Healthcare CMO Market Synopsis:

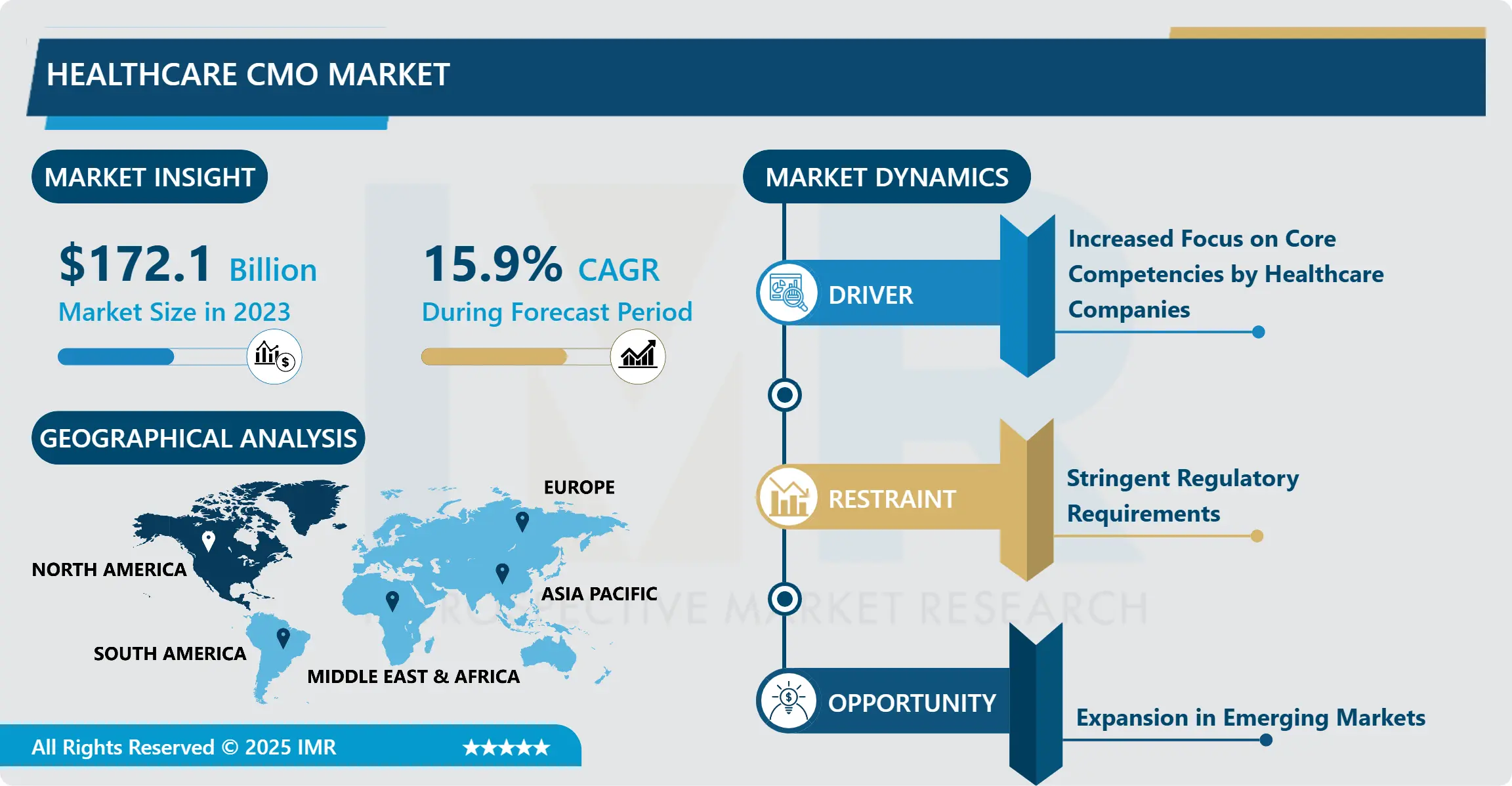

Healthcare CMO Market Size Was Valued at USD 172.1 Billion in 2023, and is Projected to Reach USD 649.43 Billion by 2032, Growing at a CAGR of 15.9% From 2024-2032.

