Green Energy Market Synopsis

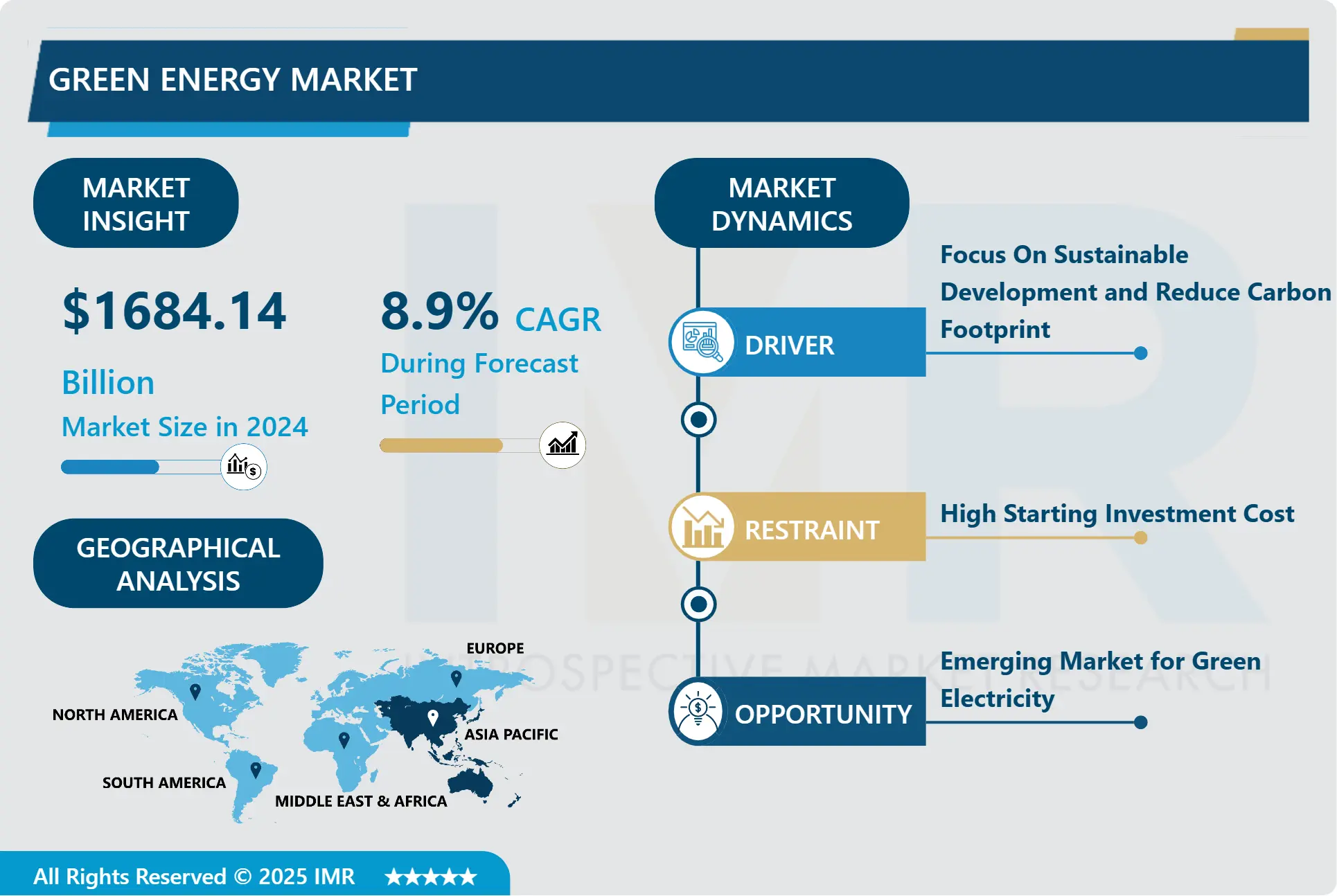

Global Green energy Market Size Was Valued at USD 1684.14 Billion in 2024 and is Projected to Reach USD 3331.2 Billion by 2032, Growing at a CAGR of 8.9% 2025-2032.

The green energy market, also known as the renewable energy market, encompasses the production, distribution, and consumption of energy derived from renewable sources such as solar, wind, hydroelectric, geothermal, and biomass. This market has experienced significant growth in recent years due to increasing concerns about climate change, environmental sustainability, and energy security.

