Dental Lab Market Synopsis:

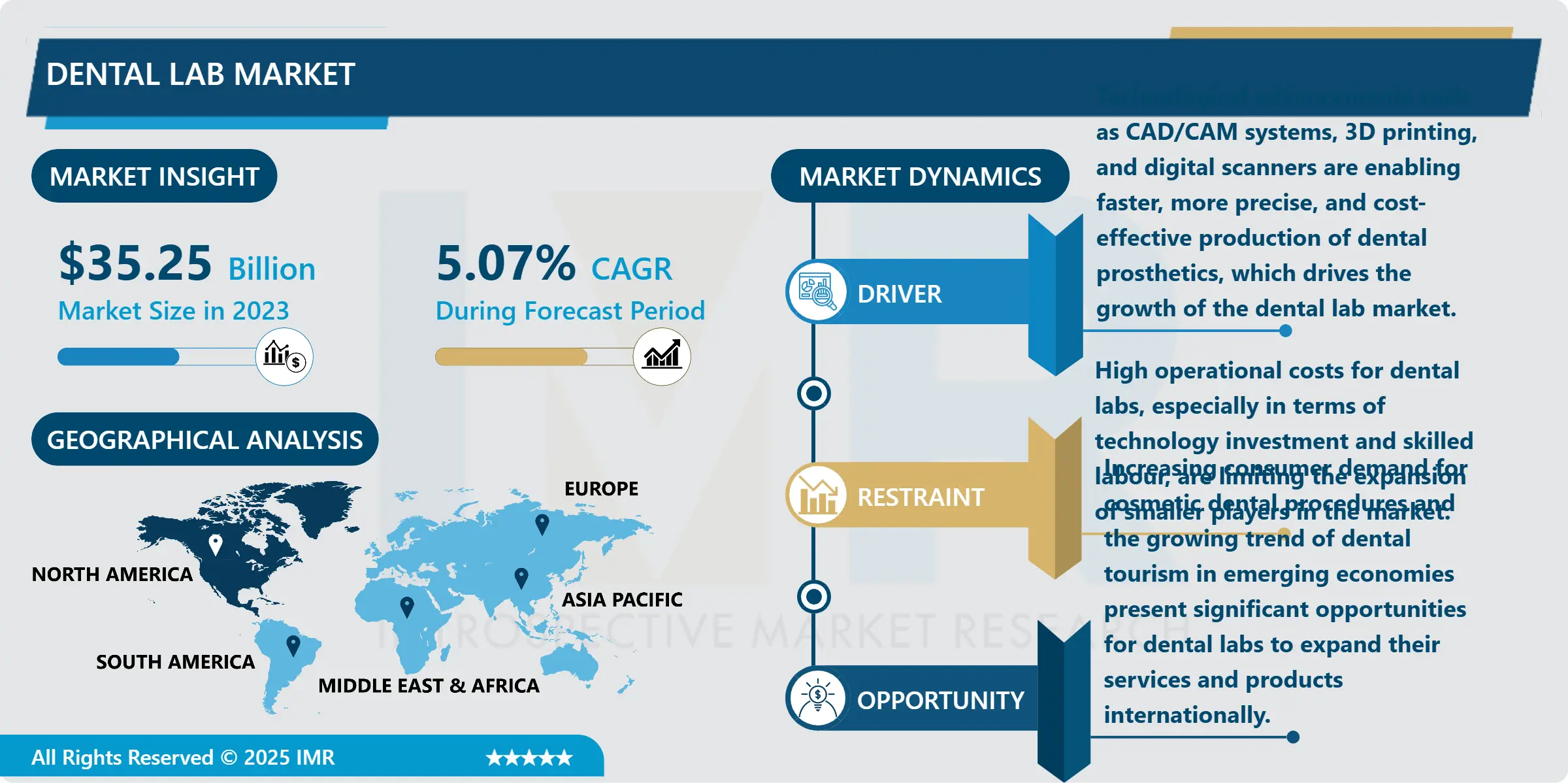

Dental Lab Market Size Was Valued at USD 35.25 Billion in 2023, and is Projected to Reach USD 55.01 Billion by 2032, Growing at a CAGR of 5.07% From 2024-2032.