The services offered by companies in the context of healthcare contract manufacturing organization (CMO) market include manufacturing services to pharma and biopharma firms that develop medical devices. CMOs provide various specialized services including drug formulation, device fabrication, or packaging for the health care firm to concentrated on their core competency that may encompass research and development while outsourcing the manufacturing to CMOs. This market is highly significant to the health care market so as to endeavor on cost efficiency, expansion and meeting set legal requirements.

The growing needs of pharmaceutical products, innovative therapy, and more advanced medical equipment to enhance the Healthcare CMO market. The needs for reliable, large-scale production solutions, niche manufacturing experience, and adherence to international quality requirements are necessary to sustain competitive positioning in the healthcare industry. One of the key services delivered by Healthcare CMOs involves formulation and development, packaging to distribution, which give pharmaceutical and medical device firms much-needed flexibility to accomplish bottlenecks in the value chain, and enhance productivity and speed to market.

The third reason for the growth of the market is the complexity of drug formulations and medical devices classification. As more targeted therapies, bio-similars and combination products come to the market, the manufacturing process is complex and frequently involves specializations, and compliance with appropriate regulations. When production is outsourced to CMOs, a healthcare company is able to spend more of its time in other essential business activities like research and development instead of manufacturing and worrying about compliance with the law. Also, thanks to CMO’s solutions healthcare companies can adjust to changes in the market within a shorter amount of time because CMO services are designed to support different levels of production.

CMOs also come in handy for serving small and mid-sized profitable pharmaceutical and biotech companies that may not afford to put up production capacities. For these companies, partnering with CMOs allows them to access state of the art manufacturing equipment and technical knowhow without investing enormous amounts of capital. Another advantage of this model is the ability for CMOs to promote innovation in the healthcare industry, and to guarantee that new treatments and medical equipment make it to the public, quickly.

Healthcare CMO Market Trend Analysis:

Growing Demand for Biologics Manufacturing

-

Global sales of biologic drugs such as monoclonal antibodies and vaccines, and gene therapy products are on an upward rise because they offer multiple beneficial effects on specific diseases like cancer and autoimmune diseases. This trend has created significant shifts toward biologics manufacturing in the Healthcare CMO Market with many CMO players extending their offering capacity to address the biologics requirements. Due to the complex aseptic processing and unique equipment and handling requirements needed for biologics manufacturing, this field is expected to be a large growth area for CMOs.

- To address this trend, CMOs are providing capital intensive latest technologies and facilities to serve the requirement of biologics manufacturers. In a way that also increases their ability in fields such as cell culture technology, bioprocessing and sterile filling so that biologics production is of the highest quality and conforms to standard regulatory specifications. The biologics trend also demonstrates the increased dependence of the industry on CMOs to provide access to these specialized therapies.

Expansion in Emerging Markets

-

The Healthcare CMO Market is also identifying a significant opportunity in new markets because many developing markets such as Asia-Pacific and Latin America also present promising growth opportunities. These markets are becoming more ac healthcare investments, expanding populations, and enhanced availability of medical products. Those CMOs that have recently integrated the regions have the incentive of a pool of cheap human resource, increased skilled workforce and favorable policies that favor affordable production.

- Going global also lets CMOs fastened local pharmaceutical and medical device firms that are keen on upgrading the health sector in their countries. In this case, CMOs are better positioned to build production facilities near these markets to mitigate some supply chain risks and provide shorter delivery cycles so that a more localized, more sustainable manufacturing network can be created. Not only does this opportunity expanded the market reach for CMOs but also serve the global need for better healthcare in developing nations.

Healthcare CMO Market Segment Analysis:

Healthcare CMO Market is Segmented on the basis of Service Type, Product Type, End User, and Region

By Service Type, Pharmaceutical Contract Manufacturing segment is expected to dominate the market during the forecast period

-

Pharmaceutical Contract Manufacturing: Here, Misc-category involves specific manufacturing services targeted at the production of pharmaceutical products such as APIs, formulation, and packaging segment. Pharmaceutical CMO constitutes a high proportion of the global demand, owing the increasing demand for pharmaceutical products. Most CMOs in this specialised area usually have accredited GMP facilities, state-of-the-art equipment and skilled staff to meet the quality standards and requirements of the products they handle for the varied clients.

