Global Healthcare Consulting Services Market Overview

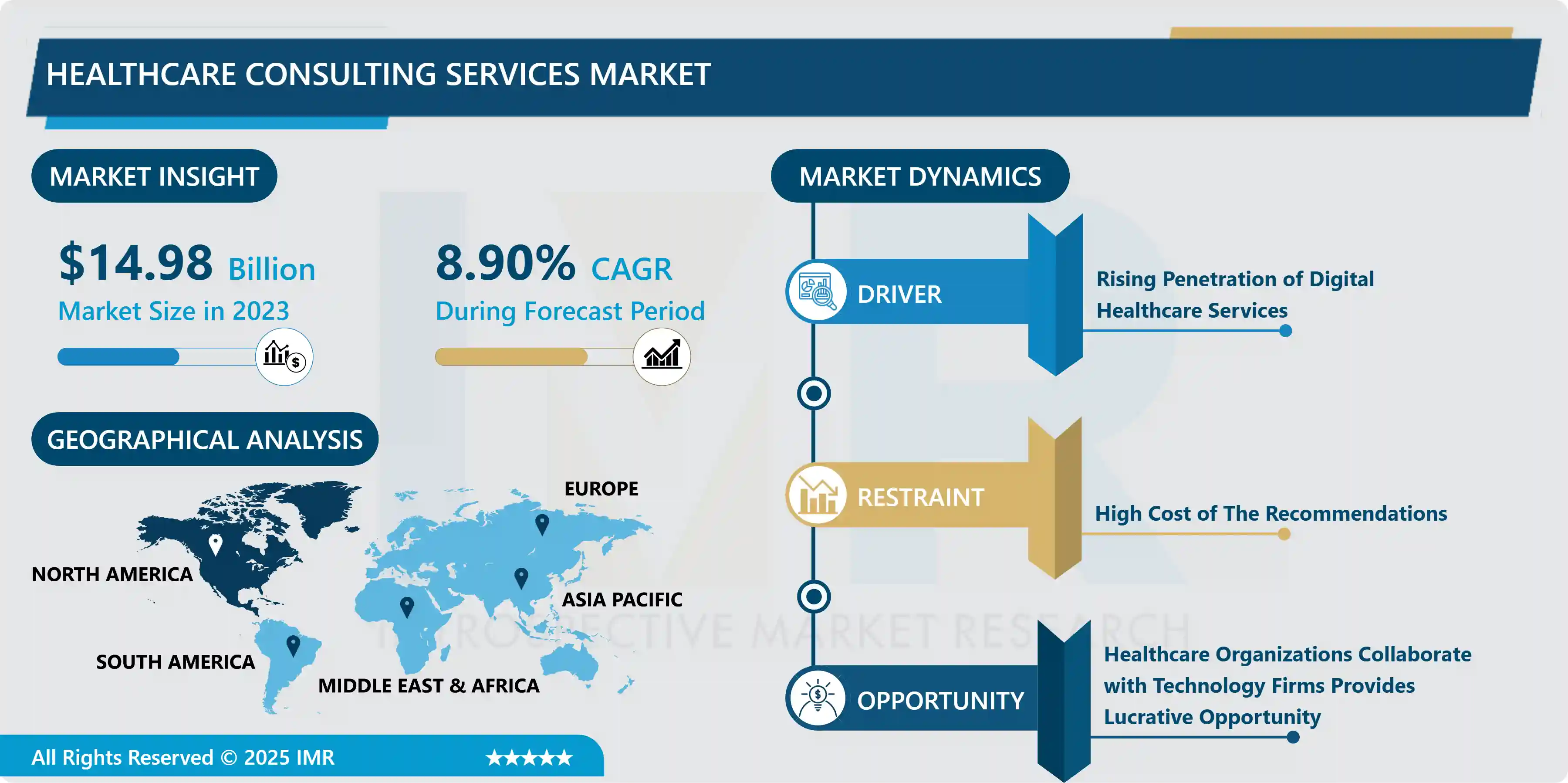

The market for healthcare consulting services was USD 14.98 billion in 2023 and is estimated to reach USD 32.53 billion by 2032, growing at a CAGR of 8.9% during the forecasted timespan.

Healthcare consulting firms play a crucial role in optimizing the performance of organizations within the healthcare industry. Acting as third-party advisors, these firms provide specialized expertise to a diverse range of clients, including hospitals, doctor’s offices, clinics, managed care organizations, insurance companies, government healthcare programs, pharmaceutical companies, pharmacies, and medical equipment manufacturers. Their primary objective is to help these entities enhance organizational competency, increase efficiency, improve revenue generation, and implement structural changes to adapt to evolving industry needs.

