Key Market Highlights

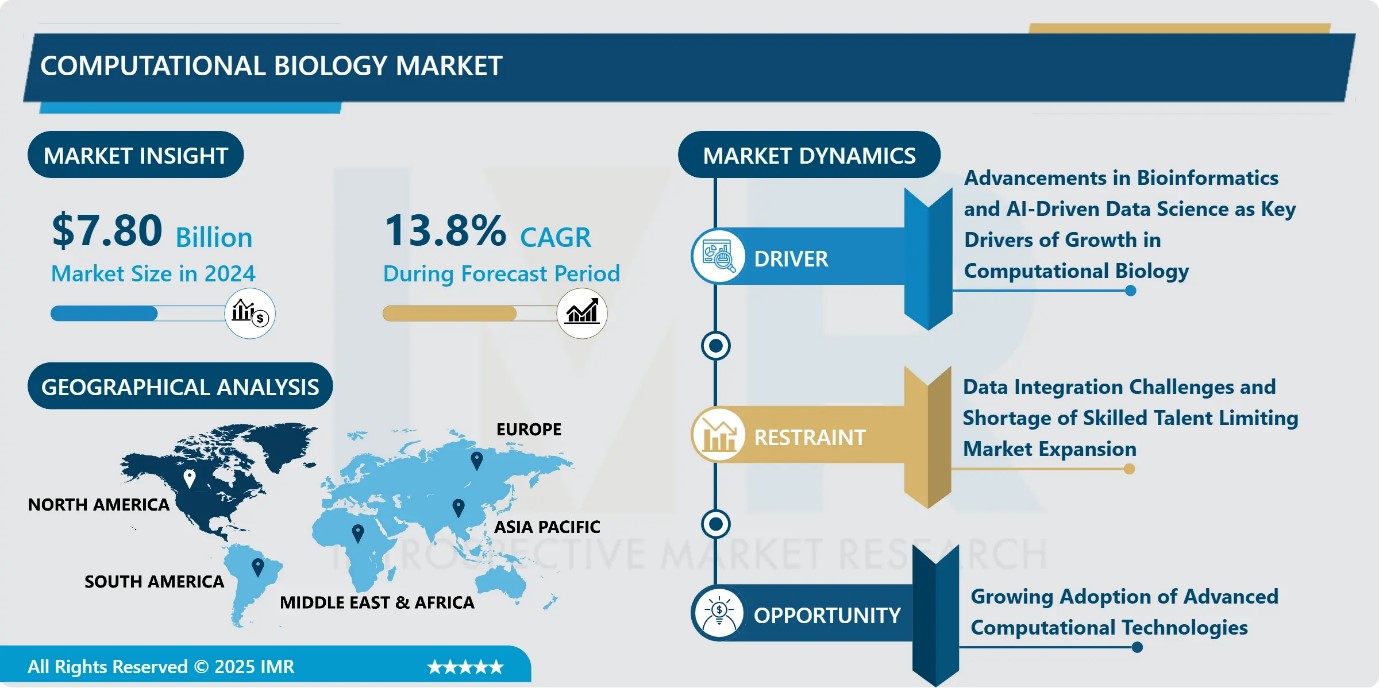

Computational Biology Market Size Was Valued at USD 7.80 Billion in 2024, and is Projected to Reach USD 32.33 Billion by 2035, Growing at a CAGR of 13.8% from 2025-2035.

- Market Size in 2024: USD 7.80 Billion

- Projected Market Size by 2035: USD 32.33 Billion

- CAGR (2025–2035): 13.8%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Tools: The Database segment is anticipated to lead the market by accounting for 33.45 % of the market share throughout the forecast period.

- By Application: The Cellular and Biological Simulation segment is expected to capture 26.87% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.56% of the market share during the forecast period.

- Active Players: Aganitha AI Inc. (United States), Atomwise (United States), BenevolentAI (United Kingdom), Certara, Inc. (United States), Compugen Ltd. (Israel), and Other Active Players.

