Healthcare Payer Services Market Synopsis:

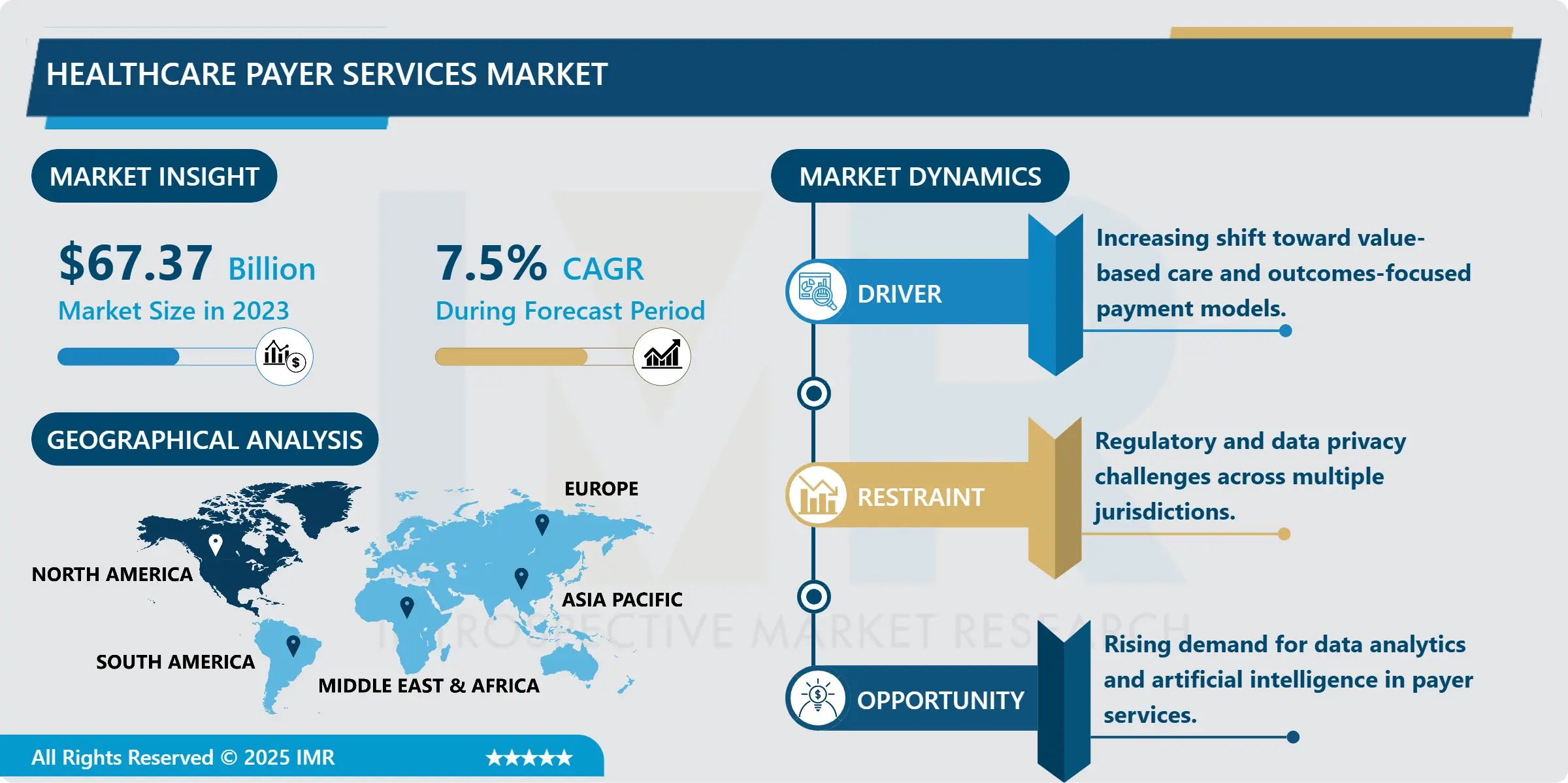

Healthcare Payer Services Market Size Was Valued at USD 67.37 Billion in 2023, and is Projected to Reach USD 129.16 Billion by 2032, Growing at a CAGR of 7.5% From 2024-2032.

