Electric Vehicle Insurance Market Synopsis

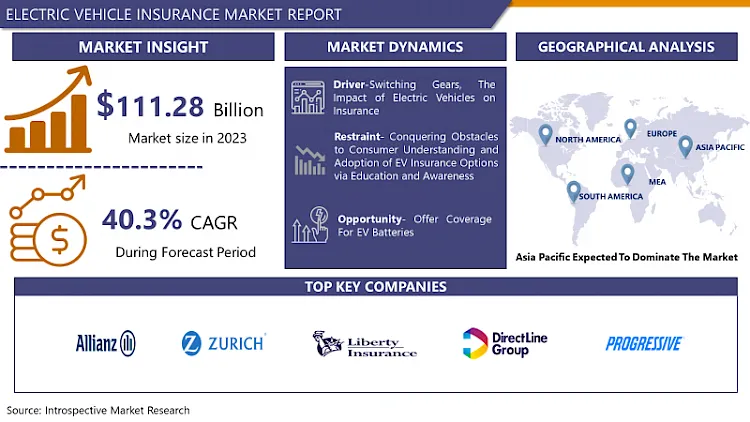

Electric Vehicle Insurance Market Size Was Valued at USD 156.13 Billion in 2024 and is Projected to Reach USD 2343.95 Billion by 2032, Growing at a CAGR of 40.3% From 2025-2032.

The EV insurance niche caters to the unique needs of EV owners. It covers the expensive-to-repair or replace components like high voltage systems and batteries. Some policies also cover charging devices and address issues like range anxiety. Insurers may offer discounts or usage-based insurance to owners of electric vehicles. With the increased demand for EVs comes more opportunities to get insurance for these vehicles.

The EV insurance market is a developing sector that is experiencing significant transformation due to the growing adoption of EVs worldwide. The growing popularity of electric cars among consumers has created a specific interest in insurance products that meet the unique needs of EV owners. One of the key drivers that contribute to the development of this industry is the offering of additional insurance that relates to electric vehicles. EVs as compared to conventional vehicles have got battery and high voltage related systems which require dedicated insurance coverage.

Another factor is the need for coverage of certain EV-specific components, including batteries. The costs of repairing or replacing batteries in electric cars can be extremely high, which makes dedicated battery cover a non-negotiable element of EV insurance policies. Moreover, insurance firms are offering roadside assistance or payout in case an EV gets stranded due to low battery charge to help mitigate range anxiety – a common concern among EV owners.

The former also covers theft or damage of EV charging equipment used to charge EVs, including public charging stations or home charging stations. Some insurers offer discounts or bonuses to owners of EVs as a way of promoting energy sustainable forms of mobility. Meanwhile, UBI is more and more popular for EVs. UBI helps to minimise the risk of accidents by the way premiums are calculated as they are based on how the car is used and thus may lead to reduced costs for the owner.

We expect the market for electric vehicle insurance will grow in parallel with the electric vehicle market. This will increase the choice and competitiveness of prices for owners of electric vehicles, and thus emphasize the importance of searching for the most suitable insurance policy for their needs.

Electric Vehicle Insurance Market Trend Analysis

Empowering Electric, The Changing Face of EV Insurance.

- The insurance industry for electric vehicles (EVs) around the world is experiencing a fundamental change because of the increased interest in EVs. Due to the rapid development of the EV industry and the increased awareness of climate change issues, the insurance companies are responding to the needs of EV drivers.

- A significant trend in the electric vehicle (EV) insurance industry is the proliferation of EV-specific insurance policies that are designed to meet the unique needs of EVs. These policies often include sections relating to high-voltage systems, batteries, and other specialized repairs, reflecting the added risks of owning an EV.

- Additionally, the insurance companies are offering innovative solutions to overcome challenges that are specific to EVs, such as the reliability of charging stations and driving range. Reassuring EV owners, some insurers provide insurance or support in the case of an EV running out of power – up to arranging a vehicle’s transfer to the nearest charging point.

- Another development is the introduction of UBI for electric vehicles. The use of UBI programs where premiums are dynamically set based on actual vehicle utilization not only fosters safer driving behaviour but also provides EV owners with the potential for cost savings.

- Similarly, the insurance industry is also recognizing environmentally responsible choices and rewarding them, such as giving owners of electric vehicles a discount on their premiums, which encourages the use of sustainable transport in society.

Charging Up the Insurance Market: Niche Markets: Electric Vehicle Coverage.

- The EV insurance market has the potential to provide several opportunities due to the significant changes taking place in the automotive industry with regard to the growing adoption of electric vehicles. The niche opportunity arises from the specific nature of EV insurance underwriting, which allows offering highly differentiated products tailored to the unique needs of EV drivers. This means protecting pricy-to-fix or replace EV-specific parts such as high-voltage systems and batteries.