Dental lab market describes the business of manufacturing dental prosthetics, orthodontic appliances and other items required for patients’ treatment. This market also comprises fabrication of crowns, bridges, dentures, implants and all other medical and aesthetic dental treatment that one might require. Dental labs have great importance to the process of providing elegant prosthodontic treatment to the patients because these services include designing and many of these products are done according to the patient requirement. It incorporates the conventional practices with new features experiencing advanced technology in digital dentistry and 3D printing that will bring about better and efficient growth in dental procedures and satisfaction of the patient.

The market of dental labs has been quickly growing in the past years due to the constantly growing need for dental services, the ageing population of the population, as well as the increasing health consciousness. In parallel with the development of dental treatments, more digital technologies are embraced in the dentistry field, CAD/CAM, 3D printing, and Intraoral scanner in particular has facilitated dental labs to produce more personalized solutions with less time. Furthermore, higher demand of aesthetic dental surgery like teeth whitening, veneer and implants has also given boost to the market.

However, other factors that have triggered increased demand for dental prosthetics and services include; technological expansion, dental tourism, which deals with prosthetic treatments in the regions with comparatively low prices for dental services. These include dental implant and replacement, orthodontic treatments, cosmetic dentistry and related products as well as increased awareness among the masses. Further, the increased government policies and better standardization for quality and patient safety have fostered the customers’ confidence in dental lab products. Thus, the market of dental laboratories is anticipated to strengthen further in terms of growth with the help of new technologies, increasing tendencies of healthcare spending, and focus on the problems of sthetics and hygiene of teeth and jaws.

Dental Lab Market Trend Analysis:

Advancements in Digital Dentistry

-

However, one of the major trends apparent in the dental lab market is that digital solutions are being steadily incorporated into production and design. CAD/CAM systems are breaking new ground in the industry because they can offer faster and more accurate means for constructing dental products. These technologies enable the dentist to take a picture of the patient’s mouth, transfer it to a computer, and create crowns, bridges, other dental appliances and the like with pinpoint precision. It also allows for a faster working rate as opposed to conventional means while decreasing the human intervention factor to produce a better-quality dental restoration.

- Not only that, 3D printing has also been widely used in many dental laboratories to fabricate specific dental implants, dentures, and crowns. This has rendered the process less costly and time-consuming and is thereby a worthwhile innovation. 3D printing makes it possible to adjust the final product to a specific patient more effectively and create more comfortable dental devices. Digitalization of markets in the dental laboratory industry has also strengthened the relationship between dentists and lab personnel, which also enables faster deliveries and improved patients’ processes. This trend is revolutionising the kind of dental products that are being developed, which in essence, will be advantageous for both dentists’ and patients.

Expanding Market for Cosmetic Dentistry

-

There exists an opportunity especially for the players in the dental lab market due to rising consumer consciousness in presentation, hence cosmetic dentistry. Due to increase in awareness of people wanting to improve their smile, the emergent cosmetic treatments for instance, bleaching, cosmetic fillings or braces are becoming popular among people. The change in consumer preferences has forced dental labs to come up with more unique solutions for precise customer requirements. The advancements in dental implant technology which provides a long term, aesthetic solution for missing teeth also provides a business opportunity for dental labs to increase diversification of their products and cater for this increasing demand for cosmetic dental prosthetics.

- In addition, growing personal disposable income coupled with widespread dental tourism across developed countries and increasing international opportunities in the value-added field by absorbing new markets, it has the potential to expand more and more by providing affordable and superior quality cosmetic dental products. There exists the constant and progressive material innovation of zirconia, lithium disilicate, as well as other superior ceramics that continue to improve the aesthetic and functional characteristics of dental restorations. These opportunities are opening up the way for dental labs to expand their output of more robust, aesthetic and adjustable substitute teeth thus extending their client niche and future market opportunities in the global dentistry market.

Dental Lab Market Segment Analysis:

Dental Lab Market Segmented on the basis of Type, Application, End User, and Region

By Type, the implants segment is expected to dominate the market during the forecast period

-

The market classification of dental labs is done more by the type of services offered, and the major product categories include crowns and bridges, dentures, implants, braces and other orthodontic products, veneers and others such as dental facial surgeries, and dental accessories. People often use crowns and bridges for the repair of the teeth as well as for replacing the lost monoliths dental dentures are used for the most severe cases of tooth loss. Implants, which can serve as an implant for the permanent tooth is also find to have increased growth rate because of being aesthetic and functional. Cosmetic dentistry services make orthodontic products such as braces and aligners popular since many people seek to have healthy teeth that are aligned well.