Computational Biology Market Synopsis:

Computational biology is an interdisciplinary field that applies algorithms, mathematical modeling, artificial intelligence, and high-performance computing to analyze complex biological data such as genomics, proteomics, and clinical datasets. The market is witnessing strong growth due to rising adoption of AI-driven tools in drug discovery, disease modeling, personalized medicine, and clinical trials. Increasing volumes of omics data, high costs and long timelines of traditional drug development, and the need for precision medicine are driving demand. Government funding, public-private partnerships, and growing investments by pharmaceutical and biotechnology companies further support market expansion. Continuous innovation in AI, machine learning, and simulation technologies is accelerating research efficiency and improving therapeutic outcomes.

Computational Biology Market Dynamics and Trend Analysis:

Computational Biology Market Growth Driver-Advancements in Bioinformatics and AI-Driven Data Science as Key Drivers of Growth in Computational Biology

- Ongoing advancements in bioinformatics and data science are driving growth in the computational biology market. Increasing adoption of advanced computational tools is enhancing applications in drug discovery, precision medicine, and the development of novel therapies. Investments from pharmaceutical companies, government agencies, and private organizations are accelerating the integration of AI-driven bioinformatics platforms in life science research, addressing the rising chronic disease burden and promoting longevity. Expanding volumes of omics data, including single-cell RNA sequencing and multi-omics integration, combined with declining sequencing costs, are further fueling demand. Cloud-based bioinformatics platforms and AI-assisted data analysis tools are streamlining workflows, automating experiments, and improving interoperability, making them essential for organizations seeking efficient data management and competitive advantages in research and therapeutic development.

Computational Biology Market Limiting Factor-Data Integration Challenges and Shortage of Skilled Talent Limiting Market Expansion

- Data disintegration and ineffective data management remain key restraints in the computational biology market. Researchers must handle large volumes of complex, heterogeneous, and often noisy biological data generated from multiple sources. The lack of standardized data formats and metadata complicates data integration, comparison, and reproducibility of research outcomes. Inconsistent data quality further limits the accuracy of computational models and analyses. Additionally, the shortage of multidisciplinary professionals with expertise in biology, data science, and software engineering constrains market growth. High implementation costs for advanced data management platforms and the need for robust computational infrastructure also pose significant challenges, particularly for small and mid-sized research organizations.

Computational Biology Market Expansion Opportunity-Growing Adoption of Advanced Computational Technologies

- The increasing emphasis on adopting advanced technologies presents a significant growth opportunity for the computational biology market. Rising competition among market players, expansion of product portfolios, and growing investments in innovative computational platforms are accelerating technology adoption across life science applications. The expanding use of mRNA immunotherapies, drug discovery, and disease modeling has amplified demand for advanced bioinformatics, machine learning, and predictive modeling tools. AI-driven protein design, digital twins, and hybrid computational systems are improving research efficiency and reducing development timelines. Additionally, the expansion of pharmacogenomics and pharmacokinetics studies is driving demand for data-intensive computational solutions, positioning computational biology as a critical enabler of next-generation therapeutic development.

Computational Biology Market Challenge and Risk-Data Privacy, Regulatory Compliance, and Interoperability Issues Challenging Market Adoption

- Rising concerns over data privacy present a major challenge for the computational biology market. The field depends on extensive use of sensitive genetic and clinical data, making data security, confidentiality, and ethical use critical issues. Increasing regulatory requirements, such as strict data protection and compliance standards, add operational complexity and raise costs for market participants. Interoperability and data standardization gaps further complicate secure data sharing across platforms and geographies. Smaller companies often struggle to implement advanced security frameworks and navigate regulatory uncertainty, limiting innovation and scalability. Concerns over data breaches, ownership, and misuse continue to affect stakeholder trust, slowing adoption of computational biology solutions across the life sciences ecosystem.