The scope of healthcare consulting is vast, encompassing various specializations that address distinct aspects of healthcare operations. These can include strategy consulting, IT implementation, financial management, operational optimization, regulatory compliance, and patient care enhancement. Given the complexity of the healthcare sector, consultants must possess in-depth knowledge of the industry’s regulations, challenges, and innovations. By leveraging this expertise, healthcare consultants provide valuable insights and actionable strategies tailored to their client’s unique needs.

Most healthcare consultants are engaged on a project basis. Organizations typically hire consultants or consulting teams to address specific challenges or achieve defined objectives, such as streamlining workflows, enhancing patient experiences, or integrating advanced technologies like electronic health records (EHRs) and artificial intelligence (AI). These projects can vary in scope and duration, offering healthcare organizations a focused and result-oriented approach to problem-solving. However, larger healthcare organizations with substantial financial resources often engage consulting firms on a retainer basis. This arrangement provides continuous evaluation, strategy development, and advisory services, ensuring sustained performance improvements over time.

Healthcare consulting firms contribute significantly to the growth and transformation of the industry. By addressing inefficiencies, identifying revenue generation opportunities, and guiding organizational changes, they enable healthcare providers and stakeholders to deliver better patient outcomes while navigating the complex regulatory landscape. The importance of healthcare consulting has grown as the industry faces mounting pressures, such as rising costs, technological advancements, an aging population, and an increasing focus on value-based care.

As the global healthcare industry continues to expand, the demand for consulting services is expected to rise. Organizations are recognizing the value of expert guidance in navigating challenges, embracing innovation, and staying competitive. With their ability to drive efficiency and foster growth, healthcare consulting firms are set to play a pivotal role in shaping the future of healthcare delivery and administration.

Market Dynamics and Key Factors of Healthcare Consulting Services:

Drivers:

- With more patients, more efficient solutions for controlling patient flow and maintaining a high quality of care are required. Consultants can assist healthcare providers irrespective of their size in managing their patient loads in several ways, including developing a patient intake and onboarding system that can aid in monitoring the load on the healthcare industry. Appointment planning or walk-in systems can also aid in providing better and more timely care to patients. Healthcare consulting firms can help identify areas where employees need to improve their performance. They can also make suggestions to directors about how to effectively manage patients. Thus, the services offered by the consulting firms can benefit the healthcare industry in terms of managing patient load thus, driving the growth of the market over the forecast period.

- Consultants are also experts in the field of productivity. They encourage employees to work together by conducting assessments to ensure that everyone is doing their part. These comprehensive productivity assessments are challenging for healthcare providers to undertake themselves. For one, the work involved is demanding for both management and healthcare professionals. Second, internal bias can influence results, whereas a third-party consultant can provide objective advice. These evaluations include assessing current productivity levels across the organization, identifying areas of strength and weakness, creating improvement recommendations, assisting in the implementation of necessary changes, and rewarding what is already done Healthcare providers can boost productivity across the board by hiring a consulting team to examine the efficacy of their day-to-day system, hence supporting the growth of the healthcare consulting services market in the projected timeframe.

Restraints:

- Cost savings and the business value that can be achieved from consulting are frequently hampered by poor planning and financial allocation for consulting services. Unexpected expenditures, such as those incurred while analyzing and selecting a vendor, managing offshore contracts, process change, and strengthening security and severance pay for employees, are not factored into financial planning when consulting services are chosen. Calculating the overall cost of consulting services, particularly IT, has always been difficult, but the changing nature of IT, combined with unanticipated expenses, exposes businesses to even more hidden costs. The role of retained IT resources is changing in many consulting engagements as the firm realigns around business results and product centricity. Therefore, the high cost of the recommendations may hinder the development of healthcare consulting services in the forecast period.

Opportunities:

- Even though three-quarters of health executives expect to invest in AI in the next three years, many lack the ability to execute it, according to PwC's GSISS survey. Only 20% of the respondents claimed they possessed the necessary technology to succeed with AI. Data is a major area of relevance for AI; firms will need to examine how their systems capture, integrate, store, and analyze data to guarantee that it can be merged with appropriate systems. AI tools will be required to automate repetitive processes such as scheduling, timesheet entry, and accounting. Healthcare organizations will need to collaborate with technology firms and others with outside expertise to address these issues thus, creating a lucrative opportunity for the market players.

