Feed Mycotoxin Binders Market Overview

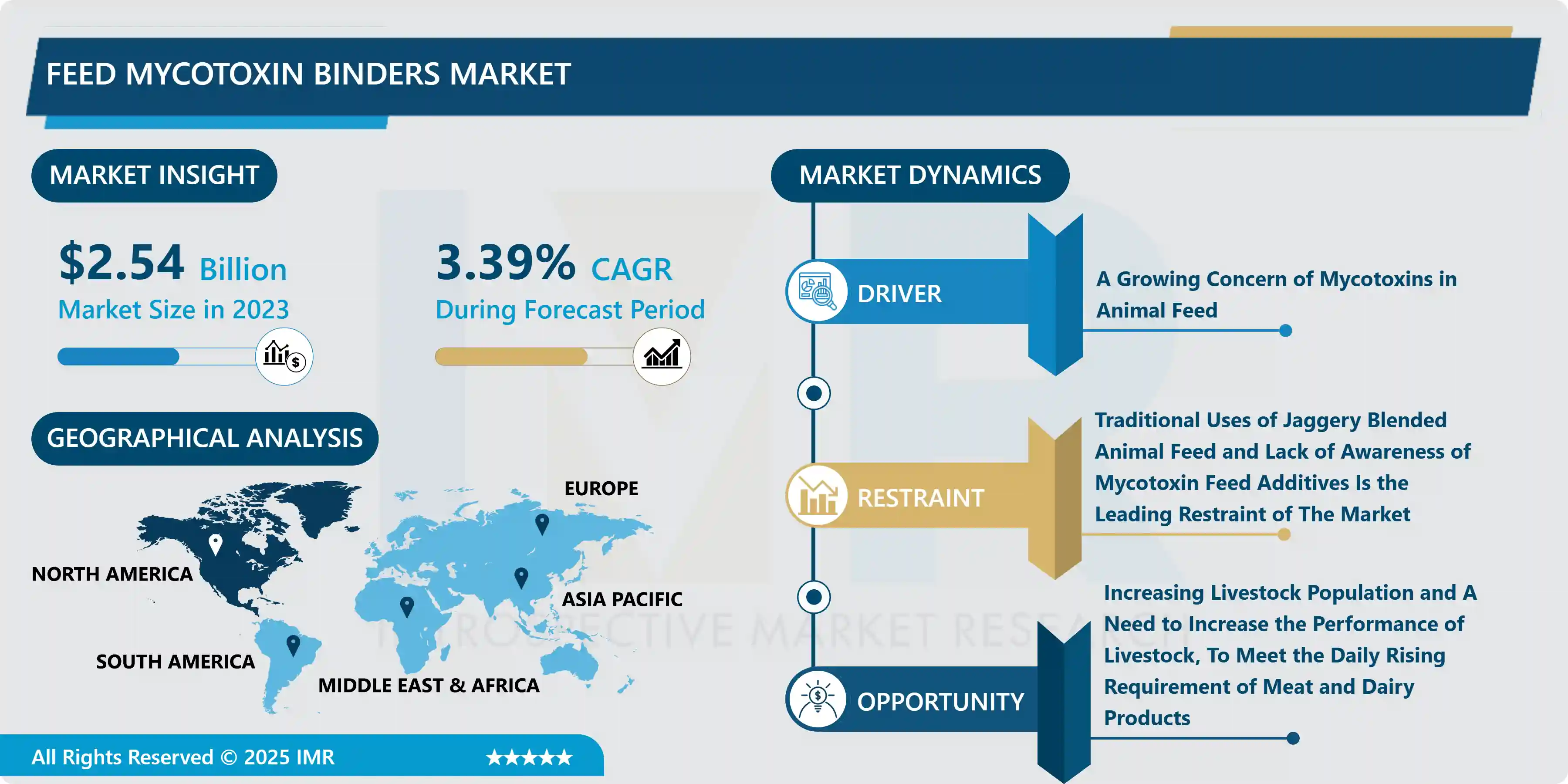

Feed Mycotoxin Binders Market Size Was Valued at USD 2.54 Billion in 2023, and is Projected to Reach USD 3.43 Billion by 2032, Growing at a CAGR of 3.39% From 2024-2032

