Database as a Service Market Synopsis

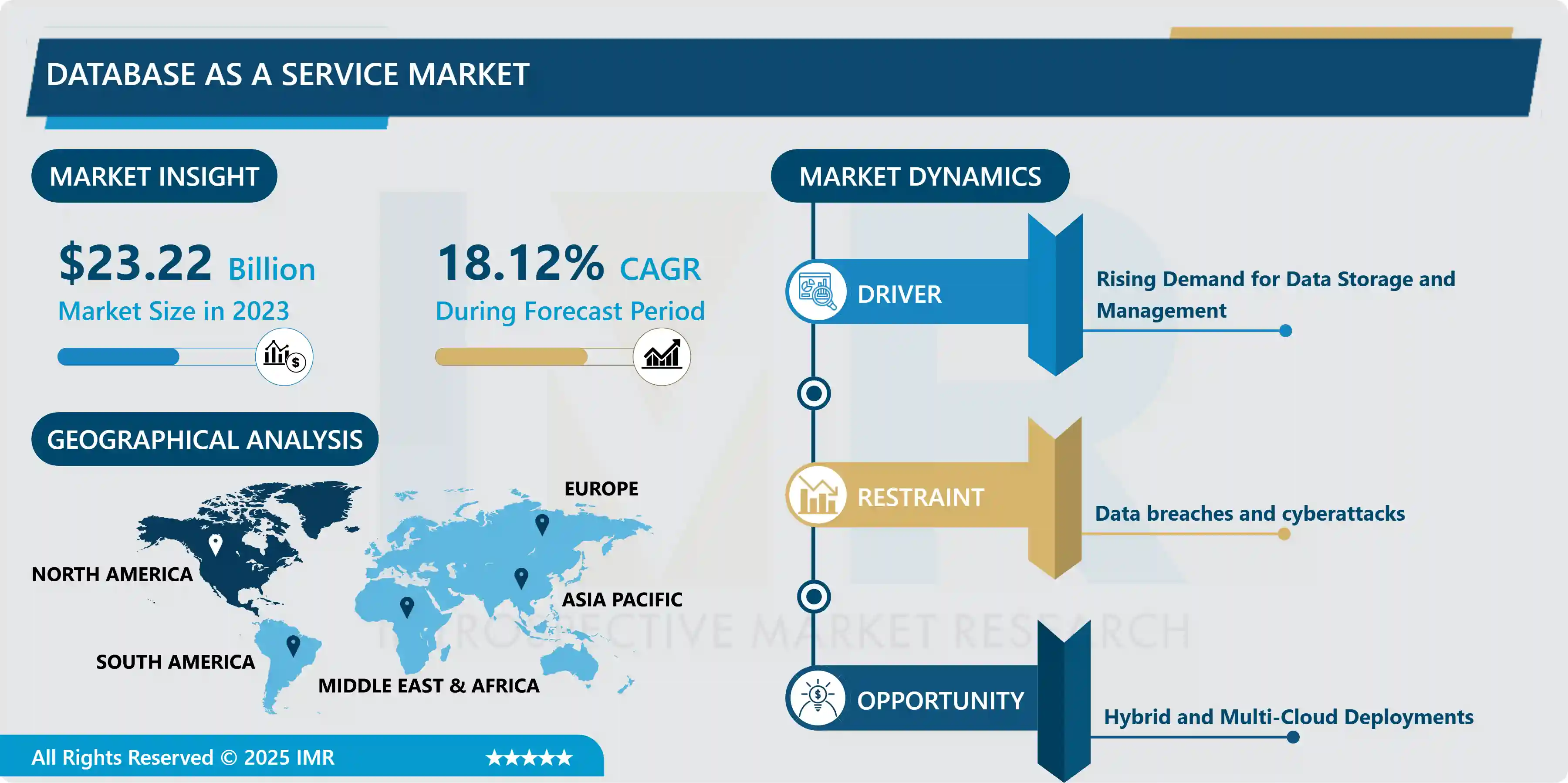

Database as a Service Market Size Was Valued at USD 23.22 Billion in 2023, and is Projected to Reach USD 103.94 Billion by 2032, Growing at a CAGR of 18.12% From 2024-2032.

