Enterprise Intranet Solution Market Synopsis

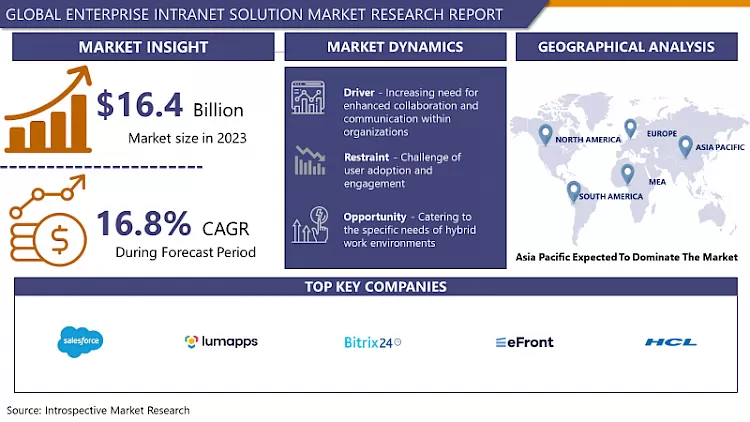

Enterprise Intranet Solution Market Size Was Valued at USD 16.4 Billion in 2024, and is Projected to Reach USD 66.3 Billion by 2032, Growing at a CAGR of 16.8% From 2024-2032.

A corporate internet in the aspect of a centralized digital platform created to achieve communication, collaboration, and information sharing across the organization is the Enterprise Intranet Solution. It may encompass components such as the document management, internal email messaging, employee directories, assignment assigner and functional intranet webpages for the specific departments/teams. A high-level objective is to increase productivity, unify workflow processes and build a feeling of community and collusion in the enterprise by offering a safe and comfortable open channel for the resources usage and knowledge sharing as well as initiating and coordinating the projects within the private network of the company.

The intranet solutions market for enterprise has experienced considerable upward move, due to the high demand in the world for as dynamic as possible and digitizable workplace strategy adoption by the organizations. These solutions create a commonplace where the internal communication and collaboration can take place, thus producing the competitive output.

The market players continue to focus on developing new tools to satisfy the demands of modern business by streamlining mobile access, integration of external tools and security enhancements. Enterprises intranet solution market is expected to keep rising in the face of the increasing demands for remote work solutions and the growing engagement focus on the employees that can be seen in the foreseeable future.

Similarly, the market experiences various problems including interoperability, data safety uncertainties, and effective adoption strategies through implementation. Yet, the multiplicity in the number of solution providers in the market with varying solutions often compels organizations to make the best decision by comparing their needs and objectives with the solution that matches both. While it is true that there are enormous challenges that make this market a competitive place, at the same time, it is very easy for vendors to gain a foothold in it by the growing demand for it as a digital workplace solution and thus ensuring they own a piece of this rapidly changing field.

???????

???????

Enterprise Intranet Solution Market Trend Analysis

Increasing emphasis on AI-driven personalization

- Businesses use algorithms of the artificial intelligence to build up intranets in depth that will be most appealing and useful to individual users. It offers recommendations, interesting things, and features, based on their roles, likes, and way of working. This trend is not only empowering the employees by nurturing their interest and productivity but also creates an atmosphere where the employees get more information that they can understand, and this is due to the dynamic of the present-day workforce.

- Furthermore, AI based personalization is only one trend in Enterprise Intranet Solution Market, as the integration of advanced analytics and business insights is perhaps the most valuable feature of it. Organizations are making use of clever advanced analyses device to gain insight on how employees are working on the intranet platform. Through the comprehension of users' behaviour, content consumption patterns and engagement metrics it will be possible to establish trends, find out what needs to be improved, and follow data-based decisions to develop a more successful intranet experience for the users. This tendency reveals a growing tendency to make use of data as a strategic asset for improving the effectiveness of intranet assets for an intranet that adjusts to the condition of today business.

Catering to the specific needs of hybrid work environments

- As remote and hybrid work situations become more commonplace, businesses are looking for intranet solutions that work smoothly and are compatible with their current workflows regardless of the location in which the employees find themselves, whether in the office, home, or some other place.

- Being capable to deal with issues like a powerful mobile accessibility, correspond through various collaboration tools, and advanced security measures especially for remote access, the vendors can have some advantage in this changing space.

- Moreover, increasing the solution variance that shapes organizations' intranet platforms to fit the new hybrid work regime residually segments a company from the competition.

