Cyclocomputer Market Synopsis:

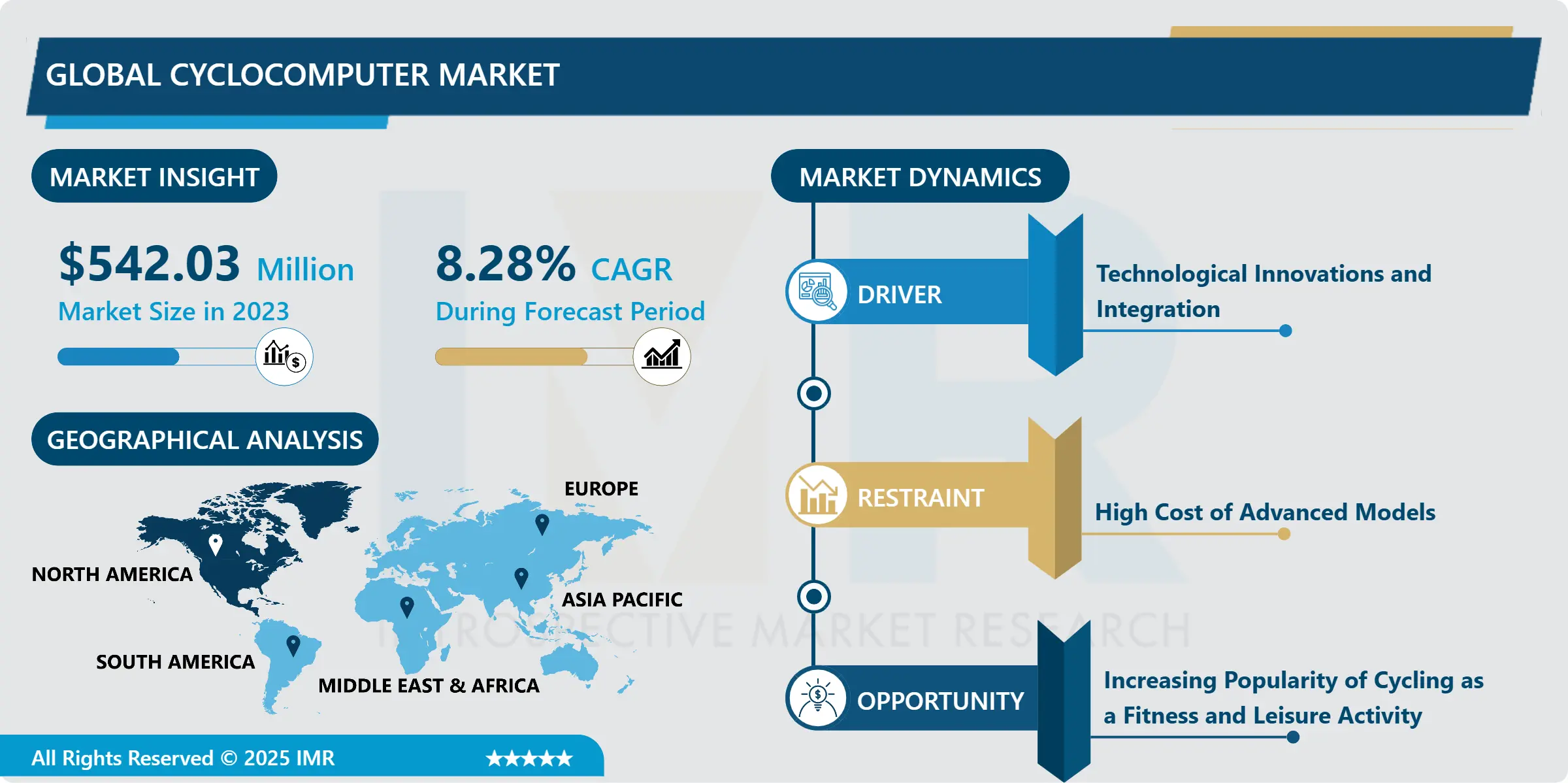

Cyclocomputer Market Size Was Valued at USD 542.03 Million in 2023, and is Projected to Reach USD 1109.07 Million by 2032, Growing at a CAGR of 8.28% From 2024-2032.