Mycotoxin binder or adsorbent is a substance, which is added to animal feed in small quantities that bind to mycotoxins and prevent them from getting absorbed in the gut, thus preventing them from entering the bloodstream of livestock. Mycotoxins are chemical substances produced from fungi (molds), which swallowed by livestock can negatively affect the performance of the livestock, thus helping the feed mycotoxin binders' market to expand in the forecast period. Animal feed has become an eccentric issue with the rising population of livestock, to tackle this problem feed volume has increased still this feed is incompetent as it contains some harmful substances along with vital nutrients, these harmful substances hamper the uptake of nutrients that are essential for the growth of livestock, thus halting the production capacity and performance of the livestock.

Moreover, the animal feed contains fungi which are responsible for the proliferation of mycotoxins. More than 500 mycotoxins are identified in the environment. Most common mycotoxins include- aflatoxins, ergot alkaloids, ochratoxins, trichothecenes, fumonisins, and zearalenone. Bentonites are extraordinary substances for the adsorption of aflatoxin B1 (AfB1). Research studies have shown that bentonites can effectively reduce the hindering effects of dietary aflatoxin B1 (AfB1). Bentonite alone is not effective in binding all the mycotoxins present in the environment. Moreover, the occurrence of mycotoxins in animal feed has increased in recent times, eventually helping the feed mycotoxin binders market expand during the forecast period.

Market Dynamics And Factors In Feed Mycotoxin Binders Market

Drivers:

A growing concern of mycotoxins in animal feed

- Mycotoxin-triggered contamination in the animal feed industry is the leading cause driving the growth of the feed mycotoxin binders’ market in the forecast period. The rising population of livestock and the flaws in traditional practice methods of feeding animals has forced livestock growers to enhance the quality of feed. According to the FAO study, 25% of the animal feed crops produced around the globe contain mycotoxin. Moreover, to maximize livestock production, performance, and health, the use of mycotoxin binders among the livestock growers is expected to increase, eventually encouraging the development of feed mycotoxin binders' market during the forecast period. Recently, there have been a lot of incidences of disease outbreaks across the globe and there are future concerns of more outbreaks causing tremendous financial losses to the livestock growers. To reduce mycotoxicosis and to enhance livestock growth, mycotoxin binders are gaining popularity. Rapid urbanization and changing lifestyles have compelled consumers to shift towards ready-to-eat food products. Packaged meat products have seen a tremendous rise in recent years. Additionally, to elevate the standards of these meat products, livestock growers are embracing the innovative technologies to ensure the required standards are met thus, supporting the expansion of the feed mycotoxin binders' market throughout the forecast.

Restraints:

Traditional uses of jaggery blended animal feed and lack of awareness of mycotoxin feed additives is the leading restraint of the market

- Livestock growers don't have enough knowledge of the use of mycotoxin binders, livestock growers practice traditional jaggery blended methods to feed livestock, which lacks mycotoxin binders thus hampering the growth, production, performance, and health of the livestock. The prominent use of acidifiers, mold growth inhibitors and other feed preservatives to promote gut health instead of mycotoxin binders will restrain the growth of the market. The high cost associated with the manufacturing of mycotoxin binders and their insufficiency in binding to mycotoxins in certain cases is still a big deal. Moreover, small livestock growers are unaware of feed mycotoxin binders, which hinders the expansion of the market in the forecast period. Though the mycotoxin binders bind the mycotoxin, certain binders bind with the proteins which reduce the protein uptake, eventually restraining the growth of the market.

Opportunities:

Increasing livestock population and a need to increase the performance of livestock, to meet the daily rising requirement of meat and dairy products.

- As the human population continues to grow the need for animal products such as meat, poultry, dairy products, wool, leather, and other products also increase. Moreover, to match this requirement, successive steps should be taken to enhance livestock health, significantly providing opportunities for the market companies to develop economical feed additives that will boost livestock health and their performance. The big opportunity for market companies is that developing economies are focused more on livestock health, as livestock products contribute to nearly 50% of agricultural GDP in high-income countries and 25% of agricultural GDP in low-income countries, according to the Livestock Data for Decisions (LD4D).