- Additional, veneer that is being a thin layer of material placed on the tooth’s surfaces for cosmetic function is also being sought by many as a way to enhance their appearance. In the same token, ‘Others’ comprise dental requirements, including materials, tools and other equipment used in various dental restorative and preventive services. This segmentation is devised bearing in mind the various categories of the dental industry where each set of products seeks to address a unique phase of dentistry which may include cosmetics or restoration, invisible orthodontic braces among others.

By Application, Cosmetic Dentistry segment expected to held the largest share

-

This is a market that is categorized based on various applications, and one of the largest categories is restorative dentistry. This branch of dentistry is mainly centered on taking care of the teeth that hitherto has been damaged, or their function compromised through decay, etc. Various dental restorations serve to replace missing teeth, such as crowns, bridges, and fillings, may be used in this area in a patient’s mouth to restore mirror smile and ability to chew. Besides, restorative treatments, there is a steady grow of cosmetic dentistry since people start paying more attention to the way their teeth look. Such actions as a tooth whitening, veneers, or smile makeovers are on request since people seek to improve their appearance and therefore confidence.

- This sector has enjoyed growth, particularly due to the growth in the usage of clear aligners and improved orthodontics. Dental Implantology which is the process of insertion of implant supported prosthetics for replacement of missing teeth is another large sub-sector within the dental lab business. Dental implants are preferred due to the longevity of the procedure, and functionality of the implant prosthetics, and also the aesthetic aspect of the appliance. Last but not least, prosthetics which include dentures, partial dentures and other forms of dental prosthetics deal with tooth loss and offer the patient a means of restoring full function and aesthetics for the mouth where teeth are missing. Every of them can be designed for different needs of the dentistry and, thus, they all belong to the extensive dental lab market.

Dental Lab Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

While in the year 2023, Dental lab market lies mainly in North America, which has nearly 40 percent of market share in the global market. This is primarily so given the dominance of the USA that possesses well-developed Healthcare industry and a significant emphasis on such dental categories as aesthetic and implant. The area enjoys the relatively high disposable income, which enable the people to embrace a wide range of advanced dental solutions and latest techniques. The presence of advanced CAD/CAM systems and 3D printing technology and innovation used in dental laboratories support the above position hence establishing the U.S as current leading in digital dental procedures. In addition, the growth of the rule body and especially the aging one which turn out to dental procedures more often as the awareness for oral health is increasing boosts the market greatly.

- The largest share of dental lab is still dominant in North America; however, the European market for dental lab is also quite substantial due to a well-developed health care system and rising popularity of cosmetic dentistry. At the same time the Asia Pacific zone significantly builds up, and can be considered as a prospective region. This is because of increased disposable income and frequency of symptoms, improving access to the health care sector, and a widespread tendency of travelling to other countries for dental treatment at lower costs. These factors are making Asia Pacific as a strategic market for future growth as dental labs are also working in both regional and global markets.

Active Key Players in the Dental Lab Market:

-

3M (USA)

- Align Technology (USA)

- Amann Girrbach (Austria)

- Burbank Dental Lab (USA)

- Dental Wings (Canada)

- Dentsply Sirona (USA)

- GC Corporation (Japan)

- Henry Schein (USA)

- Ivoclar Vivadent (Liechtenstein)

- Kavo Kerr (Germany)

- Kuraray Noritake Dental (Japan)

- Lantis Laser (USA)

- Nobel Biocare (Switzerland)

- Straumann (Switzerland)

- Zirkonzahn (Italy)

- Other Active Players

|

Global Dental Lab Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 35.25 Billion |

|

Forecast Period 2024-32 CAGR: |

5.07 % |

Market Size in 2032: |

USD 55.01 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dental Lab Market by Type

4.1 Dental Lab Market Snapshot and Growth Engine

4.2 Dental Lab Market Overview

4.3 Crowns & Bridges

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Crowns & Bridges: Geographic Segmentation Analysis

4.4 Dentures

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Dentures: Geographic Segmentation Analysis

4.5 Implants

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Implants: Geographic Segmentation Analysis

4.6 Orthodontic Products

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Orthodontic Products: Geographic Segmentation Analysis

4.7 Veneers

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Veneers: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Dental Lab Market by Application

5.1 Dental Lab Market Snapshot and Growth Engine

5.2 Dental Lab Market Overview

5.3 Restorative Dentistry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Restorative Dentistry: Geographic Segmentation Analysis

5.4 Cosmetic Dentistry

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cosmetic Dentistry: Geographic Segmentation Analysis