The Cyclocomputer Market encompasses for products aimed at developing constructing and selling Cyclocomputers that are electronic machines that monitor and record different parameters of cycling performance including speed distance time cadence altitude and heartrate. These devices are worn by cyclists inclusive of both the amateur cyclists, the weekend cyclists, and the professional athletes and endurance cyclists to keep track of their performance so that they can make modifications to their training regimens. This sector is defined by basic models ranging up to the advanced GPS products with option of navigation, mapping and connectivity features included. The development of this market depends on four factors – the increased interest in cycling as a sport and as a recreation, development of technologies, and the need for intelligent cycling services.

The cyclocomputer also receives considerable sales growth due to the constantly growing popularity of cycling throughout the world due to increased health literacy, demand for cycling as a means of transport, as well as a growing number of people interested in active healthy lifestyles. Cyclocomputers with features like the current speed and distance, time and GPS are a common tool used by cyclists and these include; recreational cyclists, competitive cyclists among others. This market includes devices that provide gross statistics and additional applications such as heart rate measurement, cadence, power, and connection with a smartphone. The market for the cyclocomputers is especially existent since cycling is very popular in Europe and North America, and cyclists are using better facilities. A major factor remains one of technological enhancement in their products which include integrating GPS, ANT+, Bluetooth and IoT among others to enrich the user experience as well as to improve on the quality of information collected. Also, the increasing integration of more advanced and efficient cycling computers that are compatible with smartphones, and other fitness devices has also been found to drive the market further. Therefore, as e-bikes progress, there is also a trend towards dedicated cyclocomputers, e- Bike specific, measuring battery status and power.

In the short term, cyclocomputer market remains firm and is expected to grow further as cycling becomes more popular and is promoted as an ecological and a healthy form of transport. Manufacturers are expected to pay more attention on building innovations through offering a diverse set of cyclocomputers of different complexities to suit the casual cyclist, the amateur or the professional. Furthermore, the concepts such as integration of extra features, options to increase connectivity, and convenient interfaces will always be a priority in developing products. As seen, the global increase in cycling events and competition requires precise performance data, which will further drive development in the market. Major players in the global bicycle market may opt to expand cooperation with suppliers and dealers and develop extensive advertising campaigns to respond to new market demands and take a greater slice of the global market.

Cyclocomputer Market Trend Analysis:

Technological Innovations and Integration

-

Traditional cyclocomputers have also changed from simple wheel odometers to computitle gadgets with numerous features such as speed, distance, cadence, HR and altitude. Such devices have now integrated GPS navigation, smart connection to a smartphone, as well as the best data analysis tools that make these devices a tool a cyclist would need to monitor his or her performance. Automated systems such as cycling computers have become popular as cycling has evolved from being only a sport activity but also a means of transport and as bikers need more information about the ride and the training data, route map, among others. This is also magnified with the current concern of health leading to more people adopting the cyclocomputers. Through compatibility with fitness apps and wearables, these devices provide a complete picture of a cyclist’s health; which in turn allows them to work out more efficiently.

- Second, the technological advancement has promoted diversification in cyclocomputer product form and operation in the cycling market. Modern models not only show information about cycling but also are compatible with other smart devices like smartwatches or fitness trackers that means that user will have a holistic fitness tracking system. Hence the optimizations offered have enhanced usability and portability of the cyclocomputers aimed at helmets, bikers whether regular cyclists or athletes. More so, as the cycling industry expands and integrates technology into its products and services, cyclocomputers are likely to be developed with other features such as actual time performance feedback/share, social network connectivity, and better battery durability. This changing dynamic suggests that the market will grow further as consumers call for seamless and intelligent cycling experience.

Increasing Popularity of Cycling as a Fitness and Leisure Activity

-

As more people incorporate cycling as either a means of exercising or as a recreational activity, there is a corresponding need for a wide range of new, enhanced cycling gadgets that include but are not limited to speed, distance, cadence, pulse rate, GPS navigation systems among others. This trend is rather popular among consumer health-conscious who want to get the most of their cycling and keep track of the progress. The integration of smart technologies into cyclocomputers like Smartphone, training and performance applications improves user experience and brings a new market of customers. Such elements help cyclists track the progress more effectively, remain motivated, and join an online community of cycling enthusiasts.