The Healthcare Payer Services Market refers to any service provided by third-party vendors to help healthcare payers, including insurers, sponsors of health plans, and various government entities manage administrative, operational, and information technology workflows. These services include claims processing, reimbursement, membership servicing, enrolment and customer support, analytics and advisory services that is targeted at enhancing payer operations. With the continuous shift being witnessed in the healthcare industry, payer services plays a significant role in making healthcare systems more efficient, cost-effective and effective in delivering quality solutions to the customers through freeing up the payer’s time to innovate and develop new ideas in making their payer services customer oriented.

Health care Payer services market is experiencing significant growth because there is more attention placed on healthcare management to reduce tasks, escalating costs, and the adaptability of the global Healthcare Payer towards Value based care models. It is becoming more challenging, or time-consuming for payers to handle a range of broader administrative duties more effectively and at the same time enhance the quality of their services. It is important for payers to outsource their services to specialized vendors as this give them an opportunity of getting efficient technology, cutting down on their operating cost and planning their resources properly. This shift is well in line with the industry trends where many organizations are leveraging on data processing and automation to minimize expenses and instead maximize efficiency in tasks that range from claim filings to member enrolment and even customer relations.

Furthermore, as governments and private sectors administrate various advanced healthcare policies and value based reimbursement models, payer organizations rely highly on external service providers for compliance, risk assessment and policy change. Thus, the payer service sector has seen increasing demands in analytics, consulting as well as the management of data stemming from the ever-increasing rosy, which has forced players to adapt to continuous changes in payer regulations. Also, the existing and emerging technologies of artificial intelligence (AI) and machine learning (ML) are defining the payer services, for real-time analytics and decision-making with personalized member experience and even forecast. Hence, the market of payer services is expected to experience good levels of growth in the future years as more payers begin to outsource operational administrative functions.

Healthcare Payer Services Market Trend Analysis:

Growing Adoption of Automation and AI in Payer Services

- Automation with elements of artificial intelligence in the services of a healthcare payer is changing the efficiency of work and the quality of services. Robotic process automation (RPA) solutions are cutting the increasing amount of paperwork and other routine administrative tasks by a large margin, which includes the claims and billing. By adopting these tasks, the payers can cut down on the time taken and also minimize on the error rate hence can work better and economically. Artificial intelligence also lifts the capabilities of the payer organizations because it provides insights that can be used to improve the organisation’s capacity to detect frauds, to use statistical models, and to fine-tune customers’ engagement. The integration of the AI into these central processes enables payers to understand patterns, to anticipate risks and, in turn, to develop interventions that translate into better patient outcomes and operational effectiveness.

- Further, AI technologies increases the abilities of payers to provide chatbots or personal communication with members to provide better and even proactive customer service to the members. Artificial intelligence (AI) and data analytics applications enable the process of reflecting on large data volumes to find relevant information that influences positive changes in the claims performance, member satisfaction, risk management, and others. The implementation of these technologies is anticipated to grow to the rising trend in growth and development that can be traced with the current and future payer organizations due to a competitive human health care sector that is armed with technological advances and highly regulated. By following continued scalability and development, AI and automation will become fundamental differentiators in payer services, allowing organizations to function more accurately and accommodate customers on a more unique basis.

Rising Demand for Analytics and Data Management Services

- One of the major growth prospects that exist for the Healthcare Payer Services Market is the burgeoning need for analytics and data management solutions that are currently a high priority for payers in light of need for better efficiency. The use of data analytics in payer organisation is on the rise, thanks to its potentials to help in curbing fraud, meeting regulatory requirements and enhancing decision making, among others. Advanced analytics of important rates including member demographics, usage, and financial position improve payer’s customer focus, risk assessment as well as accelerates claims processing. With the emphasis placed on data insight, payers are starting to see analytics as a means to a basic end of operational efficiency.