The green energy market has experienced significant growth in recent years, driven by factors such as declining costs of renewable technologies, increasing concerns about climate change, government incentives and policies, and technological advancements. This growth is evident in the increasing installation of renewable energy capacity worldwide.

Ongoing research and development efforts are focused on improving the efficiency, reliability, and affordability of renewable energy technologies. Innovations in areas such as energy storage, grid integration, and smart grid systems are crucial for maximizing the potential of renewable energy sources and overcoming challenges such as intermittency.

The global green energy market is expected to continue expanding in the coming years, driven by factors such as increasing energy demand, environmental concerns, technological advancements, and supportive policies Many governments have implemented policies and incentives to promote the adoption of green energy, including feed-in tariffs, tax credits, renewable energy targets, and carbon pricing mechanisms. These measures aim to level the playing field between renewable and conventional energy sources and accelerate the transition to a low-carbon economy.

Green Energy Market Trend Analysi- Focus On Sustainable Development and Reducing Carbon Footprint

- Sustainable development and reduced carbon emissions have become a major global priority in recent years. Consumers and corporations alike are increasingly conscious of their environmental impact and looking for sustainable options. This shift in attitudes and priorities is having a profound effect on the growing green energy market worldwide.More companies and governments are investing in renewable and clean energy sources like solar, wind, and hydropower to reduce their reliance on fossil fuels and lower carbon emissions.

- Growing environmental concerns is one of the significant growth drivers in the market. Globally, governments and businesses are devoting more resources to renewable energy sources like solar, wind, and hydropower to reduce carbon emissions.As awareness about climate change impacts increases, citizens are demanding more large-scale transition to greener alternatives from fossil fuels which are heavily polluting. Many nations have announced ambitious targets over the next decade to increase the share of renewables in their total energy mix and move away from coal.

Green Energy Market Opportunities- Increasing Investment in Research and Development

-

Investments in research and development (R&D) could unlock tremendous opportunities in the market. As global energy demand grows, the need for innovative technologies also accelerates the worldwide transition to renewables. Increased R&D spending by both private industries and public research institutions, would help drive the discoveries required to significantly decrease the costs of solar, wind, battery storage, and other renewable technologies over the coming decade.

- Many analysts believe green technologies will witness their most drastic cost reductions and performance boosts in the next 10-15 years. More efficient solar photovoltaic panels, lightweight building integrated wind turbines, longer lasting, and higher capacity battery chemistries could all emerge from boosted research efforts. Energy storage is a critical component of the transition to renewable energy, as it enables the intermittent energy generated by sources like solar and wind to be stored and used when needed. Investing in R&D for battery technologies, hydrogen storage, and other energy storage solutions can unlock new opportunities for grid flexibility and stability.

Emerging Markets for Green Electricity

- Emerging markets for green electricity present a promising opportunity for advancement in the global renewable energy sector. Many developing nations are experiencing rapid economic growth and a ballooning demand for power. However, their electricity grids have traditionally relied heavily on fossil fuel sources that produce greenhouse gas emissions. A shift towards cleaner, locally generated solar and wind power could help these countries leapfrog older carbon-intensive technologies to meet new demand. This would get them on a more sustainable path to power their growing populations and economies for decades to come.

- Advances in renewable energy technologies, such as solar photovoltaics, wind turbines, energy storage systems, and smart grid infrastructure, have made green energy more efficient, reliable, and cost-effective. These advancements are driving down the costs of renewable energy generation, making it more competitive with traditional fossil fuels. The renewable energy sector presents attractive investment opportunities for financial institutions, venture capitalists, and private equity firms. As the market continues to grow, investors are increasingly allocating capital to renewable energy projects, leading to further expansion and innovation in the sector.

Green Energy Market Segment Analysis

Green Energy Market is segmented based on type and end-users.

By Type, Hydro Energy Segment Is Expected to Dominate The Market During The Forecast Period

- The hydroenergy segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted for by the rapid construction of hydropower plants and their wide application across sectors .Moreover, hydropower is the pillar of low-carbon electricity generation, supplying nearly half of it globally today. Hydropower contributes 55% more than nuclear and more than all other renewables combined, including wind, solar PV, bioenergy, and geothermal.