- Also, the cyclocomputer manufacturers can look forward to the increasing market for electric bikes or e-bikes. The riders need improved positioning and performance information from their vehicles when dealing with methods related to electric motors and battery issues. Thus, meeting the needs of this new type of cyclist, manufacturers can supply a market that requires specifically tailored cyclocomputers. Additional provisions for particular e-bike users like the battery indicators and the motors could be of benefit to the manufacturers and help to increase market expansion.

Cyclocomputer Market Segment Analysis:

Cyclocomputer Market is Segmented on the basis of By Connectivity, Functionality, Distribution Channel, and Region.

By Connectivity, Wired segment is expected to dominate the market during the forecast period

-

By connectivity type, the wired segment is expected to dominate the market during the forecast period. Wired connectivity refers to audio devices that require cables to connect to power sources or other electronic equipment. This method provides a reliable and uninterrupted connection without the interference often experienced with wireless connections. Wireless connections are typically suitable for applications where the highest audio quality is not critical, such as home cinema or casual listening. Wired connections commonly use 3.5mm audio ports, USB inputs, or optical inputs. Users who prioritize sound quality over the convenience of wireless connectivity often prefer wired options, as they deliver excellent fidelity for voice, instruments, and other sounds without channel compression or latency issues inherent in wireless transmission.

- Cabling plays a vital role in delivering wired connectivity by providing a dedicated path for sound signals with minimal interference. This is especially important in professional settings where the accuracy of timbre and amplitude is crucial. The stable nature of wired connections also means they do not drain batteries, suffer from weak signals, or cause interference with other electronic devices. Despite the inconvenience of managing cables, many users prefer wired connections due to their superior sound quality and reliability. For portable use, those unwilling to compromise on listening quality often choose wired connections to ensure the best audio experience.

By Distribution Channel, Online segment expected to held the largest share

-

By distribution channel, the online segment is expected to hold the largest market share. Online sales of audio devices occur through e-commerce websites, manufacturers’ own sites, and electronic marketplaces. This method offers consumers a wide range of choices, easy price comparisons, and access to customer reviews, which significantly influence buying decisions. Many online stores provide better discounts and promotional offers than physical stores, making this channel particularly attractive to price-sensitive buyers. Online distribution also caters to the growing population of digital shoppers, especially modern consumers who prefer quick, convenient, and diverse shopping options. Additionally, it enables manufacturers to reach customers regardless of their geographic location, including those who may not have access to physical retail stores. The reduction in physical storefronts also lowers overhead costs for manufacturers, which often translates into more competitive prices for consumers.

- However, there are some drawbacks to shopping online that may deter certain buyers. One major limitation is the inability to physically touch or test the product before purchase, which is important for consumers who value experiencing the comfort, build quality, and sound firsthand. While detailed product descriptions and customer reviews provide helpful information, they cannot fully replace the experience of interacting with a product in person. Furthermore, in-store shopping allows customers to ask sellers questions, receive professional advice, and make more informed decisions, which can be especially valuable for those less familiar with technical specifications or audio equipment.

Cyclocomputer Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the cyclocomputer market over the forecast period. The growing demand is driven by an increasing number of biking enthusiasts who use these devices to track important metrics such as speed, distance, cadence, and elevation. This growth is strongly linked to rising fitness awareness and the shift toward energy conservation, with cycling becoming a popular mode of transportation. As more people adopt cycling for fitness and as an environmentally friendly, low-impact transport option, the demand for high-end cyclocomputers for continuous performance monitoring has surged. Additionally, smart features like built-in GPS for navigation, heart rate monitoring, and compatibility with other fitness tracking devices have expanded the usability of cyclocomputers, making them valuable tools for everyday fitness and outdoor activities.

- The primary factor fueling the cyclocomputer market in North America is the integration of smart technology, which offers enhanced technological solutions. Increasing consumer awareness and the adoption of innovative features have led to a growing market for smart cyclocomputers. Benefits such as smartphone connectivity, tracking of multiple parameters, and real-time performance analysis appeal to both casual cyclists and serious athletes. Supporting this trend is the expanding ecosystem of fitness apps and platforms that utilize cyclocomputer data to provide comprehensive insights into a cyclist’s progress and achievements. Over time, these devices are becoming an integral part of cyclists’ fitness routines, driving continuous market growth.