Database as a Service (DBaaS) is a cloud computing model that allows users to access a managed database system via the Internet. In this service model, the user relinquishes responsibility for database infrastructure management, maintenance, and security to the service provider. DBaaS offerings typically include database management tasks like provisioning, configuration, patching, backups, and scaling, allowing users to focus on using the database for their applications rather than worrying about the underlying infrastructure complexities.

DBaaS providers provide a variety of database options, including relational databases like MySQL, PostgreSQL, and SQL Server, as well as non-relational databases like MongoDB, Cassandra, and Redis, to meet a wide range of application needs. Users can easily deploy and manage databases using the service provider's intuitive user interfaces or APIs, allowing for rapid application development, deployment, and scaling without requiring extensive database administration expertise.

The proliferation of data-intensive applications, the need for real-time data processing and analytics, and the growing preference for scalable and flexible database solutions all contribute to the DBaaS market's growth. Furthermore, the introduction of technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) has increased the demand for robust database platforms capable of handling large amounts of data and supporting complex data analytics tasks.

The DBaaS market is expected to grow rapidly as more businesses recognise the benefits of using cloud-based database services to drive innovation, shorten time-to-market, and gain a competitive advantage in today's data-driven business landscape. With the ongoing evolution of technology and the emergence of new use cases, the DBaaS market is expected to remain dynamic and competitive for the foreseeable future.

Database as a Service Market Trend Analysis

Rising Demand for Data Storage and Management

- Businesses across industries are creating and collecting massive amounts of data from a variety of sources, including customer interactions, transactions, and IoT devices. The exponential growth in data volume necessitates scalable and dependable storage solutions provided by DBaaS platforms. Furthermore, as cloud computing and digital transformation initiatives gain traction, organizations are looking for adaptable and cost-effective data management solutions that can meet changing business needs while maintaining data integrity, availability, and security.

- The demand for advanced database solutions provided by DBaaS providers is being driven by the increasing complexity of data management tasks, such as data integration, processing, analysis, and reporting. Relational and non-relational databases with features like automated backups, disaster recovery, and real-time analytics capabilities are among the database options that these platforms provide.

- The growing emphasis on regulatory compliance, data privacy, and security standards is driving up demand for robust data management solutions provided by DBaaS platforms. These platforms include built-in security features such as encryption, access controls, and compliance certifications, which protect sensitive data from unauthorized access and breaches. The increasing demand for data storage and management solutions in the DBaaS market emphasizes the importance of scalable, secure, and efficient database platforms.

- The bar chart illustrates the rankings of different database management systems (DBMS) in the Database as a Service (DBaaS) market. MySQL and Oracle are the leading contenders, with scores of 1111.49 and 1240.88, respectively, followed by MS SQL Server and PostgreSQL. MongoDB, Redis, and Elasticsearch also perform well, demonstrating their importance in the evolving DBaaS landscape.

Hybrid and Multi-Cloud Deployments

- Hybrid and multi-cloud deployments are becoming more common in the Database as a Service (DBaaS) market, as businesses look to reap the benefits of both on-premises and cloud-based infrastructures while avoiding vendor lock-in and increasing flexibility. Hybrid deployments enable businesses to keep certain databases on-premises for sensitive or regulated data while using cloud-based DBaaS solutions for scalability, agility, and cost-efficiency.

- This hybrid approach allows organizations to strike a balance between the need for data control and security and the benefits of cloud computing, ensuring that critical workloads can be seamlessly integrated and managed across various environments. Businesses can reduce the impact of potential outages or disruptions by distributing workloads across multiple cloud platforms, resulting in greater resilience, redundancy, and disaster recovery capabilities.

