Key Market Highlights

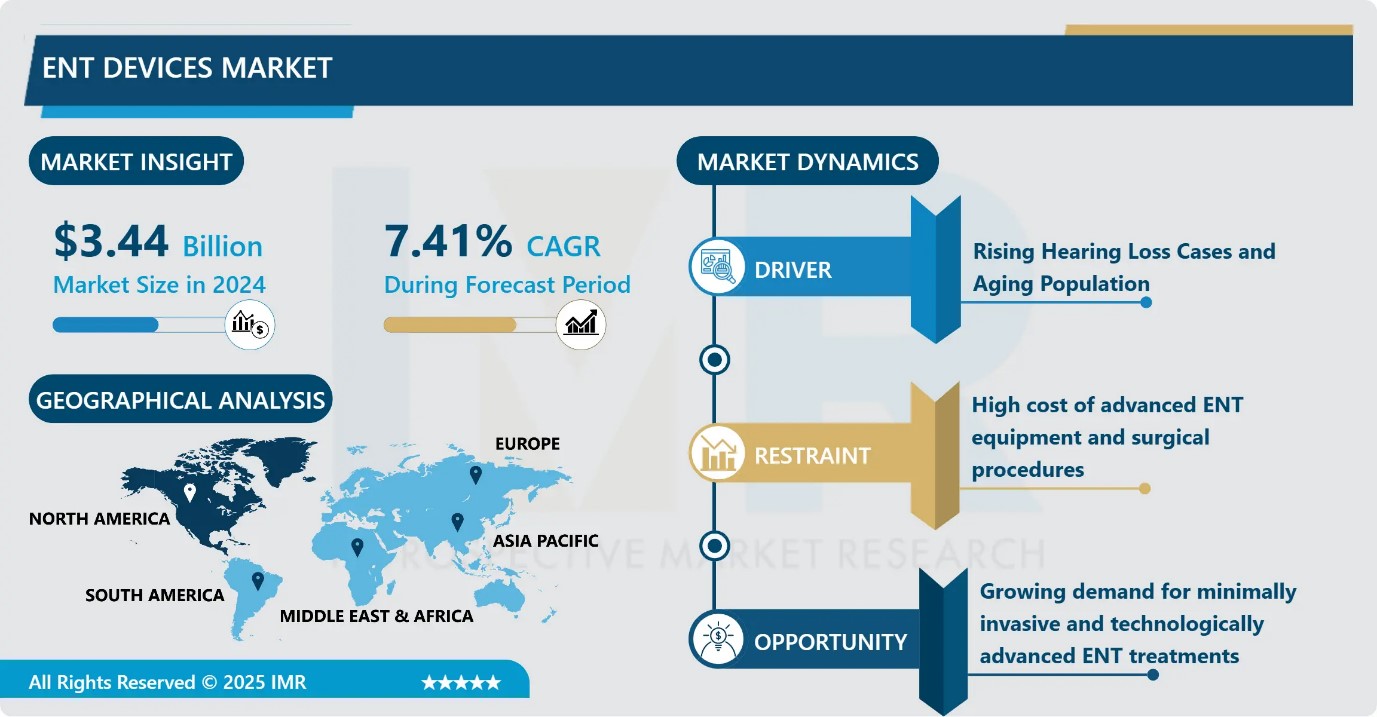

ENT Devices Market Size Was Valued at USD 3.44 Billion in 2024, and is Projected to Reach USD 7.02 Billion by 2035, Growing at a CAGR of 7.41% from 2025-2035.

- Market Size in 2024: USD 3.44 Billion

- Projected Market Size by 2035: USD 7.02 Billion

- CAGR (2025–2035): 7.4%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Product: The Hearing Aids segment is anticipated to lead the market by accounting for 27.54% of the market share throughout the forecast period.

- By Application: The Hearing Disorders segment is expected to capture 24.71% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 34.61% of the market share during the forecast period.