- Medical Device Contract Manufacturing: Several medical device contract manufacturing services which are involved include manufacture and assembly of complicated medical devices, diagnostic equipment and implants. There is a higher demand for these services because the present medical devices have become complex and need precise manufacturing procedures. CMOs are particularly skilled at dealing with regulations which, for orthopedic/athletic medicine devices may include ISO certifications, and healthcare firms seeking device manufacture need solid CMO partners with whom to collaborate.

By End User, Pharmaceutical Companies segment expected to held the largest share

-

Pharmaceutical Companies: Pharmaceutical companies are primary users of CMO services due to the extensive requirements for drug manufacturing, which involve regulatory compliance, quality assurance, and scalability. That is why CMOs effectively help these companies to minimize capital investments and production-related issues by offering compliant manufacturing solutions for clinical and full-scale production. Biotechnology Companies: To part this problem, it is common to see biotechnology firms employing the services of CMOs due to the specialized manufacturing processes that comes with biologics and advanced therapies production. By outsourcing these functions, biotech companies can access specialized expertise and facilities necessary for biologics production, including cell culture and fermentation capabilities. This partnership is especially advantageous for smaller biotech firms that cannot afford the high costs of setting up biologics production facilities.

- Medical Device Companies: Medical device companies rely on CMOs for the production of complex devices, diagnostics, and wearable technologies. CMOs provide valuable support in areas such as regulatory compliance, sterilization, and packaging, which are critical for medical device quality and safety. By leveraging CMO services, device companies can achieve faster time-to-market and maintain product standards, making this segment an essential component of the Healthcare CMO Market.

Healthcare CMO Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America accounted for the largest share of the Healthcare CMO Market owing to its well-developed health facility, higher demand for pharmaceutical and medical device products as well as popularity of several powerful pharmaceutical and biotechnology companies. The main established regional characteristic is the emphasis placed on stringent quality standards in North America, particularly the United States, and this is reflected in growth of the specialized CMO. It is further strengthened by generous future spending plans on biopharmaceuticals and other high-level treatments for which CMOs offering manufacturing assistance are needed.

- Also, there are skilled professional and an easy access to the latest technologies which enables CMOs and their clients to set up base in North America. Biopharmaceutical producers undertake extensive R&D, and a majority of North American CMOs are also extending their Biologic, cell and gene therapy capacities to meet the market prospects in the health care domain. With this growth in the specialized manufacturing, North America is set to strengthen its dominance in the world Healthcare CMO Market.

Active Key Players in the Healthcare CMO Market:

-

Lonza Group (Switzerland)

- Catalent, Inc. (United States)

- WuXi AppTec (China)

- Samsung Biologics (South Korea)

- Boehringer Ingelheim BioXcellence (Germany)

- Patheon (United States)

- Siegfried Holding AG (Switzerland)

- Recipharm AB (Sweden)

- Jubilant Life Sciences (India)

- AMRI (United States)

- Fujifilm Diosynth Biotechnologies (Japan)

- Thermo Fisher Scientific (United States)

- Other Active Players

|

Healthcare CMO Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 172.1 Billion |

|

Forecast Period 2024-32 CAGR: |

15.9% |

Market Size in 2032: |

USD 649.43 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Product Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Healthcare CMO Market by Service Type

4.1 Healthcare CMO Market Snapshot and Growth Engine

4.2 Healthcare CMO Market Overview

4.3 Pharmaceutical Contract Manufacturing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Pharmaceutical Contract Manufacturing: Geographic Segmentation Analysis

4.4 Medical Device Contract Manufacturing

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Medical Device Contract Manufacturing: Geographic Segmentation Analysis

Chapter 5: Healthcare CMO Market by Product Type

5.1 Healthcare CMO Market Snapshot and Growth Engine

5.2 Healthcare CMO Market Overview

5.3 Active Pharmaceutical Ingredients (API)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Active Pharmaceutical Ingredients (API): Geographic Segmentation Analysis

5.4 Finished Dosage Formulations (FDF)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Finished Dosage Formulations (FDF): Geographic Segmentation Analysis

5.5 Medical Devices

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Medical Devices: Geographic Segmentation Analysis

Chapter 6: Healthcare CMO Market by End User

6.1 Healthcare CMO Market Snapshot and Growth Engine

6.2 Healthcare CMO Market Overview

6.3 Pharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pharmaceutical Companies: Geographic Segmentation Analysis

6.4 Biotechnology Companies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Biotechnology Companies: Geographic Segmentation Analysis