- Multi-cloud strategies also allow organizations to leverage each cloud provider's distinct offerings, such as specialized databases, advanced analytics tools, and global infrastructure, to meet a wide range of application requirements and optimize performance. Hybrid and multi-cloud deployments are a strategic approach for organizations to optimize their database infrastructure, increase flexibility, and future-proof their IT environments in the rapidly changing digital landscape.

Database as a Service Market Segment Analysis:

Database as a Service Market Segmented on the basis of Type, Deployment Model, Organization Size, and Industry Vertical.

By Type, NoSQL Databases segment is expected to dominate the market during the forecast period

- NoSQL databases offer unparalleled scalability and performance capabilities, making them well-suited for handling the massive volumes of data generated by modern applications, such as social media platforms, e-commerce websites, and IoT devices. With NoSQL databases, organizations can easily scale out their database infrastructure horizontally across multiple nodes to accommodate growing data volumes and user traffic without sacrificing performance or availability.

- NoSQL databases provide greater flexibility and agility compared to traditional SQL databases, allowing developers to store and retrieve data in flexible, schema-less formats. This flexibility is particularly advantageous in agile development environments where data models are constantly evolving. NoSQL databases enable developers to store diverse types of data, including unstructured and semi-structured data, without the constraints of rigid schemas, thereby accelerating application development and time-to-market.

- NoSQL databases are increasingly being offered as managed services in the cloud, providing businesses with the benefits of easy deployment, automated management, and pay-as-you-go pricing models through DBaaS offerings. The combination of scalability, flexibility, and cloud-native capabilities makes NoSQL databases the fastest-growing segment in the DBaaS market, as businesses strive to harness the power of modern data management solutions to drive innovation and stay competitive in the digital era.

By Industry Vertical, IT and Telecom segment held the largest share of 32.67% in 2023

- The IT and Telecom sectors are leading digital transformation by adopting cloud-based solutions, such as DBaaS, to modernize infrastructure, improve operational efficiency, and accelerate innovation. These industries rely heavily on data-intensive applications and services like customer relationship management (CRM), enterprise resource planning (ERP), and communication platforms, all of which require robust and scalable database solutions to effectively manage massive amounts of structured and unstructured data.

- Data generation in the IT and telecom sectors is rapidly increasing, owing to the proliferation of connected devices, mobile applications, social media platforms, and streaming services. The growing adoption of emerging technologies in the IT and telecommunications industries, such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), increases the demand for scalable and flexible database solutions to support novel use cases and applications.

- These industries benefit from DBaaS offerings that include on-demand scalability, automated management, and pay-as-you-go pricing models, allowing them to optimize resource utilization, reduce capital expenditures, and accelerate time-to-market for new products and services. As a result, the IT and Telecom industry verticals are expected to maintain their dominance in the DBaaS market during the forecast period, as they invest in digital transformation initiatives and use cloud-based database solutions to drive growth and innovation.

Database as a Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is home to many technology companies, including major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. These companies provide comprehensive DBaaS solutions by leveraging their extensive infrastructure, advanced technologies, and strong security measures to meet the diverse needs of businesses across industries.

- The presence of these leading cloud providers in North America contributes significantly to the region's dominance in the DBaaS market, as businesses prefer to work with established and trustworthy vendors for their database management needs. North America has a mature IT ecosystem with widespread technological adoption in industries such as finance, healthcare, retail, and manufacturing.

- Organisations in these industries are increasingly adopting cloud computing and digital transformation initiatives, which is driving demand for scalable and flexible database solutions from DBaaS vendors. These factors create an ecosystem that encourages the adoption and proliferation of DBaaS solutions, allowing businesses to better harness the power of data, drive innovation, and gain a competitive advantage in the global marketplace.