Challenges:

Negligence In Quality Control

- Increasing demand for mycotoxin binders has led to adulteration in animal feed additives, having low binding capabilities which is a challenge for the companies to produce mycotoxin binders under strict quality control. The development of mycotoxin binders having high adsorptive capacity, specificity, and safety is a key challenge to market companies. Moreover, a single mycotoxin binder is not effective in binding all the mycotoxins present in the environment, thus depending on the geographical area and the presence of mycotoxins, selective binders should be used to prevent the irrational use of a useless binder.

Market Segmentation

Segmentation Analysis of Feed Mycotoxin Binders Market:

- Depending on Products, the clay segment is forecasted to dominate the feed mycotoxin binders market in the forecast period. The growing awareness about the advantageous effects of clay in animal feed is the main factor driving the growth of this segment. Natural Carbon Clay a subtype of clay segment is a natural mineral made of carbon (charcoal) and kaolin clay. It performs several functions such as absorbent of ammonia, liquid, mycotoxins, other toxins, and pathogens in the animal's gut. Studies have shown that utilization of clay as a feed mycotoxin binder has reduced ammonia emissions, enhanced the health of livestock, and has improved dung decomposition thus, helping the segment expand.

- Depending on the Source, the inorganic segment is predicted to lead the feed mycotoxin binders market in the estimated timeframe. The inorganic feed mycotoxin binders play a vital role in adsorbing mycotoxins. Inorganic mycotoxin adsorbing agents can be silica-based, natural clay products, or synthetic polymers. In addition, they are efficient in preventing adverse effects exerted by many toxic agents, not only from the environment but also from living organisms. Inorganic mycotoxin binders such as aluminosilicates, bentonites, montmorillonites, zeolite, HSCAS (Hydrated sodium calcium aluminosilicate), and synthetic polymers are used in the feed industry to bind the harmful aflatoxins.

- Depending on the Form, the dry segment is expected to have the highest share of the feed mycotoxin binders’ market in the projected year. The dry form of feed mycotoxin binders mixes readily with the animal feed and other ingredients. Furthermore, the dry form can be easily stored by the users and are easy to measure thus, stimulating the growth of the segment.

- Depending on Livestock, the poultry segment is anticipated to have the highest growth rate. The rising disease outbreaks in the poultry population are the vital factor supporting the growth of this segment. Moreover, to increase the quality of meat and eggs for commercial consumption and growing concern about poultry health is increasing the consumption of feed mycotoxin in poultry feed.

Regional Analysis of Feed Mycotoxin Binders Market:

- The North American region is anticipated to have the highest share of the Feed Mycotoxin Binders Market in the forecast period. The presence of prominent companies and the increasing awareness about diseases related to mycotoxins is stimulating livestock growers to increase the usage of mycotoxin binders in animal feed. The major crops utilized for animal feed in this region are corn, wheat, and barley. In addition, these crops are highly susceptible to the growth of fungus and mycotoxin contamination. To eliminate the growth of mycotoxin contaminants in the food chain the demand for feed mycotoxin binders is increasing rapidly thus, strengthening the development of the market in this region.

- North America followed by Asia, is forecasted to have the highest significant growth rate during the forecast period. The rise in the consumption of animal-derived food products such as milk, meat, and others is a vital factor in increasing the consumption of feed mycotoxin binders in this region. The livestock population in this region has flourished at a rapid rate. Moreover, to feed the ever-growing livestock population, feed volume has increased but the quality of feed has degraded. To elevate the quality of feed livestock growers are utilizing mycotoxin binders in animal feeds. Countries like China, India, Australia, and Japan are prominent contributors to the growth of the market.

- The European region is expected to show a positive growth rate in the period of forecast. Swine is the most reared livestock in this region. Countries such as Spain, Germany, France, and Denmark are prominent countries rearing swine for their meat. Moreover, the swine population in this region was 143 million according to the latest report of Eurostat. Furthermore, swine breeding and the young pigs being susceptible to mycotoxin contamination is forcing livestock growers to incorporate mycotoxin binder in animal feed thus, supporting the development of feed mycotoxin binders' market during the forecast region in this region.