- Active Players: Alma Lasers (Israel), American Hearing Systems Inc. (US), Atos Medical AB (Sweden), Audina Hearing Instruments (US), Cochlear Limited (Australia), GN Store Nord (Denmark), Horentek Systems (Italy), Hoya Corporation (Japan), Intersect ENT, Inc. (US), Karl Storz GmbH & co. KG (Germany), Lumenis (Israel), MED-EL GmbH (Austria), Meril Life Sciences Pvt Ltd (India), Narang Medical Limited (India), Richard Wolf GmbH (Germany), SinuSys Corporation (US), Smith & Nephew plc (UK), Starkey Hearing Technology (US), Stryker Corporation (US), William Demant holding a/s (Denmark), and Other Active Players.

ENT Devices Market Synopsis:

The ENT devices market encompasses specialized medical equipment and instruments used for the diagnosis, treatment, and management of Ear, Nose, and Throat conditions, including endoscopes, hearing aids, surgical tools, and implants, driven by rising ENT disorders, aging populations, and innovations in AI and minimally invasive techniques

ENT Devices Market Dynamics and Trend Analysis:

ENT Devices Market Growth Driver- Rising Hearing Loss Cases and Aging Population

- The ENT devices market is mainly driven by the rising number of patients suffering from hearing loss, sinus problems, sleep apnea, and throat disorders. An increase in the elderly population, who are more likely to face ENT-related conditions, is boosting demand for advanced treatment devices.

- Growing awareness about early diagnosis and the availability of modern, minimally invasive ENT procedures are also supporting market expansion. In addition, continuous technological improvements such as digital hearing aids, image-guided surgery, and smart implants are encouraging faster adoption. Higher healthcare spending and better access to specialized ENT care further strengthen market growth.

ENT Devices Market Limiting Factor- High cost of advanced ENT equipment and surgical procedures

- A key limiting factor in the ENT devices market is the high cost of advanced ENT equipment and surgical procedures, which makes them difficult to afford for many patients, especially in low- and middle-income regions. Modern technologies like image-guided systems, hearing implants, and robotic ENT surgery require significant investment from hospitals, increasing treatment costs.

- Limited reimbursement coverage for hearing aids and specialty ENT procedures also creates financial barriers. In addition, a shortage of trained ENT specialists and slow adoption in smaller healthcare facilities further restricts market expansion, reducing accessibility and delaying wider use of advanced ENT solutions.

ENT Devices Market Expansion Opportunity- Growing demand for minimally invasive and technologically advanced ENT treatments

- The ENT devices market offers strong expansion opportunities through the growing demand for minimally invasive and technologically advanced ENT treatments, especially in emerging economies. Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in healthcare infrastructure, creating new openings for device manufacturers.

- Increasing awareness programs for hearing loss, government screening initiatives, and rising acceptance of digital hearing aids and cochlear implants support future growth. The integration of AI, tele-audiology, and wireless connectivity in ENT care offers additional opportunities to improve patient outcomes and reach remote populations, enabling companies to expand market presence and drive higher adoption.

ENT Devices Market Challenge and Risk- Strict Regulatory Approval Process.

- A major challenge for the ENT devices market is the strict regulatory approval process, which increases development time and cost for new devices. Manufacturers must meet complex safety and performance standards, creating delays in product launches. Another risk is the shortage of skilled ENT surgeons and audiology professionals, which limits the effective use of advanced technologies.

- Additionally, the high cost of ENT surgeries and premium devices such as cochlear implants can reduce patient acceptance, especially where reimbursement is limited. Competition from low-cost alternatives and concerns about device failures or post-surgical complications also pose risks to market stability.

