Global Food Nanotechnology Market Overview

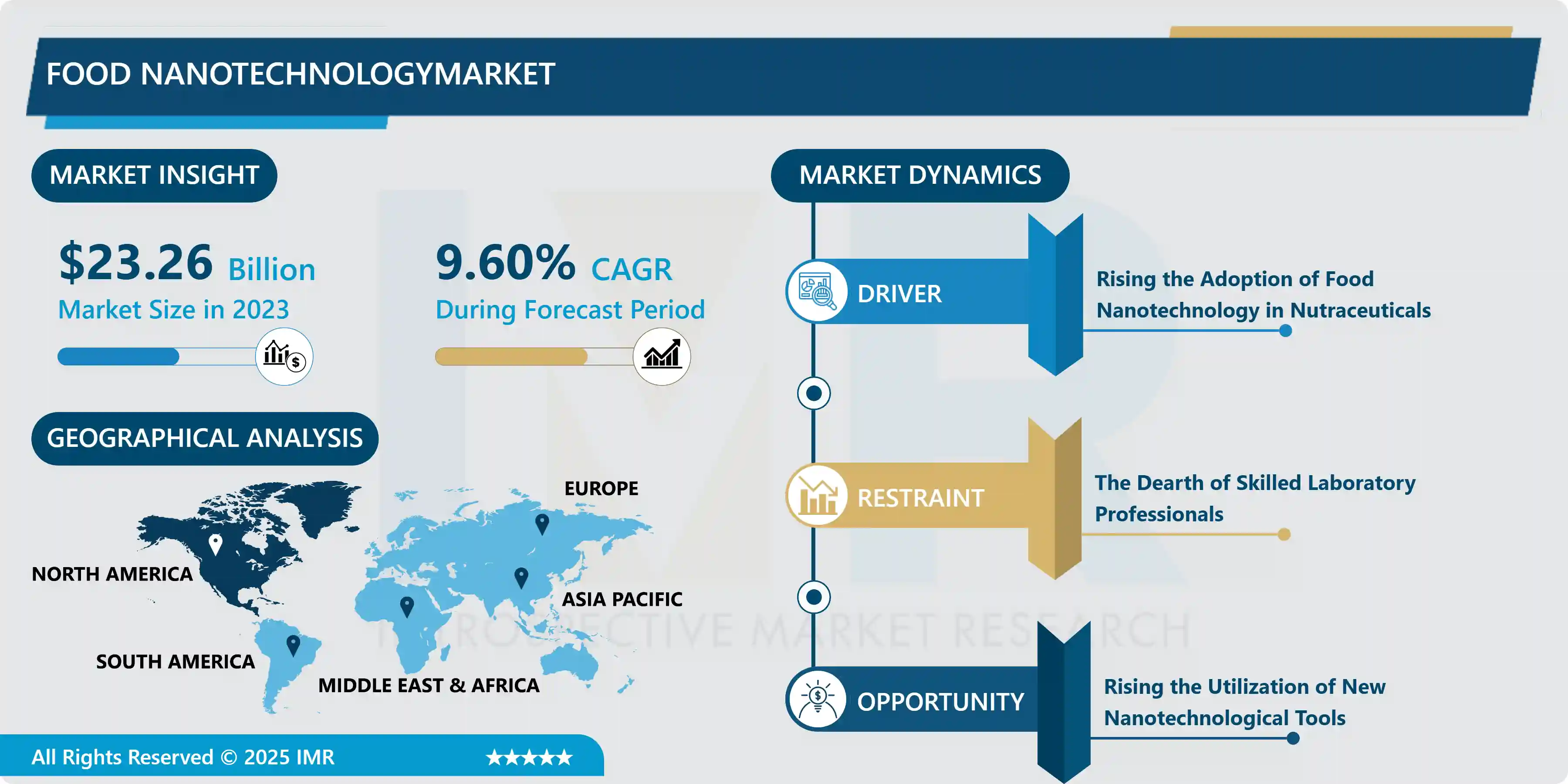

The Food Nanotechnology Market size was valued at USD 23.26 Billion in 2023 and is projected to reach USD 53.08 Billion by 2032, growing at a CAGR of 9.60% from 2024 to 2032.

Nanotechnology is the science and technology that are used in the food industry to detect bacteria in packaging or produce stronger flavors and color quality, and safety by increasing the barrier properties. Food nanotechnology was introduced by Pasteur and it started from the Pasteurization process to kill the spoilage bacteria (1000 nm), which made the first move to improving food processing and enhancing the quality of food. This food nanotechnology assists human health through a novel and advanced perspective. Nanotechnology is also used in the food and agriculture industries to protect the plant, monitor the plant growth, eliminate the plant and animal diseases, enhance the global food production, improve the food quality, and reduce waste for sustainable intensification. For instance, according to the UN's Food and Agriculture Organization every year, more than 1.3 billion metric tonnes of consumable food are wasted because of poor post-harvest procedures, storage, and transportation facilities via the supply chain. Thus, nanotechnology is used for reducing waste which propels the growth of the market within the projected timeframe.