6.5 Medical Device Companies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Medical Device Companies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Healthcare CMO Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LONZA GROUP (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CATALENT INC. (UNITED STATES)

7.4 WUXI APPTEC (CHINA)

7.5 SAMSUNG BIOLOGICS (SOUTH KOREA)

7.6 BOEHRINGER INGELHEIM BIOXCELLENCE (GERMANY)

7.7 PATHEON (UNITED STATES)

7.8 SIEGFRIED HOLDING AG (SWITZERLAND)

7.9 RECIPHARM AB (SWEDEN)

7.10 JUBILANT LIFE SCIENCES (INDIA)

7.11 AMRI (UNITED STATES)

7.12 FUJIFILM DIOSYNTH BIOTECHNOLOGIES (JAPAN)

7.13 THERMO FISHER SCIENTIFIC (UNITED STATES)

7.14 .

7.15 OTHER ACTIVE PLAYERS

Chapter 8: Global Healthcare CMO Market By Region

8.1 Overview

8.2. North America Healthcare CMO Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Service Type

8.2.4.1 Pharmaceutical Contract Manufacturing

8.2.4.2 Medical Device Contract Manufacturing

8.2.5 Historic and Forecasted Market Size By Product Type

8.2.5.1 Active Pharmaceutical Ingredients (API)

8.2.5.2 Finished Dosage Formulations (FDF)

8.2.5.3 Medical Devices

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Pharmaceutical Companies

8.2.6.2 Biotechnology Companies

8.2.6.3 Medical Device Companies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Healthcare CMO Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Service Type

8.3.4.1 Pharmaceutical Contract Manufacturing

8.3.4.2 Medical Device Contract Manufacturing

8.3.5 Historic and Forecasted Market Size By Product Type

8.3.5.1 Active Pharmaceutical Ingredients (API)

8.3.5.2 Finished Dosage Formulations (FDF)

8.3.5.3 Medical Devices

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Pharmaceutical Companies

8.3.6.2 Biotechnology Companies

8.3.6.3 Medical Device Companies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Healthcare CMO Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Service Type

8.4.4.1 Pharmaceutical Contract Manufacturing

8.4.4.2 Medical Device Contract Manufacturing

8.4.5 Historic and Forecasted Market Size By Product Type

8.4.5.1 Active Pharmaceutical Ingredients (API)

8.4.5.2 Finished Dosage Formulations (FDF)

8.4.5.3 Medical Devices

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Pharmaceutical Companies

8.4.6.2 Biotechnology Companies

8.4.6.3 Medical Device Companies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Healthcare CMO Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Service Type

8.5.4.1 Pharmaceutical Contract Manufacturing

8.5.4.2 Medical Device Contract Manufacturing

8.5.5 Historic and Forecasted Market Size By Product Type

8.5.5.1 Active Pharmaceutical Ingredients (API)

8.5.5.2 Finished Dosage Formulations (FDF)

8.5.5.3 Medical Devices

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Pharmaceutical Companies

8.5.6.2 Biotechnology Companies

8.5.6.3 Medical Device Companies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Healthcare CMO Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Service Type

8.6.4.1 Pharmaceutical Contract Manufacturing

8.6.4.2 Medical Device Contract Manufacturing

8.6.5 Historic and Forecasted Market Size By Product Type

8.6.5.1 Active Pharmaceutical Ingredients (API)

8.6.5.2 Finished Dosage Formulations (FDF)

8.6.5.3 Medical Devices

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Pharmaceutical Companies

8.6.6.2 Biotechnology Companies

8.6.6.3 Medical Device Companies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Healthcare CMO Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Service Type

8.7.4.1 Pharmaceutical Contract Manufacturing

8.7.4.2 Medical Device Contract Manufacturing

8.7.5 Historic and Forecasted Market Size By Product Type

8.7.5.1 Active Pharmaceutical Ingredients (API)

8.7.5.2 Finished Dosage Formulations (FDF)

8.7.5.3 Medical Devices

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Pharmaceutical Companies

8.7.6.2 Biotechnology Companies

8.7.6.3 Medical Device Companies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Healthcare CMO Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 172.1 Billion |

|

Forecast Period 2024-32 CAGR: |

15.9% |

Market Size in 2032: |

USD 649.43 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Product Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||