Enterprise Intranet Solution Market Segment Analysis:

Enterprise Intranet Solution Market is segmented on the basis of Deployment type, Functionality, and Organization Size.

By Deployment Type, Cloud-Based segment is expected to dominate the market during the forecast period

- The period of dominance by the segment of the intranet solution for the enterprise market under the forecast period may present a great opportunity for service providers and organizations as well. Cloud-based intranet solutions include buying traffic, such as scalability, flexibility, and cost efficiency while traditional on-premise deployments do not have such characteristics. The emergence of remote and hybrid work roles has made it essential for organizations to use cloud-based intranet solutions for elasticity and access by distributed teams, requiring corporate data and resources to be accessed anytime and anywhere as an option.

- Also, the cloud-deployment model perfectly fits with the flowing technological transformation and software-as-a-service orientation that are gaining popularity in the industry. The implementation of cloud-based infrastructures enables organizations to benefit from quick launches, automatic updates and lowered infrastructure and maintenance costs, reducing the need for dedicated staff to run and maintain the system. Along with the elegance of cloud exclusivity, intranet-solutions often provide security features and compliance certifications by default, thus giving peace of mind to the personnel of the organization concerning data protection and similar regulations.

By Functionality, Communication and Collaboration segment held the largest share in 2023

- Party of global intranet solution market for corporate business reveals important part of existing(now) communication and interaction in company activity. This outcome’s significance also images the increasing understanding among businesses to offer openness and to facilitate collective exchanges as well as knowledge sharing both among staff as well as cross departmentally. Communication and Collaboration functionalities contain a broad array of features such as chatting, video conferencing, document sharing, work groups and social networks that aim at specifying the communication, innovations and productivity at work.

- The Communication and Collaboration segment's hefty market share emphasizes the changing nature of occupational activities with roaming and remote work gaining grounds, which are facilitated by digital devices, which enable messaging and collaboration from remote areas. As companies shift their thinking towards flexibility, Agility, and Employee engagement, Interactive intranet solutions that support robust communication and are collaboration will probably be perfectly in line with these evolving requirements.

Enterprise Intranet Solution Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Now of all, the Asia Pacific region is one of the economies which are the fastest developing economies of the world made up of countries like China, India and the Southeast Asia. Since more and more businesses from these countries start growing and becoming modernized, it is no expectation that they will require the services of advanced technology like enterprise intranet solutions grow and flourish.

- Stakeholders both in government and private businesses in the Asia Pacific region have doubled down their efforts in digital transformation initiatives with the objective to improve productivity, quality and competitiveness. Enterprise intranet solutions become the core medium that makes the effort of centralized communication, collaboration, and knowledge sharing across the organization possible by a huge lever, which is the employee location or operating device.

- The quickly growing Small and Medium Enterprise (SME) in Asia Pacific region is very diverse and complex. Most of this SMEs’ boards are noticing the fact that intranet solutions are being the thing that really helps to enhance internal communication, increase productivity of employees and make the company united. Consequently, there is an increasing interest in the SMEs of the region for such interactive intranet solution, in the same way as it is affordable.

Active Key Players in the Enterprise Intranet Solution Market

- Atlassian Jira Work Management (Australia)

- Bitrix24 (United States)

- eFront (United States)

- Google Workspace (United States)

- HCL OneHub (India)

- Jive (United States)

- LumApps (France)

- Microsoft SharePoint (United States)

- Salesforce (India)

- Zoho Cliq (India), and Other active Players

|

Global Enterprise Intranet Solution Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 19.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8 % |

Market Size in 2032: |

USD 66.36 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Functionality |

|

||

|

By Organisation Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Enterprise Intranet Solution Market by Deployment Type (2018-2032)

4.1 Enterprise Intranet Solution Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud-Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-Premises

Chapter 5: Enterprise Intranet Solution Market by Functionality (2018-2032)

5.1 Enterprise Intranet Solution Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Communication and Collaboration

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Content Management

5.5 Employee Engagement

5.6 Integration and Customization

Chapter 6: Enterprise Intranet Solution Market by Organisation Size (2018-2032)

6.1 Enterprise Intranet Solution Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium-sized Enterprises (SMEs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Enterprise Intranet Solution Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EXECUTIVE SUITES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WEWORK (UNITED STATES)