Computational Biology Market Trend-Integration of Artificial Intelligence Transforming Computational Biology Workflows and Research Outcomes

- The integration of artificial intelligence with computational biology is emerging as a transformative market trend in life sciences. AI-driven algorithms enable rapid analysis of complex biological and genomic datasets, improving gene function prediction, disease association studies, and regulatory element identification. This convergence is accelerating drug discovery by enhancing target identification, optimizing molecular structures, and predicting drug–target interactions with greater accuracy. AI also supports predictive modeling, workflow automation, and large-scale data interpretation, significantly improving research efficiency. Increasing research funding and collaborative initiatives focused on AI-powered computational biology further reinforce this trend. Despite macroeconomic and geopolitical uncertainties, continued advancements in AI technologies are expected to sustain innovation and long-term market growth.

Computational Biology Market Segment Analysis:

Computational Biology Market is segmented based on Application, Tools, Service Model, End User and Region

By Tools, Databases segment is expected to dominate the market with around 33.45% share during the forecast period.

- Databases continue to represent the dominant segment in the computational biology market, accounting for the largest share due to their foundational role in storing, organizing, and managing vast volumes of biological data. The rapid expansion of genomic, proteomic, and clinical datasets has made robust databases essential infrastructure for research institutions, pharmaceutical companies, and biotechnology firms.

- These platforms enable efficient data retrieval, standardization, and long-term preservation, supporting downstream applications such as drug discovery, disease modeling, and precision medicine. The dominance of databases is further reinforced by their widespread adoption across academia and industry, integration with multiple analytical tools, and compliance with data governance requirements. As data generation continues to accelerate, reliable and scalable database solutions remain central to computational biology workflows.

By Application, Cellular and biological simulation is expected to dominate with close to 26.87% market share during the forecast period.

- Cellular and biological simulation represents the dominant application segment in the computational biology market, driven by its extensive use across fundamental research and pharmaceutical development. These simulations enable researchers to model complex biological systems, cellular interactions, and disease mechanisms with high precision, supporting hypothesis testing and experimental design. The segment’s dominance is reinforced by its broad applicability in understanding biological pathways, validating drug targets, and predicting therapeutic responses before laboratory or clinical testing.

- Integration of multi-omics data and advanced computational models enhances simulation accuracy and scalability. Widespread adoption by academic institutions, research laboratories, and biotechnology companies, along with its critical role in reducing experimental costs and timelines, positions cellular and biological simulation as a core and indispensable application within computational biology workflows.

Computational Biology Market Regional Insights:

North America region is estimated to lead the market with around 31.56% share during the forecast period.

- The U.S. computational biology market has demonstrated strong growth and is expected to expand significantly over the coming years, driven by rapid advances in data-driven biological research and increasing adoption of computational tools across healthcare and life sciences. North America holds the leading position in the global market due to its well-established research ecosystem, presence of top academic institutions, and strong collaboration between industry and academia.

- The widespread use of artificial intelligence, machine learning, and big data analytics has enhanced applications in genomics, drug discovery, and personalized medicine. Additionally, active government involvement through funding, national research programs, and policy support has accelerated innovation. The region’s dominance is further reinforced by the concentration of major biotechnology and pharmaceutical companies and the availability of highly skilled computational biologists.

Computational Biology Market Active Players:

- Aganitha AI Inc. (United States)

- Atomwise (United States)

- BenevolentAI (United Kingdom)

- Certara, Inc. (United States)

- Compugen Ltd. (Israel)

- Dassault Systèmes (France)

- DNAnexus, Inc. (United States)

- Evaxion Biotech (Denmark)

- Fios Genomics (United Kingdom)

- Genedata AG (Switzerland)

- Illumina, Inc. (United States)

- QIAGEN (Netherlands)

- Schrödinger, Inc. (United States)

- Simulations Plus, Inc. (United States)

- Thermo Fisher Scientific, Inc. (United States)

- Other Active Players

Key Industry Developments in the Computational Biology Market:

- In June 2025: Illumina completed the acquisition of SomaLogic for up to USD 425 million, strengthening its proteomics and biomarker analysis capabilities. This strategic move expands Illumina’s multi-omics offerings and enhances its ability to support advanced precision medicine and biomarker discovery. The acquisition reinforces Illumina’s position in integrated life sciences research solutions.

