Electric Curtains Market Synopsis

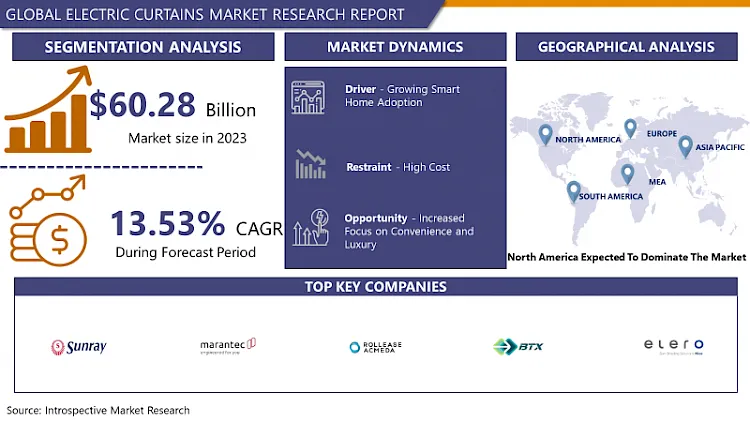

Electric Curtains Market Size Was Valued at USD 60.28 Billion in 2023, and is Projected to Reach USD 188.87 Billion by 2032, Growing at a CAGR of 13.53% From 2024-2032.

The electric curtains market is a dynamic segment within the broader home automation industry, addressing the evolving needs of consumers in managing window treatments. Characterized by motorized systems, electric curtains provide users with convenient and automated control over opening and closing functions.

This market caters to both residential and commercial spaces, offering a blend of technology and functionality to enhance the management of natural light and privacy. With a focus on modernizing living spaces, electric curtains contribute to the smart home ecosystem by integrating seamlessly with various automation platforms.

Consumers seek solutions that can be easily controlled through smartphones or voice commands, aligning with the broader trend of interconnected home devices. Additionally, a key trend is the emphasis on energy efficiency, with electric curtains allowing users to optimize natural light and temperature, reducing reliance on artificial lighting and heating or cooling systems.

Electric Curtains Market Trend Analysis

Growing Smart Home Adoption

- The growing adoption of smart homes is a key driver for the electric curtains market, fueled by an increasing desire among consumers for seamless integration with home automation systems. As more households embrace connected technologies, there is a heightened demand for window treatments that can be easily controlled and automated through smart devices. Electric curtains play a pivotal role in this trend by offering compatibility with popular home automation platforms, allowing users to manage their curtains remotely using smartphones, tablets, or voice-controlled virtual assistants.

- The surge in smart home adoption in the electric curtains market is closely tied to the desire for enhanced convenience and lifestyle benefits. With the ability to schedule certain movements, adjust light levels, and create personalized settings, electric curtains contribute to a more comfortable and efficient living space. Users appreciate the ability to effortlessly control their curtains, whether they are at home or away, adding a layer of convenience that aligns with the broader trend of connected living.

Increased Focus on Convenience and Luxury

- The electric curtains market experienced a significant boost due to an increased consumer focus on convenience. Modern lifestyles emphasize time-saving solutions, and electric curtains align perfectly with this trend by offering hassle-free and automated control. Users can effortlessly open or close curtains with a touch of a button on a remote control or through smart home applications. This level of convenience resonates with consumers seeking streamlined and efficient ways to manage their living spaces, creating a strong demand for motorized curtain solutions.

- Luxury has become a key driver in the electric curtains market, transforming window treatments into a sophisticated and high-end element of home decor. Motorized curtains add a touch of opulence to residential and commercial spaces, contributing to the overall ambiance. The luxury aspect is not only about the convenience of automation but also about the perceived value of cutting-edge technology seamlessly integrated into everyday living.

Electric Curtains Market Segment Analysis:

Electric Curtains Market Segmented based on Product Type, Rod Size, Fabric Type, and Technology.

By Fabric Type, Polyester segment is expected to dominate the market during the forecast period

- The dominance of the polyester segment in the electric curtains market can be attributed to its inherent qualities that align with consumer preferences. Polyester fabrics are known for their durability, making them well-suited for long-lasting and functional window treatments. The robust nature of polyester ensures that electric curtains crafted from this material withstand frequent opening and closing, contributing to a longer lifespan.