- Healthcare firms will need to adopt new strategies and reconsider their current business models and supply chains as a result of the tax changes. Companies will evaluate how to utilize repatriated cash and how other changes, such as depreciating assets being expensed or charitable giving, would affect them. As tax provisions take effect, healthcare firms will need to audit their financial systems to identify what modifications need to be made and how their systems need to be updated to gather essential information hence, creating a profitable opportunity for the market players.

Market Segmentation

- By end-user, the pharmaceutical and Biotech Companies segment is expected to register the highest revenue in the projected timeframe. Biotech or pharma consultants work with their clients to reconsider the science endeavor's growth, merging advanced technologies, scientific development, and prior expertise of numerous globally marketed medical treatments. They can create calculated plans to collaborate with their clients in order to get the best possible results. They can suitably convey regulatory information, enabling internal and external understanding of short- and long-term development.

- By service type, the IT consulting segment is set to dominate the healthcare consulting services market in the forecasted timeframe. This segment is projected to record a CAGR of 10% and reach a valuation of USD 5.1 billion by the end of the analysis period. IT consulting can help healthcare organizations to keep proper records of EHRs as these are the most valuable. Implementation of EHR can reduce the paperwork as well as these can be saved on the cloud or on-premise. These can also be accessed remotely by the healthcare provider thus, eliminating the hassle to go through bunches of paper. The growing amount of patient data and its effective management are creating a need for IT consulting services in the healthcare industry.

Players Covered in Healthcare Consulting Services market are :

- Bain & Company

- Cognizant

- PwC

- Elbit Systems Ltd.

- McKinsey & Company

- Ernst & Young

- Accenture Consulting

- Huron Consulting

- STREIT Group

- Boston Consulting Group

- Deloitte Touche Tohmatsu Limited

- KPMG

- Oshkosh Corporation and other major players.

Regional Analysis of Healthcare Consulting Services Market:

- The North American region is anticipated to have the highest share of the healthcare consulting services market over the forecasted timeframe. Growing digitization in healthcare, increasing adoption of big data analytics, IoT, and cloud deployment, favorable changes in the HCIT environment, government support for HCIT solutions, and the requirement for data security are the primary factors driving the growth of the healthcare consulting services market in this region. Additionally, Healthcare consulting services in the United States are being propelled by a rising elderly population base across the country, ongoing technological improvements in the healthcare sector, and the growing importance of value-based care.

- The healthcare consulting services market in the European region is expected to develop at a significant growth rate. demand for healthcare consulting services that support integrated payer-provider risk sharing, public-private partnerships, and other clinical integration agreements is rapidly expanding, thus supporting the growth of the healthcare consulting services market in this region. Moreover, the presence of key market players and the increasing competition in the healthcare industry is further expected to shape the growth of the market. Mergers and acquisitions of small companies by larger ones, changing regulatory environment policies, an unstable economy due to COVID-19 have upsurged the demand for healthcare consulting services in this region.

- The healthcare consulting services market in the Asia-Pacific region is projected to grow at the highest CAGR attributed to the growing healthcare industry in this region. Governments are spending a large amount of money to develop the healthcare infrastructure. The Indian healthcare industry faces several challenges because of the growing competition. Other factors that affect hospital profitability include the economic recession, the rise in unsecured care, and growing competition for outpatient services. Furthermore, technological advancement, investment by multinational pharmaceutical companies in the region, and more need for remote care and telemedicine in rural areas have promoted the growth of healthcare consulting firms in this region. The pressure to provide good quality of care at lower costs and changing regulatory frameworks are responsible for healthcare organizations to seek help from consulting firms thereby, consolidating the development of the healthcare consulting services market in this region.

Recent Developments in Healthcare Consulting Services Market:

- In July 2024, Accenture has introduced an AI-powered patient engagement platform, enhancing patient interactions, appointment scheduling, treatment adherence, and personalized health recommendations through intuitive and automated communication channels.

- In May 2023, VMG Health, a major healthcare strategy company acquired the specialist healthcare advisory firm, BSM Consulting. With this acquisition, BSM added new services, including recruitment, subscription-based membership programs, and leadership development resources that can help advance VMG Health’s wider array of solutions.

|

Healthcare Consulting Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.9% |

Market Size in 2032: |

USD 32.53 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Healthcare Consulting Services Market by Service Type (2018-2032)

4.1 Healthcare Consulting Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 IT Consulting

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Digital Consulting

4.5 Financial Consulting

4.6 Operations Consulting

4.7 Strategy Consulting

4.8 HR & Talent Consulting

Chapter 5: Healthcare Consulting Services Market by End-Users (2018-2032)

5.1 Healthcare Consulting Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Government Bodies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Health Insurance Payers

