Frozen Food Market Synopsis

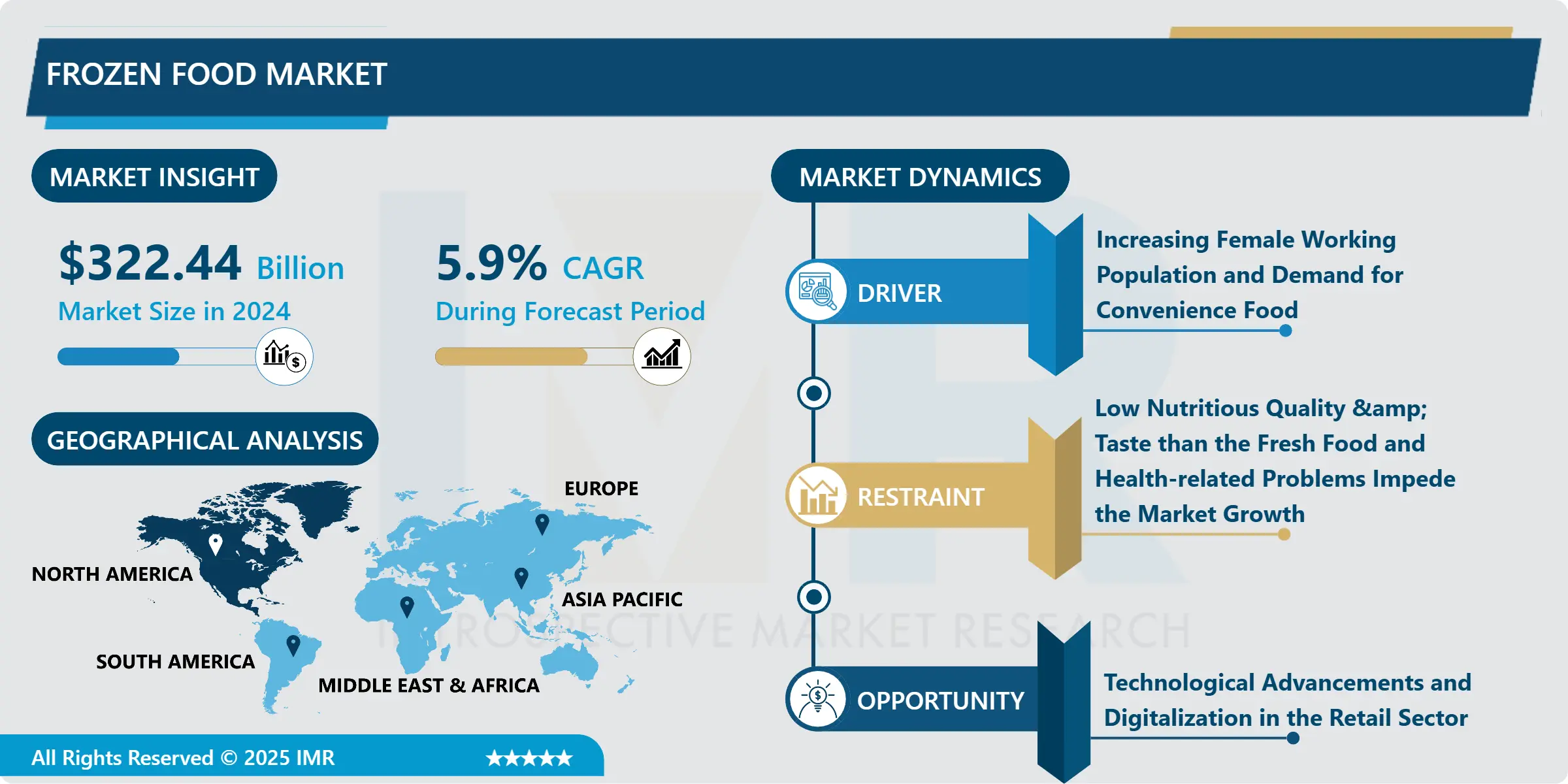

Frozen Food Market Size Was Valued at USD 322.44 Billion in 2024 and is Projected to Reach USD 510.06 Billion by 2032, Growing at a CAGR of 5.9% From 2025-2032.

Food and beverages which are thoroughly processed, packed, and preserved by freezing following good commercial practices, which are further intended for consumption are called as frozen food.

Frozen foods are an extremely affordable and convenient way to incorporate nutritious and healthy foods, including fruits & vegetables, protein & dairy, as well as whole grains. Chefs across the globe are highly benefitted from frozen foods as they deliver excellent quality as well as reduce labor and waste.

Frozen foods contain more minerals and vitamins as fresh foods tend to lose them over a certain time, whereas freezing preserves and retains nutrients. This is one of the major factors that attract maximum consumers to choose frozen food over fresh food. For instance, a survey of 2000 adults by Deloitte found that although consumers may enjoy the consumption of fresh foods, they are aware of the huge food waste, and thus opt for frozen foods owing to their nutritional value as well as extended shelf life. In the firm’s findings, 57% of all 18-34 years old adults stated that frozen vegetables are relatively better than fresh.