Market Dynamics And Factors For Food Nanotechnology Market

Drivers:

Rising the Adoption of Food Nanotechnology in Nutraceuticals

- The rising demand for nutraceutical products is because of the increase in the precedence for a healthy lifestyle. The nutraceuticals segment contains dietary supplements, food additives such as vitamins, and natural coloring agents. Consumers are more aware of the food quality, and their health benefits. The active compound or ingredients of nutritional supplements are protected from the high temperature at the time of processing by using nanocapsules and preserve the nutritional properties of the supplements. Food nanotechnology enhances the efficiency, and effectiveness of delivery of nutraceuticals by improving the solubility, and bioavailability, and facilitating controlled release. These beneficial applications support the growth of the food nanotechnology market in the analysis period.

Increased Awareness About Health Among the People

- People across the world have become more aware of health and health-related problems. Thus, increasing the demand for clean label products and rising the adoption of new food processing techniques in the food and beverage industry and other food industries to maintain and enhance the quality of products. People have a preference to buy packaged food which helps to increase the demand for nanotechnology used in food packaging which helps to increase the market of food nanotechnology in the forecast period.

Restraints:

The Dearth of Skilled Laboratory Professionals

- The specific analysis and evaluation of results are the crucial part of the experiments including nanotechnology. Thus, well-trained and skilled personnel are required to perform nanotechnology experiments. In the developing countries of APAC, Africa, and South America, lack of trained people in nanotechnology experiments. Peoples are more aware of the benefits of food nanotechnology. So, they want an accurate analysis of nanotechnology but a dearth of the skilled person, and industries can’t perform accurate analysis which hampering the growth of the market in the forecast year.

Opportunity:

Rising the Utilization of New Nanotechnological Tools.

- Rising the research and development of nanotechnology tools to grow new varieties of plants, and improve the productivity of plants is a lucrative opportunity for the market of food nanotechnology in the forecasted period. The fast-growing global population across the world leads to a growing demand for food. This demand is encountered by rising agricultural production. Nanotechnology offers several benefits to the agricultural food industry such as it helps for improving the quality, and safety, and increasing production. Thus, researchers in developed countries are engaged in the development of nanotechnology to increase the production of food. This is a gainful opportunity for the growth of the market of food nanotechnology in the projected timeframe.

Segmentation Analysis Of Food Nanotechnology Market

- By type, the nanomaterials segment is projected to maximum market share in the food nanotechnology over the forecast period. The use of nanomaterials in food processing enhances the mechanical strength and provides better protection, and durability of packaging materials. It is used as a food additive, carriers for smart nutrient delivery, anti-caking agents, antibacterial agents, and fillers. Nanomaterials contain nanosilver, nano-titanium dioxide, nano-magnesium oxide, nano-copper oxide, and carbon nanotubes. These nanomaterials are added to food packaging to keep the food fresh and reduce food waste. Thus, rising the demand for nanomaterials in food processing which support the growth of the food nanotechnology market over the forecasted year.

- By application, the food packaging segment is anticipated to hold the maximum share in the food nanotechnology market throughout the forecast year. Nanotechnology is used in food packaging to improve mechanical strength, reduce weight, increase heat resistance, and also improve barrier properties of food package materials from oxygen, carbon dioxide, ultraviolet radiation, moisture, and volatiles. Additionally, nanotechnology in food increases food longevity and provides food safety. Nanotechnology contains a host of sensors that detect the contaminants, gasses, or microbes in packaged food. Thus, rising the demand in the various segment such as meat, fruits, vegetables, and in the food and beverages industry for packaging based on nanotechnology. These factors drive the growth of the market in the forecast period.

Regional Analysis Of Food Nanotechnology Market

- The Asia Pacific is projected to largest market share growth in food nanotechnology during the forecast period. The growing population leads to an increase in the demand for food. This, increase the industrialization in this region including food industries. The growing urbanization of this region, and rising awareness about the healthier and safer nutritious food. These factors support the market growth. In the Asia Pacific region, China and Singapore have the highest market share in food nanotechnology. The presence of the largest consumer of packaged food in this region. Thus, this region is projected to faster-growing market for food nanotechnology as compared to Europe, South America, the Middle East, and Africa in the forecast year.

- North America is the second-largest market share in food nanotechnology. The peoples in this region prefer packaged fresh food accounting for increasing the market. In this region, the US is dominating country in the food technology market. Rising the food industries, and increasing the research and development of nanotechnology tools propels the growth of the market. In the addition to this, growing the demand for health-benefiting nutraceutical products and rising industrialization with the adoption of new technology in the food industry also support an increase in the market of food nanotechnology in the projected timeframe.

- In Europe significant growth in the food nanotechnology market. The government of European countries sponsored research programs, infrastructure, and institutions to support food products. Thus, rising the industrialization in this region containing food industries. Apart from this grown the awareness among the people about healthier and safer nutritious food and rising the demand for packaged food in this region. These factors support the growth of the market of food nanotechnology in the forecast period.