Players Covered in Feed Mycotoxin Binders Market are:

- BIOMIN (Austria)

- Bentoli (US)

- AngelYeast Co.Ltd. (China)

- Cargill (US)

- BASF SE (Germany)

- Archer Daniels Midland (US)

- Bayer AG (Germany)

- Perstorp (Sweden)

- Chr. Hansen Holding A/S (Denmark)

- Anfotal Nutrition's Private Limited (India)

- Vlvipro (UK)

- Virbac (India)

- NOVUS INTERNATIONAL (US)

- Selko (Netherlands) and Other major key players.

Key Industry Development In Feed Mycotoxin Binders Market

- In October 2023, BIOMIN Holding GmbH announced the launched of Biofix Pro, a new mycotoxin binder specifically designed for poultry feed. Biofix Pro is a synergistic blend of yeast cell wall components and inorganic adsorbents that effectively binds a wide range of mycotoxins, including aflatoxins, fumonisins, and zearalenone.

|

Feed Mycotoxin Binders Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.54 Bn. |

|

Forecast Period 2034-32 CAGR: |

3.39% |

Market Size in 2032: |

USD 3.43 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By source |

|

||

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Feed Mycotoxin Binders Market by Product (2018-2032)

4.1 Feed Mycotoxin Binders Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aluminosilicates

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hydrated Sodium Calcium Aluminosilicates [HSCAS]

4.5 Clays

4.6 Bentonite Clay

4.7 Natural Carbon Clay

4.8 Zeolites

4.9 Activated Charcoal

4.10 Cell-Wall Components of Yeasts

Chapter 5: Feed Mycotoxin Binders Market by source (2018-2032)

5.1 Feed Mycotoxin Binders Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Organic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Inorganic

Chapter 6: Feed Mycotoxin Binders Market by Form (2018-2032)

6.1 Feed Mycotoxin Binders Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Liquid

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dry

Chapter 7: Feed Mycotoxin Binders Market by Livestock (2018-2032)

7.1 Feed Mycotoxin Binders Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Poultry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Swine

7.5 Ruminants

7.6 Aquatic Animals

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Feed Mycotoxin Binders Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AL FAKHER TOBACCO FACTORY (UNITED ARAB EMIRATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CLOUD TOBACCO (UNITED STATES)

8.4 EASTERN TOBACCO (EGYPT)

8.5 FLAVORS OF AMERICAS S.A. (PANAMA)

8.6 FUMARI (UNITED STATES)

8.7 GODFREY PHILLIPS INDIA (INDIA)

8.8 HAZE TOBACCO (UNITED STATES)

8.9 JAPAN TOBACCO INC. (JAPAN)

8.10 MAZAYA (JORDAN)

8.11 NAKHLA (EGYPT)

8.12 PRINCE MOLASSES (UNITED STATES)

8.13 ROMMAN SHISHA (JORDAN)

8.14 SOCIALSMOKE (UNITED STATES)

8.15 SOEX (GERMANY)

8.16 STARBUZZ (UNITED STATES)

8.17 OTHER KEY PLAYERS

8.18

Chapter 9: Global Feed Mycotoxin Binders Market By Region

9.1 Overview

9.2. North America Feed Mycotoxin Binders Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Aluminosilicates

9.2.4.2 Hydrated Sodium Calcium Aluminosilicates [HSCAS]

9.2.4.3 Clays

9.2.4.4 Bentonite Clay

9.2.4.5 Natural Carbon Clay

9.2.4.6 Zeolites

9.2.4.7 Activated Charcoal

9.2.4.8 Cell-Wall Components of Yeasts

9.2.5 Historic and Forecasted Market Size by source

9.2.5.1 Organic

9.2.5.2 Inorganic

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Liquid

9.2.6.2 Dry

9.2.7 Historic and Forecasted Market Size by Livestock

9.2.7.1 Poultry

9.2.7.2 Swine

9.2.7.3 Ruminants

9.2.7.4 Aquatic Animals

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Feed Mycotoxin Binders Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Aluminosilicates