- Another opportunity arises from the growing customer preference for environmentally conscious travel methods. Insurers can also benefit from this trend by offering discounts or incentives to EV owners to support the expansion of EV use and ensure their coverage is consistent with sustainability goals.

- Additionally, the EV market boom also means that there is an increased demand for charging stations. Through identifying and exploring possible routes of providing coverage for EV charging points – both public and residential – insurers can expand the scope of their product portfolio within the EV sector.

- Additionally, as EVs become more mainstream, insurers may have the opportunity to develop new products, particularly UBI, that meet the specific needs of these vehicles. Offering the potential to lower insurance rates and encourage safer driving behaviors among electric vehicle drivers, UBI is a win-win solution for both insurers and consumers.

Electric Vehicle Insurance Market Segment Analysis:

Electric Vehicle Insurance Market is Segmented on the basis of Propulsion type, Vehicle type, Coverage Type, and Region.

By Propulsion Type, Electric Vehicle Insurance Market segment is expected to dominate the market during the forecast period

- BEVs are vehicles that solely use rechargeable batteries as power sources. They do not have ICE and do not produce any emissions. BEVs are preferred by environmentally conscious consumers because of energy efficacy and perception as an environmentally friendly vehicle. They have lower operating costs in comparison with the conventional vehicles and also have a simpler maintenance process because of the reduced number of moving elements. However, their key drawbacks include shorter refueling durations and reduced travel distances compared to traditional cars.

- Hybrids are motor vehicles that employ an ICE, a battery, and an electric motor. They are able to run on either electricity or petroleum or a mixture of the two. The objective of hybrid vehicles is to decrease the level of emissions and enhance fuel economy in comparison to conventional vehicles. Besides giving the comfort of gasoline-powered vehicles they also have more fuel economy and less emissions. On the other hand, hybrids are usually more costly and are often more difficult to obtain than BEVs.

By Vehicle Type, Electric Vehicle Insurance Market segment held the largest share in 2024

- By vehicle type, the electric vehicle (EV) market is divided into two segments: sedans and trucks. Passenger cars include sedans, hatchbacks, SUVs and other vehicles that are primarily designed for personal use.

- The number of electric passenger cars on the road has been rising due to their technological developments, fuel efficiency, and environmental sustainability. On the other hand commercial involves trucks vans buses and other means of transport used to transport goods or passengers. There is a growing interest in the use of electric commercial vehicles (ECVs) due to their lower emissions and potential for long-term cost savings.

- The segment of EV businesses and consumers seeking more sustainable means of mobility offers significant opportunities for growth and innovation in the EV market.

Electric Vehicle Insurance Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The EV insurance market in the Asia-Pacific region is growing considerably, indicating the increasing popularity of electric vehicles in the region. This growth is attributable to various factors such as policies by different governments to encourage the use of electric vehicles, increasing environmental concerns, and improvement of technology in the EV industry.

- Due to the high penetration of EVs in countries such as China, Japan, and South Korea, there is a growing need for insurance products that meet the needs of EV owners. In these markets, dedicated providing insurers cover EV-specific components, including batteries and chargers.

- There is a recent trend in the Asia Pacific region concerning the development of unique insurance models for EVs. Some insurers offer usage-based insurance (UBI) for EVs to encourage safer driving behavior by linking EV insurance rates directly to vehicle usage.

- Furthermore, due to the increased development of electric car networks in the region, in particular, the charging stations, some insurers offer EV owners coverage of damage to or theft of charging equipment.

Active Key Players in the Electric Vehicle Insurance Market.

- Allianz (Germany)

- AXA (France)

- Zurich Insurance Group (Switzerland)

- Liberty Mutual Insurance Company (U.S.)

- Aviva (U.K.)

- Direct Line Insurance Group plc (U.K.)

- The Progressive Corporation (U.S.)

- GEICO (U.S.)

- Allstate Insurance Company (U.S.)

- State Farm Mutual Automobile Insurance Company (U.S.)

- Other Active Players

Key Industry Developments in the Electric Vehicle Insurance Market:

- In February 2024, Allianz General Insurance Company (Malaysia) Berhad (Allianz General) launched a new insurance coverage The Allianz EV Shield for electric cars under the Private Car Comprehensive policy featuring an industry first coverage of on-the-go charging, allaying concerns among car owners for stalled EVs out of charge. The event was held in Sentul Depot, Kuala Lumpur on Wednesday.