ENT Devices Market Trend- Integrating artificial intelligence (AI), advanced imaging, and minimally invasive surgical tools

- The ENT devices market is being reshaped by rapid technological innovation. Increasingly, devices used for diagnosis, treatment, and hearing support are integrating artificial intelligence (AI), advanced imaging, and minimally invasive surgical tools improving accuracy and patient comfort

- There is a rising shift toward digital and remote-enabled solutions such as smart or wireless hearing aids and tele-audiology, which expand access to care, especially for patients outside major hospitals.

ENT Devices Market Segment Analysis:

ENT Devices Market is segmented based on Type, Application, End-Users, and Region

By Type, Hearing Aids segment is expected to dominate the market with around 27.54% share during the forecast period.

- Within the ENT devices market, hearing aids currently account for the largest share among all product categories. This leadership is mainly due to the growing number of people experiencing hearing loss, especially older adults. Hearing aids are widely preferred because they provide an easy, non-surgical, and affordable solution to support daily communication and improve quality of life.

- Continuous advancements, such as Bluetooth connectivity, rechargeable batteries, and noise-reduction technology, have increased user acceptance and market demand. In addition, greater awareness, rising screening programs, and better access to hearing-care services further strengthen the dominance of the hearing aids segment.

By Application, hearing disorders / hearing-loss is expected to dominate with close to 24.71% market share during the forecast period.

- Among application types in the global ENT-devices market, the hearing disorders / hearing-loss segment holds the largest share. This is because hearing impairment is highly prevalent worldwide, particularly among older adults and people exposed to noise pollution or ear infections.

- Demand for solutions such as hearing aids and cochlear implants remains strong because they significantly improve quality of life, enabling clearer communication and social engagement. Further, increasing awareness about hearing loss, routine screenings, and advances in hearing-device technology (such as digital aids and implants) boost adoption, sustaining the dominance of this application segment globally.

ENT Devices Market Regional Insights:

North America region is estimated to lead the market with around 34.61% share during the forecast period.

- North America is the leading market for ENT devices mainly because it has a strong and advanced healthcare system. Hospitals and clinics in the US and Canada use modern technology and adopt new medical devices faster than other regions. The region also has a large elderly population that commonly faces hearing loss, sinus problems, and throat disorders, which increases demand for ENT treatments.

- High healthcare spending, strong insurance and reimbursement policies, and active research and development also support growth. In addition, many global ENT device manufacturers are based in North America, making access and innovation stronger in this region.

ENT Devices Market Active Players:

- Alma Lasers (Israel)

- American Hearing Systems Inc. (US)

- Atos Medical AB (Sweden)

- Audina Hearing Instruments (US)

- Cochlear Limited (Australia)

- GN Store Nord (Denmark)

- Horentek Systems (Italy)

- Hoya Corporation (Japan)

- Intersect ENT, Inc. (US)

- Karl Storz GmbH & co. KG (Germany)

- Lumenis (Israel)

- MED-EL GmbH (Austria)

- Meril Life Sciences Pvt Ltd (India)

- Narang Medical Limited (India)

- Richard Wolf GmbH (Germany)

- SinuSys Corporation (US)

- Smith & Nephew plc (UK)

- Starkey Hearing Technology (US)

- Stryker Corporation (US)

- William Demant holding a/s (Denmark)

- Other Active Players

Key Industry Developments in the ENT Devices Market:

- In October 2025, Sonova Holding AG: Sonova announced the launch of the Infinio Ultra Sphere™ hearing aid, which features enhanced AI and a patented wax-management system, strengthening its leadership in hearing care

- In July 2025, Cigna Healthcare reclassified Stryker's ClariFix cryotherapy device for chronic rhinitis, removing it from the experimental list and improving patient access

Technical Overview of ENT Devices Market

- ENT (Ear, Nose, and Throat) devices are medical instruments used to diagnose, monitor, and treat disorders related to the auditory, nasal, and throat regions. Diagnostic devices, such as otoscopes, endoscopes, and audiometers, help physicians visualize internal structures, assess hearing levels, and detect abnormalities like sinus blockages, vocal cord issues, or ear infections.

