Evening Primrose Oil Market Synopsis

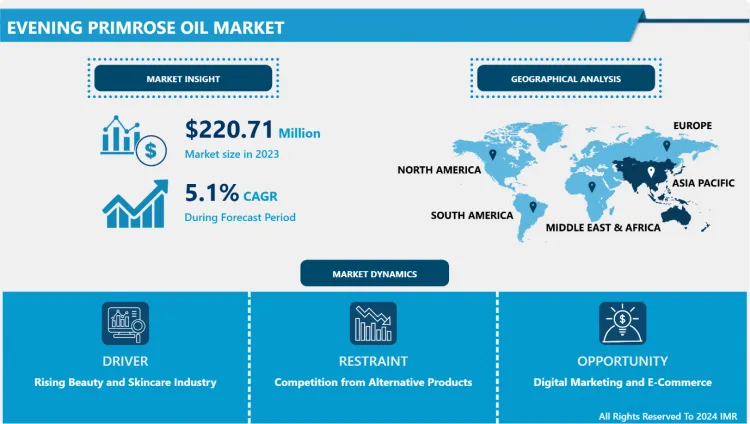

Evening Primrose Oil Market Size Was Valued at USD 232.41 Million in 2024, and is Projected to Reach USD 410.17 Million by 2035, Growing at a CAGR of 5.3% From 2025-2035.

Evening primrose oil (EPO) is derived from the seeds of the evening primrose plant (Oenothera biennis), known for its medicinal properties. Rich in gamma-linolenic acid (GLA), an omega-6 fatty acid, EPO is renowned for its potential health benefits. GLA is believed to play a role in reducing inflammation within the body and supporting overall skin health.

Primarily used as a dietary supplement, EPO has gained popularity for its purported effects in managing various conditions, including eczema, rheumatoid arthritis, premenstrual syndrome (PMS), and menopause symptoms. Some research suggests that the anti-inflammatory properties of EPO may help alleviate skin irritation and improve skin moisture for those with eczema. Additionally, its use in PMS and menopause is associated with potential relief from breast pain, mood swings, and hot flashes, although further studies are needed to confirm these effects conclusively.

While Evening Primrose Oil is generally considered safe for short-term use, it's essential to consult a healthcare professional before incorporating it into your routine, especially if you have underlying medical conditions or are taking other medications. Adverse effects such as mild stomach upset or headaches have been reported in some cases, emphasizing the importance of proper dosage and individual considerations before its consumption.

Evening Primrose Oil Market Trend Analysis

Rising Beauty and Skincare Industry

- EPO's recognized potential in enhancing skin health has positioned it as a coveted ingredient in cosmetic formulations. Renowned for its moisturizing and anti-inflammatory properties, EPO has found extensive use in various skincare products, including creams, serums, and lotions. Its ability to alleviate skin conditions like eczema and promote overall skin hydration has significantly contributed to its increasing integration into the beauty market.

- Moreover, consumer preferences leaning toward natural and plant-based skincare solutions have propelled the demand for EPO-infused products. As individuals seek effective yet gentle remedies for their skin concerns, EPO's natural origin and purported benefits align with the rising trend of clean and organic beauty. This consumer inclination towards natural ingredients has led skincare companies to incorporate EPO into their formulations, capitalizing on its perceived efficacy and attracting a broader clientele.

- Furthermore, the market's growth is amplified by the beauty industry's constant innovation and product diversification. Companies continue to explore and develop new formulations harnessing the potential of EPO, introducing an array of skincare solutions tailored to address specific skin needs. This persistent innovation and the emphasis on EPO's beneficial attributes within skincare products continue to propel the market forward, establishing Evening Primrose Oil as a prominent player in the beauty and skincare landscape.

Digital Marketing and E-Commerce

- The burgeoning prominence of online platforms presents a significant avenue for EPO manufacturers and retailers to amplify their market presence and accessibility. With the global shift toward digital shopping experiences, leveraging e-commerce allows for a broader reach, enabling consumers worldwide to access EPO products conveniently.

- Digital marketing strategies, including targeted advertising, social media campaigns, and informative content creation, hold immense potential in educating consumers about EPO's benefits. Engaging and informative content can enhance consumer understanding, building trust and interest in EPO as a natural health remedy. Moreover, these strategies facilitate direct engagement with the target audience, enabling companies to tailor their messaging and promotions to specific demographics or health concerns, thereby maximizing the impact of their marketing efforts.

- The ease and convenience offered by online platforms not only simplify the purchasing process but also allow for comprehensive product information dissemination. Through e-commerce channels, companies can provide detailed product descriptions, usage guidelines, and customer reviews, fostering consumer confidence and informed decision-making. This accessibility coupled with strategic digital marketing initiatives enhances brand visibility, fostering market growth by tapping into a vast consumer base seeking natural health solutions in the digital sphere.

Evening Primrose Oil Market Segment Analysis:

Evening Primrose Oil Market Segmented on the basis of product type, form, distribution channel and application.