- In April 2025: Siemens finalized its USD 5.1 billion acquisition of Dotmatics, integrating advanced R&D informatics with Siemens’ industrial digital-twin technologies. The transaction aims to accelerate data-driven innovation across life sciences and industrial research workflows. This move significantly enhances Siemens’ digital transformation capabilities in scientific R&D.

Technical Framework and Computational Infrastructure Driving the Evolution of the Computational Biology Market

- The computational biology market is underpinned by advanced computational frameworks that enable the modeling, simulation, and analysis of complex biological systems. It integrates bioinformatics, systems biology, and data science to process large-scale genomic, proteomic, transcriptomic, and metabolomic datasets. High-performance computing, cloud-based platforms, and scalable data architectures support intensive data storage and parallel processing requirements. The increasing use of artificial intelligence and machine learning enhances pattern recognition, predictive modeling, and hypothesis generation, particularly in drug discovery and disease modeling.

- Techniques such as molecular dynamics simulations, network biology, and digital twin modeling allow detailed exploration of biological interactions at cellular and molecular levels. Interoperable data pipelines, application programming interfaces, and standardized metadata frameworks enable data integration across platforms. As biological data volumes continue to grow, advancements in analytical software, automation, and computational infrastructure remain critical to the evolution of the computational biology market.

|

Computational Biology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.80 Bn. |

|

Forecast Period 2025-35 CAGR: |

13.8% |

Market Size in 2035: |

USD 32.33 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Tools

|

|

||

|

By Service Models |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Computational Biology Market by Application (2018-2035)

4.1 Computational Biology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cellular and Biological Simulation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Computational Genomics

4.5 Computational Proteomics

4.6 Drug Discovery and Disease Modelling

4.7 Preclinical Drug Development

4.8 Clinical Trials

4.9 Human Body Simulation Software and Others

Chapter 5: Computational Biology Market by Tools (2018-2035)

5.1 Computational Biology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Databases

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Software Platforms

5.5 Infrastructure & Hardware and Services

Chapter 6: Computational Biology Market by Service Model (2018-2035)

6.1 Computational Biology Market Snapshot and Growth Engine

6.2 Market Overview

6.3 In-House and Contract

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

Chapter 7: Computational Biology Market by End User (2018-2035)

7.1 Computational Biology Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Academics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical Industry

7.5 Commercial Organizations

7.6 Government and Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Computational Biology Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 AGANITHA AI INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ATOMWISE (UNITED STATES)

8.4 BENEVOLENTAI (UNITED KINGDOM)

8.5 CERTARA

8.6 INC. (UNITED STATES)

8.7 COMPUGEN LTD. (ISRAEL)

8.8 DASSAULT SYSTÈMES (FRANCE)

8.9 DNANEXUS

8.10 INC. (UNITED STATES)

8.11 EVAXION BIOTECH (DENMARK)

8.12 FIOS GENOMICS (UNITED KINGDOM)

8.13 GENEDATA AG (SWITZERLAND)

8.14 ILLUMINA

8.15 INC. (UNITED STATES)

8.16 QIAGEN (NETHERLANDS)

8.17 SCHRÖDINGER

8.18 INC. (UNITED STATES)

8.19 SIMULATIONS PLUS

8.20 INC. (UNITED STATES)

8.21 THERMO FISHER SCIENTIFIC

8.22 INC. (UNITED STATES)

8.23 AND OTHER ACTIVE PLAYERS.

Chapter 9: Global Computational Biology Market By Region

9.1 Overview

9.2. North America Computational Biology Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Computational Biology Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Computational Biology Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Computational Biology Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Computational Biology Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Computational Biology Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Computational Biology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.80 Bn. |

|

Forecast Period 2025-35 CAGR: |

13.8% |

Market Size in 2035: |

USD 32.33 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Tools

|

|

||

|

By Service Models |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||