- Polyester fabric offers versatility in design and style, allowing manufacturers to create a wide range of electric curtain options to cater to diverse consumer tastes. Its adaptability in terms of colors, patterns, and textures enables the production of curtains that complement various interior aesthetics. Moreover, polyester is known for its ease of maintenance – it is resistant to wrinkles, fading, and shrinking. This low-maintenance characteristic appeals to consumers seeking a convenient and time-saving solution for their window treatments.

By Technology, Wall Switch segment held the largest share of 52.2% in 2022

- The dominance of the Wall Switch segment in the electric curtain market can be attributed to the familiarity and simplicity it offers to consumers. Wall switches have been a traditional and widely used method for controlling various household features, including lighting and fans. Leveraging this familiarity, electric curtains equipped with wall switches provide a seamless integration into existing home infrastructure. Consumers appreciate the convenience of controlling their curtains with a familiar wall-mounted switch, as it eliminates the need for additional devices or remotes. The ease of use and straightforward operation contribute to the sustained popularity of the Wall Switch technology, leading to its largest share in the market.

- Wall switches play a crucial role in integrating electric curtains into broader home automation systems. Many consumers prefer a unified control system that consolidates various smart devices, and wall switches serve as a central component in this setup. The compatibility of Wall Switch technology with existing home wiring allows for easier installation and often requires minimal modifications to the home environment.

Electric Curtains Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America in the electric curtains market can be attributed to the region's high disposable income and a well-established culture of home automation. With a significant portion of the population having robust purchasing power, consumers in North America are more inclined towards investing in smart home technologies. This includes the adoption of electric curtains, seen as a premium and convenient addition to modern homes. The cultural acceptance and enthusiasm for home automation in North America further drive the demand for electric curtains, making it the leading market in the region.

- In North America, the dominance of Wall Switches in control technology and the popularity of polyester and cotton fabrics reflect the region's emphasis on practicality and affordability. Wall switches offer a familiar and user-friendly control method, aligning with the preference for straightforward and easy-to-use technologies. Additionally, the choice of polyester and cotton fabrics resonates with consumers seeking cost-effective yet durable options.

Electric Curtains Market Top Key Players:

- Somfy Systems Inc. (United States)

- Lutron Electronics Co., Inc. (United States)

- Hunter Douglas N.V. (United States)

- Springs Window Fashions, LLC(United States)

- Graber (United States)

- Rollease Acmeda (United States)

- BTX Intelligent Fashion LLC (United States)

- Electric Blinds Company (United States)

- Automated Shade (United States)

- Mecho (United States)

- QMotion Shades (United States)

- Silent Gliss Inc. (United States)

- Elero GmbH (Germany)

- MHZ Hachtel GmbH & Co. KG (Germany)

- Rademacher Electronics GmbH (Germany)

- Marantec Deutschland GmbH (Germany)

- Antea Automasjon AS (Norway)

- A-OK Blinds and Shutters Pty Ltd (Australia)

- Blinds Direct (Australia)

- Silent Gliss UK Ltd (United Kingdom)

- GKB Blinds (United Kingdom)

- Home Automation Asia (United Kingdom)

- Sunray Solutions Sdn Bhd (Singapore)

- A-Living Technology Co., Ltd. (Malaysia)

- Dooya (Guangzhou)

- Technology Co., Ltd. (China)

Key Industry Developments in the Electric Curtains Market:

- In September 2023, Somfy Systems Inc., strategically bolstered its position in the smart window treatment market through the acquisition of U.S.-based company Automated Shade. This move marked a significant milestone in Somfy's growth strategy, positioning the company as a key player in the evolving landscape of home automation.

- In June 2023, Spring Window Fashions, LLC, based in the United States, unveiled a strategic partnership with Google, propelling the company into the forefront of smart home automation within the electric curtain market. This visionary collaboration aims to seamlessly integrate Springs Window Fashions' window blinds with the Google Home ecosystem and the Google Assistant platform. The strategic alignment with Google represents a pivotal step for Springs Window Fashions, positioning the company to meet the escalating consumer demand for intelligent and interconnected home solutions.

|

Global Electric Curtains Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 60.28 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.53% |

Market Size in 2032: |

USD 188.87 Bn. |

|

Segments Covered: |

By Product Type

|

|

|

|

By Rod Size |

|

||

|

By Fabric Type |

|

||

|

By Power Source |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Curtains Market by Product Type (2018-2032)