Active Key Players in the Cyclocomputer Market:

- Acer Inc. (Taiwan)

- Bryton Inc. (Taiwan)

- CATEYE Co., Ltd. (Japan)

- Cycle Parts GmbH (Germany)

- Garmin Ltd. (USA)

- Giant Bicycles (Taiwan)

- Giant Manufacturing Co. Ltd (Taiwan)

- Lezyne Inc. (USA)

- MiTAC Holdings Corp. (Taiwan)

- MSW Bicycle Accessories (Germany)

- Pioneer Electronics (USA) Inc. (USA)

- Polar Electro Oy (Finland)

- SIGMA-ELEKTRO GmbH (Germany)

- Stages Cycling, LLC (USA)

- Trek Bicycle Corporation (USA)

- Wahoo Fitness (USA)

- Other Active Players

|

GLOBAL CYCLOCOMPUTER MARKET |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 542.03 Million |

|

Forecast Period 2024-32 CAGR: |

8.28% |

Market Size in 2032: |

USD 1109.07 Million |

|

|

By Connectivity |

|

|

|

By Functionality |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cyclocomputer Market by Connectivity

4.1 Cyclocomputer Market Snapshot and Growth Engine

4.2 Cyclocomputer Market Overview

4.3 Wired and Wireless

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Wired and Wireless: Geographic Segmentation Analysis

Chapter 5: Cyclocomputer Market by Functionalit

5.1 Cyclocomputer Market Snapshot and Growth Engine

5.2 Cyclocomputer Market Overview

5.3 Basic and Advanced

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Basic and Advanced: Geographic Segmentation Analysis

Chapter 6: Cyclocomputer Market by Distribution Channel

6.1 Cyclocomputer Market Snapshot and Growth Engine

6.2 Cyclocomputer Market Overview

6.3 Online and Offline

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Online and Offline : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cyclocomputer Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACER INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BRYTON INC.

7.4 CATEYE CO.

7.5 LTD.

7.6 CYCLE PARTS GMBH

7.7 GARMINLTD.

7.8 GIANT BICYCLES

7.9 GIANT MANUFACTURING CO. LTD

7.10 LEZYNE INC.

7.11 MITAC HOLDINGS CORP.

7.12 MSW BICYCLE ACCESSORIES

7.13 PIONEER ELECTRONICS (USA) INC.

7.14 POLAR ELECTRO OY

7.15 SIGMA-ELEKTRO GMBH

7.16 STAGES CYCLING LLC

7.17 TREK BICYCLE CORPORATION

7.18 AND WAHOO FITNESS

7.19 OTHER ACTIVE PLAYERS

Chapter 8: Global Cyclocomputer Market By Region

8.1 Overview

8.2. North America Cyclocomputer Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Connectivity

8.2.4.1 Wired and Wireless

8.2.5 Historic and Forecasted Market Size By Functionalit

8.2.5.1 Basic and Advanced

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Online and Offline

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cyclocomputer Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Connectivity

8.3.4.1 Wired and Wireless

8.3.5 Historic and Forecasted Market Size By Functionalit

8.3.5.1 Basic and Advanced

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Online and Offline

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cyclocomputer Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Connectivity

8.4.4.1 Wired and Wireless

8.4.5 Historic and Forecasted Market Size By Functionalit

8.4.5.1 Basic and Advanced

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Online and Offline

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cyclocomputer Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Connectivity

8.5.4.1 Wired and Wireless

8.5.5 Historic and Forecasted Market Size By Functionalit

8.5.5.1 Basic and Advanced

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Online and Offline

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cyclocomputer Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Connectivity

8.6.4.1 Wired and Wireless

8.6.5 Historic and Forecasted Market Size By Functionalit

8.6.5.1 Basic and Advanced

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Online and Offline

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cyclocomputer Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Connectivity

8.7.4.1 Wired and Wireless

8.7.5 Historic and Forecasted Market Size By Functionalit

8.7.5.1 Basic and Advanced

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Online and Offline

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

GLOBAL CYCLOCOMPUTER MARKET |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 542.03 Million |

|

Forecast Period 2024-32 CAGR: |

8.28% |

Market Size in 2032: |

USD 1109.07 Million |

|

|

By Connectivity |

|

|

|

By Functionality |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||