- In addition, the movement to value has accelerated the demand for analytical tools that evaluate the efficacy and expense of treatments, so that payer service providers can offer member-focused guidance on health management, risk differentiation, and cost control. The adoption of Electronic Health Records (EHRs) as well as increase in usage of telemedicine systems also significantly contributes to the need of large volume data integration and one stop management. On this trend, there is a clear indication of the potential for analytics in the payer services market as more healthcare payers increasingly look for ways to handle big data and achieve improved financial and health outcomes.

Healthcare Payer Services Market Segment Analysis:

Healthcare Payer Services Market is Segmented on the basis of Source Type, Application, End User, and Region.

By Source Type, Business Process Outsourcing (BPO) segment is expected to dominate the market during the forecast period

- The Business Process Outsourcing (BPO) Services segment in the healthcare payer services market is related to outsourcing of the administrative and back office functions to third party service providers. The services that fall under BPO are claims processing, customer relation, billing, and accounts services. Outsourcing of these functions saves costs and time hence allowing healthcare payers to direct their efforts towards valued added services and core healthcare functions. BPO has become popular in the payer organizations because they want to improve the efficiency of their processes, face increased data volume and want to develop members services without more investment in human capital. This segment becomes useful and necessary for payers willing to decrease administrative costs and increase the adherence to regulatory requirements.

- IT Outsourcing Services and Knowledge Processing Outsourcing Services are also crucial for the healthcare payers who want to adopt new technologies & data analytics. ITO services may involve outsourcing of it infrastructure management services as well as cybersecurity services, software development services and cloud services. Through the engagement of ITO services, payers can gain timely and efficient access to the settings of new technology, secure processes and perfect management of data without an expensive in house IT department. On the other hand, KPO involves systematically more complex, high-value business processes which are more information intensive and include data analysis, evaluation of risks, and consultancy. The above-mentioned services help HWAs to understand members’ health concerns and costs, risks areas, and trends in the given population in order to develop an evidence-based strategy to deliver maximum value to members. All together, the BPO, ITO, and KPO services contribute a more efficient and integrating model that boosts the growth of innovations in overall healthcare payers category.

By Application, Claims Management Services segment expected to held the largest share

- In the claims management services for the healthcare payer services market claims management services are considered significant as it involves the management and processing of claims for healthcare services, their evaluation, and their settlement, which greatly lessens turn-around time and increases accuracy. Claims management reduces the chances of claim denial, increase cost control and improve member satisfaction through timely processing and accurate claims payment. Member Enrolment Services help to make a new membership or changes to existing memberships as easy as possible because otherwise, problems can arise with regard to access to benefits and administrative problems. Collectively, these services enable the healthcare payer to have optimal operational efficiency, first-pass accuracy, and the Member Experience.

- Customer Care Service, Billing and Accounts Management Service and Fraud Management Service are equally important for supporting the main activities of payers. Express customer services include call centers, chat, and email support for handling doubts, containing issues to give effective solutions promptly and extend goodwill to members. Billing and accounts management services arrange and control the money flow between members and providers and improves the quality of money related operations. Fraud management, however, relates to the identification and prevention of frauds in relations to claims and payments, which is very paramount in avoiding wastage associated with fraudulent payments in relation to the payer. Analytics and Reporting Services also have a crucial role by generating system intelligence and trends, containing vital finances and operationalization data to help decision making and compliance. Last but not the least, Other Administrative Services complete the scope of services by handling a host of back-end activities so that healthcare payers can focus on providing quality care and planned growth.