Additionally, the young population is majorly inclined towards frozen food due to the quality & healthfulness it provides, which henceforth drives the market growth.

Frozen Food Market Trend Analysis

Frozen Food Market Growth Drivers- Increasing Female Working Population and Demand for Convenience Food

- In recent years, there has been a tremendous increase in the female working population worldwide. As there is a rise in the number of working women, it becomes hard for them to prepare or cook fresh meals daily. Also, the hectic lifestyles and busy working schedules restrict them from consuming a healthy diet and thus the purchase of frozen food meals is increasing rapidly.

- According to the U.S. Department of Labor in 2019, women’s employment rate in the U.S. is 46%, in South Africa, it is 45%, and in China is 43.7%. With the growing female working population, there is a significant increase in the sales of frozen food products, including both raw materials as well as ready-to-cook or ready-to-eat foods. Frozen foods help in save time for preparation, as well as can be carried anywhere, thereby driving the rapid market growth. Additionally, the rising disposable incomes and increasing awareness, and the advent of longer shelf-life goods among the female population also boost the growth. Further, with huge technological innovations in the food industry, the range of convenience food including canned, packaged, frozen, and instant food products, has expanded from frozen, microwave-able, shelf-stable, and others.

- Frozen food thereby holds a large share in this segment. As more female populations are entering the workforce and the lifestyle trends are widely changing, the demand for convenience food is expected to increase rapidly, further propelling the frozen food market growth.

Frozen Food Market Opportunities- Technological Advancements and Digitalization in the Retail Sector creates an opportunity

- Online grocery shopping as well as the introduction of new apps are growing widely. The growing retail industry is making it convenient and easy for consumers to choose products according to their preferences.

- Consumers are inclined more towards online shopping because of the added features of convenience and variety. With the rapid penetration of internet and smartphone usage, rapid digitalization in the retail sector can create profitable opportunities for the growth of the frozen food market. Major manufacturers and companies can showcase their frozen food products and sell widely with the help of online grocery platforms.

- Additionally, the growing R&D initiatives by key manufacturers & retailers to improve and maintain product quality can be beneficial for market growth. Further, the introduction of new technologies such as high-pressure processing (HPP), is essential in bringing a cost-effective solution and offering lucrative opportunities for the frozen food market.

Frozen Food Market Segment Analysis:

Frozen Food Market Segmented based on type, product.

By Type, the Ready-to-Eat segment is expected to dominate the market during the forecast period

- By Type, the Ready-to-Eat segment is expected to dominate the market growth of frozen food in the forecast period. The huge dominance is due to the hectic lifestyles, and the ease of availability of frozen food meals.

- Additionally, as these foods do not consume any preparation time, and maintain a longer shelf-life, consumers across the world choose such eatables again and again over a while.

- Frozen ready-to-eat meals and breakfasts are healthier food options to simplify lives during stressful routines, and they thus have witnessed a huge demand from the consumer of every age group. Further, the health benefits, easy management of calorie intake, and wide availability of food varieties are estimated to drive the huge growth of this segment.

By Product, Meat and Seafood segment held the largest share in 2024

- By Product, Meat and Seafood Products is the major dominating segment of the frozen food market. The increasing usage of such products by the major food companies such as KFC, Pizza Hut, and McDonald’s acts as a key driver of the growth of the meat and seafood product segment.

- Furthermore, the utilization of meat and seafood products by numerous end users such as hotels, full-service restaurants, resorts, and quick-service restaurants boosts the market growth.

- Additionally, as frozen meat and seafood provides additional benefits as they are free from harmful preservatives, and possess high nutritional value, the segment is expected to attain huge growth. Also, due to the extended shelf life, high-quality meat, and higher food safety, meat, and seafood products dominate the frozen food market.

Frozen Food Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the frozen food market in recent years and is expected to witness huge growth over the forecasted period. The major factors that are aiding the rapid growth of the frozen food market in the North American region are the rapidly growing benefits of such frozen eatables, rise in urbanization, growing population, and rising consumer awareness regarding ready-to-eat and ready-to-cook meals. According to Statista, Frozen novelties were the best-selling items of frozen food in the United States, which recorded nearly US$ 1.6 billion in 2021.

- The most prominent player in the frozen food industry is Nestlé USA, which consistently manufactures products for almost every single category. Statista also recorded a net sale of Nestlé USA in the frozen pizza segment which accounted for US$ 2.3 billion in 2021, further driving the growth of the frozen food market.

- Average consumer spending in the United States on frozen foods amounted to 7.16 dollars for frozen pizza, and 11.48 U.S. dollars per consumer unit for seafood in 2019. The use of ready-to-cook processed meals is further expected to flourish the market growth of frozen food in the North American region in the upcoming years.