- Hydroelectric power plants can harness the energy of flowing water to generate electricity on a large scale. Regions with abundant water resources, such as rivers and waterfalls, have significant hydroelectric potential, making it a viable option for power generation. large-scale hydroelectric projects can have environmental impacts such as habitat disruption and alterations to river ecosystems, they generally produce fewer greenhouse gas emissions compared to fossil fuel power plants. Additionally, advancements in hydroelectric technology, such as fish-friendly turbines and improved environmental management practices, aim to minimize these impacts.

By End Users, The Commercial Segment Held the Largest Share In 2024

- The commercial segment is anticipated to garner the highest revenue. The growth of the segment can be attributed to the growing demand for energy in this sector. Further, the majority of companies are investing more in renewable energy owing to various environmental concerns. Energy use is intimately related to climate change. The ecology is harmed by fossil fuels, and their prices are unstable. Hence, the environment could be preserved by substituting clean energy sources for fossil fuels.

- Many governments offer incentives and policies to promote the adoption of solar energy, such as tax credits, rebates, feed-in tariffs, and renewable energy mandates. These incentives help offset the upfront costs of solar installations and make them more financially attractive for commercial entities. Solar energy solutions are highly scalable, making them suitable for a wide range of commercial applications, from small businesses to large industrial complexes. Whether it's rooftop solar panels, solar carports, or ground-mounted arrays, solar installations can be customized to meet the specific energy needs of commercial entities.

Green Energy Market Regional Insights

Asia Pacific Is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region dominated the renewable energy market to the global market. This is due to the increasing density of the population and progressing industrialization in countries like India, China, Japan, and Australia, which have led to rising demand for sustainable renewable energy. The industrial growth in the region has created a high electricity demand, which is being met to some extent by electricity generated from solar, wind, and hydropower sources.

- Asia Pacific is the largest consumer of renewable energy globally, and China continued its dominance in the market of renewable energy capacity. The country has been investing heavily in renewable energy, particularly in solar and wind power. Additionally, the Chinese government has implemented policies to encourage the deployment of renewable energy, which has contributed to the country's dominance in the market.

- Other countries in the Asia Pacific region such as Japan and Australia are also investing in renewable energy to meet their energy needs and reduce their carbon footprint. Japan has been focusing on solar power and has set ambitious targets to increase the share of renewable energy in its energy mix.

Key Players in the Green Energy Market

- Tesla, Inc. (United States)

- NextEra Energy, Inc. (United States)

- Vestas Wind Systems (Denmark)

- Tata Power Renewable Energy Ltd (India)

- SunPower Corporation (United States)

- Enel Green Power (Italy)

- Canadian Solar Inc. (Canada)

- First Solar, Inc. (United States)

- Siemens Gamesa Renewable Energy (Spain)

- SolarEdge Technologies, Inc. (Israel)

- Brookfield Renewable Partners (Canada)

- Jinko Solar Holding Co., Ltd. (China)

- Infigen Energy (Australia)

- Hanwha Q Cells Co., Ltd. (South Korea)

- Engie (France)

- Duke Energy Renewables (United States)

- Yingli Green Energy Holding Co., Ltd. (China)

- Pattern Energy Group Inc. (United States)

- Sunrun Inc. (United States)

- AES Corporation (United States)

- NRG Energy, Inc. (United States)

- ABB Group (Switzerland)

- EDF Renewables (United States)

- Acciona Energía (Spain)

- Longi Green Energy Technology Co., Ltd. (China)

- Trina Solar Limited (China) and Other active players.

Key Industry Developments in The Green Energy Market:

- In May 2024, Trina solar lim. the leading global PV and smart energy total solution provider has been supporting Uzbekistan's transition to renewable energy Global.

- In January 2024, Massive expansion of renewable power opens the door to achieving the global tripling goal set at COP28

- In January 2024, Yes Energy, a leader in power market data, today announced the acquisition of TESLA, Inc. The combination of TESLA, Inc. and Yes Energy will add tremendous value to power market analysts by creating an integrated solution for load forecasting and analytics in the highly data-intensive power markets.

|

Global Green Energy Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1684.14 Billion |

|

Forecast Period 2025-30 CAGR: |

8.9% |

Market Size in 2032: |

USD 3331.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By end-users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Green Energy Market by Type (2018-2032)

4.1 Green Energy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solar energy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hydro energy

4.5 Wind energy

4.6 Tidal energy

4.7 Bio-energy

4.8 Geothermal energy

Chapter 5: Green Energy Market by end-users (2018-2032)