Healthcare Payer Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- This year, the market was headed by North America with its approximate market share of forty percent due to several significant factors. One of the main reasons for this dominance is that both the United States and Canada are showing high usage rates for digital health solutions and preferably the governmental legislation towards improving effectiveness in the sphere of healthcare. Repository of laws like the affordable healthcare has ensured that health care payers focus on operations that will meet the legal requirements hence leading to adoption of outsourced payer services. With changes in emphasis towards utilization of effective and efficient healthcare policies and insurance reforms, the payers have sought service of third party administrators for the provision of ancillary services such as claims processing, billing and management of data.

- North America has strong healthcare IT systems that also facilitate the development of the payer services market. This environment offers healthcare payers in the region the perfect opportunity to take advantage of the available sophisticated digital tools and platform to embrace automated and data-driven solutions to enhanced operation efficiency and improved service delivery at lower cost. Large outsourcing as well as high technological readiness and willingness of the regional market to adopt technological solutions makes North America the ideal environment for payer service providers. This strong underlying presumption of digital inclination and legal acknowledgement is also key to why the North American region remains by far the most developed market for healthcare payer services, it provides an attractive pool of providers who wish to strike out into a market that is highly centered on operational efficiency and health technology.

Active Key Players in the Healthcare Payer Services Market:

- Accenture (Ireland)

- Cognizant (United States)

- Concentrix (United States)

- EXL Service (United States)

- Genpact (United States)

- HCL Technologies (India)

- Hewlett Packard Enterprise (United States)

- Infosys (India)

- NTT DATA (Japan)

- Optum (United States)

- Sutherland (United States)

- Tata Consultancy Services (India)

- Tech Mahindra (India)

- Teleperformance (France)

- Wipro (India)

- Other Active Players

|

Global Healthcare Payer Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 67.37 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5 % |

Market Size in 2032: |

USD 129.16 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Healthcare Payer Services Market by Service Type

4.1 Healthcare Payer Services Market Snapshot and Growth Engine

4.2 Healthcare Payer Services Market Overview

4.3 Business Process Outsourcing (BPO) Services

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Business Process Outsourcing (BPO) Services: Geographic Segmentation Analysis

4.4 Information Technology Outsourcing (ITO) Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Information Technology Outsourcing (ITO) Services: Geographic Segmentation Analysis

4.5 Knowledge Process Outsourcing (KPO) Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Knowledge Process Outsourcing (KPO) Services: Geographic Segmentation Analysis

Chapter 5: Healthcare Payer Services Market by Application

5.1 Healthcare Payer Services Market Snapshot and Growth Engine

5.2 Healthcare Payer Services Market Overview

5.3 Claims Management Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Claims Management Services: Geographic Segmentation Analysis

5.4 Member Enrolment Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Member Enrolment Services: Geographic Segmentation Analysis

5.5 Customer Care Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Customer Care Services: Geographic Segmentation Analysis

5.6 Billing and Accounts Management Services

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Billing and Accounts Management Services: Geographic Segmentation Analysis

5.7 Fraud Management Services

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Fraud Management Services: Geographic Segmentation Analysis

5.8 Analytics and Reporting Services

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Analytics and Reporting Services: Geographic Segmentation Analysis

5.9 Other Administrative Services

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Other Administrative Services: Geographic Segmentation Analysis

Chapter 6: Healthcare Payer Services Market by End User

6.1 Healthcare Payer Services Market Snapshot and Growth Engine

6.2 Healthcare Payer Services Market Overview

6.3 Private Payers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Private Payers: Geographic Segmentation Analysis

6.4 Public Payers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Public Payers: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Healthcare Payer Services Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACCENTURE (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COGNIZANT (UNITED STATES)