By Product Type, GNC Women’s Evening Primrose Oil segment is expected to dominate the market during the forecast period

- The GNC Women’s Evening Primrose Oil segment is poised to assert dominance in the market throughout the forecast period. GNC, a renowned health and wellness brand, has strategically focused on catering to women's health needs with their Evening Primrose Oil offerings. Leveraging its established brand reputation and a dedicated focus on women's wellness, GNC has positioned its Evening Primrose Oil products as a go-to choose for women seeking natural remedies.

- With a robust emphasis on quality, purity, and efficacy, GNC's Women’s Evening Primrose Oil segment is anticipated to resonate strongly with consumers. Their formulations specifically tailored to address women's health concerns, including hormonal balance, menstrual health, and skin wellness, are expected to drive significant market traction. The brand's credibility and commitment to providing trusted supplements for women's health needs position GNC's Evening Primrose Oil segment as a frontrunner, likely to dominate the market by offering tailored solutions for women's wellness.

By Application, Cosmetic Industry segment held the largest market share of 50.9% in 2024

- Within the Evening Primrose Oil (EPO) market, the cosmetic industry segment has dominated, securing the largest market share. The significant demand for EPO in cosmetic formulations stems from its acclaimed benefits for skin health. Renowned for its moisturizing properties and ability to soothe skin irritation, EPO has become a sought-after ingredient in various skincare products such as creams, serums, and lotions.

- Consumers' growing preference for natural and plant-based ingredients in skincare has bolstered the integration of EPO into cosmetic formulations. Its perceived efficacy in addressing skin conditions like eczema and enhancing overall skin hydration has propelled its utilization by cosmetic companies. This sector's dominance is a testament to the increasing consumer inclination toward clean and natural beauty products. EPO's presence in cosmetics aligns with this trend, cementing its position as a significant contributor to the cosmetic industry's market share within the broader EPO market.

Evening Primrose Oil Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to assert its dominance in the Evening Primrose Oil (EPO) market over the forecast period. Several factors contribute to this anticipated growth, including the region's burgeoning population, increasing disposable income, and a growing awareness of holistic health and wellness practices. The cultural significance of natural remedies and traditional medicine in countries across Asia Pacific further amplifies the market potential for EPO.

- Moreover, the expanding beauty and skincare industry in countries like China, Japan, South Korea, and India drives the demand for EPO-infused products. Consumers in these markets exhibit a strong inclination toward natural ingredients, seeking skincare solutions rooted in botanical extracts like Evening Primrose Oil. This consumer preference aligns with the rising trend of clean beauty, propelling the use of EPO in various cosmetic formulations. With a combination of favorable demographics, rising consumer awareness, and an expanding beauty sector, the Asia Pacific region is poised to lead the EPO market, both in consumption and production, during the forecast period.

Evening Primrose Oil Market Top Key Players:

- Aromex Industry (India)

- Baxco (U.S.)

- Connoils (U.S.)

- Dalian Tianshan (China)

- Efamol (U.K.)

- Hebei Xinqidian (China)

- Henry Lamotte And Oils Gmbh (Germany)

- Honsea (China)

- Htc Health (U.K.)

- Jilin Baili (China)

- Jilin Shengji (China)

- Jilin Shuangjia Foods Co. Ltd. (China)

- Liaoning Jiashi (China)

- Oil Seed Extractions (India)

- Omeganz (Australia)

- Panjin Tianyuan Pharmaceutical (China)

- Pioneer Herb (China)

- Plimon Group (Netherlands)

- Sanmark (Finland)

- Shenzhen Kangerjian (China)

- Yuanhua Biotechnology (China) and Other Major Players

|

Evening Primrose Oil Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2025: |

USD 232.41 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.3% |

Market Size in 2035: |

USD 410.17 Mn. |

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Evening Primrose Oil Market by Product Type (2018-2032)

4.1 Evening Primrose Oil Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Puritan's Pride Evening Primrose Oil

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Nature's Bounty Evening Primrose Oil

4.5 GNC Women's Evening Primrose Oil

4.6 Blackmores Evening Primrose Oil

Chapter 5: Evening Primrose Oil Market by Form (2018-2032)

5.1 Evening Primrose Oil Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Capsule

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Liquid/Oil

Chapter 6: Evening Primrose Oil Market by Distribution Channel (2018-2032)

6.1 Evening Primrose Oil Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarket or Hypermarket

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online Stores

6.5 Retail Stores

Chapter 7: Evening Primrose Oil Market by Application (2018-2032)

7.1 Evening Primrose Oil Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceuticals Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Cosmetic Industry

7.5 Food & Beverages

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Evening Primrose Oil Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PFIZER INC. (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BAXTER INTERNATIONAL INC. (U.S.)