5.1 Green Energy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

5.5 Industrial

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Green Energy Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 TESLA INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NEXTERA ENERGY INC. (UNITED STATES)

6.4 VESTAS WIND SYSTEMS (DENMARK)

6.5 TATA POWER RENEWABLE ENERGY LTD (INDIA)

6.6 SUNPOWER CORPORATION (UNITED STATES)

6.7 ENEL GREEN POWER (ITALY)

6.8 CANADIAN SOLAR INC. (CANADA)

6.9 FIRST SOLAR INC. (UNITED STATES)

6.10 SIEMENS GAMESA RENEWABLE ENERGY (SPAIN)

6.11 SOLAREDGE TECHNOLOGIES INC. (ISRAEL)

6.12 BROOKFIELD RENEWABLE PARTNERS (CANADA)

6.13 JINKO SOLAR HOLDING COLTD. (CHINA)

6.14 INFIGEN ENERGY (AUSTRALIA)

6.15 HANWHA Q CELLS COLTD. (SOUTH KOREA)

6.16 ENGIE (FRANCE)

6.17 DUKE ENERGY RENEWABLES (UNITED STATES)

6.18 YINGLI GREEN ENERGY HOLDING COLTD. (CHINA)

6.19 PATTERN ENERGY GROUP INC. (UNITED STATES)

6.20 SUNRUN INC. (UNITED STATES)

6.21 AES CORPORATION (UNITED STATES)

6.22 NRG ENERGY INC. (UNITED STATES)

6.23 ABB GROUP (SWITZERLAND)

6.24 EDF RENEWABLES (UNITED STATES)

6.25 ACCIONA ENERGÍA (SPAIN)

6.26 LONGI GREEN ENERGY TECHNOLOGY COLTD. (CHINA)

6.27 TRINA SOLAR LIMITED (CHINA)

Chapter 7: Global Green Energy Market By Region

7.1 Overview

7.2. North America Green Energy Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Solar energy

7.2.4.2 Hydro energy

7.2.4.3 Wind energy

7.2.4.4 Tidal energy

7.2.4.5 Bio-energy

7.2.4.6 Geothermal energy

7.2.5 Historic and Forecasted Market Size by end-users

7.2.5.1 Residential

7.2.5.2 Commercial

7.2.5.3 Industrial

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Green Energy Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Solar energy

7.3.4.2 Hydro energy

7.3.4.3 Wind energy

7.3.4.4 Tidal energy

7.3.4.5 Bio-energy

7.3.4.6 Geothermal energy

7.3.5 Historic and Forecasted Market Size by end-users

7.3.5.1 Residential

7.3.5.2 Commercial

7.3.5.3 Industrial

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Green Energy Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Solar energy

7.4.4.2 Hydro energy

7.4.4.3 Wind energy

7.4.4.4 Tidal energy

7.4.4.5 Bio-energy

7.4.4.6 Geothermal energy

7.4.5 Historic and Forecasted Market Size by end-users

7.4.5.1 Residential

7.4.5.2 Commercial

7.4.5.3 Industrial

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Green Energy Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Solar energy

7.5.4.2 Hydro energy

7.5.4.3 Wind energy

7.5.4.4 Tidal energy

7.5.4.5 Bio-energy

7.5.4.6 Geothermal energy

7.5.5 Historic and Forecasted Market Size by end-users

7.5.5.1 Residential

7.5.5.2 Commercial

7.5.5.3 Industrial

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Green Energy Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Solar energy

7.6.4.2 Hydro energy

7.6.4.3 Wind energy

7.6.4.4 Tidal energy

7.6.4.5 Bio-energy

7.6.4.6 Geothermal energy

7.6.5 Historic and Forecasted Market Size by end-users

7.6.5.1 Residential

7.6.5.2 Commercial

7.6.5.3 Industrial

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Green Energy Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Solar energy

7.7.4.2 Hydro energy

7.7.4.3 Wind energy

7.7.4.4 Tidal energy

7.7.4.5 Bio-energy

7.7.4.6 Geothermal energy

7.7.5 Historic and Forecasted Market Size by end-users

7.7.5.1 Residential

7.7.5.2 Commercial

7.7.5.3 Industrial

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Green Energy Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1684.14 Billion |

|

Forecast Period 2025-30 CAGR: |

8.9% |

Market Size in 2032: |

USD 3331.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By end-users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||