7.4 ALLIANCE VIRTUAL OFFICES (UNITED STATES)

7.5 BUSINESSLINK (UNITED STATES)

7.6 SERVICED OFFICES (UNITED STATES)

7.7 NOMAD COWORK (UNITED STATES)

7.8 ALPHA OFFICES (UNITED STATES)

7.9 BREATHER (UNITED STATES)

7.10 REGUS (LUXEMBOURG)

7.11 OFFICE SPACE INTERNATIONAL (UNITED KINGDOM)

7.12 SPACES (NETHERLANDS)

7.13 IWG PLC (UNITED KINGDOM)

7.14 THE REGUS GROUP (LUXEMBOURG)

7.15 UNCOMMON CAPITAL (UNITED KINGDOM)

7.16 OFFICE HUB (AUSTRALIA)

7.17 INSTANT OFFICES (UNITED KINGDOM)

7.18 SERVCORP(AUSTRALIA)

7.19 COMPASS OFFICES (HONG KONG)

7.20 THE EXECUTIVE CENTRE (HONG KONG)

7.21 VSERV VIRTUAL OFFICES (INDIA)

7.22 COWORKING INDIA (INDIA)

7.23 WORKLANE (BELGIUM)

7.24 MINDSPACE (ISRAEL)

7.25 LANDMARK GROUP (UNITED ARAB EMIRATES)

7.26 THE HIVE (HONG KONG)

Chapter 8: Global Enterprise Intranet Solution Market By Region

8.1 Overview

8.2. North America Enterprise Intranet Solution Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment Type

8.2.4.1 Cloud-Based

8.2.4.2 On-Premises

8.2.5 Historic and Forecasted Market Size by Functionality

8.2.5.1 Communication and Collaboration

8.2.5.2 Content Management

8.2.5.3 Employee Engagement

8.2.5.4 Integration and Customization

8.2.6 Historic and Forecasted Market Size by Organisation Size

8.2.6.1 Small and Medium-sized Enterprises (SMEs)

8.2.6.2 Large Enterprises

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Enterprise Intranet Solution Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment Type

8.3.4.1 Cloud-Based

8.3.4.2 On-Premises

8.3.5 Historic and Forecasted Market Size by Functionality

8.3.5.1 Communication and Collaboration

8.3.5.2 Content Management

8.3.5.3 Employee Engagement

8.3.5.4 Integration and Customization

8.3.6 Historic and Forecasted Market Size by Organisation Size

8.3.6.1 Small and Medium-sized Enterprises (SMEs)

8.3.6.2 Large Enterprises

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Enterprise Intranet Solution Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment Type

8.4.4.1 Cloud-Based

8.4.4.2 On-Premises

8.4.5 Historic and Forecasted Market Size by Functionality

8.4.5.1 Communication and Collaboration

8.4.5.2 Content Management

8.4.5.3 Employee Engagement

8.4.5.4 Integration and Customization

8.4.6 Historic and Forecasted Market Size by Organisation Size

8.4.6.1 Small and Medium-sized Enterprises (SMEs)

8.4.6.2 Large Enterprises

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Enterprise Intranet Solution Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment Type

8.5.4.1 Cloud-Based

8.5.4.2 On-Premises

8.5.5 Historic and Forecasted Market Size by Functionality

8.5.5.1 Communication and Collaboration

8.5.5.2 Content Management

8.5.5.3 Employee Engagement

8.5.5.4 Integration and Customization

8.5.6 Historic and Forecasted Market Size by Organisation Size

8.5.6.1 Small and Medium-sized Enterprises (SMEs)

8.5.6.2 Large Enterprises

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Enterprise Intranet Solution Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment Type

8.6.4.1 Cloud-Based

8.6.4.2 On-Premises

8.6.5 Historic and Forecasted Market Size by Functionality

8.6.5.1 Communication and Collaboration

8.6.5.2 Content Management

8.6.5.3 Employee Engagement

8.6.5.4 Integration and Customization

8.6.6 Historic and Forecasted Market Size by Organisation Size

8.6.6.1 Small and Medium-sized Enterprises (SMEs)

8.6.6.2 Large Enterprises

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Enterprise Intranet Solution Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment Type

8.7.4.1 Cloud-Based

8.7.4.2 On-Premises

8.7.5 Historic and Forecasted Market Size by Functionality

8.7.5.1 Communication and Collaboration

8.7.5.2 Content Management

8.7.5.3 Employee Engagement

8.7.5.4 Integration and Customization

8.7.6 Historic and Forecasted Market Size by Organisation Size

8.7.6.1 Small and Medium-sized Enterprises (SMEs)

8.7.6.2 Large Enterprises

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Enterprise Intranet Solution Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 19.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8 % |

Market Size in 2032: |

USD 66.36 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Functionality |

|

||

|

By Organisation Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||