Database as a Service Market Top Key Players:

- Oracle (US)

- Microsoft (US)

- Google (US)

- Amazon (US)

- IBM (US)

- MongoDB (US)

- Redis Ltd. (US)

- EnterpriseDB (US)

- Couchbase Inc. (US)

- DataStax (US)

- Rackspace Technology (US)

- Cockroach Labs (US)

- Yugabyte (US)

- Fauna (US)

- DigitalOcean (US)

- Linode (US)

- ScaleGrid (US)

- InfluxData (US)

- Salesforce (US)

- Timescale (US)

- ArangoDB (US)

- SAP (Germany)

- Alibaba (China), and other major players.

Key Industry Developments in the Database as a Service Market:

- In September 2023, Microsoft and Oracle expanded their partnership to provide Oracle Database Services on Oracle Cloud Infrastructure in Microsoft Azure. Oracle Corp. and Microsoft Corp. announced Oracle Database@Azure, which provides customers with direct access to Oracle database services running on Oracle Cloud Infrastructure (OCI) and deployed in Microsoft Azure data centers.

- In November 2023, IBM (NYSE: IBM) collaborated with Amazon Web Services (AWS) on the general availability of Amazon Relational Database Service (Amazon RDS) for Db2, a fully managed cloud offering designed to help database customers manage data for artificial intelligence (AI) workloads across hybrid cloud environments.

|

Global Database as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.22 Bn. |

|

Forecast Period 2024-32 CAGR: |

18.12% |

Market Size in 2032: |

USD 103.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Model |

|

||

|

By Organization Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Database as a Service Market by Type (2018-2032)

4.1 Database as a Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 SQL Databases

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 NoSQL Databases

Chapter 5: Database as a Service Market by Deployment Model (2018-2032)

5.1 Database as a Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Public Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Private Cloud

5.5 Hybrid Cloud

Chapter 6: Database as a Service Market by Organization Size (2018-2032)

6.1 Database as a Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Large Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Small and Medium-sized Enterprises (SMEs)

Chapter 7: Database as a Service Market by Industry Vertical (2018-2032)

7.1 Database as a Service Market Snapshot and Growth Engine

7.2 Market Overview

7.3 IT and Telecom

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 Retail and E-commerce

7.6 Financial Services

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Database as a Service Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALLSTATE INSURANCE COMPANY (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AMERICAN INTERNATIONAL GROUP INC. (US)

8.4 AXA (FRANCE)

8.5 CHUBB (US)

8.6 STATE FARM (US)

8.7 NATIONWIDE (US)

8.8 ALLSTATE (US)

8.9 CHUBB LIMITED (US)

8.10 FARMERS INSURANCE GROUP (US)

8.11 PROGRESSIVE (US)

8.12 LIBERTY MUTUAL (US)

8.13 AXA GROUP (EUROPE)

8.14 MUNICH RE(EUROPE)

8.15 ALLIANZ(GERMANY)

8.16 ADMIRAL (UK)

8.17 LIBERTY MUTUAL INSURANCE COMPANY (BOSTON)

8.18 PICC (SWITZERLAND)

8.19 STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY (BLOOMINGTON)

8.20 ZURICH (SWITZERLAND)

8.21 AFLAC (COLUMBUS)

8.22 GEICO (MARYLAND)

8.23 BUPA (UK)

8.24 PINGAN (CHINA)

8.25 KUNLUN (CHINA)

8.26 SHELTER INSURANCE (COLUMBIA)

Chapter 9: Global Database as a Service Market By Region

9.1 Overview

9.2. North America Database as a Service Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 SQL Databases

9.2.4.2 NoSQL Databases

9.2.5 Historic and Forecasted Market Size by Deployment Model

9.2.5.1 Public Cloud

9.2.5.2 Private Cloud

9.2.5.3 Hybrid Cloud

9.2.6 Historic and Forecasted Market Size by Organization Size

9.2.6.1 Large Enterprises

9.2.6.2 Small and Medium-sized Enterprises (SMEs)

9.2.7 Historic and Forecasted Market Size by Industry Vertical

9.2.7.1 IT and Telecom

9.2.7.2 Healthcare

9.2.7.3 Retail and E-commerce

9.2.7.4 Financial Services

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Database as a Service Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 SQL Databases