4.1 Electric Curtains Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ripple Fold

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pleat

4.5 Tailored

4.6 Pinch

4.7 Inverted

4.8 Goblet

4.9 Grommet

4.10 Rod Pocket

4.11 Cubicle

Chapter 5: Electric Curtains Market by Rod Size (2018-2032)

5.1 Electric Curtains Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fix

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Adjustable

Chapter 6: Electric Curtains Market by Fabric Type (2018-2032)

6.1 Electric Curtains Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cotton

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Linen

6.5 Velvet

6.6 Silk

6.7 Burlap

6.8 Polyester

6.9 Others

Chapter 7: Electric Curtains Market by Power Source (2018-2032)

7.1 Electric Curtains Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Batteries

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Mains Electricity

Chapter 8: Electric Curtains Market by Technology (2018-2032)

8.1 Electric Curtains Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Wall Switch

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Remote Control

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Electric Curtains Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 APPFOLIO (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 CORELOGIC (RESMAN) (UNITED STATES)

9.4 BUILDIUM (UNITED STATES)

9.5 APPLAUD (UNITED STATES)

9.6 RENTCAFE(UNITED STATES)

9.7 REALPAGE (APPFOLIO) (UNITED STATES)

9.8 COZY.CO (UNITED STATES)

9.9 AVAIL (UNITED STATES)

9.10 HOUSECANARY (UNITED STATES)

9.11 JEEVES (UNITED STATES)

9.12 RENTROLL (UNITED STATES)

9.13 BUILDQUICK (UNITED STATES)

9.14 PROPERTY SOLUTIONS (UNITED STATES)

9.15 PROPSTREAM (UNITED STATES)

9.16 PROPWAY (UNITED STATES)

9.17 PROPERTYMINDER (UNITED STATES)

9.18 PROPERTY PORTALS (UNITED STATES)

9.19 COZY.CO (UNITED STATES)

9.20 RENTROLL (UNITED STATES)

9.21 BUILDQUICK (UNITED STATES)

9.22 APPWAY (UNITED KINGDOM)

9.23 PROPERTYBASE (UNITED KINGDOM)

Chapter 10: Global Electric Curtains Market By Region

10.1 Overview

10.2. North America Electric Curtains Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Ripple Fold

10.2.4.2 Pleat

10.2.4.3 Tailored

10.2.4.4 Pinch

10.2.4.5 Inverted

10.2.4.6 Goblet

10.2.4.7 Grommet

10.2.4.8 Rod Pocket

10.2.4.9 Cubicle

10.2.5 Historic and Forecasted Market Size by Rod Size

10.2.5.1 Fix

10.2.5.2 Adjustable

10.2.6 Historic and Forecasted Market Size by Fabric Type

10.2.6.1 Cotton

10.2.6.2 Linen

10.2.6.3 Velvet

10.2.6.4 Silk

10.2.6.5 Burlap

10.2.6.6 Polyester

10.2.6.7 Others

10.2.7 Historic and Forecasted Market Size by Power Source

10.2.7.1 Batteries

10.2.7.2 Mains Electricity

10.2.8 Historic and Forecasted Market Size by Technology

10.2.8.1 Wall Switch

10.2.8.2 Remote Control

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Electric Curtains Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Ripple Fold

10.3.4.2 Pleat

10.3.4.3 Tailored

10.3.4.4 Pinch

10.3.4.5 Inverted

10.3.4.6 Goblet

10.3.4.7 Grommet

10.3.4.8 Rod Pocket

10.3.4.9 Cubicle

10.3.5 Historic and Forecasted Market Size by Rod Size

10.3.5.1 Fix

10.3.5.2 Adjustable

10.3.6 Historic and Forecasted Market Size by Fabric Type

10.3.6.1 Cotton

10.3.6.2 Linen

10.3.6.3 Velvet

10.3.6.4 Silk

10.3.6.5 Burlap

10.3.6.6 Polyester

10.3.6.7 Others

10.3.7 Historic and Forecasted Market Size by Power Source

10.3.7.1 Batteries

10.3.7.2 Mains Electricity

10.3.8 Historic and Forecasted Market Size by Technology

10.3.8.1 Wall Switch

10.3.8.2 Remote Control

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Electric Curtains Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Ripple Fold