- The Middle East and South Africa have sluggish growth in the food nanotechnology market. The growing research and development of nanotechnology in the Saudi Arabia country in this region support the growth of the food nanotechnology market. Rising the demand for nutritious products and packaged food thus increasing the adoption of nanotechnology in food industries also propels the growth of the market in the forecast year.

Top Key Players Covered In Food Nanotechnology Market

- BASF (Germany)

- Valentis Nanotech (Israel)

- Blue California (US)

- Aquanova(Russia)

- NanoPack(US)

- PEN (US)

- Frutarom Industries (Israel)

- Nestlé S.A.

- Danone S.A.

- Bayer AG

- Unilever PLC

- Dow Chemical Company

- Tate & Lyle PLC

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Kemin Industries, Inc.

- Advanced Nanotech Solutions Inc.

- Nanophase Technologies Corporation

- Zyvex Labs

- NanoFood Technologies

- Nanoscale Corporation

- Kraft Foods

- Cargill

- Southwest Research Institute (US) and other major players.

Key Industry Development In The Food Nanotechnology Market

- In July 2024, BASF launched Tinuvin® NOR® 211 AR to assist film producers and converters globally in navigating the challenging landscape of plasticulture – the use of plastic materials in agricultural applications. This new high-performance heat and light stabilizer was designed to protect and prolong the lifespan of agricultural plastics that required resistance to high levels of inorganic chemicals such as sulfur and chlorine. Tinuvin NOR 211 AR offered an effective value-in-use solution for agricultural plastics exposed to intense UV radiation, thermal stress, and inorganic chemicals commonly used in crop management and disinfection.

- In February 2024, Blue California, an industry leader in science-driven ingredient development, announced the successful completion of a groundbreaking human clinical trial of ergothioneine. The double-blinded, placebo-controlled clinical trial, sponsored by Blue California, demonstrated that ErgoActive® ergothioneine supported aspects of cognitive function, memory, and sleep in healthy elderly subjects with subjective memory complaints.

|

Global Food Nanotechnology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.26 Bn. |

|

Forecast Period 2024-32CAGR: |

9.60% |

Market Size in 2032: |

USD 53.08 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Nanotechnology Market by Type (2018-2032)

4.1 Food Nanotechnology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Nano Materials

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Nano Tools

4.5 Nano Devices

Chapter 5: Food Nanotechnology Market by Application (2018-2032)

5.1 Food Nanotechnology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food Packaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food Processing

5.5 Food Testing

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Food Nanotechnology Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CHEMSERVICE INC. (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SPECTRUM CHEMICAL (U.S.)

6.4 GELEST INC. (U.S.)

6.5 SARCHEM LABORATORIES INC. (U.S.)

6.6 VWR INTERNATIONAL

6.7 LLC. (U.S.)

6.8 AUSTIN CHEMICAL COMPANY INC. (U.S.)

6.9 SANTA CRUZ BIOTECHNOLOGY INC (U.S.)

6.10 MERCK KGAA (GERMANY)

6.11 MATRIX FINE CHEMICALS GMBH (GERMANY)

6.12 CYMIT QUÍMICA S.L (SPAIN)

6.13 PROCURENET LIMITED (CHINA)

6.14 ALFA CHEMICAL COLTD (CHINA)

6.15 CHEMVON BIOTECHNOLOGY CO. LTD (CHINA)

6.16 LOOKCHEM (CHINA)

6.17 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD. (INDIA)

6.18

Chapter 7: Global Food Nanotechnology Market By Region

7.1 Overview

7.2. North America Food Nanotechnology Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Nano Materials

7.2.4.2 Nano Tools

7.2.4.3 Nano Devices

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Food Packaging

7.2.5.2 Food Processing

7.2.5.3 Food Testing

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Food Nanotechnology Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Nano Materials

7.3.4.2 Nano Tools

7.3.4.3 Nano Devices

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Food Packaging

7.3.5.2 Food Processing

7.3.5.3 Food Testing

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Food Nanotechnology Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Nano Materials

7.4.4.2 Nano Tools

7.4.4.3 Nano Devices

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Food Packaging

7.4.5.2 Food Processing

7.4.5.3 Food Testing

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Food Nanotechnology Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Nano Materials

7.5.4.2 Nano Tools

7.5.4.3 Nano Devices

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Food Packaging

7.5.5.2 Food Processing

7.5.5.3 Food Testing

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Food Nanotechnology Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Nano Materials

7.6.4.2 Nano Tools

7.6.4.3 Nano Devices

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Food Packaging

7.6.5.2 Food Processing

7.6.5.3 Food Testing

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Food Nanotechnology Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Nano Materials

7.7.4.2 Nano Tools

7.7.4.3 Nano Devices

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Food Packaging

7.7.5.2 Food Processing

7.7.5.3 Food Testing

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Food Nanotechnology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.26 Bn. |

|

Forecast Period 2024-32CAGR: |

9.60% |

Market Size in 2032: |

USD 53.08 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The Food Nanotechnology Market size was valued at USD 23.26 Billion in 2023 and is projected to reach USD 53.08 Billion by 2032, growing at a CAGR of 9.60% from 2024 to 2032.