9.3.4.2 NoSQL Databases

9.3.5 Historic and Forecasted Market Size by Deployment Model

9.3.5.1 Public Cloud

9.3.5.2 Private Cloud

9.3.5.3 Hybrid Cloud

9.3.6 Historic and Forecasted Market Size by Organization Size

9.3.6.1 Large Enterprises

9.3.6.2 Small and Medium-sized Enterprises (SMEs)

9.3.7 Historic and Forecasted Market Size by Industry Vertical

9.3.7.1 IT and Telecom

9.3.7.2 Healthcare

9.3.7.3 Retail and E-commerce

9.3.7.4 Financial Services

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Database as a Service Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 SQL Databases

9.4.4.2 NoSQL Databases

9.4.5 Historic and Forecasted Market Size by Deployment Model

9.4.5.1 Public Cloud

9.4.5.2 Private Cloud

9.4.5.3 Hybrid Cloud

9.4.6 Historic and Forecasted Market Size by Organization Size

9.4.6.1 Large Enterprises

9.4.6.2 Small and Medium-sized Enterprises (SMEs)

9.4.7 Historic and Forecasted Market Size by Industry Vertical

9.4.7.1 IT and Telecom

9.4.7.2 Healthcare

9.4.7.3 Retail and E-commerce

9.4.7.4 Financial Services

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Database as a Service Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 SQL Databases

9.5.4.2 NoSQL Databases

9.5.5 Historic and Forecasted Market Size by Deployment Model

9.5.5.1 Public Cloud

9.5.5.2 Private Cloud

9.5.5.3 Hybrid Cloud

9.5.6 Historic and Forecasted Market Size by Organization Size

9.5.6.1 Large Enterprises

9.5.6.2 Small and Medium-sized Enterprises (SMEs)

9.5.7 Historic and Forecasted Market Size by Industry Vertical

9.5.7.1 IT and Telecom

9.5.7.2 Healthcare

9.5.7.3 Retail and E-commerce

9.5.7.4 Financial Services

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Database as a Service Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 SQL Databases

9.6.4.2 NoSQL Databases

9.6.5 Historic and Forecasted Market Size by Deployment Model

9.6.5.1 Public Cloud

9.6.5.2 Private Cloud

9.6.5.3 Hybrid Cloud

9.6.6 Historic and Forecasted Market Size by Organization Size

9.6.6.1 Large Enterprises

9.6.6.2 Small and Medium-sized Enterprises (SMEs)

9.6.7 Historic and Forecasted Market Size by Industry Vertical

9.6.7.1 IT and Telecom

9.6.7.2 Healthcare

9.6.7.3 Retail and E-commerce

9.6.7.4 Financial Services

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Database as a Service Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 SQL Databases

9.7.4.2 NoSQL Databases

9.7.5 Historic and Forecasted Market Size by Deployment Model

9.7.5.1 Public Cloud

9.7.5.2 Private Cloud

9.7.5.3 Hybrid Cloud

9.7.6 Historic and Forecasted Market Size by Organization Size

9.7.6.1 Large Enterprises

9.7.6.2 Small and Medium-sized Enterprises (SMEs)

9.7.7 Historic and Forecasted Market Size by Industry Vertical

9.7.7.1 IT and Telecom

9.7.7.2 Healthcare

9.7.7.3 Retail and E-commerce

9.7.7.4 Financial Services

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Database as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.22 Bn. |

|

Forecast Period 2024-32 CAGR: |

18.12% |

Market Size in 2032: |

USD 103.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Model |

|

||

|

By Organization Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||