10.4.4.2 Pleat

10.4.4.3 Tailored

10.4.4.4 Pinch

10.4.4.5 Inverted

10.4.4.6 Goblet

10.4.4.7 Grommet

10.4.4.8 Rod Pocket

10.4.4.9 Cubicle

10.4.5 Historic and Forecasted Market Size by Rod Size

10.4.5.1 Fix

10.4.5.2 Adjustable

10.4.6 Historic and Forecasted Market Size by Fabric Type

10.4.6.1 Cotton

10.4.6.2 Linen

10.4.6.3 Velvet

10.4.6.4 Silk

10.4.6.5 Burlap

10.4.6.6 Polyester

10.4.6.7 Others

10.4.7 Historic and Forecasted Market Size by Power Source

10.4.7.1 Batteries

10.4.7.2 Mains Electricity

10.4.8 Historic and Forecasted Market Size by Technology

10.4.8.1 Wall Switch

10.4.8.2 Remote Control

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Electric Curtains Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Ripple Fold

10.5.4.2 Pleat

10.5.4.3 Tailored

10.5.4.4 Pinch

10.5.4.5 Inverted

10.5.4.6 Goblet

10.5.4.7 Grommet

10.5.4.8 Rod Pocket

10.5.4.9 Cubicle

10.5.5 Historic and Forecasted Market Size by Rod Size

10.5.5.1 Fix

10.5.5.2 Adjustable

10.5.6 Historic and Forecasted Market Size by Fabric Type

10.5.6.1 Cotton

10.5.6.2 Linen

10.5.6.3 Velvet

10.5.6.4 Silk

10.5.6.5 Burlap

10.5.6.6 Polyester

10.5.6.7 Others

10.5.7 Historic and Forecasted Market Size by Power Source

10.5.7.1 Batteries

10.5.7.2 Mains Electricity

10.5.8 Historic and Forecasted Market Size by Technology

10.5.8.1 Wall Switch

10.5.8.2 Remote Control

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Electric Curtains Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Ripple Fold

10.6.4.2 Pleat

10.6.4.3 Tailored

10.6.4.4 Pinch

10.6.4.5 Inverted

10.6.4.6 Goblet

10.6.4.7 Grommet

10.6.4.8 Rod Pocket

10.6.4.9 Cubicle

10.6.5 Historic and Forecasted Market Size by Rod Size

10.6.5.1 Fix

10.6.5.2 Adjustable

10.6.6 Historic and Forecasted Market Size by Fabric Type

10.6.6.1 Cotton

10.6.6.2 Linen

10.6.6.3 Velvet

10.6.6.4 Silk

10.6.6.5 Burlap

10.6.6.6 Polyester

10.6.6.7 Others

10.6.7 Historic and Forecasted Market Size by Power Source

10.6.7.1 Batteries

10.6.7.2 Mains Electricity

10.6.8 Historic and Forecasted Market Size by Technology

10.6.8.1 Wall Switch

10.6.8.2 Remote Control

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Electric Curtains Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Ripple Fold

10.7.4.2 Pleat

10.7.4.3 Tailored

10.7.4.4 Pinch

10.7.4.5 Inverted

10.7.4.6 Goblet

10.7.4.7 Grommet

10.7.4.8 Rod Pocket

10.7.4.9 Cubicle

10.7.5 Historic and Forecasted Market Size by Rod Size

10.7.5.1 Fix

10.7.5.2 Adjustable

10.7.6 Historic and Forecasted Market Size by Fabric Type

10.7.6.1 Cotton

10.7.6.2 Linen

10.7.6.3 Velvet

10.7.6.4 Silk

10.7.6.5 Burlap

10.7.6.6 Polyester

10.7.6.7 Others

10.7.7 Historic and Forecasted Market Size by Power Source

10.7.7.1 Batteries

10.7.7.2 Mains Electricity

10.7.8 Historic and Forecasted Market Size by Technology

10.7.8.1 Wall Switch

10.7.8.2 Remote Control

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Electric Curtains Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 60.28 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.53% |

Market Size in 2032: |

USD 188.87 Bn. |

|

Segments Covered: |

By Product Type

|

|

|

|

By Rod Size |

|

||

|

By Fabric Type |

|

||

|

By Power Source |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||