9.3.4.2 Hydrated Sodium Calcium Aluminosilicates [HSCAS]

9.3.4.3 Clays

9.3.4.4 Bentonite Clay

9.3.4.5 Natural Carbon Clay

9.3.4.6 Zeolites

9.3.4.7 Activated Charcoal

9.3.4.8 Cell-Wall Components of Yeasts

9.3.5 Historic and Forecasted Market Size by source

9.3.5.1 Organic

9.3.5.2 Inorganic

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Liquid

9.3.6.2 Dry

9.3.7 Historic and Forecasted Market Size by Livestock

9.3.7.1 Poultry

9.3.7.2 Swine

9.3.7.3 Ruminants

9.3.7.4 Aquatic Animals

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Feed Mycotoxin Binders Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Aluminosilicates

9.4.4.2 Hydrated Sodium Calcium Aluminosilicates [HSCAS]

9.4.4.3 Clays

9.4.4.4 Bentonite Clay

9.4.4.5 Natural Carbon Clay

9.4.4.6 Zeolites

9.4.4.7 Activated Charcoal

9.4.4.8 Cell-Wall Components of Yeasts

9.4.5 Historic and Forecasted Market Size by source

9.4.5.1 Organic

9.4.5.2 Inorganic

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Liquid

9.4.6.2 Dry

9.4.7 Historic and Forecasted Market Size by Livestock

9.4.7.1 Poultry

9.4.7.2 Swine

9.4.7.3 Ruminants

9.4.7.4 Aquatic Animals

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Feed Mycotoxin Binders Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Aluminosilicates

9.5.4.2 Hydrated Sodium Calcium Aluminosilicates [HSCAS]

9.5.4.3 Clays

9.5.4.4 Bentonite Clay

9.5.4.5 Natural Carbon Clay

9.5.4.6 Zeolites

9.5.4.7 Activated Charcoal

9.5.4.8 Cell-Wall Components of Yeasts

9.5.5 Historic and Forecasted Market Size by source

9.5.5.1 Organic

9.5.5.2 Inorganic

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Liquid

9.5.6.2 Dry

9.5.7 Historic and Forecasted Market Size by Livestock

9.5.7.1 Poultry

9.5.7.2 Swine

9.5.7.3 Ruminants

9.5.7.4 Aquatic Animals

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Feed Mycotoxin Binders Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Aluminosilicates

9.6.4.2 Hydrated Sodium Calcium Aluminosilicates [HSCAS]

9.6.4.3 Clays

9.6.4.4 Bentonite Clay

9.6.4.5 Natural Carbon Clay

9.6.4.6 Zeolites

9.6.4.7 Activated Charcoal

9.6.4.8 Cell-Wall Components of Yeasts

9.6.5 Historic and Forecasted Market Size by source

9.6.5.1 Organic

9.6.5.2 Inorganic

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Liquid

9.6.6.2 Dry

9.6.7 Historic and Forecasted Market Size by Livestock

9.6.7.1 Poultry

9.6.7.2 Swine

9.6.7.3 Ruminants

9.6.7.4 Aquatic Animals

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Feed Mycotoxin Binders Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Aluminosilicates

9.7.4.2 Hydrated Sodium Calcium Aluminosilicates [HSCAS]

9.7.4.3 Clays

9.7.4.4 Bentonite Clay

9.7.4.5 Natural Carbon Clay

9.7.4.6 Zeolites

9.7.4.7 Activated Charcoal

9.7.4.8 Cell-Wall Components of Yeasts

9.7.5 Historic and Forecasted Market Size by source

9.7.5.1 Organic

9.7.5.2 Inorganic

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Liquid

9.7.6.2 Dry

9.7.7 Historic and Forecasted Market Size by Livestock

9.7.7.1 Poultry

9.7.7.2 Swine

9.7.7.3 Ruminants

9.7.7.4 Aquatic Animals

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Feed Mycotoxin Binders Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.54 Bn. |

|

Forecast Period 2034-32 CAGR: |

3.39% |

Market Size in 2032: |

USD 3.43 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By source |

|

||

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||