7.13 MERCK GROUP (GERMANY)

7.14 POCMED HEALTHCARE (CHINA)

7.15 ROCHE DIAGNOSTICS (SWITZERLAND)

7.16 SIEMENS HEALTHINEERS (GERMANY)

7.17 THERMO FISHER SCIENTIFIC (UNITED STATES)

7.18 TRINITY BIOTECH (IRELAND)

7.19 YOKOGAWA ELECTRIC CORPORATION (JAPAN)

7.20 .

7.21 OTHER ACTIVE PLAYERS

Chapter 8: Global Hemoglobin A1c Testing Devices Market By Region

8.1 Overview

8.2. North America Hemoglobin A1c Testing Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Assay

8.2.4.2 Chromatography

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Clinical Diagnostics

8.2.5.2 Screening and Monitoring

8.2.5.3 Research & Development

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals and Clinics

8.2.6.2 Home Care/Individual Users

8.2.6.3 Diagnostic Laboratories

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hemoglobin A1c Testing Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Assay

8.3.4.2 Chromatography

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Clinical Diagnostics

8.3.5.2 Screening and Monitoring

8.3.5.3 Research & Development

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals and Clinics

8.3.6.2 Home Care/Individual Users

8.3.6.3 Diagnostic Laboratories

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hemoglobin A1c Testing Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Assay

8.4.4.2 Chromatography

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Clinical Diagnostics

8.4.5.2 Screening and Monitoring

8.4.5.3 Research & Development

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals and Clinics

8.4.6.2 Home Care/Individual Users

8.4.6.3 Diagnostic Laboratories

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hemoglobin A1c Testing Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Assay

8.5.4.2 Chromatography

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Clinical Diagnostics

8.5.5.2 Screening and Monitoring

8.5.5.3 Research & Development

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals and Clinics

8.5.6.2 Home Care/Individual Users

8.5.6.3 Diagnostic Laboratories

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hemoglobin A1c Testing Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Assay

8.6.4.2 Chromatography

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Clinical Diagnostics

8.6.5.2 Screening and Monitoring

8.6.5.3 Research & Development

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals and Clinics

8.6.6.2 Home Care/Individual Users

8.6.6.3 Diagnostic Laboratories

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hemoglobin A1c Testing Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Assay

8.7.4.2 Chromatography

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Clinical Diagnostics

8.7.5.2 Screening and Monitoring

8.7.5.3 Research & Development

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals and Clinics

8.7.6.2 Home Care/Individual Users

8.7.6.3 Diagnostic Laboratories

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.4 Billion |

|

Forecast Period 2024-32 CAGR: |

7.7 % |

Market Size in 2032: |

USD 2.87 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||