Frozen Food Market Top Key Players:

- Nestlé (Switzerland)

- J.M. Smucker (USA)

- McCain Foods (Canada)

- Mondelez International (USA)

- Ajinomoto Co., Inc. (Japan)

- Nomad Foods (United Kingdom)

- CP Foods (Thailand)

- McCormick & Company (USA)

- Green Giant (USA)

- OSI Industries, Inc. (USA)

- Premier Foods plc (England)

- Van den Berghe Foods (Netherlands)

- Froneri International Ltd. (England)

- Samyang Food (South Korea)

- McCormick Plc (USA)

- C.F. Mueller Company (USA)

- CP Kelloggs India (India)

- Iglo Foods Holdings Limited (Germany)

- Fuji Food Corporation (Japan)

- B&G Foods, Inc. (USA)

- Other Active Players

Key Industry Developments in the Frozen Food Market:

- In May 2024, Nestlé led to launch of a new frozen food brand, Vital Pursuit, in fall 2024 due to the popularity of GLP-1 drugs for weight loss and diabetes management. The line will offer essential nutrients such as protein, fiber, vitamins, and minerals. While these food products may help those on weight loss medications get necessary nutrients, experts warn against relying solely on them.

- In March 2024, BigBasket partners with Sanjeev Kapoor to launch frozen foods brand Precia, featuring frozen vegetables, snacks, and sweets. It will feature frozen vegetables such as green peas and mixed vegetables, frozen snacks like momos and french fries, and frozen sweets including gajar ka halwa and purani dilli rabdi.

|

Global Frozen Food Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 322.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 510.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Frozen Food Market by Type (2018-2032)

4.1 Frozen Food Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Raw Material

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Half-Cooked

4.5 Ready-To-Eat

Chapter 5: Frozen Food Market by Product (2018-2032)

5.1 Frozen Food Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Convenience Food & Ready Meals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Meat & Seafood Products

5.5 Dairy Products

5.6 Bakery Products

5.7 Fruits & Vegetables

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Frozen Food Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DEERE & COMPANY (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 IBM (US)

6.4 SAP SE (GERMANY)

6.5 TRIMBLE(US)

6.6 MONSANTO (US)

6.7 ORACLE (US)

6.8 ACCENTURE (IRELAND)

6.9 ITERIS (US)

6.10 TARANIS (ISRAEL)

6.11 AGRIBOTIX (US)

6.12 AGRIVI (UK)

6.13 DTN (US)

6.14 AWHERE (US)

6.15 CONSERVIS CORPORATION (US)

6.16 DELAVAL (SWEDEN)

6.17 FBN (US)

6.18 FARMERS EDGE (US)

6.19 GEOSYS (US)

6.20 GRANULAR (US)

6.21 GRO INTELLIGENCE (US)

6.22

Chapter 7: Global Frozen Food Market By Region

7.1 Overview

7.2. North America Frozen Food Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Raw Material

7.2.4.2 Half-Cooked

7.2.4.3 Ready-To-Eat

7.2.5 Historic and Forecasted Market Size by Product

7.2.5.1 Convenience Food & Ready Meals

7.2.5.2 Meat & Seafood Products

7.2.5.3 Dairy Products

7.2.5.4 Bakery Products

7.2.5.5 Fruits & Vegetables

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Frozen Food Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Raw Material

7.3.4.2 Half-Cooked

7.3.4.3 Ready-To-Eat

7.3.5 Historic and Forecasted Market Size by Product

7.3.5.1 Convenience Food & Ready Meals

7.3.5.2 Meat & Seafood Products

7.3.5.3 Dairy Products

7.3.5.4 Bakery Products

7.3.5.5 Fruits & Vegetables

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Frozen Food Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Raw Material

7.4.4.2 Half-Cooked

7.4.4.3 Ready-To-Eat

7.4.5 Historic and Forecasted Market Size by Product

7.4.5.1 Convenience Food & Ready Meals

7.4.5.2 Meat & Seafood Products

7.4.5.3 Dairy Products

7.4.5.4 Bakery Products

7.4.5.5 Fruits & Vegetables

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Frozen Food Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Raw Material

7.5.4.2 Half-Cooked

7.5.4.3 Ready-To-Eat

7.5.5 Historic and Forecasted Market Size by Product

7.5.5.1 Convenience Food & Ready Meals

7.5.5.2 Meat & Seafood Products

7.5.5.3 Dairy Products

7.5.5.4 Bakery Products

7.5.5.5 Fruits & Vegetables

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Frozen Food Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Raw Material

7.6.4.2 Half-Cooked

7.6.4.3 Ready-To-Eat

7.6.5 Historic and Forecasted Market Size by Product

7.6.5.1 Convenience Food & Ready Meals

7.6.5.2 Meat & Seafood Products

7.6.5.3 Dairy Products

7.6.5.4 Bakery Products

7.6.5.5 Fruits & Vegetables

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Frozen Food Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Raw Material

7.7.4.2 Half-Cooked

7.7.4.3 Ready-To-Eat

7.7.5 Historic and Forecasted Market Size by Product

7.7.5.1 Convenience Food & Ready Meals

7.7.5.2 Meat & Seafood Products

7.7.5.3 Dairy Products

7.7.5.4 Bakery Products

7.7.5.5 Fruits & Vegetables

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Frozen Food Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 322.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 510.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||