5.5 Hospitals

5.6 Pharmaceutical & Biotech Companies

5.7 Research Institutes

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Healthcare Consulting Services Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 GOOGLE (US) MICROSOFT (US) SONY GROUP CORPORATION (JAPAN) META (US) SAMSUNG (SOUTH KOREA) HTC CORPORATION (TAIWAN) APPLE INC. (US) PTC INC. (US) SEIKO EPSON CORPORATION (JAPAN) LENOVO (CHINA) WIKITUDE

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 A QUALCOMM COMPANY (AUSTRIA) EON REALITY (US) MAXST COLTD. (SOUTH KOREA) MAGIC LEAP INC. (US) BLIPPAR GROUP LIMITED(UK) ATHEER INC (US) VUZIX (US) CYBERGLOVE SYSTEMS INC. (US) LEAP MOTIONS (ULTRALEAP) (US) PENUMBRA INC. (US)

6.4 OTHER KEY PLAYERS

Chapter 7: Global Healthcare Consulting Services Market By Region

7.1 Overview

7.2. North America Healthcare Consulting Services Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Service Type

7.2.4.1 IT Consulting

7.2.4.2 Digital Consulting

7.2.4.3 Financial Consulting

7.2.4.4 Operations Consulting

7.2.4.5 Strategy Consulting

7.2.4.6 HR & Talent Consulting

7.2.5 Historic and Forecasted Market Size by End-Users

7.2.5.1 Government Bodies

7.2.5.2 Health Insurance Payers

7.2.5.3 Hospitals

7.2.5.4 Pharmaceutical & Biotech Companies

7.2.5.5 Research Institutes

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Healthcare Consulting Services Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Service Type

7.3.4.1 IT Consulting

7.3.4.2 Digital Consulting

7.3.4.3 Financial Consulting

7.3.4.4 Operations Consulting

7.3.4.5 Strategy Consulting

7.3.4.6 HR & Talent Consulting

7.3.5 Historic and Forecasted Market Size by End-Users

7.3.5.1 Government Bodies

7.3.5.2 Health Insurance Payers

7.3.5.3 Hospitals

7.3.5.4 Pharmaceutical & Biotech Companies

7.3.5.5 Research Institutes

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Healthcare Consulting Services Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Service Type

7.4.4.1 IT Consulting

7.4.4.2 Digital Consulting

7.4.4.3 Financial Consulting

7.4.4.4 Operations Consulting

7.4.4.5 Strategy Consulting

7.4.4.6 HR & Talent Consulting

7.4.5 Historic and Forecasted Market Size by End-Users

7.4.5.1 Government Bodies

7.4.5.2 Health Insurance Payers

7.4.5.3 Hospitals

7.4.5.4 Pharmaceutical & Biotech Companies

7.4.5.5 Research Institutes

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Healthcare Consulting Services Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Service Type

7.5.4.1 IT Consulting

7.5.4.2 Digital Consulting

7.5.4.3 Financial Consulting

7.5.4.4 Operations Consulting

7.5.4.5 Strategy Consulting

7.5.4.6 HR & Talent Consulting

7.5.5 Historic and Forecasted Market Size by End-Users

7.5.5.1 Government Bodies

7.5.5.2 Health Insurance Payers

7.5.5.3 Hospitals

7.5.5.4 Pharmaceutical & Biotech Companies

7.5.5.5 Research Institutes

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Healthcare Consulting Services Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Service Type

7.6.4.1 IT Consulting

7.6.4.2 Digital Consulting

7.6.4.3 Financial Consulting

7.6.4.4 Operations Consulting

7.6.4.5 Strategy Consulting

7.6.4.6 HR & Talent Consulting

7.6.5 Historic and Forecasted Market Size by End-Users

7.6.5.1 Government Bodies

7.6.5.2 Health Insurance Payers

7.6.5.3 Hospitals

7.6.5.4 Pharmaceutical & Biotech Companies

7.6.5.5 Research Institutes

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Healthcare Consulting Services Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Service Type

7.7.4.1 IT Consulting

7.7.4.2 Digital Consulting

7.7.4.3 Financial Consulting

7.7.4.4 Operations Consulting

7.7.4.5 Strategy Consulting

7.7.4.6 HR & Talent Consulting

7.7.5 Historic and Forecasted Market Size by End-Users

7.7.5.1 Government Bodies

7.7.5.2 Health Insurance Payers

7.7.5.3 Hospitals

7.7.5.4 Pharmaceutical & Biotech Companies

7.7.5.5 Research Institutes

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Healthcare Consulting Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.9% |

Market Size in 2032: |

USD 32.53 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||