5.5 Orthodontics

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Orthodontics: Geographic Segmentation Analysis

5.6 Implantology

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Implantology: Geographic Segmentation Analysis

5.7 Prosthetics

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Prosthetics: Geographic Segmentation Analysis

Chapter 6: Dental Lab Market by End User

6.1 Dental Lab Market Snapshot and Growth Engine

6.2 Dental Lab Market Overview

6.3 Dental Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Dental Clinics: Geographic Segmentation Analysis

6.4 Hospitals

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Hospitals: Geographic Segmentation Analysis

6.5 Dental Laboratories

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Dental Laboratories: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Dental Lab Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALIGN TECHNOLOGY (USA)

7.4 AMANN GIRRBACH (AUSTRIA)

7.5 BURBANK DENTAL LAB (USA)

7.6 DENTAL WINGS (CANADA)

7.7 DENTSPLY SIRONA (USA)

7.8 GC CORPORATION (JAPAN)

7.9 HENRY SCHEIN (USA)

7.10 IVOCLAR VIVADENT (LIECHTENSTEIN)

7.11 KAVO KERR (GERMANY)

7.12 KURARAY NORITAKE DENTAL (JAPAN)

7.13 LANTIS LASER (USA)

7.14 NOBEL BIOCARE (SWITZERLAND)

7.15 STRAUMANN (SWITZERLAND)

7.16 ZIRKONZAHN (ITALY)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Dental Lab Market By Region

8.1 Overview

8.2. North America Dental Lab Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Crowns & Bridges

8.2.4.2 Dentures

8.2.4.3 Implants

8.2.4.4 Orthodontic Products

8.2.4.5 Veneers

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Restorative Dentistry

8.2.5.2 Cosmetic Dentistry

8.2.5.3 Orthodontics

8.2.5.4 Implantology

8.2.5.5 Prosthetics

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Dental Clinics

8.2.6.2 Hospitals

8.2.6.3 Dental Laboratories

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Dental Lab Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Crowns & Bridges

8.3.4.2 Dentures

8.3.4.3 Implants

8.3.4.4 Orthodontic Products

8.3.4.5 Veneers

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Restorative Dentistry

8.3.5.2 Cosmetic Dentistry

8.3.5.3 Orthodontics

8.3.5.4 Implantology

8.3.5.5 Prosthetics

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Dental Clinics

8.3.6.2 Hospitals

8.3.6.3 Dental Laboratories

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Dental Lab Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Crowns & Bridges

8.4.4.2 Dentures

8.4.4.3 Implants

8.4.4.4 Orthodontic Products

8.4.4.5 Veneers

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Restorative Dentistry

8.4.5.2 Cosmetic Dentistry

8.4.5.3 Orthodontics

8.4.5.4 Implantology

8.4.5.5 Prosthetics

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Dental Clinics

8.4.6.2 Hospitals

8.4.6.3 Dental Laboratories

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Dental Lab Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Crowns & Bridges

8.5.4.2 Dentures

8.5.4.3 Implants

8.5.4.4 Orthodontic Products

8.5.4.5 Veneers

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Restorative Dentistry

8.5.5.2 Cosmetic Dentistry

8.5.5.3 Orthodontics

8.5.5.4 Implantology

8.5.5.5 Prosthetics

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Dental Clinics

8.5.6.2 Hospitals

8.5.6.3 Dental Laboratories

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Dental Lab Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Crowns & Bridges

8.6.4.2 Dentures

8.6.4.3 Implants

8.6.4.4 Orthodontic Products

8.6.4.5 Veneers

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Restorative Dentistry

8.6.5.2 Cosmetic Dentistry

8.6.5.3 Orthodontics

8.6.5.4 Implantology

8.6.5.5 Prosthetics

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Dental Clinics

8.6.6.2 Hospitals

8.6.6.3 Dental Laboratories

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Dental Lab Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Crowns & Bridges

8.7.4.2 Dentures

8.7.4.3 Implants

8.7.4.4 Orthodontic Products

8.7.4.5 Veneers

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Restorative Dentistry

8.7.5.2 Cosmetic Dentistry

8.7.5.3 Orthodontics

8.7.5.4 Implantology

8.7.5.5 Prosthetics

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Dental Clinics

8.7.6.2 Hospitals

8.7.6.3 Dental Laboratories

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Dental Lab Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 35.25 Billion |

|

Forecast Period 2024-32 CAGR: |

5.07 % |

Market Size in 2032: |

USD 55.01 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||