- In Jul 2024, Aviva Launches the renewable energy sector continues to see rapid growth in the UK and globally, they focused on developing innovative insurance solutions that support this industry acceleration. They see a growing number of private companies installing public Electric Vehicle charging points, in areas such as car parks and motorway service stations across the UK and around the world. As a leading insurer in Renewable Energy, they committed to the continuous development and streamlining of solutions that cater for these technologies.

|

Global Electric Vehicle Insurance Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 156.13 Bn. |

|

Forecast Period 2025-32 CAGR: |

40.3% |

Market Size in 2032: |

USD 2343.95 Bn. |

|

Segments Covered: |

By Propulsion Type |

|

|

|

By Vehicle Type |

|

||

|

By Coverage Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Insurance Market by Propulsion Type (2018-2032)

4.1 Electric Vehicle Insurance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Battery Electric Vehicles (BEV)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid

Chapter 5: Electric Vehicle Insurance Market by Vehicle Type (2018-2032)

5.1 Electric Vehicle Insurance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles

Chapter 6: Electric Vehicle Insurance Market by Coverage Type (2018-2032)

6.1 Electric Vehicle Insurance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Accidental Damage

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Theft or Malicious Damage

6.5 Car Battery & Auto Parts Replacement

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electric Vehicle Insurance Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CONTINENTAL AG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS AG

7.4 AMERICAN MOTORS CORPORATION

7.5 TEXAS INSTRUMENTS

7.6 ROBERT BOSCH GMBH

7.7 TOYOTA INDUSTRIES CORPORATION

7.8 DELPHI TECHNOLOGIES PLC

7.9 DENSO CORPORATION

7.10 EVS AUTO GROUP

7.11 FUJI ELECTRIC CO. LTDHITACHI AUTOMOTIVE SYSTEMS

7.12 OTHER KEY PLAYERS

Chapter 8: Global Electric Vehicle Insurance Market By Region

8.1 Overview

8.2. North America Electric Vehicle Insurance Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Propulsion Type

8.2.4.1 Battery Electric Vehicles (BEV)

8.2.4.2 Hybrid

8.2.5 Historic and Forecasted Market Size by Vehicle Type

8.2.5.1 Passenger Cars

8.2.5.2 Commercial Vehicles

8.2.6 Historic and Forecasted Market Size by Coverage Type

8.2.6.1 Accidental Damage

8.2.6.2 Theft or Malicious Damage

8.2.6.3 Car Battery & Auto Parts Replacement

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electric Vehicle Insurance Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Propulsion Type

8.3.4.1 Battery Electric Vehicles (BEV)

8.3.4.2 Hybrid

8.3.5 Historic and Forecasted Market Size by Vehicle Type

8.3.5.1 Passenger Cars

8.3.5.2 Commercial Vehicles

8.3.6 Historic and Forecasted Market Size by Coverage Type

8.3.6.1 Accidental Damage

8.3.6.2 Theft or Malicious Damage

8.3.6.3 Car Battery & Auto Parts Replacement

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electric Vehicle Insurance Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Propulsion Type

8.4.4.1 Battery Electric Vehicles (BEV)

8.4.4.2 Hybrid

8.4.5 Historic and Forecasted Market Size by Vehicle Type

8.4.5.1 Passenger Cars

8.4.5.2 Commercial Vehicles

8.4.6 Historic and Forecasted Market Size by Coverage Type

8.4.6.1 Accidental Damage

8.4.6.2 Theft or Malicious Damage

8.4.6.3 Car Battery & Auto Parts Replacement

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electric Vehicle Insurance Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Propulsion Type

8.5.4.1 Battery Electric Vehicles (BEV)

8.5.4.2 Hybrid

8.5.5 Historic and Forecasted Market Size by Vehicle Type

8.5.5.1 Passenger Cars

8.5.5.2 Commercial Vehicles

8.5.6 Historic and Forecasted Market Size by Coverage Type

8.5.6.1 Accidental Damage

8.5.6.2 Theft or Malicious Damage

8.5.6.3 Car Battery & Auto Parts Replacement

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electric Vehicle Insurance Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Propulsion Type

8.6.4.1 Battery Electric Vehicles (BEV)

8.6.4.2 Hybrid

8.6.5 Historic and Forecasted Market Size by Vehicle Type

8.6.5.1 Passenger Cars

8.6.5.2 Commercial Vehicles

8.6.6 Historic and Forecasted Market Size by Coverage Type

8.6.6.1 Accidental Damage

8.6.6.2 Theft or Malicious Damage

8.6.6.3 Car Battery & Auto Parts Replacement

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electric Vehicle Insurance Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Propulsion Type

8.7.4.1 Battery Electric Vehicles (BEV)

8.7.4.2 Hybrid

8.7.5 Historic and Forecasted Market Size by Vehicle Type

8.7.5.1 Passenger Cars

8.7.5.2 Commercial Vehicles

8.7.6 Historic and Forecasted Market Size by Coverage Type

8.7.6.1 Accidental Damage

8.7.6.2 Theft or Malicious Damage

8.7.6.3 Car Battery & Auto Parts Replacement

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Electric Vehicle Insurance Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 156.13 Bn. |

|

Forecast Period 2025-32 CAGR: |

40.3% |

Market Size in 2032: |

USD 2343.95 Bn. |

|

Segments Covered: |

By Propulsion Type |

|

|

|

By Vehicle Type |

|

||

|

By Coverage Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||