8.4 JOHNSON & JOHNSON SERVICES INC. (U.S)

8.5 HIKMA THYMOORGAN PHARMAZIE GMBH (GERMANY)

8.6 SYNBIAS PHARMA AG (SWITZERLAND)

8.7 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

8.8 SANDOZ AG (SWITZERLAND)

8.9 ACCORD HEALTHCARE IRELAND LTD. (IRELAND)

8.10 CADILA PHARMACEUTICALS (INDIA)

8.11 CIPLA LIMITED (INDIA)

8.12 SRS PHARMACEUTICALS PVT. LTD (INDIA)

8.13 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

8.14 ZYDUS GROUP ((INDIA)

8.15 REDDY’S LABORATORIES LTD. (INDIA)

8.16 GLENMARK PHARMACEUTICALS LTD (INDIA)

8.17 MEIJI SEIKA PHARMA CO. LTD. (JAPAN)

8.18 MICROBIOPHARM JAPAN COLTD. (JAPAN)

8.19 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

8.20 BORYUNG PHARMACEUTICAL COLTD. (SOUTH KOREA)

8.21

Chapter 9: Global Evening Primrose Oil Market By Region

9.1 Overview

9.2. North America Evening Primrose Oil Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Puritan's Pride Evening Primrose Oil

9.2.4.2 Nature's Bounty Evening Primrose Oil

9.2.4.3 GNC Women's Evening Primrose Oil

9.2.4.4 Blackmores Evening Primrose Oil

9.2.5 Historic and Forecasted Market Size by Form

9.2.5.1 Capsule

9.2.5.2 Liquid/Oil

9.2.6 Historic and Forecasted Market Size by Distribution Channel

9.2.6.1 Supermarket or Hypermarket

9.2.6.2 Online Stores

9.2.6.3 Retail Stores

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Pharmaceuticals Industry

9.2.7.2 Cosmetic Industry

9.2.7.3 Food & Beverages

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Evening Primrose Oil Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Puritan's Pride Evening Primrose Oil

9.3.4.2 Nature's Bounty Evening Primrose Oil

9.3.4.3 GNC Women's Evening Primrose Oil

9.3.4.4 Blackmores Evening Primrose Oil

9.3.5 Historic and Forecasted Market Size by Form

9.3.5.1 Capsule

9.3.5.2 Liquid/Oil

9.3.6 Historic and Forecasted Market Size by Distribution Channel

9.3.6.1 Supermarket or Hypermarket

9.3.6.2 Online Stores

9.3.6.3 Retail Stores

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Pharmaceuticals Industry

9.3.7.2 Cosmetic Industry

9.3.7.3 Food & Beverages

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Evening Primrose Oil Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Puritan's Pride Evening Primrose Oil

9.4.4.2 Nature's Bounty Evening Primrose Oil

9.4.4.3 GNC Women's Evening Primrose Oil

9.4.4.4 Blackmores Evening Primrose Oil

9.4.5 Historic and Forecasted Market Size by Form

9.4.5.1 Capsule

9.4.5.2 Liquid/Oil

9.4.6 Historic and Forecasted Market Size by Distribution Channel

9.4.6.1 Supermarket or Hypermarket

9.4.6.2 Online Stores

9.4.6.3 Retail Stores

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Pharmaceuticals Industry

9.4.7.2 Cosmetic Industry

9.4.7.3 Food & Beverages

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Evening Primrose Oil Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Puritan's Pride Evening Primrose Oil

9.5.4.2 Nature's Bounty Evening Primrose Oil

9.5.4.3 GNC Women's Evening Primrose Oil

9.5.4.4 Blackmores Evening Primrose Oil

9.5.5 Historic and Forecasted Market Size by Form

9.5.5.1 Capsule

9.5.5.2 Liquid/Oil

9.5.6 Historic and Forecasted Market Size by Distribution Channel

9.5.6.1 Supermarket or Hypermarket

9.5.6.2 Online Stores

9.5.6.3 Retail Stores

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Pharmaceuticals Industry

9.5.7.2 Cosmetic Industry

9.5.7.3 Food & Beverages

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Evening Primrose Oil Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Puritan's Pride Evening Primrose Oil

9.6.4.2 Nature's Bounty Evening Primrose Oil

9.6.4.3 GNC Women's Evening Primrose Oil

9.6.4.4 Blackmores Evening Primrose Oil

9.6.5 Historic and Forecasted Market Size by Form

9.6.5.1 Capsule

9.6.5.2 Liquid/Oil

9.6.6 Historic and Forecasted Market Size by Distribution Channel

9.6.6.1 Supermarket or Hypermarket

9.6.6.2 Online Stores

9.6.6.3 Retail Stores

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Pharmaceuticals Industry

9.6.7.2 Cosmetic Industry

9.6.7.3 Food & Beverages

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Evening Primrose Oil Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Puritan's Pride Evening Primrose Oil

9.7.4.2 Nature's Bounty Evening Primrose Oil

9.7.4.3 GNC Women's Evening Primrose Oil

9.7.4.4 Blackmores Evening Primrose Oil

9.7.5 Historic and Forecasted Market Size by Form

9.7.5.1 Capsule

9.7.5.2 Liquid/Oil

9.7.6 Historic and Forecasted Market Size by Distribution Channel

9.7.6.1 Supermarket or Hypermarket

9.7.6.2 Online Stores

9.7.6.3 Retail Stores

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Pharmaceuticals Industry

9.7.7.2 Cosmetic Industry

9.7.7.3 Food & Beverages

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Evening Primrose Oil Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2025: |

USD 232.41 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.3% |

Market Size in 2035: |

USD 410.17 Mn. |

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||