7.4 CONCENTRIX (UNITED STATES)

7.5 EXL SERVICE (UNITED STATES)

7.6 GENPACT (UNITED STATES)

7.7 HCL TECHNOLOGIES (INDIA)

7.8 HEWLETT PACKARD ENTERPRISE (UNITED STATES)

7.9 INFOSYS (INDIA)

7.10 NTT DATA (JAPAN)

7.11 OPTUM (UNITED STATES)

7.12 SUTHERLAND (UNITED STATES)

7.13 TATA CONSULTANCY SERVICES (INDIA)

7.14 TECH MAHINDRA (INDIA)

7.15 TELEPERFORMANCE (FRANCE)

7.16 WIPRO (INDIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Healthcare Payer Services Market By Region

8.1 Overview

8.2. North America Healthcare Payer Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Service Type

8.2.4.1 Business Process Outsourcing (BPO) Services

8.2.4.2 Information Technology Outsourcing (ITO) Services

8.2.4.3 Knowledge Process Outsourcing (KPO) Services

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Claims Management Services

8.2.5.2 Member Enrolment Services

8.2.5.3 Customer Care Services

8.2.5.4 Billing and Accounts Management Services

8.2.5.5 Fraud Management Services

8.2.5.6 Analytics and Reporting Services

8.2.5.7 Other Administrative Services

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Private Payers

8.2.6.2 Public Payers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Healthcare Payer Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Service Type

8.3.4.1 Business Process Outsourcing (BPO) Services

8.3.4.2 Information Technology Outsourcing (ITO) Services

8.3.4.3 Knowledge Process Outsourcing (KPO) Services

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Claims Management Services

8.3.5.2 Member Enrolment Services

8.3.5.3 Customer Care Services

8.3.5.4 Billing and Accounts Management Services

8.3.5.5 Fraud Management Services

8.3.5.6 Analytics and Reporting Services

8.3.5.7 Other Administrative Services

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Private Payers

8.3.6.2 Public Payers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Healthcare Payer Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Service Type

8.4.4.1 Business Process Outsourcing (BPO) Services

8.4.4.2 Information Technology Outsourcing (ITO) Services

8.4.4.3 Knowledge Process Outsourcing (KPO) Services

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Claims Management Services

8.4.5.2 Member Enrolment Services

8.4.5.3 Customer Care Services

8.4.5.4 Billing and Accounts Management Services

8.4.5.5 Fraud Management Services

8.4.5.6 Analytics and Reporting Services

8.4.5.7 Other Administrative Services

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Private Payers

8.4.6.2 Public Payers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Healthcare Payer Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Service Type

8.5.4.1 Business Process Outsourcing (BPO) Services

8.5.4.2 Information Technology Outsourcing (ITO) Services

8.5.4.3 Knowledge Process Outsourcing (KPO) Services

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Claims Management Services

8.5.5.2 Member Enrolment Services

8.5.5.3 Customer Care Services

8.5.5.4 Billing and Accounts Management Services

8.5.5.5 Fraud Management Services

8.5.5.6 Analytics and Reporting Services

8.5.5.7 Other Administrative Services

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Private Payers

8.5.6.2 Public Payers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Healthcare Payer Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Service Type

8.6.4.1 Business Process Outsourcing (BPO) Services

8.6.4.2 Information Technology Outsourcing (ITO) Services

8.6.4.3 Knowledge Process Outsourcing (KPO) Services

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Claims Management Services

8.6.5.2 Member Enrolment Services

8.6.5.3 Customer Care Services

8.6.5.4 Billing and Accounts Management Services

8.6.5.5 Fraud Management Services

8.6.5.6 Analytics and Reporting Services

8.6.5.7 Other Administrative Services

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Private Payers

8.6.6.2 Public Payers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Healthcare Payer Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Service Type

8.7.4.1 Business Process Outsourcing (BPO) Services

8.7.4.2 Information Technology Outsourcing (ITO) Services

8.7.4.3 Knowledge Process Outsourcing (KPO) Services

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Claims Management Services

8.7.5.2 Member Enrolment Services

8.7.5.3 Customer Care Services

8.7.5.4 Billing and Accounts Management Services

8.7.5.5 Fraud Management Services

8.7.5.6 Analytics and Reporting Services

8.7.5.7 Other Administrative Services

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Private Payers

8.7.6.2 Public Payers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Healthcare Payer Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 67.37 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5 % |

Market Size in 2032: |

USD 129.16 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||