- Surgical ENT devices, including powered instruments, laser systems, and balloon sinuplasty tools, enable minimally invasive interventions that reduce patient recovery time, enhance precision, and lower complication risks. Hearing aids and cochlear implants restore auditory function for patients with partial or complete hearing loss, improving communication and overall quality of life.

- The importance of ENT devices lies in their role in early detection, accurate diagnosis, and effective treatment of disorders that can impact speech, hearing, sleep, and daily functioning. Timely interventions using these devices prevent complications such as chronic sinusitis, hearing deterioration, and obstructive sleep apnea.

- Recent innovations are reshaping the market. Digital and wireless hearing aids now offer AI-based sound processing, noise reduction, and smartphone connectivity. Image-guided surgery systems provide 3D visualization for complex procedures, enhancing safety. Robotic-assisted ENT surgery allows ultra-precise operations in delicate areas.

- Additionally, tele-audiology platforms enable remote hearing assessments, expanding access in underserved regions. Continuous R&D in biocompatible implants, miniaturized sensors, and AI-driven diagnostic tools is further improving device accuracy, efficiency, and patient experience, making ENT care more advanced and widely accessible globally.

|

ENT Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.44 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.41% |

Market Size in 2035: |

USD 7.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Audina Hearing Instruments (US), Cochlear Limited (Australia), GN Store Nord (Denmark), Horentek Systems (Italy), Hoya Corporation (Japan), Intersect ENT Inc. (US), Other Active Players |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Ent Devices Market by Product (2018-2035)

4.1 Ent Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Diagnostic ENT Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Surgical ENT Devices

4.5 Hearing Aids

4.6 Hearing Implants

4.7 Others

Chapter 5: Ent Devices Market by Application (2018-2035)

5.1 Ent Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hearing Disorders

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sinus Disorders

5.5 Sleep Apnea

5.6 Throat Cancer

5.7 Nasal Polyps

5.8 Voice & Speech Disorders

Chapter 6: Ent Devices Market by Technology (2018-2035)

6.1 Ent Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Conventional Surgical Technology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Minimally Invasive / Image-Guided Surgery (IGS)

6.5 Robot-Assisted ENT Surgery

6.6 Digital & Wireless Connectivity

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ent Devices Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ALMA LASERS (ISRAEL)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 AMERICAN HEARING SYSTEMS INC (US)

7.4 ATOS MEDICAL AB (SWEDEN)

7.5 AUDINA HEARING INSTRUMENTS (US)

7.6 COCHLEAR LIMITED (AUSTRALIA)

7.7 GN STORE NORD (DENMARK)

7.8 HORENTEK SYSTEMS (ITALY)

7.9 HOYA CORPORATION (JAPAN)

7.10 INTERSECT ENT (US)

7.11 KARL STORZ GMBH (GERMANY)

7.12 LUMENIS (ISRAEL)

7.13 MED-EL GMBH (AUSTRIA)

7.14 MERIL LIFE SCIENCES PVT LTD (INDIA)

7.15 NARANG MEDICAL LIMITED (INDIA)

7.16 RICHARD WOLF GMBH (GERMANY)

7.17 SINUSYS CORPORATION (US)

7.18 SMITH & NEPHEW PLC (UK)

7.19 STARKEY HEARING TECHNOLOGY (US)

7.20 STRYKER CORPORATION (US)

7.21 WILLIAM DEMANT HOLDING (DENMARK)

7.22 AND OTHER ACTIVE PLAYERS

Chapter 8: Global Ent Devices Market By Region

8.1 Overview

8.2. North America Ent Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Ent Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Ent Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Ent Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Ent Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Ent Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

ENT Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.44 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.41% |

Market Size in 2035: |

USD 7.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Audina Hearing Instruments (US), Cochlear Limited (Australia), GN Store Nord (Denmark), Horentek Systems (Italy), Hoya Corporation (Japan), Intersect ENT Inc. (US), Other Active Players |

||